Background: The issue related to chargeability of tax on Work Contract has always been a subject matter of debate as both transfer of goods and service are included in this kind of transaction.

In a general sense, a contract of works, may relate to both immovable and immovable property. E.g. if a sub-contractor, undertakes a sub-contract for the building work, it would be a works contract in relation to immovable property. Similarly, if a composite supply in relation to movable property such as fabrication/painting/annual maintenance contracts etc. is undertaken, the same would come within the ambit of the broad definition of a works contract.

But thankfully in GST regime, this debate or confusion on taxability of Work Contract has been removed and now been declared as a supply of service as mentioned in Schedule II to the CGST Act, 2017.

Page Contents

- Work Contract in Pre-GST era:

- Position of Work Contract under GST regime:

- Works Contract is a Supply of Services

- Place of Supply under GST in case of Work Contract:

- Valuation of Works Contract under GST

- Time of supply of service

- Rate of GST on work contract

- Input tax Credit to Work contractor

- Maintenance of Records by Work contractor:

Work Contract in Pre-GST era:

A works contract has elements of both provision of services and sale of goods, and was therefore taxable under both laws.

The principles of segregation of the value of goods were provided in Rule 2A of the Service Tax (Determination of Value) Rules, 2006, hence transfer of property in goods involved in the execution of a works contract was taxable under VAT laws and service portion involved in the execution of works contract being a declared service under service tax provision was chargeable to Service Tax.

It is pertinent to mention here that in the Pre-GST regime, all types of Works Contracts whether in relation to Movable Property or Immovable Property were covered within the scope of Work Contracts.

So work contract being a single activity taxed under different laws for its different activities. This causes a lot of confusion regarding its taxability, which has ultimately resulted into many legal disputes.

Position of Work Contract under GST regime:

As per section 2(119) of CGST Act “works contract” is defined as a contract for:

♦ building

♦ construction,

♦ fabrication,

♦ completion,

♦ erection,

♦ installation

♦ fitting out,

♦ improvement,

♦ modification,

♦ repair,

♦ maintenance,

♦ renovation,

♦ alteration or

♦ commissioning

of any Immovable property* wherein transfer of property in goods (whether as goods or in some other form) is involved in the execution of such contract.

In simple words, any contract in relation to an Immovable property where services are provided along with transfer of goods is known as a “Works Contract”.

* “Immovable property” is not defined under the GST Act. The term ‘goods’ is defined under Section 2(52) of the GST Act as all kinds of moveable properties other than money and securities but includes actionable claim, growing crops, grass and things attached to or forming part of the land which are agreed to be severed before supply or under a contract of supply.

Property other than goods, money and securities should, therefore, be considered as ‘immovable property’ under the GST Act.

However, in the absence of a definitive explanation under the GST Act, recourse is being taken to other statues dealing with “property” to determine the definition of “Immovable property”

It is seen that Section 3(26) of the General Clauses Act, 1897 defines “Immovable Property” as to include land, benefits to arise out of the land, and things attached to the earth, or permanently fastened to anything attached to the earth;

Therefore the essential character of ‘immovable property’, as emerges from the above discussion and relevant to the present context is that

– it is attached to the earth, or

– permanently fastened to anything attached to the earth, or

– forming part of the land and not agreed to be severed before supply or under a contract of supply.

Works Contract is a Supply of Services

Activities covered under Schedule II are to be treated as a supply of the nature described under section 7(1A) ^ of the GST Act.

^ Inserted by the Central Goods and Services Tax (Amendment) Act 2018 (No. 31 of 2018). Applicability w.e.f. 01.02.2019

As per Para 6 (a) of Schedule II to the CGST Act, 2017, works contracts as defined in section 2(119) of the CGST Act, 2017 shall be treated as a supply of services. Thus, there is a clear demarcation of a works contract as a supply of service under GST.

Thus GST has removed the confusion regarding taxability of work contract as service and not as a supply of goods as it is no longer necessary to segregate the supply of goods in an indivisible composite contract for the purpose of taxation under GST regime. This means works contract shall always be treated as service and tax would be charged accordingly (not as goods or part goods/part services) on entire value chain which is the bundled supply of goods and services for execution of an indivisible composite** contract for construction, erection, commissioning etc. of an immovable property.

Thus any composite supply** undertaken on movable property such as fabrication or painting job done in automotive body shop or annual maintenance contracts will not be covered under works contract as defined in the GST Act. Such contracts shall now be separately dealt as composite supplies and not as Works Contracts for the purposes of GST.

**2(30) of CGST Act deals with concept of Composite Supply. It means a supply made by a taxable person to a recipient consisting of two or more taxable supplies of goods or services or both or any combination thereof, which are naturally bundled and supplied in conjunction with each other in the ordinary course of business, one of which is a principal supply.

Therefore the essential check for establishing composite supply would be to ascertain whether

– two or more supplies are naturally bundled or not ,

– provided in combination in the ordinary course of business,

– Inseparable in nature.

Chargeability: Composite supply shall be treated as a supply of the principal supply and the rate of GST shall be the rate as applicable to such principal supply.

Place of Supply under GST in case of Work Contract:

If property is situated in India

In terms of section 7(3) of IGST, the supply of service shall be interstate supply where location of supplier and the place of supply are in two different states/union territories.

Further place of supply, in the case of work contract service, shall be the location at which immovable property (construction site) is situated as per Section 12(3) (a) of IGST Act.

If property is situated outside India

In case the immovable property is located outside India and supplier as well as recipient is located in India, place of supply would be the location of recipient as per proviso to Section 12(3) of the IGST Act, 2017.

As per Section 13(4) of the IGST Act, 2017, where either the supplier or recipient is located outside India, place of supply shall be the location of immovable property.

Valuation of Works Contract under GST

If work contract involves transfer of property:

Valuation of a works contract service depends on whether the contract includes transfer of property in land as a part of the works contract. In case of supply of service, involving transfer of property in land or undivided share of land, the value shall be:-

Value of supply of service and goods portion in such supply=

Total amount*** charged for such supply

(-)

Value of share of land or undivided share of land

***Total amount means the sum total of:

– consideration charged for the aforesaid service and

– amount charged for transfer of land or undivided share of land, as the case may be.

Value of land shall be deemed to be one-third of the total amount charged for such supply.

Thus clear 33.33% deduction is allowed towards cost of land. This is deeming price. No scope for proving actual land cost.

If work contract does not involve transfer of property:

In case of Works Contracts where transfer of land is not involved, in that case Value for the purpose of charging GST shall normally be taken as Transaction Value which shall be consideration charged

for the said service. As per Section 15(1) of the CGST Act, 2017 the Valuation method can be summarized in the following way:

| Where the supplier and the recipient of the supply are not related | Where the supplier and the recipient of the supply are related | |

| Value shall be the transaction value (open market value), which is the price actually paid or payable for the said supply of goods or services or both | As per this rule 28 of CGST | |

| a. if open market value of such supply is available | Open Market Value | |

| b. if open market value of such supply is not available | like kind and quality | |

| If price cannot determined as per (a) or (b) above | one hundred and ten percent of the cost of production or manufacture or the cost of acquisition of such goods or the cost of provision of such service | |

Issue: Case-1

(a) In case of work contract say for construction of Building wherein say Total contract value is Rs. 25 Crores. Contractee has agreed to supply free issue of material say cement and steel worth Rs. 5 Crores. What would be the taxability under GST if said value is not a part of contract?

Case (b) Will the answer differs is said value is a part of the contract?

Case (c) what would be the input tax credit implication case (1)?

Answer to Case (a): Yes, such value needs to be included in the valuation of Supplier by virtue of Section 15(2) (b) of CGST Act. The contract value being Rs. 25 Crores, the contractor would charge GST on whole contract value at the prescribed rate.

15(2)(b) the value of supply shall include any amount that the supplier is liable to pay in relation to such supply but which has been incurred by the recipient of the supply and not included in the price actually paid or payable for the goods or services or both;

Answer to Case (b) in such case, the contract value would be Rs. 20 Crores and accordingly chargeable to GST by contactor.

Answer to Case (c) Input would not be available to Contractee as specifically given under the negative list prescribed under Section 17(5).

Registration

Here comes another issue. Suppose if a work contractor gets a work contract for effecting taxable supply in state other than his place of business, does he need to obtain registration in other state?

Let’s try to discuss it with reference to statutory provision:

Section 22 of CGST Act deals with requirement of registration of every taxable person effecting taxable supply, subject to threshold limit. Section 22 of CGST Act reads as under

22 (1) Every supplier shall be liable to be registered under this Act in the State or Union territory, other than special category States, from where he makes a taxable supply of goods or services# or both, if his aggregate turnover in a financial year exceeds twenty lakh rupees.

From bare understanding of this section it can be understood that for the purpose of registration it is important to determine the location of the supplier, aggregate turnover in a financial year and place of business from where supplier makes a taxable supply.

#Section 2(71) of CGST “location of the supplier of services” means,—

(a) where a supply is made from a place of business for which the registration has been obtained, the location of such place of business;

(b) where a supply is made from a place other than the place of business for which registration has been obtained (a fixed establishment elsewhere), the location of such fixed establishment;

(c) where a supply is made from more than one establishment, whether the place of business or fixed establishment, the location of the establishment most directly concerned with the provisions of the supply; and

(d) in absence of such places, the location of the usual place of residence of the supplier;

And place of business generally means the place specified as the principal place of business in the certificate of registration;

So from the perusal of said provision, it may be inferred that unless he establishes a office or establishment in another state, which is having sufficient degree of permanence and suitable structure in terms of human and technical resources, it shall always be location of supplier and his place of business for which registration has been obtained under this act.

Therefore the place of supplier is nothing but the principal place of business and as such there is no requirement to obtain registration in another state.

Same was also upheld in the very recent Advance Ruiling of M/s T & D Electricals (Advance Ruiling No: KAR ADRG 18/2020 dated 31.03.2020).

Time of supply of service

The time of supply of services shall be the earliest of the following dates, namely:—

– date of issue of invoice if invoice is issued within 30 days from the date of provision of service as prescribed u/s 31 of CGST Act.

– date of receipt of payment

– date of provision of service if invoice is not issued within time prescribed u/s 31 of CGST Act (30 days).

Since the works contracts of immovable property are normally completed over the months or may be years. It shall be deemed as continuous supply of service. There is a specific provision for continuous supply of goods and continuous supply of services given u/s 31(5) of CGST Act.

2(33) “Continuous supply of services” means a supply of services which is provided, or agreed to be provided, continuously or on recurrent basis, under a contract, for a period exceeding three months with periodic payment obligations and includes supply of such services as the Government may, subject to such conditions, as it may, by notification, specify.

Time of supply for ‘continuous supply of services’ shall be determined as follow

|

Continuous supply of services |

Due date of payment is ascertainable | On or before the due date of payment |

| Due date of payment is not ascertainable | Before or at time of receiving payment | |

| Payment is linked to with completion of event | On or before the date of completion of that event. |

Rate of GST on work contract

GST rate on Work contract is prescribed in Serial No. 3 of Notification No. 11/2017-Central Tax (Rate) dated 28.06.2017 as amended by Notification No. 20/2017-Central Tax (Rate) dated 22.08.2017, Notification no.24/2017-Central Tax (Rate) dated 21.09.2017 & Notification No. 01/2018-Central Tax (Rate). Readers are advised to follow the said notification to identify the rate of GST on Works Contract.

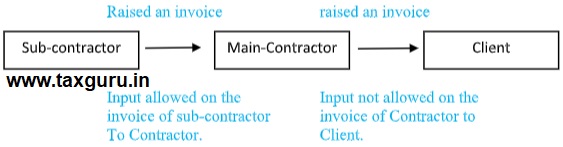

Case (2) In case of composite supply covered in Section 2(119) of CGST Act i.e. work contract where work contract has been sub contracted to the Sub-Contractor by the main Contractor providing work contract service, whether the Sub-Contractor would charge the same rate as charged by the main contractor.?

Sub-contractor would charge the same rate as charged by the Main-Contactor to his client if sub-contractor providing the same service as stipulated in Serial No 3 item (iii) or item (vi) or item (vii) under construction service which got amended by item (ix) & item (x) as notified in Notification No 1/2018 dated 25.02.2018 to the Central Government, State Government, Union Territory, a local authority, A government authority or a government entity.

If GST rate on the work contract is 12% or 5% then sub-contractor is also liable to discharge his GST liability @ 12% or 5% as the case may be. Similarly if GST rate on the said work contract is exempted or 0%, then supply of service in the form of work contract by the sub-contractors will also come in the purview of exempted or 0%.Thus if principal contractor is providing an exempt work contract service to Government in terms of Notification No. 12/2017-Central Tax (Rate) dated 28.06.2017 (as amended from time to time) and in such case it work contract is partially or wholly sub-contracted then the sub-contractors would also be exempted from payment of GST.” The Authority for Advance Rulings, Uttarakhand NHPC Ltd, Ruling no 17/2018-19, Dated Jan 30, 2019

Input tax Credit to Work contractor

Chapter V of CGST Rules, 2017 talks about Input Tax credit mechanism. Registered taxable person shall be eligible to avail ITC credited to the e-credit ledger subject to condition prescribed without restrictions of availment

The Work contractor shall be entitled to take input tax credit under section 16 of CGST Act on all input and input service used in supply of service (work contract) subject to provision of section 17(5).

The block credits under sections 17(5)(c) and (d) are specific conditions for works contracts which are read as follows:

“(c) the works contract services when supplied for construction of an immovable property (other than plant and machinery) except where it is an input service for further supply of works contract service.

(d) Goods or services or both received by a taxable person for construction of an immovable property (other than plant and machinery) on his own account including when such goods or services or both are used in the course of furtherance of business.“

Explanation. – For the purposes of clauses (c) and (d), the expression “construction” includes re-construction, renovation, additions or alterations or repairs, to the extent of capitalisation, to the said immovable property”

Plant and Machinery in certain cases when affixed permanently to the earth would constitute immovable property. When a works contract is for the construction of plant and machinery, the ITC of the tax paid to the works contractor would be available to the recipient, whatever is the business of the recipient. This is because works contract in respect of plant and machinery comes within the exclusion clause of the negative list and ITC would be available when used in the course or furtherance of business.

Thus following inferences can be drawn from the understanding of the above provisions:

> ITC of WCT in relation to construction of immovable property is not allowed.

> ITC not allowable if goods procured or service availed by the owner on his own account

> ITC not allowable if transaction is capitalised in the books of account.

> ITC is allowed if some structure work is done in relation to plant and machinery.

> Contractor can avail the ITC in respect of services availed from the sub-contractor.

Therefore, if the land owner wishes to construct a factory building, then he must award works contract services for construction of immovable property to work contractor. In this case he would not be eligible for input tax credit qua the tax charged by the contractor on such supplies.

Similarly if a taxable person purchases steel, cement, sand etc. and is charged the GST on invoices and if such goods are used for construction of the factory guest house, then he will not be allowed the input tax credit in terms of section 17(5)(d).

Maintenance of Records by Work contractor:

Every registered person executing works contract is required to maintain separate accounts for works contract showing the following details :—

> names and addresses of the persons on whose behalf the works contract is executed

> description, value and quantity of goods or services

> received for the execution of works contract and

> utilized in the execution of works contract

> details of payment received in respect of each works contract

> names and addresses of suppliers from whom he received goods or services

DISCLAIMER: Every care has been taken in the preparation of this article to ensure its accuracy. The views contained in this article are personal and the contents of this document are solely for informational purpose and it does not constitute professional advice that may be required before acting on any matter. For any suggestion plz contact at capraveenbisht@yahoo.in.

Excellent presentation reg works contract