Article compiles top 10 Changes in Income Tax for Assessment Year 2018-19.

Page Contents

- 1. Change in Income Tax Slab Rate for AY 2018-19 for Individuals :

- 2. Rebate u/s. 87A:

- 3. Applicability Of Section 234F Fee For Default In Furnishing Of Income Tax Return Within Due Dates Specified U/S. 139(1)

- 4. Change of Base Year for Indexation:

- 5. Change in the Holding Period of Capital Asset for the purpose of Computation of Capital Gains :

- 6. Tax Cases can be reopened for up to 10 Years :

- 7. Disallowance of certain deductions if return is not furnished within the Due Date specified u/s. 139(1) :

- 8. Due Dates for Filing of Income Tax Return for AY 2018-19 are as follows :

- 9. Extension of Aadhaar-PAN linking :

- 10. Recent important changes in the ITR forms for AY 18-19 :

1. Change in Income Tax Slab Rate for AY 2018-19 for Individuals :

The only change in Income Tax Slab Rate is change in the tax rate for income falling between 2,50,000 – 5,00,000, it has reduced from 10%(in AY 17-18) to 5%.

Individual (Resident or Non-Resident), whose age is less than 60 years on the last day of the Relevant Previous Year:

| Taxable income | Tax Rate |

| Up to Rs. 2,50,000 | Nil |

| Rs. 2,50,001 to Rs. 5,00,000 | 5% |

| Rs. 5,00,001 to Rs. 10,00,000 | 20% |

| Above Rs. 10,00,000 | 30% |

Individual (Resident Senior Citizen), Whose age is 60 years or more on the last day of Relevant Previous Year :

| Taxable income | Tax Rate |

| Up to Rs. 3,00,000 | Nil |

| Rs. 3,00,001 to 5,00,000 | 5% |

| Rs. 5,00,001 to 10,00,000 | 20% |

| Above Rs. 10,00,000 | 30% |

Individual (Resident Super Senior Citizen), Whose age is 80 years or more on the last day of Relevant Previous Year :

| Taxable income | Tax Rate |

| Up to Rs. 5,00,000 | Nil |

| Rs. 5,00,001 to 10,00,000 | 20% |

| Above Rs. 10,00,000 | 30% |

Surcharge :

10% of tax where total income exceeds Rs. 50 lakhs

15% of tax where total income exceeds Rs. 1 crore.

Clarity with respect to Applicable rate of Cess :

| Assessment Year (AY) | Rate |

| 18-19 | 3% |

| 19-20 | 4% |

2. Rebate u/s. 87A:

Comparison of Rebate between AY 17-18 and AY 18-19

| AY 17-18 | Particulrs | AY 18-19 |

|

5,000 (or) 100% of Income Tax (Whichever is Lower) |

Amount of Rebate Allowed

|

2,500 (or) 100% of Income Tax (Whichever is Lower)

|

| Resident Individual Whose Total Income does not exceed 5,00,000 |

Who are eligible for rebate |

Resident Individual Whose Total Income does not exceed 3,50,000 |

3. Applicability Of Section 234F Fee For Default In Furnishing Of Income Tax Return Within Due Dates Specified U/S. 139(1)

| Total Income | Period of Return Actually Filed | Fee (in Rs.) |

| Not Exceeds 5,00,000 | On or Before 31st July,2018 | Nil |

| 1st August,2018 to 31st March,2019 | 1,000

|

|

| Exceeds 5,00,000 | On or Before 31st July,2018 | Nil

|

| 1st August,2018 to 31st December,2018 | 5,000

|

|

| 1st January,2019 to 31st March,2019 | 10,000

|

4. Change of Base Year for Indexation:

Earlier 1st April, 1981 is considered as a base year for calculating Indexed Cost of Acquisition for the purpose of Long Term Capital Gain. Now, the same has been changed to 1st April 2001.

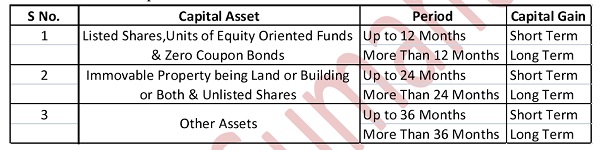

5. Change in the Holding Period of Capital Asset for the purpose of Computation of Capital Gains :

Classification of Capital Asset :

6. Tax Cases can be reopened for up to 10 Years :

The Income Tax Department can now scrutinize income tax returns up to Previous 10 Years if it suspects undisclosed income or assets of more than Rs. 50 lakhs. Currently this limit was 6 years.

7. Disallowance of certain deductions if return is not furnished within the Due Date specified u/s. 139(1) :

Earlier, Deductions under sections 80-IA or 80-IAB or 80-IB or 80-IC are not allowed unless he furnishes a return of his income for such assessment year on or before the due date specified under section 139(1).

However, this disallowance extended to all similar deductions which are covered under “Heading C”- Deductions in respect of certain incomes in Chapter VIA.

Now, Sections covered for disallowances are 80H to 80RRB.

8. Due Dates for Filing of Income Tax Return for AY 2018-19 are as follows :

| Person | Due Date |

| Companies | 30th September |

| persons other than companies, Whose Books of Accounts are not subject to tax audit u/s. 44AB | 31st July |

| persons other than companies, Whose Books of Accounts are subject to Tax Audit u/s. 44AB | 30th September |

| Working Partner of a Firm Whose Books of Accounts are subject to Tax Audit u/s. 44AB | 30th September |

Note : As per Income Tax Act, Person includes Individuals, HUF, Partnership Firms, Companies, Body of Individuals or Association of Persons, Local Bodies and Artificial Jurisdictional Person.

9. Extension of Aadhaar-PAN linking :

CBDT extended the last date for Aadhaar-PAN linking till June 30,2018. If one fails to do so, he/she may not be able to get his/her tax returns processed by tax department.

As per Section 139AA(2) of the Income Tax Act, Every Person who is having PAN as on July 1, 2017, and eligible to obtain Aadhaar, must intimate his Aadhaar number to the tax authorities.

10. Recent important changes in the ITR forms for AY 18-19 :

1. Detailed inputs with respect to Income From Salary and House Property :

With respect to Income from Salary, ITR is made available in such a way we need to enter all the details which are there in Form 16.

With respect to Income from House Property, We need to give inputs of Gross Rent received, Taxes paid to Local Authorities, Interest on Borrowing Capital.

2. Cash deposits during the period of Demonetization fields are removed.

.3. only “Resident and Ordinary Resident” is allowed to file ITR 1.

4. GST No. to be Quoted :

The Assesses filing ITR 3 & ITR 4 would have to enter GST Registration no. and its Turnover. This is to Correlate the Direct and Indirect taxes to put a check on tax evasions.

What is the best saving tax plan scheme for a businessman, whose Gross turn over is more than 50(Fifty) Lac.

Very well explained the amendments!!!

First 7 points are very important

One must thoroughly go through them before filing AY 18-19 ITR.

Thank you.

REALLY ITS GREAT

perfect way to share the knowledge thanks

Kotak life insurance old mutual fund policies were ridim after lockin period of 5 years on 25/4/17. Policies taken on 31/3/12. Will capital gain tex be counted for IT. Will interest on loans over these policies be allowed to diduct from gain.

Without meaning disrespect to any, I raise the following points. We get INCOME for the services rendered to the Society. Why one should be taxed based on the services rendered/Contribution made. Instead why not tax me for the services I receive from the Society/Consumption as reflected by my bank account–the primary source from which I withdraw to meet my personal needs. I would like to be enlightened. I have some thoughts how bank a/c based tax is to be levied. It would cover almost everyone. No one need to submit any tax return. Tax would be computed and recovered by the System with almost no human intervention. My ID is sviss38atyahoodotcom

Thanks! Really helpful.

1. Applicability of Sec 234F Financial year relevant to the assessment year

2.sec under which reopen of assessment up to 10 years

As the information provieded by you , it considered you are a salaried employee.you have to file ITR-1. If you need any assistance to file ITR-1 please contact 7386887732(srinu)

pl let us know which sec is amended to reopen upto 10 years

Very nice information sir. If we withdraw PF amount within the 5 years service period, TDS 10% will be deducted by the PF authorities. Then where we have to show this in ITR forms and which form? please clarify sir.