Article explains Salient Features Of The Direct Tax Vivad Se Vishwas Act, 2020 (‘Scheme’), Steps Involved In Payment Of Tax Arrears, Important Definitions Under Direct Tax Vivad Se Vishwas Scheme, Amount Payable By Declarant, Filing Of Declaration under Direct Tax Vivad Se Vishwas Scheme, Immunity From Initiation Of Proceedings and Non Applicability Of Direct Tax Vivad Se Vishwas Scheme.

Page Contents

- 1. Salient Features Of The Direct Tax Vivad Se Vishwas Act, 2020 (‘Scheme’)

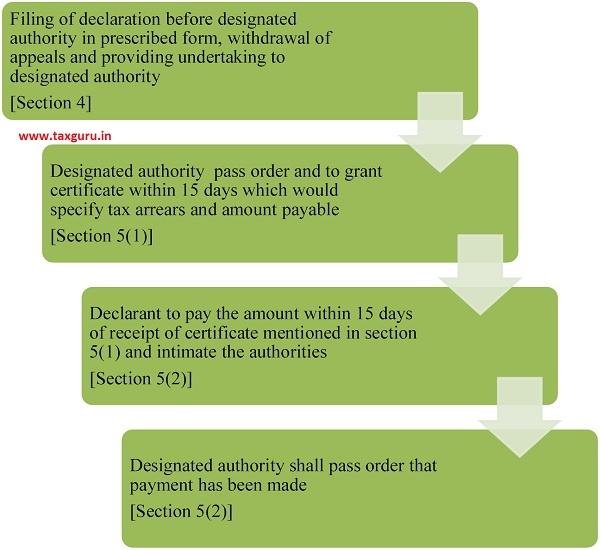

- 2. Steps Involved In Payment Of Tax Arrears under Direct Tax Vivad Se Vishwas Scheme

- 3. Important Definitions Under The Direct Tax Vivad Se Vishwas Scheme

- 4. Amount Payable By Declarant

- 5. Immunity From Initiation Of Proceedings

- 6. Non Applicability Of Scheme

1. Salient Features Of The Direct Tax Vivad Se Vishwas Act, 2020 (‘Scheme’)

- The Direct Tax Vivad se Vishwas Act, 2020 is a separate Act and not part of the Income-tax Act, 1961 (‘Act’).

- The Scheme is on similar lines to the Sabka Vishwas Scheme introduced under Indirect tax regime, – Amount stuck in litigation: Rs. 3.75 lakh crores; No of cases settled under the Scheme: 1,89,000; Realisation from the scheme: around Rs. 38,000 crores.

- For Direct Taxes, 4,83,000 cases pending, amount stuck in litigation: Rs. 9.32 lakh crore (as on 30 November 2019)

- In the Statement of objects and reasons it is clearly stated that the scheme is for dispute resolution relating to direct taxes, however the scheme provides only for disputes in relation to Income Tax Act, 1961 and not for Wealth Tax or other direct taxes. It needs to be seen whether such exclusion was envisaged by the legislature.

- Appeals pending as on 31st day of January 2020 are covered by the scheme.

- Last date for opting for the scheme is yet to be notified. However, as per the Budget speech of the Hon’ble Finance Minister, the scheme will be operative up to 30 June 2020.

- The appeals can be pertaining to any assessment year.

- There is no minimum or maximum eligibility criterion for the purpose of opting into the Scheme.

- The Scheme provides for payment of 100% of the disputed tax and consequently no interest and penalty shall be levied for such disputed tax. The scheme does not provide any reduction in payment of disputed tax, unlike the Sabka Vishwas Scheme which provided for the same under the indirect taxes regime.

- Assent from the President is yet to be received and the scheme shall be effective on the day it receives assent from the President.

- To improve the ecosystem of the taxpayers and tax administrators, the CBDT should seek to allay the fears, whether settlement of the tax dispute by a tax payer would allow the tax administrator to take similar position in law for future assessments, thus never ending the spiral of litigation.

2. Steps Involved In Payment Of Tax Arrears under Direct Tax Vivad Se Vishwas Scheme

3. Important Definitions Under The Direct Tax Vivad Se Vishwas Scheme

| Important Definitions [Section 2] | – The Scheme provides for the ‘declarant’ to file a ‘declaration’ in respect of the matters, for which the declarant / appellant is in appeal.

– The Scheme is in respect of an appellant who has filed appeal before the appellate forum and such appeal is pending as on 31 January 2020 (being the ‘specified date’ under the Scheme). – The appellate forum covered under the Scheme means the Commissioner (Appeals) (‘CIT(A)’), Income Tax Appellate Tribunal (‘ITAT’), High Court , Supreme Court. – The declaration is in respect of ‘tax arrear’.

(i) the aggregate amount of disputed tax, interest chargeable or charged on such disputed tax, and penalty leviable or levied on such disputed tax; or (ii) disputed interest; or (iii) disputed penalty; or (iv) disputed fee, as determined under the provisions of the Income-tax Act; – Section 2(j)(i) defines Disputed tax as:

|

| Important Definitions [contd.]

Section [2)] |

– Section 2(j)(ii) also defines Disputed tax as:

|

| VTPA Comments | – The Scheme does not provide for the proceedings before the ‘Dispute Resolution Panel’ (‘DRP’) to be settled.

– It needs to be considered that the DRP proceedings were introduced for the purposes of providing an alternate basis to settle tax disputes. However, unfortunately, this goal has not been achieved. Thus, considering the thrust of the Scheme, DRP proceedings should also have been covered under the Scheme. – The Scheme covers all persons whether resident or non-resident under the Act. |

4. Amount Payable By Declarant

As per Section 3:

| Sr. No. | Nature of tax arrear (Disputed tax liability) | Amount payable on or before 31 March 2020 | Amount payable on or after 1 April 2020 up to the last day of the scheme |

| 1 | Tax arrear is aggregate of disputed tax, interest chargeable or charged on such arrears and penalty leviable or levied on such tax | 100% of the disputed tax, i.e., without taking into consideration interest and penalty | 110% of the disputed tax |

| 2 | Tax arrear relates to disputed interest or disputed penalty or disputed fee | 25% of the disputed interest or disputed penalty or disputed fee | 30% of the disputed liability |

–

| VTPA Comments

|

– The Scheme does tend to provide an option, to settle disputed tax or disputed interest or disputed penalty or disputed fee. However, the Scheme may require clarifying the manner in which the disputed interest can be settled without settling the disputed tax liability.

– Further, from the bare reading of the Scheme, disputed penalty may be settled though the disputed tax liability continues to be litigated. |

| Filing of declaration and particulars to be furnished

[Section 4] |

– Section 4 deals with the declaration to be filed with respect to the disputed tax arrear on various counts before the designated authority.

– Section 4 states that from the date on which the certificate under section 5(1) of the Scheme is issued in respect of the declaration filed, any appeal pending before CIT(A) or ITAT, in respect of the disputed tax, arrear shall be deemed to have been withdrawn. – In respect of any appeals or writs filed before the High Court or the Supreme Court against any order in respect of disputed tax arrear, the declarant would be required to withdraw such appeal or writ petition, as required by law and furnish to designated authority proof of such withdrawal, alongwith the declaration. – Further, where the declarant has initiated any proceedings or given notice thereof, in respect of any proceeding for arbitration, conciliation or mediation under any law in force or any treaty entered into by India with any other country or territory outside India, whether in respect of protection of investment (e.g., Investment Promotion Protection Agreement signed by India, etc); then the Scheme requires the declarant to withdraw all claims under such proceedings or notice given thereof, prior to making the declaration and furnish proof thereof to the designated authority. – The declarant is also required to give an undertaking in respect of the tax arrear, whereby he waives all rights under any law or in equity or agreement entered into by India with any country or territory outside India of any nature. – The presumption under the Scheme is that all the declarations made by the declarant would be nullified and all the consequences under the Act against the declarant would be deemed to be revived if: (a) any material particular furnished in the declaration is found to be false at any stage; (b) the declarant violates any of the conditions referred to in this Act; (c) the declarant violates any of the conditions referred to in this Act; |

| Time and manner of payment

[Section 5] |

– Further section 5(3) states that once an order has been passed under section 5(1) containing particulars of the tax arrear and the amount payable by the declarant after such determination, then no further proceedings can be initiated under the Act or under any law in force or any agreement as noted above. |

–

| VTPA Comment | – The provisions of section 4 are very onerous and the declarant would need to be aware that he would be waving all his rights under the Act, DTAA, BIPA and under general provisions of law, if he intends to be covered under the Scheme.

– The Scheme states that no appellate forum or arbitrator, conciliator or mediator can continue any issue relating to any tax arrear. It would need to be seen in which manner such forums sitting outside India would be governed by the domestic law of India, and further how the appellate forums of India would be affected by such provision in the Scheme, e.g., only the ITAT has the power to permit an appeal to be withdrawn, can the scheme provide for a deeming withdrawal of such appeal is a question which may require further consideration. – However where the tax dispute has been carried forward in appeal by the tax department, the Scheme does not spell out in detail, how such tax dispute would need to be settled by the declarant and what would be the duties or the responsibilities of the tax department to bring an end to such dispute. |

5. Immunity From Initiation Of Proceedings

| Immunity from initiation of proceedings in respect of offence and imposition of penalty in certain cases. [Section 6] | – Section 6 and section 8 of the Scheme needs to be read together.

– Section 6 clearly states that the designated authority cannot initiate any proceeding in respect of any offence in respect to tax arrear or impose or levy any penalty or charge any interest in respect of the tax arrear. – Further, section 8 tends to constrict the immunity granted under the scheme in terms of section 5(3) and 6 by stating that nothing contained in the Scheme can be construed to give any benefit or concession in any other proceedings under any law in India other than those in relation to which the declaration is made. |

| VTPA Comments | – The Scheme does provide for benefits/concessions/immunity. However, this benefit is only in relation to the declaration and not anything beyond that. |

6. Non Applicability Of Scheme

| Scheme not to apply in certain cases

[Section 9] |

– Section 9 of the Scheme provides cases wherein the provisions of the Scheme would not apply. They are as under:

|

| VTPA Comments | – The exceptions provided especially in respect of proceedings under the Income-tax Act, 1961 could have been more liberal so as to encourage the declarant for paying taxes and settling the issue; albeit the amount payable under the Scheme could have been different vis-à-vis the normal tax arrears. |

Dear Sir,

As per above mentioned scheme, we are supposed to make application in prescribed form. Whether all the forms and declarations are published by the Department??

If yes, can you please provide the link.

Thank You.

Such schemes are in the nature of a compromise or settlement. They should be in the nature of give and take. Not only take. Waiving off the interest and penalty are natural and expected. They should have given relief on the tax too since it is disputed and not admitted by the Assessee. They should have given 50% off on the Tax amount and complete waiver of Interest and penalty. In India there is a tradition of high pitched assessments, and some are made 3 – 4 times so that even after 50% stay order the Assessee will be compelled to pay a large amount. There is no accountability of the officers so imaginary assessments are routine.

The TAX waiver should have been 50 % to make the offer attractive and lucrative.

Dear Sir,

We lost the appeal in CIT Appeal. We have Received Order on 7th Jan, 2020. we have not file appeal till 31st Jan, 2020 as grace period to file the appeal in ITAT is 60 days. We want to go for the scheme. can we go for the scheme. ?