The Advance Pricing Agreement (APA) programme has been a key component in shaping India’s tax regime over the past decade. Designed to promote an investor-friendly tax environment, the Central Board of Direct Taxes (CBDT) oversees its successful implementation. This Report elucidates the salient points of the APA Programme’s annual report covering the years 2019-2022.

Introduced to augment the ease of doing business in India, the APA programme serves as a bridge of trust and cooperation between taxpayers and tax authorities. As of March 2022, 421 APAs have been agreed upon, providing clarity on tax-related matters for over 2715 assessment years. By mitigating potential litigations, this initiative has been pivotal in promoting a stable business ecosystem.

PRESS RELEASE –

Government of India

Ministry of Finance

Department of Revenue

Central Board of Direct Taxes

**********

New Delhi, 1st September, 2023

Press Release

CBDT releases the fifth annual APA report

The Advance Pricing Agreement (APA) programme of CBDT is one of its foremost initiatives for promoting an investor-friendly and non-adversarial tax regime in India. Since its commencement in July, 2012, the Indian APA programme has contributed significantly to the Government of India’s mission of promoting ease of doing business.

The Central Board of Direct Taxes (CBDT) has recently released the fourth and fifth annual APA reports. The reports present key data and statistics pertaining to the APA programme. These include sectoral distribution of applicants, nature of transactions covered, transfer pricing methodologies applied etc.

The fifth report includes status of applications filed till 31st March, 2023. The statistics are updated till Financial Year (FY) 2022-23, for the present. The report highlights various achievements of the APA programme in FY 2022-23. In FY 202223, CBDT recorded the highest ever APA signings in any financial year since the launch of the APA programme, signing a total of 95 APAs.

CBDT also signed 32 Bilateral Advance Pricing Agreements (BAPAs) in FY 2022-23 being the maximum number of BAPAs in any financial year till date. This figure is more than double the previous signing record of 13 BAPAs in any financial year. The report also details the country-wise distribution of these applications. The BAPAs were signed as a consequence of entering into Mutual Agreements with India’s treaty partners namely Finland, the UK, the US, Denmark, Singapore, and Japan, showcasing the maturity of India’s relationship with various treaty partners.

A record of the largest number of single day signings in the history of the programme was also created with a total of 21 APAs signed on 24th March, 2023. Additionally, signing of the 400th Unilateral Advance Pricing Agreement (UAPA) and the 500th APA were also milestones achieved in this year. The report is available at : https://incometaxindia.gov.in/Lists/Latest%20News/Attachments/601/APA-Report-Final-2023.pdf.

CBDT stands committed to strengthen the APA programme further.

(Surabhi Ahluwalia)

Pr. Commissioner of Income Tax

(Media and Technical Policy) &

Official Spokesperson, CBDT

*****

Advance Pricing Agreement (APA) Programme of India

Annual Report

(2019-20, 2020-21, and 2021-22)

Central Board of Direct Taxes August, 2023

Page Contents

Foreword by the Chairman, CBDT

The Advance Pricing Agreement (APA) programme of the CBDT, which was introduced more than a decade ago, is one of its foremost initiatives for promoting an investor-friendly tax regime in India. The programme has been well accepted by taxpayers and tax professionals, which is evinced by the fact that 421 APAs have been entered into by the CBDT till March, 2022. The APA programme has contributed significantly to the Government of India’s mission of promoting ease of doing business, especially for MNEs which have a large number of cross-border transactions within their group entities. By virtue of being founded on principles of mutual trust and cooperation between taxpayers and tax authorities, the programme has strengthened the Indian tax administration’s commitment to provide ease of doing business.

The APA programme provides tax certainty to taxpayers spread across different years. The number of APAs signed till date have cumulatively brought about certainty for more than 2715 assessment years. This number is significant, as but for the signing of APAs, a major part of these years would have still been subject to litigation. Thus, the APA programme has contributed immensely in prevention/resolution of protracted tax disputes. This has helped in sending across a clear signal that the Government of India desires a stable business environment.

Apart from running the Unilateral leg of the APA programme successfully, the CBDT has also actively engaged with its various tax treaty partners to negotiate and enter into Bilateral APAs, which provide the taxpayers an added benefit of relieving double taxation.

As we release this Report, let me assure all stakeholders that the CBDT will continue to take steps to strengthen the APA programme and overcome the challenges that it is aware the programme faces. I would like to appreciate the sincerity and dedication of the officers in the Foreign Tax & Tax Research Division of the CBDT as well as the officers in the APA teams under Principal CCIT (International Taxation) in bringing out this report. I would also like to thank the taxpayers for being equal partners in this programme. I invite stakeholders to provide feedback/suggestions on this report which, I believe, will help us in identifying the ways of further strengthening this programme.

Nitin Gupta

Chairman, Central Board of Direct Taxes

Ministry of Finance, Government of India.

Preface by Member (L), CBDT

Tax certainty and avoidance of double taxation are areas that the CBDT has been working on for some years now. The Advance Pricing Agreement (APA) programme was introduced in India through Finance Act, 2012 with a view to fulfil these objectives. The programme has constantly strived for a meticulous, open-minded, fact-intensive and collaborative perspective on transfer pricing. In effect, a more cooperative rather than adversarial approach, forms the bedrock of the APA programme.

Our APA programme has matured manifolds over the past few years. It gives me immense pleasure to present the fourth Annual Report (for FYs 2019-20 to 2021-22) of the Indian APA programme before all stakeholders. This Annual Report presents ample numerical data cataloguing the popularity and success of the APA programme in India. The programme does face certain challenges about which we are aware, and I would like to assure all stakeholders that we are committed to taking steps to address these challenges.

I would like to commend the efforts put in by the officers in the Foreign Tax & Tax Research Division of the CBDT and the officers in the APA teams under Principal CCIT (International Taxation) to make this programme a success, especially in the backdrop of the COVID-19 pandemic. I would like to put on record my special appreciation for their dedication and hard work despite the challenges faced. In order to ensure that the APA programme continues to function during the COVID-19 pandemic, the APA teams showed great adaptability by taking steps such as holding virtual meetings and negotiations with taxpayers and conducting signing of APAs remotely. Lastly, I would also like to thank our taxpayers for reposing their faith in the APA programme and extending their full-fledged cooperation in ensuring that the programme is a success.

Pragya Sahay Saksena

Member (Legislation), Central Board of Direct Taxes

Chapter 1: APA Programme of India – Introduction

An Advance Pricing Agreement (APA) is an agreement between the tax administration and a person (taxpayer), which determines, in advance, the Arm’s Length Price (ALP) or specifies the manner of the determination of ALP (or both), in relation to an international transaction1. APA programmes are operational in a number of countries since long. The primary goal of such programmes is to provide certainty to taxpayers in respect of the pricing of cross-border transactions undertaken by taxpayers with their group entities.

Rapid growth in international trade through an increasing number of Multi National Enterprises (MNEs) has given rise to numerous tax disputes on the issue of transfer pricing. An APA is a mechanism to resolve transfer pricing disputes in advance, i.e., before the cross-border related party transaction actually takes place or, at least, before a dispute arises in respect of such cross-border transaction. The transfer price of goods and services transacted between group entities is decided in advance by the tax authorities and the taxpayers, so as to prevent any dispute arising from such transfer pricing.

The APA programme in India was launched in 2012 vide the Finance Act, 2012 through the insertion of sections 92CC and 92CD in the Income-tax Act, 1961. These statutory provisions, effective from 1st July, 2012, lent the legal backing to the CBDT to enter into APAs with taxpayers for a maximum period of 5 years in respect of international transactions between Associated Enterprises (AEs) to determine the ALP or to specify the manner in which the ALP is to be determined.

Vide notification no. 36/2012 [F. No. 133/5/2012-SO(TPL)]/SO 2005 (E), dated 30th August, 2012, the APA Scheme [Rules 10F to 10T] was inserted in the Income-tax Rules, 1962 to operationalize the APA programme. Thus, the Indian APA programme, which commenced from 1st July, 2012, became functional and operational from 30th August, 2012 with the notification of the rules. The rules deal with the various procedural aspects of the APA process, including procedures for filing of pre-filing consultation application; pre-filing consultation; payments of fees; filing of APA application; processing of APA application; withdrawal of APA application; terms and conditions of APA; filing of Annual Compliance Report; Compliance Audit; revision, cancellation and renewal of APA; etc.

Rollback provisions allow the ALP or the methodology for determining the ALP as agreed to in the APA, to be rolled back to a period prior to the commencement of the APA. Roll-back of APAs was announced by the Government on 10th July, 2014. The necessary legislative changes in this regard were carried out through the Finance (No. 2) Act, 2014. The amendment to Income-tax Rules, 1962 for implementing the Roll-back provisions were notified on 14th March, 2015 and the existing APA Scheme got amended accordingly. The Rollback provisions are applicable for a maximum of four years prior to the first year of the APA period. Thus, a taxpayer would be able to have certainty in matters of transfer pricing for a maximum period of 9 years at any one time by applying for an APA with Rollback provisions. Circular No. 10 of 2015 was issued by the CBDT on 10th June, 2015 to provide clarity on Rollback issues .

Under the Indian APA programme, APAs can be bilateral (involving the CBDT and the tax authorities of another country) or unilateral (involving the CBDT only). Over the last 10 years, more than 1400 applications have been filed in India. About 75% of these are for unilateral APAs between the Indian taxpayer and the CBDT. Till 31st March, 2022, 421 Agreements have been entered into (357 unilateral and 64 bilateral).

The APA applications are processed and analysed by dedicated APA teams working under the overall supervision of Pr. CCIT (International Taxation), New Delhi. Each APA team is headed by a Commissioner of Income-tax. The team also comprises Addl./Joint Commissioners of Income-tax and Deputy/Asst. Commissioners of Income-tax. Presently, there are four APA teams. These teams are based in Delhi, Mumbai and Bengaluru.

In respect of unilateral APAs (UAPAs), the position papers developed by the APA teams are approved by the Pr. CCIT (International Taxation), New Delhi and sent to the CBDT for approval. In the CBDT, officers of the Foreign Tax & Tax Research (FT & TR-I and II) Divisions examine and process the position papers. Joint Secretary, FT & TR-I and FT & TR-II review the examination done by the officers below and further process the position papers before sending it for final approval of the designated Member of the CBDT. The Member approves the final negotiating position to be adopted by the APA teams. Once the negotiation is complete, a draft Agreement is sent to the CBDT for approval. Thereafter, the Agreement is entered into between the CBDT and the taxpayer.

In respect of bilateral APAs (BAPAs), once the position papers are sent to the FT & TR-I & II Divisions by the Pr. CCIT (International Taxation), the Competent Authority of India (either Joint Secretary, FT & TR-I or Joint Secretary, FT & TR-II, depending upon the country with which the BAPA is to be negotiated under the Tax Treaty) initiates discussions with their counterpart in the other country. The officers in the FT & TR Division of the CBDT working with the Competent Authority examine the position paper received from the Pr.CCIT (International Taxation) and prepare the position of the Indian Competent Authority. The same is shared with the Competent Authority of the other country. Once positions have been exchanged, the Competent Authorities of both countries discuss and negotiate the terms and conditions of the APA. If they reach an understanding, then a Mutual Agreement, containing the terms and conditions of the APA, is entered into by the Competent Authorities of both countries. Thereafter, each country usually enters into an Agreement with its own taxpayer. On the Indian side, the Mutual Agreement is shared with the taxpayer and its concurrence is sought within 30 days. Once the taxpayer agrees to the resolution reached in the Mutual Agreement, a draft Agreement is prepared in consultation with the Indian taxpayer and the same is submitted for the approval of the designated Member in the CBDT.

For both UAPAs and BAPAs, the Agreements are entered into by either Joint Secretary, FT & TR-I or Joint Secretary, FT & TR-II (the two Competent Authorities of India) with the taxpayer, on behalf of the CBDT.

In order to ameliorate the hardships faced by the taxpayers due to the COVID-19 pandemic, the timeline to file APA applications (with first APA year starting in FY 2020-21) was extended from 31st March, 2020 to 31st March, 2021. Due to this extension of timeline and also due to the exceptional circumstances prevailing throughout 2020 and 2021 because of the COVID-19 pandemic, no Annual Report was brought out in the last two years. The fourth Annual Report on the APA programme therefore highlights the progress made in three financial years: 2019-20, 2020-21, and 2021-22. A total of 57 APAs were entered into during FY 2019-20, 31 APAs during FY 2020-21, and 62 during FY 2021-22. Though the number of APAs entered into had come down in FY 2020-21 primarily due to the impact of the COVID-19, the number showed an impressive upswing in FY 2021-22, due to the efforts of the CBDT and its officers working in the Foreign Tax & Tax Research Division and in the APA teams [under the Principal CCIT (International Taxation)]. The CBDT also acknowledges the cooperation and efforts of the taxpayers and their consultants in making the APA programme a success.

This Annual Report carries forward the CBDT’s unique initiative to bring into the public domain various statistical and qualitative aspects of India’s APA programme. The idea is to encourage discussion and debate amongst taxpayers, policy makers, and economists, among others, on the strengths and weaknesses of the programme. This Annual Report also underlines the importance that the APA programme holds in the Government’s endeavour to promote and preserve a non-adversarial tax regime.

Chapter 2: Data and Qualitative Analyses

2.1 Applications filed

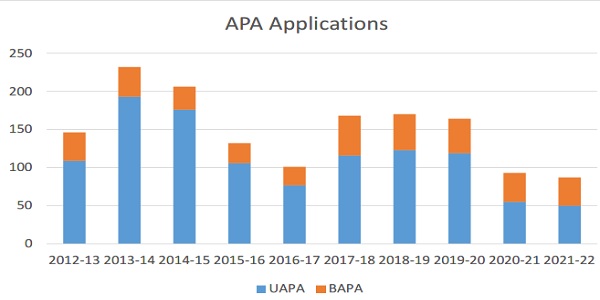

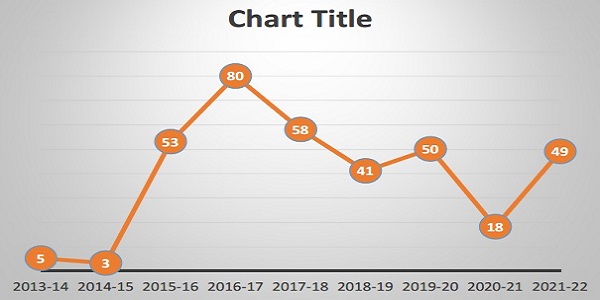

The total number of applications filed on an annual basis can be seen from Table 2-1 and Figure 2-1 below. The total number of applications remained largely consistent from FY 2017-18 to FY 2019-20 before a sharp drop in FY 2020-21 and FY 2021-22. While it is difficult to see a trend from a two-year drop, the drop is primarily attribuTable to two factors.

Firstly, there has been significant fall in transfer pricing litigation in India as transfer pricing practice and audits have matured in India. Cases are being selected for transfer pricing audit on the basis of risk assessment since 2016, which also contributes to lower disputes. While the selection of cases by risk assessment started in 2016, its effect on industry is being felt few years down the line. Secondly, the CoVID-19 pandemic has led to certain uncertainties and this might have affected the decision of certain taxpayers to participate in a five-year programme.

Interestingly, while the filing trend shows a 3:1 ratio in preference of UAPA and BAPA applications, the share of BAPAs in the total APA applications filed, has steadily been increasing. This not only indicates the need of the taxpayers for bilateral tax certainty, but also signifies the maturity of India’s BAPA programme.

Table 2-1 APA Applications Filed till 31.03.2022

| Financial Year |

UAPA applications |

BAPA applications |

Total |

| 2012-13 | 109 | 37 | 146 |

| 2013-14 | 193 | 39 | 232 |

| 2014-15 | 176 | 30 | 206 |

| 2015-16 | 106 | 26 | 132 |

| 2016-17 | 77 | 24 | 101 |

| 2017-18 | 116 | 52 | 168 |

| 2018-19 | 123 | 47 | 170 |

| 2019-202 | 122 | 42 | 164 |

| 2020-21 | 55 | 38 | 93 |

| 2021-22 | 50 | 37 | 87 |

| Total | 1127 | 372 | 1499 |

Figure 2-1 APA applications filed

2.2 Status of applications filed

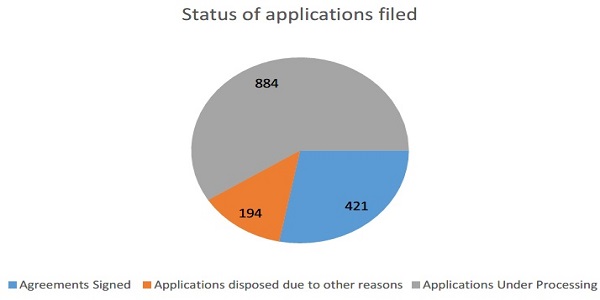

Table 2-2 shows the status of applications filed. Out of a total 1499 applications filed till 31st March 2022, a total of 609 applications have been disposed and 890 applications are under processing. A comparison of applications filed, disposed, and under processing, is presented in Figure 2-2.

Table 2-2 Status of applications filed

| Sl. No. | FY | (A)

No. of Applications Filed – Post Conversion |

(B)

No. of A |

(C) No. of Applications disposed due to other reasons out of A |

(D = A – (B+C)) No. of Applications Under Processing out of A |

| 1 | 2012-13 | 146 | 103 | 22 | 21 |

| 2 | 2013-14 | 232 | 131 | 54 | 47 |

| 3 | 2014-15 | 206 | 82 | 50 | 74 |

| 4 | 2015-16 | 132 | 51 | 26 | 55 |

| 5 | 2016-17 | 101 | 21 | 18 | 62 |

| 6 | 2017-18 | 168 | 15 | 14 | 139 |

| 7 | 2018-19 | 170 | 17 | 8 | 145 |

| 8 | 2019-20 | 164 | 1 | 1 | 162 |

| 9 | 2020-21 | 93 | 0 | 1 | 92 |

| 10 | 2021-22 | 87 | 0 | 0 | 87 |

| Total | 1499 | 421 | 194 | 8843 |

Figure 2-2 Status of applications filed from initiation of APA programme till 31.03.2022

2.3 Agreements signed: Year-wise

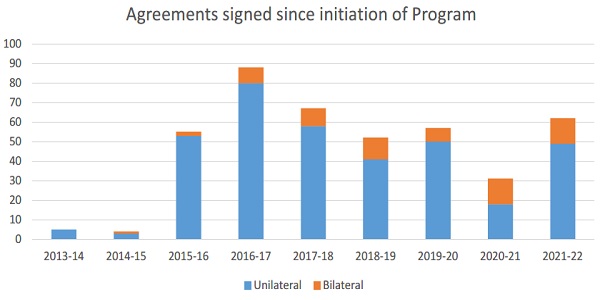

The number of agreements signed in various years of the APA programme are detailed in Table 2-3 and Figure 2-3 below. While there was a significant fall in the number of APAs signed in FY 2020-21, mainly due to the CoVID-19 pandemic, the APA programme bounced back in FY 2021-22. Adaptive measures like virtual discussions and remote signing protocols assisted in this increase in number.

Table 2-3 Agreements signed year wise

| FY | UAPAs | BAPAs | Total |

| 2013-14 | 5 | 0 | 5 |

| 2014-15 | 3 | 1 | 4 |

| 2015-16 | 53 | 2 | 55 |

| 2016-17 | 80 | 8 | 88 |

| 2017-18 | 58 | 9 | 67 |

| 2018-19 | 41 | 11 | 52 |

| 2019-20 | 50 | 7 | 57 |

| 2020-21 | 18 | 13 | 31 |

| 2021-22 | 49 | 13 | 62 |

| Total | 357 | 64 | 421 |

Figure 2-3 UAPAs and BAPAs signed since initiation of APA programme

2.4 Total covered years in Agreements signed

The impact of the APA programme in increasing the ease of doing business is evident from the number of years for which it has brought certainty in transfer pricing matters and reduced litigation. In its short period of existence in India, the APA programme has cumulatively brought about certainty for over 2715 years.

| Particulars | APA years | Rollback Years | Total Years |

| Agreements signed till 2019- 20 | 1301 years & 11 months | 487 years | 1788 years & 11 months |

| Agreements signed in 2019-20 | 265 years & 2 months | 106 years | 371 years & 2 months |

| Agreements signed in 2020-21 | 155 years | 43 years | 198 years |

| Agreements signed in 2021-22 | 301 years & 6 Months | 57 years | 358 years & 6 Months |

| Total Agreements signed till 31st March 2022 | 2023 years & 7 Months | 693 years | 2716 years & 7 months |

The APA programme is also an important tool to decongest the tax tribunals and higher judiciary of transfer pricing litigation. Even if we assume that only about half of these assessment years would have ended up in litigation, the APA programme has managed to prevent or resolve this litigation for more than 1300 assessment years, in other words more than 1300 transfer pricing matters related appeals. On an average, over the three financial years (2019-20 to 2021-22), the APA programme has provided tax certainty to more than 300 assessment years annually.

Chapter 3: Unilateral APAs

3.1 Applications Filed

Statistics pertaining to UAPA applications are presented in Table 3-1. The number of applications filed in past years remains dynamic because of conversion of UAPAs into BAPAs and vice versa. While the conversion of UAPAs into BAPAs is a trend noted in the last APA report, conversion of BAPAs into UAPAs is still rare. Applicants usually apply for conversion of BAPA applications into UAPA when either the Applicant or its AE is not covered under the tax treaty.

Table 3-1 UAPA Applications filed (original and post-conversion)

| FY | Applications (Original) | Applications (PostConversions) |

| 2012-13 | 117 | 109 |

| 2013-14 | 206 | 193 |

| 2014-15 | 192 | 176 |

| 2015-16 | 113 | 106 |

| 2016-17 | 78 | 77 |

| 2017-18 | 115 | 116 |

| 2018-19 | 123 | 123 |

| 2019-20 | 119 | 122 |

| 2020-21 | 55 | 55 |

| 2021-22 | 50 | 50 |

| Total | 1168 | 1127 |

3.2 Status of Applications Filed

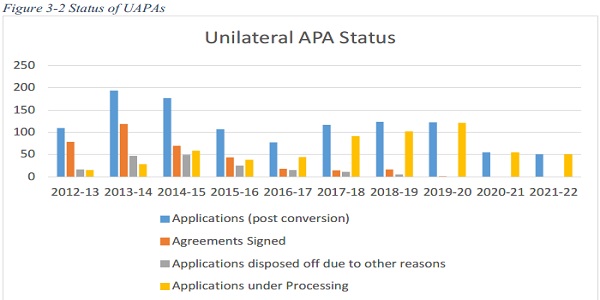

The number of UAPAs disposed off and number still under processing are detailed in Table 3-2 and Figure 3-2 below. The disposal in earlier years is high while number of cases still under processing is low. For recent years, a large proportion of cases are still under processing. Reason for this is that processing of APAs involves conducting site visits, various due diligence processes, and multiple rounds of negotiations, all of which take time. A majority of the numbers against FY 2019-20 and FY 2020-21 pertain to applications filed in March 2021 and so the processing is at a preliminary stage.

Table 3-2 Status of UAPAs filed

| FY | Applications (post conversion) | Agreements Signed |

Applications disposed off due to other reasons |

Applications under Processing |

| A | B | C | D = A – B – C | |

| 2012-13 | 109 | 78 | 16 | 15 |

| 2013-14 | 193 | 118 | 47 | 28 |

| 2014-15 | 176 | 69 | 49 | 58 |

| 2015-16 | 106 | 43 | 25 | 38 |

| 2016-17 | 77 | 18 | 15 | 44 |

| 2017-18 | 116 | 14 | 11 | 91 |

| 2018-19 | 123 | 16 | 5 | 102 |

| 2019-20 | 122 | 1 | 0 | 121 |

| 2020-21 | 55 | 0 | 0 | 55 |

| 2021-22 | 50 | 0 | 0 | 50 |

| Total | 1127 | 357 | 168 | 602 |

Figure 3-2 Status of UAPAs

3.3 Agreements Signed – Year wise

The number of UAPAs signed in various years are detailed in Table 3-3 and Figure 3-3. In 2019-20, the 50 agreements entered have provided tax certainty for 232 APA years & 5 months and 98 rollback years. A total of 26 APAs out of the 50 signed, had a rollback. In 2020-21, the 18 agreements signed have provided tax certainty of 90 APA years and 19 rollback years. A total of 5 out of the 18 APAs had a rollback. In 2021-22, the 49 agreements signed have provided tax certainty of 240 APA years & 6 months and 39 rollback years. A total of 12 APAs had a rollback.

Table 3-3 UAPAs signed

| FY | Agreements Signed |

| 2013-14 | 5 |

| 2014-15 | 3 |

| 2015-16 | 53 |

| 2016-17 | 80 |

| 2017-18 | 58 |

| 2018-19 | 41 |

| 2019-20 | 50 |

| 2020-21 | 18 |

| 2021-22 | 49 |

| Total | 357 |

Figure 3-3 UAPAs signed

3.4 Duration of Processing

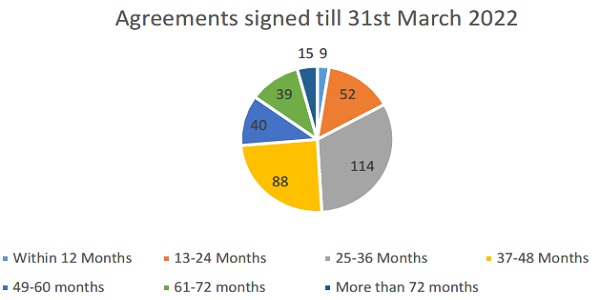

The number of UAPAs signed in FY 2019-20, FY 2020-21, and FY 2021-22 segregated on the basis of duration taken from application to signing are mentioned in Table 3-4-1 and Figures 3-4-1, 3-4-2, and 3-4-3 below. It is seen that the average duration for closure of applications in FY 2019-20 is approximately 52.43 months, while average duration in FY 2020-21 is approximately 54.33 months, and average duration in FY 2021-22 is approximately 58.23 months. The average duration of processing since the beginning of the APA programme is approximately 37.66 months. In the recent years, the focus of the APA programme has been on closure of backlog cases. Also, as the APA programme has matured, more complicated cases are being resolved. The average duration of processing of cases in

FY 2019-20, FY 2020-21, and FY 2021-22, when compared to cumulative figure, highlights the impact of these factors.

Table 3-4-1 Duration of processing of UAPAs

| Duration | No. of Agreements signed in 2019-20 | No. of Agreements signed in 2020-21 | No. of

Agreements |

TOTAL |

| within 12 Months | 0 | 0 | 0 | 0 |

| 13-24 Months | 4 | 2 | 0 | 6 |

| 25-36 Months | 4 | 2 | 11 | 17 |

| 37-48 Months | 14 | 3 | 6 | 23 |

| 49-60 months | 15 | 3 | 9 | 27 |

| 61-72 months | 10 | 5 | 14 | 29 |

| More than 72 months | 3 | 3 | 9 | 15 |

| Total | 50 | 18 | 49 | 117 |

Figure 3-4-1 The duration taken in processing and negotiation of UAPAs signed in FY 2019-20

Figure 3-4-2 The duration taken in processing and negotiation of UAPAs signed in FY 2020-21

Figure 3-4-3 The duration taken in processing and negotiation of UAPAs signed in FY 2021-22

The cumulative data on period of processing of all UAPAs till March 2022, is as under in Table 3-4-2 and Figure 3-4-4:

| Duration of processing | Agreements signed till 31st March 2022 |

| Within 12 Months | 9 |

| 13-24 Months | 52 |

| 25-36 Months | 114 |

| 37-48 Months | 88 |

| 49-60 months | 40 |

| 61-72 months | 39 |

| More than 72 months | 15 |

| Total | 357 |

Figure 3-4-4 Cumulative data on period of processing for UAPAs signed till March 2022

3.5 Sectoral distribution of applicants

The primary economic activity of applicants in whose cases UAPAs were signed in FY 201920, FY 2020-21, and FY 2021-22 are mentioned in Table 3-5 below. As can be seen, a majority of applications which culminated into agreement in FY 2019-20, FY 2020-21, and FY 2021-22 pertain to the service sector. A majority of these, in turn, are captive companies involved in software development and Business Process Outsourcing (BPO). Some of these companies are also involved in engineering design services, R&D services, and Knowledge Process Outsourcing (KPO). It may be noted that 27 out of the 117 companies with which the CBDT entered into agreements also have manufacturing activities. Further, 32 out of 117 companies are involved in trading activities. Hence, the entire spectrum of trading, manufacturing, and services, are covered under APAs signed.

Table 3-5 Number of agreements signed in FY 2019-20 , FY 2020-21 and FY 2021-22

| Sl. No. | Economic Activity | Agreements signed |

| 1 | Service | 74 |

| 2 | Manufacturing & Trading | 11 |

| 3 | Trading & Service | 11 |

| 4 | Manufacturing, trading & Service | 5 |

| 5 | Trading | 5 |

| 6 | Manufacturing & Service | 8 |

| 7 | Manufacturing | 3 |

| Total | 117 |

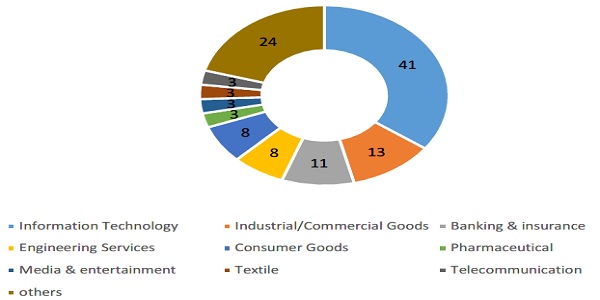

3.6 Industry-wise distribution of agreements

A majority of UAPAs signed in the three financial years pertain to the I-T industry, banking & insurance, and engineering services. This reflects on the fact that India is a major outsourcing destination for information technology and business processes, and significant number of foreign MNEs have presence in I-T clusters of India such as Bengaluru, Hyderabad, Chennai, Gurgaon, and Noida.

It is also a positive trend that the APAs are spread across multiple industries. As can be seen in Table 3-6 and Figure 3-6, there are 18 different types of industries that have availed the benefits of the Indian APA programme during the period covering FY 2019-20, FY 2020-21, and FY 2021-22.

Table 3-6 Industry-wise distribution of UAPAs

| S. No | Industry | Agreements Signed |

| 1 | Information Technology | 41 |

| 2 | Industrial/Commercial Goods | 13 |

| 3 | Banking & insurance | 11 |

| 4 | Engineering Services | 8 |

| 5 | Consumer Goods | 8 |

| 6 | Automotive | 5 |

| 7 | Power & Energy | 4 |

| 8 | Trading & Logistics | 4 |

| 9 | Textile | 3 |

| 10 | Telecommunication | 3 |

| 11 | Pharmaceutical | 3 |

| 12 | Media & entertainment | 3 |

| 13 | Healthcare | 3 |

| 14 | Consultancy | 2 |

| 15 | Foods & Beverages | 2 |

| 16 | Pumps | 2 |

| 17 | Paints & chemical | 1 |

| 18 | Elevators | 1 |

| Total | 117 |

Figure 3-6 Industries that UAPAs pertain to

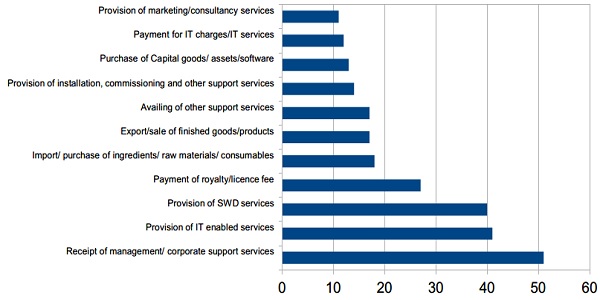

3.7 Nature of Transactions Covered

The nature of international transactions covered by the 117 UAPAs signed in FY 2019-20 to FY 2021-22 are mentioned in Table 3-7 and Figure 3-7 below. As can be seen from the table, a wide variety of transactions have been covered by the APAs signed in these three years. A diversified basket of international transactions indicates the maturity of the APA programme and competence of the APA teams in processing applications that include complex transactions.

While captive services are usually benchmarked at cost plus a mark-up under the Transactional Net Margin Method (TNMM), the determination of arm’s length price for royalty transactions, provision of advisory services, purchase of online advertisement space etc. is more intricate. Some complex transactions need to be benchmarked using multiple methods (a primary method and a secondary method for sanity check). It is worthwhile to note that 51 international transactions involving intra-group services (IGS) have been amicably settled by the CBDT and taxpayers in this period. International transactions relating to IGS are widely litigated, and their coverage by APAs is an indication that this issue can be amicably resolved by collaboration between the tax department and industry.

Table 3-7 Nature of international transactions covered by 117 UAPAs signed in FYs 2019-20, 2020-21, and 2021-22

| Sl. No. |

Covered Transaction | Total no. of Transactions |

| 1 | Receipt of management/ corporate support services | 51 |

| 2 | Provision of IT enabled services | 41 |

| 3 | Provision of SWD services | 40 |

| 4 | Payment of royalty/licence fee | 27 |

| 5 | Import/ purchase of ingredients/ raw materials/ consumables | 18 |

| 6 | Export/sale of finished goods/products | 17 |

| 7 | Availing of other support services | 17 |

| 8 | Provision of installation, commissioning and other support services | 14 |

| 9 | Purchase of Capital goods/ assets/software | 13 |

| 10 | Payment for IT charges/IT services | 12 |

| 11 | Provision of marketing/consultancy services | 10 |

| 12 | Provision of engineering design services | 8 |

| 13 | Payment of interest on borrowings | 7 |

| 14 | Import of finished goods | 6 |

| 15 | Provision of business support services | 6 |

| 16 | Receipt of corporate guarantee fee | 6 |

| 17 | Sale of ingredients/ raw materials/ consumables | 6 |

| 18 | Provision of technical support services | 5 |

| 19 | Provision of contract R&D Services | 5 |

| 20 | AMP expense | 5 |

| 21 | Receipt of commission | 5 |

| 22 | Provision of non-binding investment advisory service | 4 |

| 23 | Exports of parts/ components | 4 |

| 24 | Export of semi-finished goods/ parts | 3 |

| 25 | Provision of finance/accounting support services | 3 |

| 26 | Payment of charges/ commission | 3 |

| 27 | Purchase of software licences | 3 |

| 28 | Repayment of External Commercial Borrowings | 3 |

| 29 | Receipt of licence fee | 2 |

| 30 | Availing of engineering design services | 2 |

| 31 | Receipt of subvention income | 2 |

| 32 | Fee for providing undertaking | 2 |

| 33 | Sale of assets | 2 |

| 34 | Sale of machinery and spares | 2 |

| 35 | Provision of IT support services | 1 |

| 36 | Receipt of interest | 1 |

| 37 | Provision of data analytics services | 1 |

| 38 | Provision of D&D Support services | 1 |

| 39 | Termination of existing arrangement | 1 |

| 40 | Purchase of online advertisement space and enterprise products | 1 |

| 41 | Payment of professional fee | 1 |

| 42 | Contract manufacturing of pharmaceutical products | 1 |

| 43 | Provision of outsourcing services | 1 |

| 44 | Provision of CAPEX charges | 1 |

| 45 | Payment of advertising and promotional charges | 1 |

| 46 | Generation of Marketing Intangibles | 1 |

| 47 | Receipt of Technical Services | 1 |

| 48 | Waiver of liability received | 1 |

| 49 | Interest on trade credits | 1 |

| 50 | Interest payment on compulsory Convertible Debentures (CCD) | 1 |

| 51 | Reimbursement / Recovery of expenses | 1 |

| Total | 371 |

Figure 3-7 Nature of international transactions covered by the UAPAs signed in FYs 2019-20, 2020-21, and 2021-22

3.8 Transfer Pricing Methodologies Used

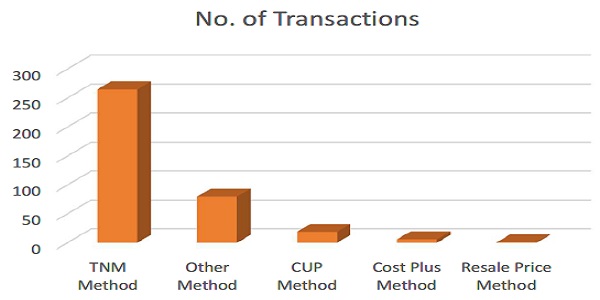

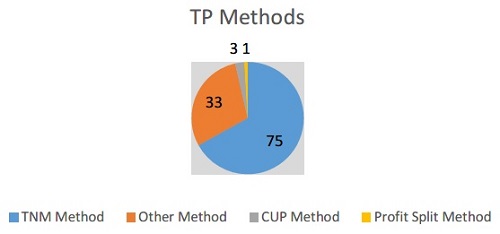

A total of 371 transactions were benchmarked using 5 different methods, across the 117 UAPAs signed in the three-year period, as seen at Table 3-8 and Figure 3-8.

Table 3-8 TP methods used to benchmark international transactions

| Sl. No | TP Methodology | No. of Transactions |

| 1 | TNM Method | 265 |

| 2 | Other Method | 80 |

| 3 | CUP Method | 19 |

| 4 | Cost Plus Method | 6 |

| 5 | Resale Price Method | 1 |

| Total | 371 |

Figure 3-8 Methods used to benchmark transactions in APA agreements

3.9 Location of AEs

The 117 UAPAs entered into in the three years have AEs across 83 countries, as seen at Table 3-9. Usually, a single APA covers AEs located in multiple jurisdictions. In a majority of cases, AEs are located in the United States, the United Kingdom, Australia, France, Germany, Japan, etc. The APA applicants are a part of MNE groups, the parent jurisdictions of which happen to be these countries. Many AEs are also located in investment and business hubs such as Singapore, Hong Kong, and Netherlands.

Table 3-9: Location of AEs

| Sl. No. |

Countries | No of agreements | Sl. No. |

Countries | No of agreements | |

| 1 | USA | 84 | 43 | Israel | 4 | |

| 2 | Singapore | 54 | 44 | Mauritius | 4 | |

| 3 | UK | 43 | 45 | Morocco | 4 | |

| 4 | Hong Kong | 32 | 46 | Norway | 4 | |

| 5 | Australia | 30 | 47 | Sri Lanka | 4 | |

| 6 | China | 30 | 48 | Pakistan | 4 | |

| 7 | Netherlands | 28 | 49 | Bermuda | 3 | |

| 8 | France | 25 | 50 | Guernsey | 3 | |

| 9 | Germany | 27 | 51 | Peru | 3 | |

| 10 | Japan | 24 | 52 | Qatar | 3 | |

| 11 | Switzerland | 20 | 53 | Cayman Islands | 3 | |

| 12 | Canada | 20 | 54 | Romania | 3 | |

| 13 | Malaysia | 20 | 55 | Ukraine | 3 | |

| 14 | Thailand | 18 | 56 | Jersey | 2 | |

| 15 | Brazil | 17 | 57 | Bahrain | 2 | |

| 16 | UAE | 16 | 58 | Colombia | 2 | |

| 17 | Belgium | 15 | 59 | Greece | 2 | |

| 18 | Italy | 15 | 60 | Nigeria | 2 | |

| 19 | South Korea | 14 | 61 | Kenya | 2 | |

| 20 | Ireland | 14 | 62 | Trinidad & Tobago | 1 | |

| 21 | South Africa | 13 | 63 | Slovakia | 1 | |

| 22 | Indonesia | 12 | 64 | Croatia | 1 | |

| 23 | Taiwan | 12 | 65 | Cyprus | 1 | |

| 24 | Philippines | 12 | 66 | Estonia | 1 | |

| 25 | Poland | 12 | 67 | Oman | 1 | |

| 26 | Spain | 11 | 68 | Panama | 1 | |

| 27 | Sweden | 10 | 69 | Venezuela | 1 | |

| 28 | Mexico | 9 | 70 | Bangladesh | 1 | |

| 29 | Finland | 7 | 71 | Zambia | 1 | |

| 30 | Portugal | 7 | 72 | Serbia | 1 | |

| 31 | New Zealand | 7 | 73 | Egypt | 1 | |

| 32 Russia | 7 74 Kuwait 1 | |||||

| 33 | Turkey | 7 | 75 | Costa Rica | 1 | |

| 34 | Denmark | 6 | 76 | Uganda | 1 | |

| 35 | Hungary | 6 | 77 | Tanzania | 1 | |

| 36 | Saudi Arabia | 5 | 78 | Zimbabwe | 1 | |

| 37 | Vietnam | 5 | 79 | Bulgaria | 1 | |

| 38 | Chile | 4 | 80 | Dubai | 1 | |

| 39 | Austria | 4 | 81 | Mombasa | 1 | |

| 40 | Argentina | 4 | 82 | Malawi | 1 | |

| 41 | Czech Republic | 4 | 83 | Senegal | 1 | |

| 42 | Luxembourg | 4 | ||||

Chapter 4: Bilateral APAs

4.1 Applications Filed

BAPA applications filed in various years, and UAPA applications filed in various years but subsequently converted into BAPA applications are detailed in Table 4-1. As can be seen from the table below, similar to the trend seen for UAPA applications, there has also been a decline in the number of BAPA applications filed in FY 2020-21 and FY 2021-22, which can be attributed to similar reasons.

Table 4-1 Number of BAPA applications filed

| FY | Applications (Original) |

Applications (After Conversions) |

| 2012-13 | 29 | 37 |

| 2013-14 | 26 | 39 |

| 2014-15 | 14 | 30 |

| 2015-16 | 19 | 26 |

| 2016-17 | 23 | 24 |

| 2017-18 | 53 | 52 |

| 2018-19 | 47 | 47 |

| 2019-20 | 45 | 42 |

| 2020-21 | 38 | 38 |

| 2021-22 | 37 | 37 |

| Total | 331 | 372 |

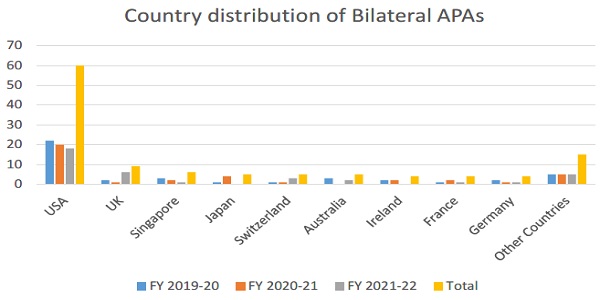

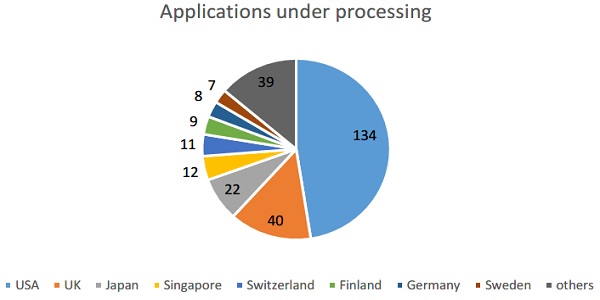

4.2 Country-wise Distribution of applications

The country-wise distribution of BAPAs is detailed in Table 4-2 and Figure 4-2. More than half of BAPA applications are with one treaty partner, i.e. the United States of America. Other treaty partners with whom large number of applications have been filed in the last three financial years are the UK, Japan, and Singapore.

Table 4-2 Country-wise distribution of BAPAs

| Countries | Applications filed in 2019-20 | Applications filed in 2020-21 | Applications filed in 2021-22 | Total |

| USA | 22 | 20 | 18 | 60 |

| UK | 2 | 1 | 6 | 9 |

| Singapore | 3 | 2 | 1 | 6 |

| Japan | 1 | 4 | 0 | 5 |

| Switzerland | 1 | 1 | 3 | 5 |

| Australia | 3 | 0 | 2 | 5 |

| Ireland | 2 | 2 | 0 | 4 |

| France | 1 | 2 | 1 | 4 |

| Germany | 2 | 1 | 1 | 4 |

| Denmark | 1 | 2 | 0 | 3 |

| Finland | 1 | 0 | 2 | 3 |

| Netherlands | 0 | 2 | 0 | 2 |

| Czech Republic | 1 | 0 | 0 | 1 |

| Italy | 1 | 0 | 0 | 1 |

| Luxembourg | 1 | 0 | 0 | 1 |

| China | 0 | 1 | 0 | 1 |

| Belgium | 0 | 0 | 1 | 1 |

| Indonesia | 0 | 0 | 1 | 1 |

| South Korea | 0 | 0 | 1 | 1 |

| Total | 42 | 38 | 37 | 117 |

Figure 4-2 Major countries to which BAPA applications filed between April 2019 to March 2022 pertain

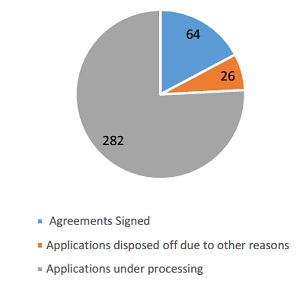

4.3 Status of Applications Filed

The status of BAPA applications filed is shown in Table 4-3 below. Out of a total 372 applications filed by 31 March 2022, a total of 90 applications have been disposed and 282 applications are under processing. A comparison of status of applications signed, disposed, and under processing for the BAPA applications filed till FY 2021-22 (as on 31 March, 2022) is presented in Figure 4-3.

Table 4-3 Status of BAPA applications filed

| Sl. No. |

FY | Applications Filed (Post Conversion) |

Agreements Signed |

Applications disposed off due to other reasons |

Applications under processing |

| A | B | C | D = A – B – C | ||

| 1 | 2012-13 | 37 | 19 | 6 | 12 |

| 2 | 2013-14 | 39 | 13 | 7 | 19 |

| 3 | 2014-15 | 30 | 16 | 1 | 13 |

| 4 | 2015-16 | 26 | 9 | 1 | 16 |

| 5 | 2016-17 | 24 | 5 | 3 | 16 |

| 6 | 2017-18 | 52 | 1 | 3 | 48 |

| 7 | 2018-19 | 47 | 1 | 3 | 43 |

| 8 | 2019-20 | 42 | 0 | 1 | 41 |

| 9 | 2020-21 | 38 | 0 | 1 | 37 |

| 10 | 2021-22 | 37 | 0 | 0 | 37 |

| Total | 372 | 64 | 26 | 282 | |

Figure 4-3 Status of BAPA applications filed till FY 2021-22, as on 31 March 2022

In the 64 BAPAs signed so far, the CBDT has provided tax certainty of 432 years & 9 months. These 432 years & 9 months include 121 years covered under the Rollback period of the concluded APAs. Out of the 64 Agreements, 37 have Rollback provisions. In FY 201920, the 7 BAPAs entered into have provided tax certainty totalling to 32 APA years & 9 months. Of these 7 BAPAs, 2 BAPAs have Rollback period of 8 years. In FY 2020-21, the 13 BAPAs entered into have provided tax certainty totalling to 65 APA years. Of these 13 BAPAs, 8 BAPAs have Rollback period of 24 years. In FY 2021-22, the 13 BAPAs entered into have provided tax certainty totalling to 61 APA years. Of these 13 BAPAs, 6 BAPAs have Rollback period of 18 years.

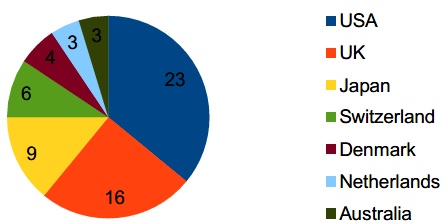

4.4 Country wise status of application filed (post conversion)

The country-wise status of BAPA applications filed is shown in Table 4-4 below. About 74% of the total BAPA applications that are still under processing, are with 4 countries – the USA, the UK, Japan, and Singapore. The maximum number of BAPAs signed so far have been with the USA followed by the UK and Japan. The country-wise breakdown of BAPAs that have been signed and that are under processing can be seen at Figure 4-4-1 and Figure 4-4-2 respectively.

Table 4-4 Status of BAPA applications filed

| Sl. No. | Country | Applications Filed | Agreements Signed | Applications disposed off due to other reasons | Applications under

Processing |

| A | B | C | D = A – B – C | ||

| 1 | USA | 164 | 23 | 7 | 134 |

| 2 | UK | 69 | 16 | 13 | 40 |

| 3 | Japan | 33 | 9 | 2 | 22 |

| 4 | Singapore | 14 | 0 | 2 | 12 |

| 5 | Switzerland | 18 | 6 | 1 | 11 |

| 6 | Finland | 9 | 0 | 0 | 9 |

| 7 | Germany | 8 | 0 | 0 | 8 |

| 8 | Sweden | 7 | 0 | 0 | 7 |

| 9 | The Netherlands | 9 | 3 | 0 | 6 |

| 10 | South Korea | 6 | 0 | 0 | 6 |

| 11 | Denmark | 8 | 4 | 0 | 4 |

| 12 | Australia | 7 | 3 | 0 | 4 |

| 13 | France | 5 | 0 | 1 | 4 |

| 14 | Ireland | 4 | 0 | 0 | 4 |

| 15 | Canada | 3 | 0 | 0 | 3 |

| 16 | Luxembourg | 2 | 0 | 0 | 2 |

| 17 | New Zealand | 1 | 0 | 0 | 1 |

| 18 | China | 1 | 0 | 0 | 1 |

| 19 | Czech Republic | 1 | 0 | 0 | 1 |

| 20 | Italy | 1 | 0 | 0 | 1 |

| 21 | Belgium | 1 | 0 | 0 | 1 |

| 22 | Indonesia | 1 | 0 | 0 | 1 |

| TOTAL | 372 | 64 | 26 | 282 |

Figure 4-4-1 BAPAs signed

Figure 4-4-2 BAPA Applications under processing

4.5 Agreements Signed – Year wise

The Table 4-5 and Figure 4-5 below show the year-wise details of BAPAs entered into till 31st March, 2022. As can be seen below, more than 50% of all BAPAs entered into till date were signed in FY 2019-20, FY 2020-21, and FY 2021-22. The year FY 2020-21 saw the highest number of BAPAs entered into in any given year so far, which exemplifies the efforts put in by the officers despite the constraints and disruptions faced due to the COVID-19 pandemic. This stellar performance was repeated in FY 2021-22, cementing the maturity of the BAPA programme in India.

In FY 2019-20, out of the 7 Agreements signed with Indian taxpayers, 3 pertained to Switzerland, 3 to UK, and 1 to USA. In FY 2020-21, out of the 13 Agreements signed with Indian taxpayers, 3 pertained to Denmark, 1 to Switzerland, and 9 to USA. In FY 2021-22, out of the 13 Agreements signed with Indian taxpayers, 1 pertained to Denmark, 1 to the UK, and 11 to the USA.

Table 4-5 Year-wise BAPAs signed

| FY | Agreements Signed |

| 2013-14 | 0 |

| 2014-15 | 1 |

| 2015-16 | 2 |

| 2016-17 | 8 |

| 2017-18 | 9 |

| 2018-19 | 11 |

| 2019-20 | 7 |

| 2020-21 | 13 |

| 2021-22 | 13 |

| Total | 64 |

Figure 4-5 Year-wise BAPAs signed

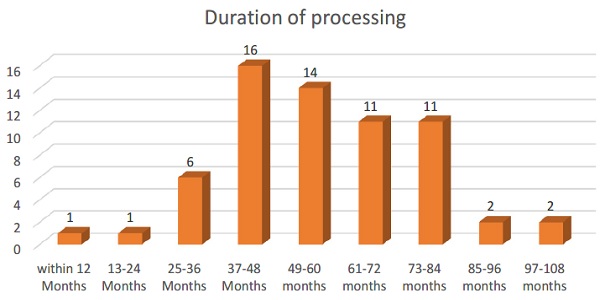

4.6 Duration of Processing

In FY 2019-20 to FY 2021-22, the average time taken to conclude BAPAs has gone up to approximately 70.86 months. The detailed analysis of this is depicted in Table 4-6-1, Table 46-2, and Figure 4-6 below. This has increased the average time taken for all BAPAs concluded till 31st March, 2022 from 44.32 months (as on 31st March, 2019) to approximately 58.91 months. The impact of COVID-19 pandemic on the average time taken to conclude BAPAs cannot be overemphasized. The pandemic did not just hinder the traditional mode of working but also precluded the possibility of holding face-to-face bilateral meetings with various treaty partner countries, which undoubtedly had an impact on the time taken to conclude APAs. Further, a number of BAPAs are actually resolved much before they are finally signed. However, due to several reasons such as the desire of the Applicants to conclude both the unilateral and bilateral legs of the application together, the Applicant waiting to clear the draft of agreements through multiple levels of internal approvals etc., the formal signing takes longer even after bilateral resolution, which increases the final duration of processing of BAPAs.

Table 4-6-1 Duration of processing of BAPA applications in FYs 2019-20, 2020-21, and 2021-22

| Duration of

Processing |

No. of Agreements

signed in FY 2019- 20 |

No. of Agreements

signed in FY 2020- 21 |

No of Agreements

signed in FY 2021- 22 |

Total

|

| Within 12 Months | 0 | 0 | 0 | 0 |

| 13-24 Months | 0 | 0 | 0 | 0 |

| 25-36 Months | 1 | 1 | 1 | 3 |

| 37-48 Months | 0 | 0 | 0 | 0 |

| 49-60 months | 2 | 5 | 1 | 8 |

| 61-72 months | 0 | 2 | 5 | 7 |

| 73-84 months | 4 | 4 | 3 | 11 |

| 85-96 months | 0 | 1 | 1 | 2 |

| 97-108 months | 0 | 0 | 2 | 2 |

| Total | 7 | 13 | 13 | 33 |

Table 4-6-2 Cumulative figures for duration of processing of BAPAs

| Duration of processing | Agreements signed till 31st March 2022 |

| Within 12 Months | 1 |

| 13-24 Months | 1 |

| 25-36 Months | 6 |

| 37-48 Months | 16 |

| 49-60 months | 14 |

| 61-72 months | 11 |

| 73-84 months | 11 |

| 85-96 months | 2 |

| 97-108 months | 2 |

| Total | 64 |

Figure 4-6 Duration of processing of all BAPAs signed till 31st March 2022

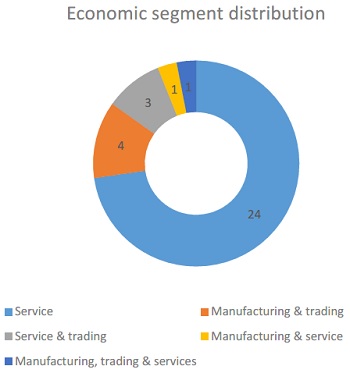

4.7 Distribution of agreements –Economic Activity wise

Table 4-7 and Figure 4-7 below capture the data regarding the economic activity or the predominant economic activity in each of the BAPAs entered into during FY 2019-20 to FY 2021-22. As in UAPAs, the service sector of the Indian economy has been the dominant sector that has been covered in BAPAs.

Table 4-7 Distribution of BAPAs as per economic activity

| S. No | Economic Activity | Agreements Signed in FY 2019-20, FY 2020-21 and FY 2021-22 |

| 1 | Service | 24 |

| 2 | Manufacturing & trading | 4 |

| 3 | Service & trading | 3 |

| 4 | Manufacturing & service | 1 |

| 5 | Manufacturing, trading & services | 1 |

| Total | 33 |

Figure 4-7 Economic activity distribution of BAPAs signed in FY 2019-20 to FY 2021-22

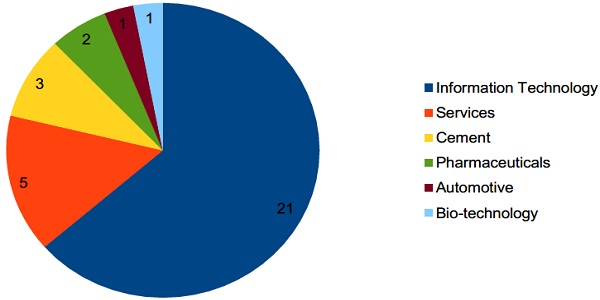

4.8 Distribution of Agreements – Industry-wise

Table 4-8 and the Figure 4-8 below reveal that there are six broad industry categories that have been covered under BAPAs concluded in FY 2019-20 to FY 2021-22. The Information Technology industry is the leading industry when it comes to being a part of the APA programme.

Table 4-8 Industry wise distribution of BAPAs signed in FY 2019-20, FY 2020-21, and FY 2021-22

| S. No | Industry | No. of Agreements Signed |

| 1 | Information Technology | 21 |

| 2 | Cement | 3 |

| 3 | Pharmaceuticals | 2 |

| 4 | Automotive | 1 |

| 5 | Services | 5 |

| 6 | Bio-Technology | 1 |

| Total | 33 |

Figure 4-8 Industry-wise distribution of BAPAs signed in FY 2019-20, FY 2020-21, and FY 2021-22

4.9 Nature of Covered Transactions

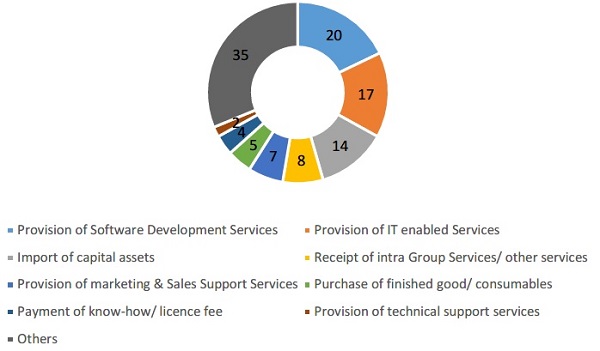

During FY 2019-20 to FY 2021-22, the 33 BAPAs entered into had a total of 112 covered international transactions as depicted in Table 4-9 and Figure 4-9. As can be seen, a wide variety of transactions have been covered by the APAs signed in these three years. Service-related transactions continue to lead in the transaction mix. It is interesting to note that 8 of the BAPAs had receipt of Intra Group Services (IGS)/other services as the covered transaction. Adjustments over receipt of IGS is one of the recurring issues in transfer pricing audit in India, which often ends up in protracted litigation.

Table 4-9 Nature of covered transactions in BAPAs signed in FY 2019-20, FY 2020-21, and FY 2021-22

| S. No | Nature of Transactions | No. of Transactions |

| 1 | Provision of Software Development Services | 20 |

| 2 | Provision of IT enabled Services | 17 |

| 3 | Import of capital assets | 14 |

| 4 | Reimbursement/ Recovery of expenses | 11 |

| 5 | Receipt of intra Group Services/ other services | 8 |

| 6 | Provision of marketing & Sales Support Services | 7 |

| 7 | Purchase of finished good/ consumables | 5 |

| 8 | Provision of R&D Services | 4 |

| 9 | Payment of know-how/ licence fee | 4 |

| 10 | Provision of technical support services | 2 |

| 11 | Sale of products to AEs | 2 |

| 12 | Provision of Hardware design services | 2 |

| 13 | Provision of Support Services | 1 |

| 14 | Import of components, equipment and machines | 1 |

| 15 | Receipt for technology and know-how fee | 1 |

| 16 | Provision customer support services | 1 |

| 17 | Provision of accounting support services | 1 |

| 18 | Provision of analytics support services | 1 |

| 19 | Provision of new product launch services | 1 |

| 20 | Provision of limited supervision activities | 1 |

| 21 | Provision of clinical trial services | 1 |

| 22 | Purchase of products | 1 |

| 23 | Distribution of products | 1 |

| 24 | Transfer of IPR | 1 |

| 25 | Provision of data hosting services | 1 |

| 26 | Payment of Royalty | 1 |

| 27 | Provision of Procurement Support Services | 1 |

| 28 | Payment of Interest on ECB | 1 |

| TOTAL | 112 |

Figure 4-9 Frequency of covered transactions in BAPAs signed in FY 2019-20, FY 2020-21, and FY 2021-22

4.10 Transfer Pricing Methodology adopted

Table 4-10 and Figure 4-10 below shows a breakup of Transfer Pricing Methodologies adopted in the signed cases. Out of 112 covered transactions, 75 have been benchmarked by using TNMM.

Table 4-10 Frequency of usage of TP methods in BAPAs signed in FY 2019-20, FY 2020-21, and FY 2021-22

| S. No | TP Methodology | No. Of Transactions |

| 1 | TNM Method | 75 |

| 2 | Other Method | 33 |

| 3 | CUP Method | 3 |

| 4 | Profit Split Method | 1 |

| Total | 112 |

Figure 4-10 Frequency of usage of various TP methods to benchmark covered transactions in BAPAs signed in FY 2019-20, FY 2020-21, and FY 2021-22

4.11 Renewal of BAPAs

An overwhelming majority of the applicants who have signed a BAPA with the CBDT have opted to file a renewal. This shows the trust reposed by the taxpayers in the APA programme and the preference for obtaining advance certainty rather than undergoing possible TP litigation and its related costs. Out of the 64 BAPAs signed till 31.03.2022, 49 applicants have opted for a renewal of the APA till date.

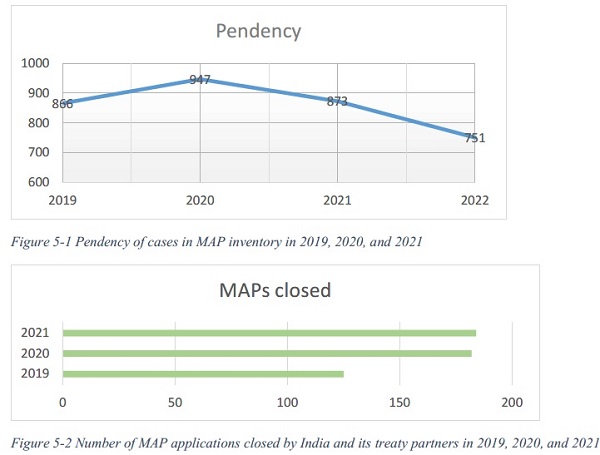

Chapter 5: Other dispute resolution processes

BAPAs are a special type of dispute prevention/resolution process between two treaty partners. Another dispute resolution channel available under India’s Double Taxation Avoidance Agreements (DTAAs) is Mutual Agreement Procedure (MAP). It is an alternate dispute resolution process involving two treaty partners, that seeks to remove taxation not in accordance with the DTAA arising from action by one or both treaty partners. India participates in the FTA MAP Forum of the Organisation of Economic Cooperation and Development (OECD) and shares its MAP statistics with the Forum. The statistics are available in the public domain.

MAP cases are negotiated by the Competent Authorities of India, namely the Joint Secretary (FT&TR-I) and Joint Secretary (FT&TR-II) in the CBDT, and other officers supporting them in this regard. MAP can be filed to avoid or resolve double taxation. The inventory of MAP cases in calendar years 2019, 2020, and 2021 as also reported under MAP statistics with the OECD is detailed in Table 5-1 below. As can be seen from the table, the number of MAP cases closed in 2020 and 2021 are substantially more than the number of new MAP applications invoked. As a result, the total number of MAP in India’s inventory is gradually reducing.

Table 5-1 MAP cases resolved in 2019, 2020, and 2021

| Sl.No. | Calendar Year | Opening Inventory | Invocations during the year | Closures

during the year |

Closing Inventory |

| 1 | 2019 | 866 | 206 | 125 | 947 |

| 2 | 2020 | 947 | 108 | 182 | 873 |

| 3 | 2021 | 873 | 62 | 184 | 751 |

As can be seen from Figures 5-1 and 5-2, the number of cases being resolved under MAP has been steadily increasing with a corresponding decline in closing inventory. This is primarily due to the maturing of our relationships with treaty partners. The MAP process faced immense challenges in the post-COVID period just like the APA programme, but India and its treaty partners managed to cope with these challenges and succeeded in resolving a significant number of cases.

Conclusion

The Indian APA programme is a very important part of the CBDT’s efforts to enhance the ease of doing business in India. Since its commencement in July, 2012, the APA programme has resolved many complex transfer pricing issues which were prone to long drawn litigation. The resolutions have been to the satisfaction of both taxpayers and the Government. While taxpayers have managed to get certainty over transfer pricing issues for five to nine years (depending upon whether rollback provisions are applicable to an Agreement), the Government has been able to divert resources away from the audit and litigation processes to more productive work.

At the same time, APAs are ensuring that the Government gets assured revenues from big taxpayers on the basis of the terms and conditions embedded in the Agreements. Though revenue mobilisation has never been the primary objective of the Indian APA programme, it is a positive externality flowing out from the programme that provides assured revenues to the Government of India. It is estimated that the 421 signed APAs have resulted in providing certainty for income of about Rs. 14,000 Crore. This translates into a tax and interest payment of about Rs. 4,000 Crore without getting into any litigation or there being any dispute. The APA Programme has done very well and the Government is aware of the benefits of the programme and how it is helping in creating a positive environment for Multinational Enterprises in doing business in India. The Government is committed to strengthening the programme by providing it with adequate human and physical resources.

Notes:

1Advance Pricing Agreement Guidance with FAQs released as part of Taxpayer Information Series No. 43

2 Usually applications filed in FY 2019-20 pertain to a period starting from FY 2020-21. Due date of filing the APA applications for period starting from FY 2020-21 was extended till 31st March, 2021. 39 BAPA and 83 UAPA requests that were filed after 31st March 2020 pertained to APA period beginning FY 2020-21

3It is worth noting that applications tagged as ‘under processing’ include applications where the applicant has neither been responsive to queries of the APA team nor has shown much interest in engaging in the APA process, but has not withdrawn its application.