Annual Information Statement (AIS) Presentation

♦ To promote transparency and simplifying the tax return filing process, CBDT has amended Form 26AS (vide Notification dated May 28, 2020)

♦ The new Form 26AS is an Annual Information Statement or AIS which will provide a complete profile of the taxpayer for a particular financial year.

♦ New information sources, not available in the current Form 26AS, have been added in AIS

♦ Taxpayer can provide feedback on information displayed in AIS

Key objectives of AIS:

- Display complete information to the taxpayer

- Promote voluntary compliance and enable seamless prefiling of return

- Deter non-compliance

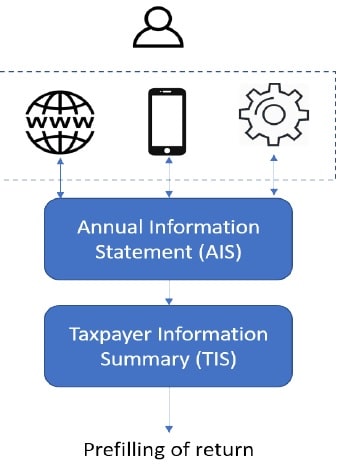

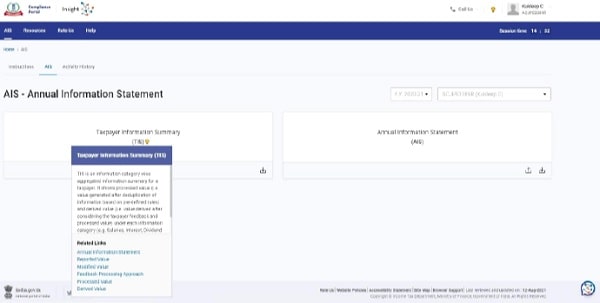

AIS and TIS Overview

About AIS :

- Annual Information Statement (AIS) is comprehensive view of information for a taxpayer displayed in Form 26AS

- Taxpayer can provide feedback on information displayed in AIS

About TIS :

- Taxpayer Information Summary (TIS) is an information category wise information summary for a taxpayer

- The same is updated based on the feedback provided by taxpayer in AIS

Page Contents

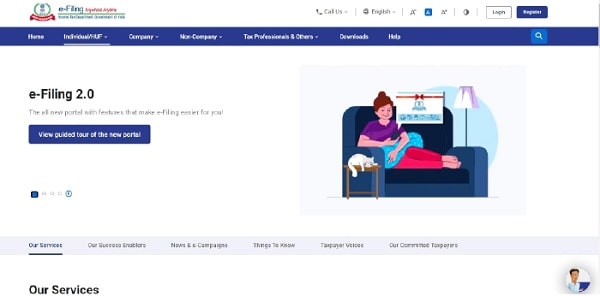

Access AIS through Portal

Access AIS via e-filing portal

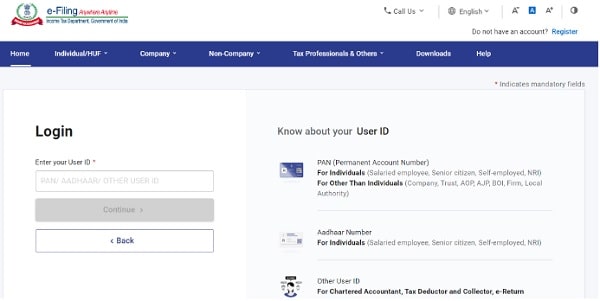

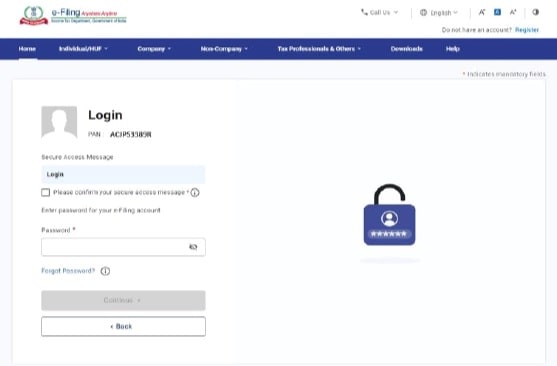

Login to e-filing portal using below steps:

- Visit Income Tax e-filing portal (www.incometax.gov.in/)

- Click on “Login” button

Note: If the user is not already registered, then user can register by clicking on the “Register” button.

- Enter user ID (PAN/ Aadhaar/ Other User ID) on the login page of and continue

- Enter password for e-filing account and confirm secure access message

- Click “Continue”

User can also select forgot password to initiate password reset

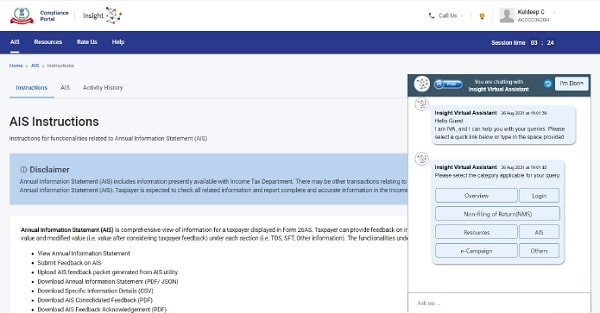

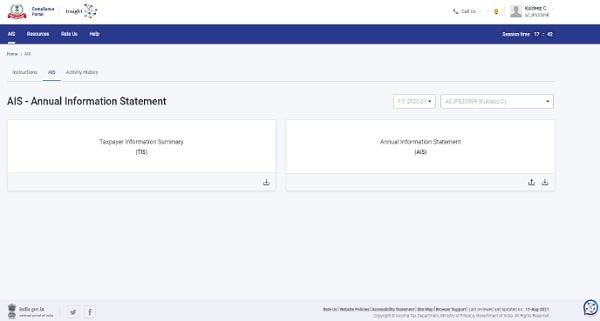

Navigate to Compliance Portal (AIS homepage)

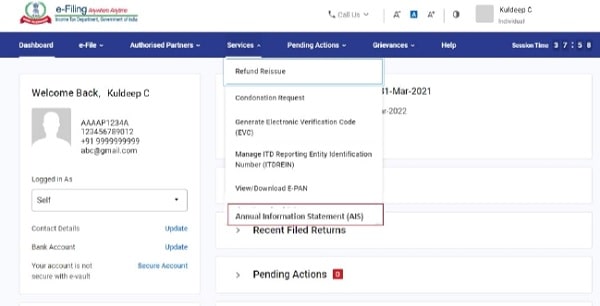

On successful login, e-filing portal home page will be displayed

To access AIS:

- Click the “Annual Information Statement (AIS)” under “Services” tab

- Click “Proceed” on the redirect to AIS Homepage message

- On successful redirection, AIS homepage on Compliance Portal will be displayed

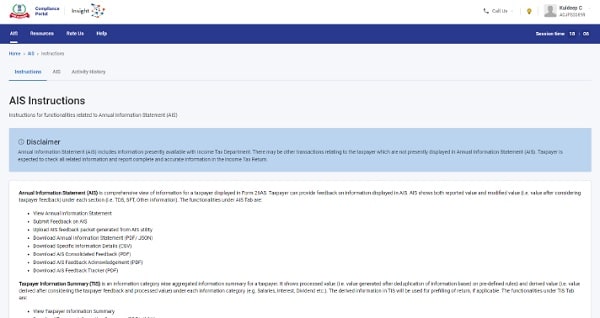

- “AIS Instructions” will be the default landing page, providing key instructions for AIS functionality

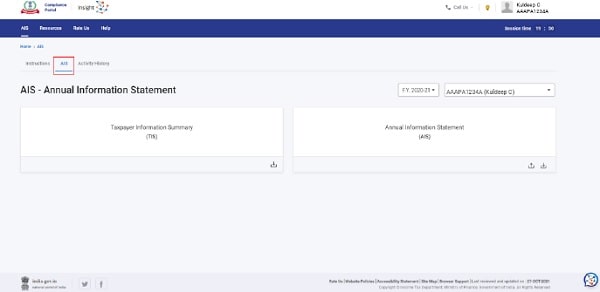

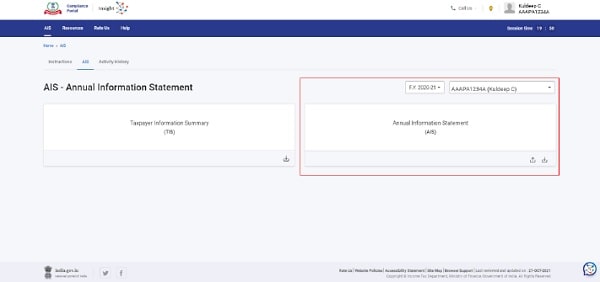

Under AIS Tab, Taxpayer Information Summary (TIS) and Annual Information Statement (AIS) tiles will be displayed

- Annual Information Statement (AIS) is comprehensive view of information for a taxpayer displayed in Form 26AS.

- Taxpayer Information Summary (TIS) is an information category wise information summary for a taxpayer.

Click AIS or TIS to access relevant functionality

View Annual Information Statement (AIS)

Annual Information Statement (AIS) is comprehensive view of information for a taxpayer displayed in Form 26AS

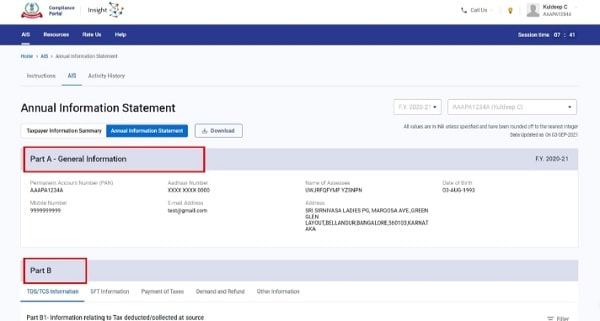

AIS can be viewed through following steps:

- Select relevant Financial Year (F.Y. 2020-21 for now)

- Click on Annual Information Statement (AIS) tile to view AIS

AIS displays information in following parts

- Part A: General information of taxpayer

- Part B: Source-wise information in defined tabs:

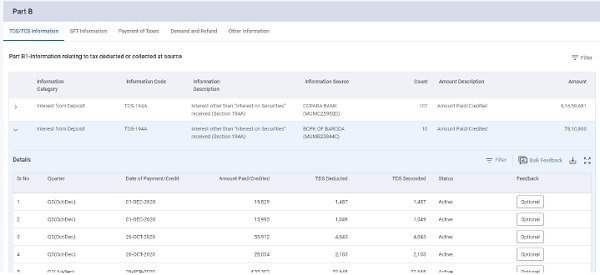

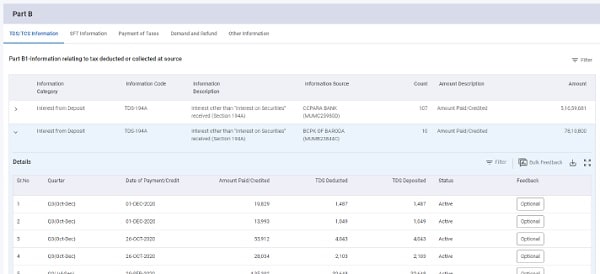

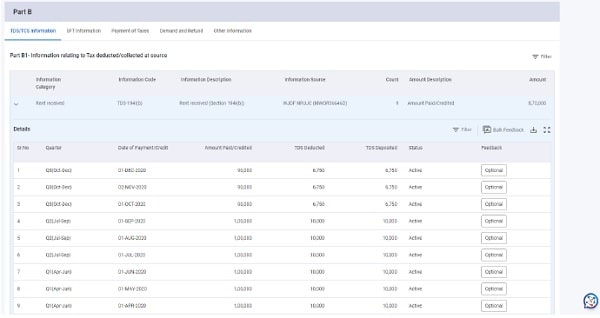

- AIS displays the information at two level

- Source wise aggregated value

- Information/transaction

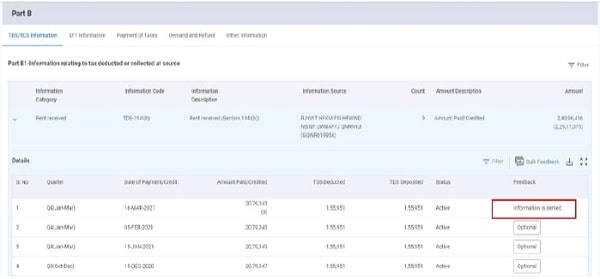

- Source wise aggregated view displays key details (Information Category, Code, description and information source) along with Count and Amount (based on active information)

- Relevant information under source wise details can be viewed by expanding the relevant details.

- Relevant Information/ transaction can be viewed by expanding any source wise aggregated view

- Information details are displayed along with status (Active/ Inactive) and option to submit feedback

- The Information details can also be downloaded in CSV format by clicking the download icon

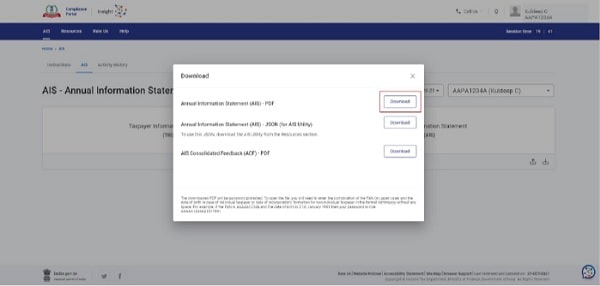

AIS can be downloaded in relevant format (PDF/ JSON) through following steps:

- Access AIS

- Click on download option available on screen

- From the Pop-Up, click “Download” button for the relevant file

Note: If the file size is large, download request will be taken and the file will be made available for download through “Activity History” tab.

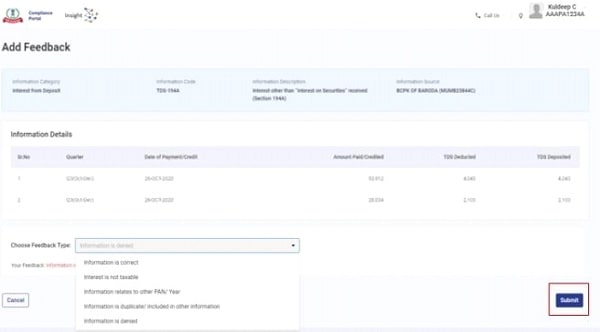

Provide Feedback on AIS Information

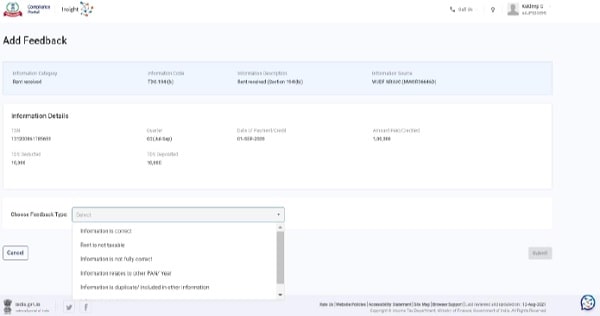

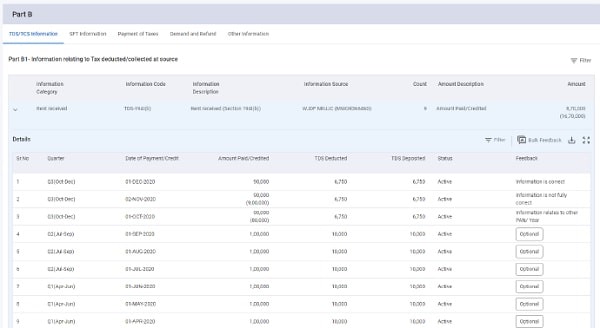

Feedback can be given on Active information displayed under TDS/TCS Information, SFT Information or Other Information through following steps:

- Navigate to AIS details and view source wise aggregated details in Part B

- Expand to see the transaction level information view

- Click on “Optional” tab in the Feedback column to proceed with submission of feedback

Following types of feedback on the information can be submitted:

-

- Information is correct

- Information is not fully correct

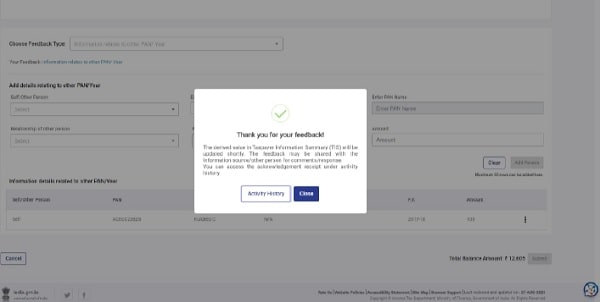

- Information relates to other PAN/Year

- Information is duplicate / included in other information

- Information is denied

- Customized Feedback (based on information category)

- Choose the relevant feedback option

- Enter the feedback details, if required and click “Submit”

- Success message along with button to navigate to “Activity History” is displayed

- Navigate to “Activity History” to download Feedback Acknowledgement Receipt

- Based on the feedback submitted on the information, the modified value will be calculated

- The same will be displayed in brackets along with the reported value of that information

- It will also be aggregated and displayed at information source level

- Modified value will be utilised to update the derived value in TIS view.

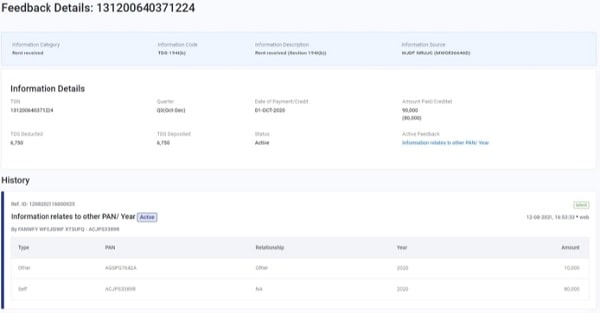

Feedback History will show the details of already provided feedback on the information

Navigate to feedback history screen through following steps:

- Navigate to relevant information for which feedback has already been submitted

- Click on the Feedback (for which feedback has already been submitted)

- View history of the feedback for the selected information

- Activity History records the relevant activities performed for AIS functionalities

- Large files can also be downloaded from Activity History screen which are made available as per request

- These files can be downloaded by clicking on the download icon against the activity

![]()

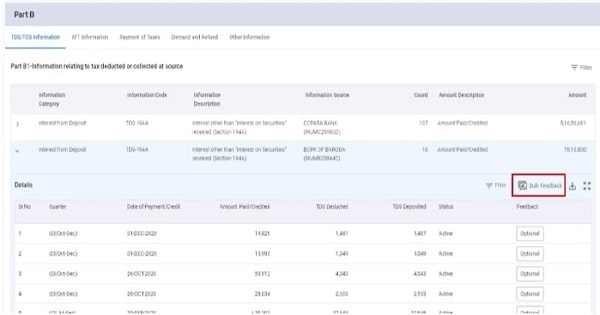

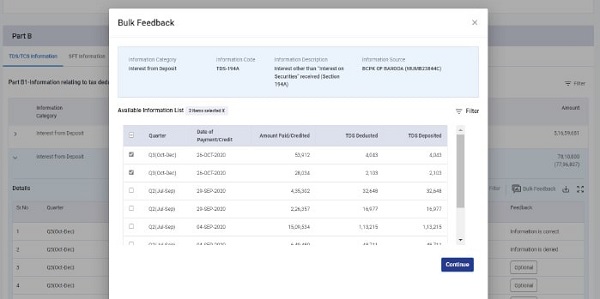

Apart from submitting feedback on each information, bulk feedback can also be submitted on selected information through following steps:

- Navigate to AIS details

- View source wise aggregated details in Part B

- Expand to see the transaction level information view on which feedback is to be provided

- Select the bulk feedback option

- Select multiple information (under one information source) for which the feedback is to be provided

- Click on “Continue” button

- Choose relevant feedback option

- Feedback options available for bulk submission include:

- Information is correct

- Information relates to other PAN/year

- Information is duplicate/ included in other information

- Information is denied

- Customized feedback option as per information category

- Click on “Submit” button

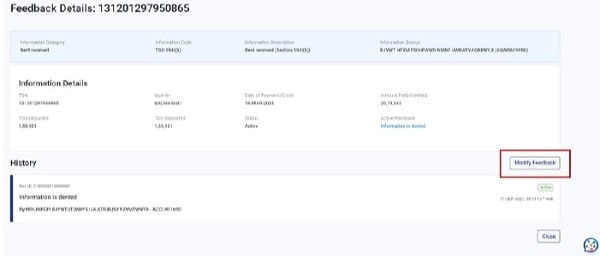

An already submitted feedback can be modified (on active information) through following steps:

- Navigate to AIS details and view source wise aggregated details in Part B

- Expand to see the transaction level information view

- Click on information on which an already provided feedback is to be modified

- On being navigated to Feedback History screen, click on “Modify Feedback”

- Select reason for modification and enter remarks

- Choose relevant feedback option and enter details

- Click on “Submit” button

- Navigate to “Activity History” to download Feedback Acknowledgement Receipt

Note: If the reason for modification is selected as “Others”, then the Remarks field would be mandatory.

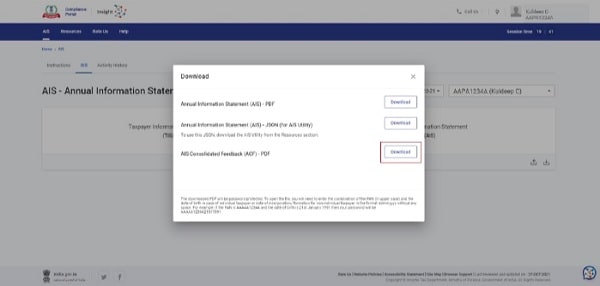

Note: Based on the feedback submitted on the information, the modified value will be calculate Consolidated Feedback PDF provides details of information on which feedback is submitted

The same can be downloaded through following steps:

- Click on the download icon on the AIS tile in AIS Homepage

- Click on the “Download” button for Consolidated Feedback (AIS) – PDF

Note: Feedback other than ‘Information is correct’ are shown in consolidated feedback file.

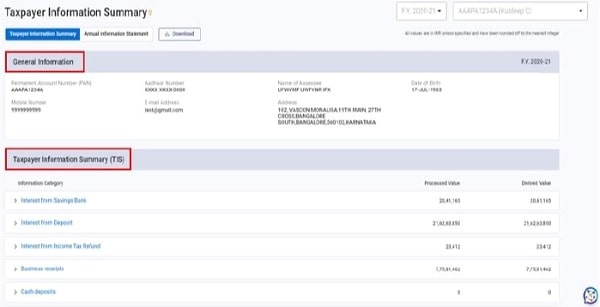

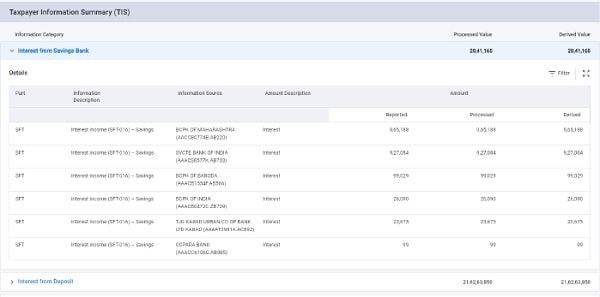

View Taxpayer Information Summary (TIS)

Taxpayer Information Summary (TIS) is an information category wise information summary for a taxpayer.

TIS can be viewed through following steps:

- Select relevant Financial Year (F.Y. 2020-21 for now)

- Click on Taxpayer Information Summary (TIS) tile to view your TIS details

TIS displays following details

- General Information of Taxpayer

- Taxpayer Information Summary – showing information category wise summary for a taxpayer along with following values:

- Processed Value – Value after processing (including deduplication of information) based on pre-defined rules

- Derived Value – Value derived after considering the taxpayer’s feedback (if any), and processed value

- On expanding any information category, the source wise aggregated value is displayed

- Along with relevant details, this view displays:

- Reported Value – Value as reported by information source

- Processed Value

- Derived Value

- The processed value and derived value of each information source is summed up for display at information category wise view

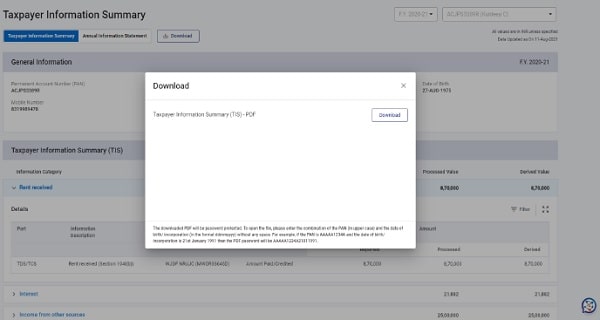

TIS can be downloaded in PDF format through following steps:

- Navigate to TIS page

- Click on download icon

- Click on “Download” button

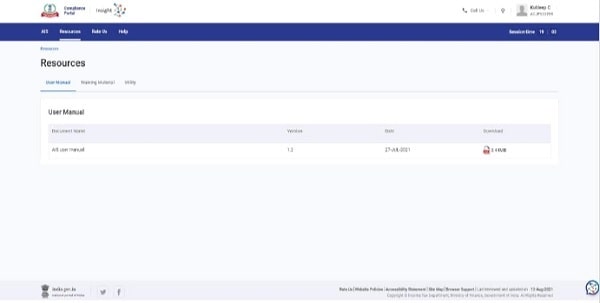

Resources, Rate us and Help

Resources

Resources consist of following:

- User Manual – Designed to give step by step assistance to users

- Training Material – This includes Frequently Asked Questions (FAQs) intended to give assistance with common queries and other relevant material

- Utility – AIS Utility can be downloaded and installed by taxpayers to submit feedback in offline mode

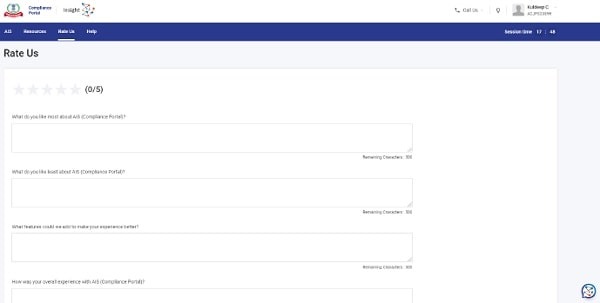

- Facility to enable users to provide their views and suggestions for the portal.

- The rating and remarks will be carefully considered to make necessary improvements in the portal

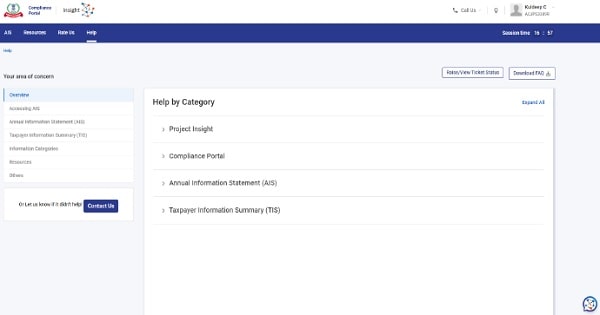

Help

- Detailed information (FAQs) on a specific category and subcategory is available

- “Contact Us” button providing details to reach out to helpdesk

- “Raise/ View Ticket Status” button can be used to raise ticket in case of any issues/ escalations

Context-based Help (Self Help)

Context-based help is introduced on AIS Portal to get quick information of important terms

Can be accessed through following steps:

- Bulb icon present at the top right of the portal screen can be used to enable/disable context specific help

- Hover the mouse pointer across the term to view the bulb icon

- Click on the bulb icon to view information description

- Click on various items under related links to explore additional information

Chatbot

- Artificial Intelligence (AI) enabled chatbot, designed for quick resolution of queries

- User can select relevant category or type query to get instant replies based on FAQs and machine learning.

- Can be easily accessed from any page on the portal using chatbot icon.