1. Legal provisions

As per sub-section (1) of section 159 of the Income-tax Act, 1961, where a person dies, his legal representative shall be liable to pay any sum which the deceased would have been liable to pay if he had not died.

Further, as per sub-section (3) of the said section, the legal representative of the deceased shall be deemed to be an assessee. Hence, the legal representative of the deceased person is required to file the income tax return on his/her behalf for the income earned as representative assesses of the deceased person.

2. Documents required to register as a Representative Assessee on e-filing 2.0:

Following documents shall be required to register as a representative assessee on e-filing 2.0:

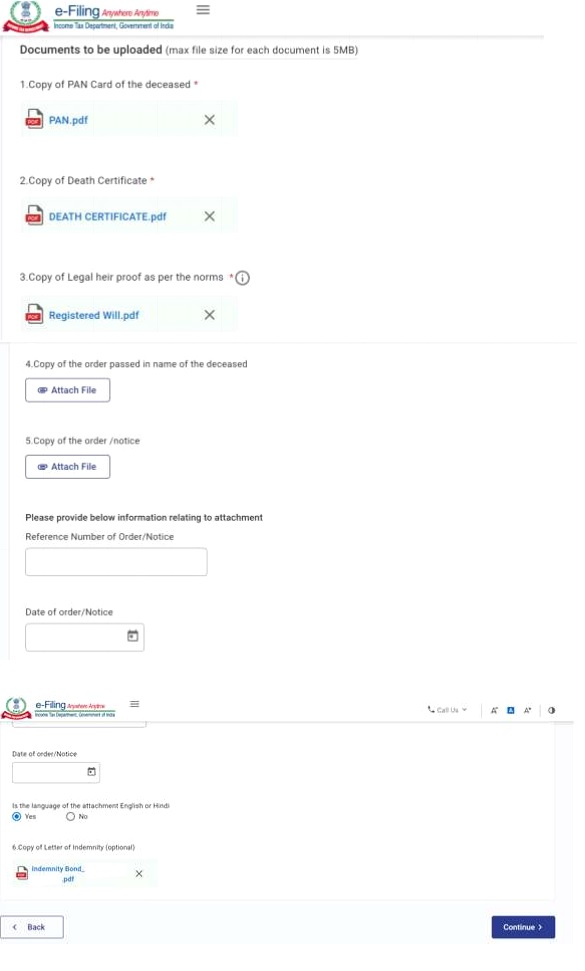

a. Copy of PAN Card of the deceased

b. Copy of Death Certificate

c. Copy of Legal heir proof

The following documents shall be accepted as a Legal heir proof (refer screenshots below):

- Legal heir certificate issued by a court of law;

- Legal heir certificate issued by local revenue authorities;

- Surviving family member certificate issued by the local revenue authorities;

- Registered will;

- Family pension certificate issued by the State/Central Government;

- Letter issued by the Banking or financial institution in their letter head with seal and signature mentioning the particulars of nominee or joint account holder to the account of the deceased at the time of the demise.

D. Copy of the order passed in name of the deceased (Mandatory only if the reason for registration is ‘Filing of an appeal against an order passed in the name of deceased’).

e. Copy of Letter of Indemnity (Optional- Format attached as Annexure-I or click the following link)

Letter of Indemnity.pdf

3. Procedure to Register as a Representative Assessee on e-filing 2.0:

3.1 Login on Income Tax account on www.incometax.gov.in

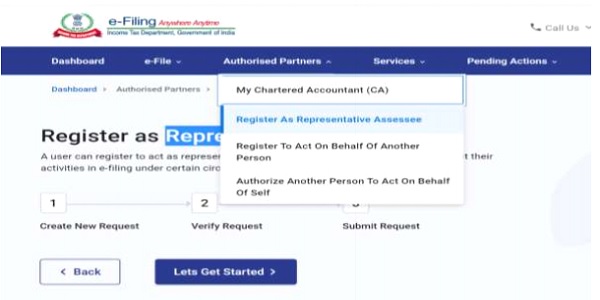

3.2 Go to Authorised Partner and click on “Register as a Representative Assessee”

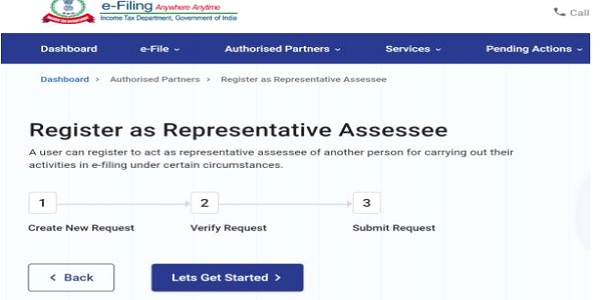

3.3 Click “Let’s Get started”.

3.4 Click on “Create New Request”

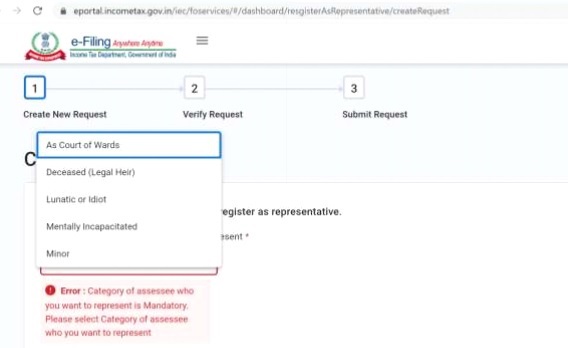

3.5 Select the category as “Deceased (Legal Heir)” and enter the required details of the deceased and the legal representative

–

–

3.6 Attach all the required documents and click on “Continue”.

3.7 Post this, a success message will be displayed confirming the submission of request to ‘Register as Representative assessee’.

3.8 After registration, a request will be sent to the e-Filing Admin for approval. The e-Filing Admin will check the authenticity of the request details and may Approve/Reject the request. Upon Approval/Rejection, an e-mail and SMS will be sent by the Income-tax Department on the registered e-mail ID.

Annexure-I

LETTER OF INDEMNITY

(To be executed on Non-judicial Stamp paper of appropriate value and notarized)

To,

Assessing Officer

Income Tax Department

Sir,

Sub: Request to Register as ‘Representative Assessee’ for Late Mr. /Mrs. _ [Permanent Account Number [•]].

1. I/We, the undersigned, hereby inform you that Mr. /Ms. /Mrs. _______________________, holder of Permanent Account Number [•],resident of______________________________, (“Deceased”), died on_____________at_____________.

2. That, the Deceased died (tick the appropriate option):

- Intestate, i.e. without leaving behind a valid and enforceable will, and that in accordance with the law of intestate succession as applicable to him/her at his/her time of death, the Deceased left behind as his/her only surviving heirs, claimants or next of kin, the following persons:

OR

- Deceased died leaving his/her last Will and Testament dated_____________ and

(i) we the undersigned are the executors and beneficiaries thereof;

(ii) and further, that we are the only persons entitled to the estate of the Deceased, as legal heirs:

| S. No. | Name | PAN Number | Address | Relationship with Deceased | Age |

That out of aforesaid legal heirs, Master/Miss_________________________ aged _____years is a minor and he/she is being represented by his/her father/mother or Legal Guardian Mr. /Mrs._______________________________ .

(Collectively referred to as “legal heirs”)

3. I/We affirm that I/we am/are the sole legal heirs of the Deceased and there are no orders, decrees, judgments or ongoing proceedings before a court of law or other forum contrary to our claims as legal heirs vis-à-vis the estate of the Deceased.

4. I/We have requested you, the Income Tax Department, to allow Mr. /Ms./ Mrs./ , being one of the legal heirs to the Deceased, to act in capacity of the ‘Representative Assessee’ for the Deceased in accordance with Section 159 of the Income Tax Act, 1961, and allied provisions and rules, on my/our behalf and you have kindly agreed to do so on my/our executing an indemnity as is contained herein, and on relying on the information given by us herein believing the same to be true, complete and accurate.

5. In consideration therefore, of your approving our request in allowing Mr. /Ms./ Mrs./ _____________________ to act in capacity of ‘Representative Assessee’ for the Deceased in accordance with Clause 4 above, I/we, the legal heirs aforementioned, for myself/ourselves and my/our respective heirs executors and administrators jointly and severally hereby indemnify you, the Income Tax Department, and agree to keep indemnified and hold the Income Tax Department saved, harmless and defended for all time hereafter from and against all losses, claims, legal proceedings, actions, demands, risks, charges, damages, costs, expenses, including attorney and legal fees and penalties whatsoever which may be initiated against the Income Tax Department, or be paid, sustained, suffered or incurred by the Income Tax Department howsoever, as a consequence direct or indirect by reason of the Income Tax Department having agreed at my/our stated request. If called upon by the Income Tax Department to do so, I/we shall join any proceedings that may be initiated against the Income Tax Department and I/we shall defend at our cost any such proceedings. Further, I/we shall initiate such proceedings as may be considered necessary by the Income Tax Department, if called upon by the Income Tax Department to do so, in order to protect the Income Tax Department’s interests and to further and perfect the indemnity granted hereby in favor of the Income Tax Department.

IN WITNESS WHEREOF:

Dated this ___ day of____________ 20____.

Signed and delivered by the legal heirs:

| Name of Legal Heir | Signature |

Before me

NOTARY PUBLIC

****

Disclaimer: This document has been prepared for academic use only to understand the procedure for adding a legal representative for a deceased person and to share the same with the fellow professionals and all concerned. Though every effort has been made to avoid errors or omissions in this document yet any error or omission may creep in. The author shall not be responsible for any damage or loss to any one, of any kind, in any manner there from. The author shall also not be liable or responsible for any loss or damage to any one in any matter due to difference of opinion or interpretation in respect of the text. On the contrary it is suggested that to avoid any doubt the user should cross check the status from the available materials on the issue including the order.

Sir, My client wants to claim the refund on the ITR of Deceased person but i am unable to claim that because the bank account of deceased is inactive. and portal cannot validate the bank account of legal heir. I have no option to update bank details. Please guide me that how can i claim refund

To all the users facing Refund issue in case of filling return for deceased person as a Registered Legal Heir here are the steps that one can follow:

– First file your IT return using Offline tool and then in the Bank account details provide the same account that you had submitted at the time of raising request for Legal Heir

– Validation will be successful and your return will be completed

– However the refund will fail because the bank account is not registered with the deceased PAN

– Then you need to raise Refund Reissue from the deceased dashboard (Logged in as Legal Heir). There you need to select the year for which refund needs to raised again and then finally account (your account).

– In case of issue talk to income tax portal support team. They will definitely assist you

REPRESENTATIVE IS BEEN ADDED AND IT DEPARTMENT HAS APPROVED THE SAME, NOW DECEASED EFILING ACCOUNT IS DEACTIVATED, HOW DO I FILE DECEASED INCOME TAX RETURNS???

Hello sir. What If we are not able to provide proof of legal heir. Then how can we return the file. Any help will be beneficial to us.

Sir please provide the format of legal hair certificate issued by bank for joint name with deceased.

Do I need Indemnity bond even after depositing death certificate of the deceased?

LEGAL HEIR IS ALREADY REGISTERED ON I.T PORTAL BUT NO BANK ACCOUNT IS SELECTED FOR REFUND THAT TIME.. NOW HOW TO GET REFUND IN LEGAL HEIR’S ACCOUNT ?

PLZ HELP

Can I (legal heir) get refund in my bank account ?

Replied on your mail

what kind of order is this – The order is passed in the name of the deceased

Sir

My wife expired on 30th Dec 2021.SHE WAS IT PAYEE.As a husband how I can file her IT return and claim refund,if any. Please send PDF format on my given e mail address.

bkgsbi@yahoo.com

9415887935

Responded on mail.

MY CLIENT IS DIED ON 21-04-2021 I WANT TO APPOINT LEGAL HEIR, PLEASE PROVIDE ME STEP-BY-STEP PROCEDURE OF THAT WORK

Dear Sir,

To register as legal heir in the portal , i have to login to the “deceased account” or the account of one who will be acting as a “legal heir”.

Thank you

Hello sir. What If we are not able to provide proof of legal heir. Then how can we return the file. Any help will be beneficial to us.

Dear Sir, Pls inform me about the format of the letter fronm Bank reqd as proof of Legal heir.

Also it is fine if a son files IT returns of deceased father using the fathers credentials in Income Tax portal? This is w/o registering as Legal heir

Dear sir

It’s been more than a month i have made request on income tax portal to add me as a legal representative assessee but i have not received any kind of reply from the department yet !! And the status is still showing as pending for approval…what can i do to resolve it asap ?

Sir please provide the format of legal hair certificate issued by bank for joint name with deceased.

Respected Sir,

Me and my husband have a joint account and he expired in Feb 2021

I(spouse) have filed return(AY 2021-22) on behalf of my deceased husband and it got processed and there is refund which has intimated via CPC order however refund is rejected as my husband PAN is now de linked from the joint account

It is now linked to my PAN hence refund should come to my account

Please advise how I can claim this refund

Please refer the following in respect of your query-

Step-1 Log in as legal representative

Step-2 Raise Refund Reissue request by following the steps mentioned at point 3 of this document- https://www.incometax.gov.in/iec/foportal/help/how-to-raise-e-filing-service-requests

Please reach out to us in case of any further queries. Would be happy to assist you.

Sir,

Bank Account of Deceased is closed. Bank Account of Deceased would not be validated in Legal Heir Login Id. How to claim Refund.

Got any solution? same problem

Replied on your mail.

LEGAL HEIR REGISTERED ON I.T PORTAL BUT NO BANK ACCOUNT WAS SELECTED. NOW HOW TO GET REFUND IN LEGAL HEIR’S ACCOUNT ?

Sir,

Bank Account of Deceased is closed.

Every time refund reissue fails. I live in Delhi and Assessing Officer lives in Chennai. Explained him everything but he is saying come to office. I cannot help over mail or call 🙁

Dear Sir, please provide the letter of Indemnity format in soft word format in my mail ID, Pls do the needful

Thanks in advance

Please share your email ID