The concept of TDS is a simple concept incorporated under GST with the intent to tap the possible chances of revenue leakage and Prevent Tax Evasion. Under the Scheme the recipient deducts tax at the notified rate from the payment due to the supplier and deposits the tax into the government treasury on behalf of the supplier. When the supplier files return, he can claim credit of the tax paid by the recipient on his behalf. Section 51 of the CGST Act deals with the issue of TDS. Let us discuss in this article detailed analysis of TDS provisions.

Page Contents

Governing Provisions of TDS under GST

With the Notification 50/2018 (Central Tax) Dated 13.09.2018, TDS under section 51 of the CGST Act is coming into force from 01.10.2018. Further Circular No. 65/39/2018-DOR, Dated the 14th September, 2018 issued regarding procedural aspects.

Who will deduct the TDS :

As per Sec 51. (1) of CGST Act & Notification No. 50/2018 – Central Tax; 13th September, 2018, following persons are required to deduct TDS w.e.f 1st October 2018.

Sec 2(69) of CGST Act Defines “local authority” as––

Sec 2(69) of CGST Act Defines “local authority” as––

(a) a “Panchayat” as defined in clause (d) of article 243 of the Constitution;

(b) a “Municipality” as defined in clause (e) of article 243P of the Constitution;

(c) a Municipal Committee, a Zilla Parishad, a District Board, and any other authority legally entitled to, or entrusted by the Central Government or any State Government with the control or management of a municipal or local fund;

(d) a Cantonment Board as defined in section 3 of the Cantonments Act, 2006;

(e) a Regional Council or a District Council constituted under the Sixth Schedule to the Constitution;

(f) a Development Board constituted under article 371 of the Constitution;

or

(g) a Regional Council constituted under article 371A of the Constitution;

TDS Applicability :

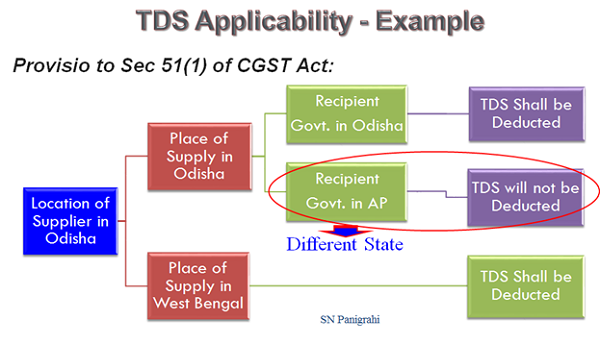

As per Sec 51 of CGST Act TDS shall be deducted where the total value of supply of taxable goods or services or both under a contract, exceeds two lakh and fifty thousand rupees. Provided that no deduction shall be made if the location of the supplier and the place of supply is in a State or Union territory which is different from the State or as the case may be, Union territory of registration of the recipient.

For the purpose of deduction of tax specified above, the value of supply shall be taken as the amount excluding the central tax, State tax, Union territory tax, integrated tax and cess indicated in the invoice.

Value of Supply on Which TDS shall be Deducted & Rate of TDS

Value of Supply on Which TDS shall be Deducted & Rate of TDS

As Explanation in Sec 51(1) of CGST Act, For purpose of deduction of TDS, the value of supply is to be taken as the amount excluding the tax indicated on the invoice. This means TDS shall not be deducted on the CGST, SGST or IGST component of invoice.

Rate of TDS

As per Sec 51(1) of CGST Act, CGST of 1% plus SGST of 1% or IGST of 2% will be deducted from the payment made or credited to the deductee.

TDS Deduction & Credit Process :

TDS Deduction & Credit Process :

Filling TDS Return – Options:

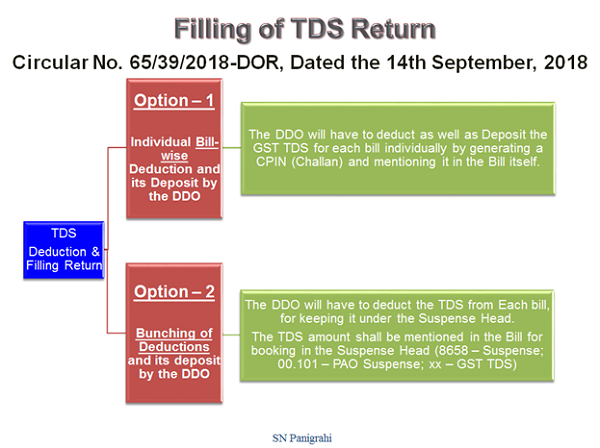

Circular No. 65/39/2018-DOR, Dated the 14th September, 2018, prescribes Two Options for TDS Deduction and filling Returns

- Option – 1 : Individual Bill-wise Deduction and its Deposit by the DDO (Drawing And Disbursing Officer)

- Option – 2 : Bunching of Deductions and its deposit by the DDO (Drawing And Disbursing Officer)

The details can be seen in the Video link provided below.

Penal Provisions for Failure or Default : Consequences of Non- compliances

Penal Provisions for Failure or Default : Consequences of Non- compliances

For more details on Registration Process of TDS Deductor, TDS Certificate, Records to be maintained by the TDS Deductor, refund of Excess deduction of TDS etc may be seen in the Video.

More Details can be viewed @ YouTube:

https://www.youtube.com/watch?v=xg3mnbQc5eQ

Disclaimer : The views and opinions; thoughts and assumptions; analysis and conclusions expressed in this article are those of the authors and do not necessarily reflect any legal standing.

Author : SN Panigrahi, GST Consultant, Practitioner, Corporate Trainer & Author

Can be reached @ snpanigrahi1963@gmail.com

Well explained article !