FAQs on Withdrawal from Composition Levy under GST

Q 1. Can I withdraw from the Composition Levy?

Ans: Yes, you can withdraw from the Composition Levy at any time of the financial year for the following reasons:

1. Voluntary withdrawal

2. Exceeding Threshold Limit as specified in Section 10 of the CGST Act

3. Supplying restaurant services other than as specified under clause (b) of para 6 of Schedule II of GST Act {OR Supplying services except supplies referred to in Clause (b) of Paragraph 6 of Schedule II of the CGST Act}

4. Supply of Goods not liable to Tax – goods and/or services you are supplying become exempt

5. Supplying of goods through E-Commerce Operator, who is required to collect tax at source under section 52

6. Manufacturing Notified Goods (e.g. Pan Masala)

7. Others

Q 2. How can I withdraw from the Composition Levy on the GST Portal?

Ans: Navigate to Services > Registration > Application for Withdrawal from Composition Levy

Q 3. When do I need to withdraw from the Composition levy?

Ans: The application to withdraw from the Composition levy is required to be filed within 7 days from the date when taxpayer fails to satisfy any condition of Section 10 of CGST/ SGST Act or rules made thereunder or a taxpayer may also voluntarily opt out of the Composition levy by filing an application.

Q 4. Which form needs to be filled by me to withdraw from Composition levy?

Ans: To withdraw from Composition levy, you are required to fill the Form GST CMP-04.

Q 5. Do I need any approval from Tax authorities to withdraw from the Composition levy?

Ans: You do not need any approval from State or Centre Tax Authorities to withdraw from the Composition levy. Once the application to withdraw from the Composition levy is filed, application is auto approved immediately and you are opted out of the Composition levy

Q 6. Is it mandatory to file Intimation of Stock Details after withdrawal from the Composition levy?

Ans: Yes, it is mandatory to file a Stock Intimation. After filing the application to withdraw from the Composition levy, you are required to file statement in FORM GST ITC-01 containing details of the stock of inputs and inputs contained in semi-finished or finished goods held in stock by you on the date on which the option is withdrawn or denied, within a period of thirty days from the date from which the option is withdraw.

Q 7. How is the application for Withdrawal from the Composition Levy authenticated?

Ans: The application for Withdrawal from the Composition Levy can be signed using DSC or authenticated using Electronic Verification Code (EVC).

Q 8. How will I know if my application for Withdrawal from the Composition Levy is successfully filed?

Ans: On successfully signing the application, the success message is displayed. You will receive an acknowledgement with an Application Reference Number (ARN), within 15 minutes of successful submission of your application, on your registered e-mail address and mobile phone number.

Q 9. I have more than one GSTIN linked to the same PAN and all my GSTINs are currently under the composition scheme. What will happen if I opt out of Composition Levy in one of these GSTINs?

Ans: It is important to note that if you withdraw from Composition Levy for any of your GSTINs, you will automatically be removed from Composition Levy for all the GSTINs linked to the same PAN.

Q 10. Can I withdraw from Composition Levy retrospectively (from a past date)?

Ans: Yes, based on your reason for withdrawal, you can withdraw from the Composition Levy on a past (or future date).

1. If reason for withdrawal selected is “Voluntary”: Date from which withdrawal from composition Levy is sought can’t be previous date, whereas current and future dates can be selected.

2. If reason for withdrawal is other than “Voluntary”: Date from which withdrawal from composition Levy is sought can’t be future date and cannot be prior to the “Effective date of composition levy”.

In case of withdrawal from composition levy, you will have to file Form GST ITC-01 for intimation of stock details.

Manual > Withdrawal from Composition Levy (FORM GST CMP- 04)

How can I withdraw from the Composition Levy on the GST Portal?

To withdraw from the Composition Levy on the GST Portal, perform the following steps:

1. Access the www.gst.gov.in URL. The GST Home page is displayed.

2. Login to the GST Portal with valid credentials.

3. Click the Services> Registration > Application for Withdrawal from Composition Levy link.

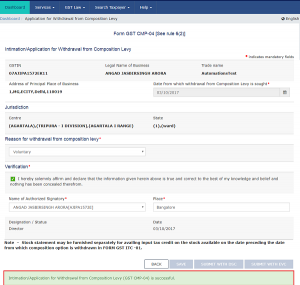

The Intimation/ Application for Withdrawal from Composition Levy page is displayed.

4. Select the Date from which withdrawal from Composition Levy is sought using the calendar. Date for withdrawal from Composition Levy cannot be before the date on which Composition Levy has been opted.

5. Select the Reason for withdrawal from Composition Levy from the drop-down list.

6. Select the Verification checkbox.

7. In the Name of Authorized Signatory drop-down list, select the name of authorized signatory.

8. In the Place field, enter the place where the form is filed.

9. Click the SAVE button to save the data.

After filling the application, you need to digitally sign the application using Digital Signature Certificate (DSC) or EVC.

In Case of DSC:

a. Click the SUBMIT WITH DSC button.

b. Click the PROCEED button.

c. Select the certificate and click the SIGN button.

In Case of EVC:

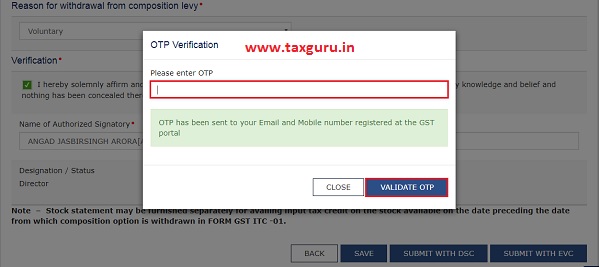

a. Click the SUBMIT WITH EVC button.

b. Enter the OTP sent to email and mobile number of the Authorized Signatory registered at the GST Portal and click the VALIDATE OTP button.

The success message is displayed. You will receive the acknowledgement in next 15 minutes on your registered e-mail address and mobile phone number. Application Reference Number (ARN) receipt is sent on your e-mail address and mobile phone number.

Once the application to withdraw from the Composition Levy is filed, application is auto approved and you are taken out of the Composition Levy.

Note: Once you are withdrawn from Composition Levy, you can go to My Profile and check that your Taxpayer Type is changed to Regular from Composition and you will have access to all the returns applicable to Regular taxpayer.

Also Read:-

1. Compulsory Withdrawal from GST Composition Levy: FAQs

2. All about Filing of Form GST CMP-08

3. How taxpayer opted for Composition Levy can intimate Stock Details?

4. How to Opt for Composition Levy under GST with FAQs

(Republished with amendments)

****

Disclaimer: The contents of this article are for information purposes only and does not constitute an advice or a legal opinion and are personal views of the author. It is based upon relevant law and/or facts available at that point of time and prepared with due accuracy & reliability. Readers are requested to check and refer relevant provisions of statute, latest judicial pronouncements, circulars, clarifications etc before acting on the basis of the above write up. The possibility of other views on the subject matter cannot be ruled out. By the use of the said information, you agree that Author / TaxGuru is not responsible or liable in any manner for the authenticity, accuracy, completeness, errors or any kind of omissions in this piece of information for any action taken thereof. This is not any kind of advertisement or solicitation of work by a professional.

I applied for withdrawal from composition levy on 01.04.2024 w.e.f. 01.04.2024 with reason “Voluntarily ” But I am unable to get Regular taxpayer category. My registration date is 07.10.2017 as a composition dealer. Following massage display at gst portal “withdrawal from composition levy date cannot be before opt for composition levy date” What I have to do ?

I applied for withdrawal from composition levy on 01.04.2024 w.e.f. 01.04.2024 with reason “Interstate supply of goods” But I am unable to get Regular taxpayer category. My registration date is 07.10.2017 as a composition dealer. Following massage display at gst portal “withdrawal from composition levy date cannot be before opt for composition levy date” What I have to do ?

R’ Sir,

As per your FAQ

Q 10. Can I withdraw from Composition Levy retrospectively (from a past date)?

Ans: Yes, based on your reason for withdrawal, you can withdraw from the Composition Levy on a past (or future date).

2. If reason for withdrawal is other than “Voluntary”: Date from which withdrawal from composition Levy is sought can’t be future date and cannot be prior to the “Effective date of composition levy”.

I applied for withdrawal from composition levy on 08.08.2020 w.e.f. 01.04.2018 with reason “Interstate supply of goods” But I am unable to get Regular taxpayer category. My registration date is 05.09.2017 as a composition dealer. Following massage display at gst portal

“withdrawal from composition levy date cannot be before opt for composition levy date”

What I have to do ?

i have withdrawal composition scheme how to take ITC of Stock