Implementation of the Goods and Service Tax is not only the biggest tax reform in India but it is also one of the major step supporting towards digitization of India. Under the erstwhile indirect taxation rules, the registered person had to visit the department for various procedural aspects like registration, obtaining a registration certificate, refund, return filing etc., however, with the introduction of Goods and Service Tax the entire process has been digitized.

Present article highlights the online steps the registered person needs to follow to download the GST registration certificate. The article also provides the understanding of the parts of the registration certificate along with the important rules attached to the registration certificate.

STEPS TO DOWNLOAD THE GST REGISTRATION CERTIFICATE

Under GST, ‘Good and Simple Tax’ as introduced by Shri Narendra Modiji, the registered person needs to follow only 4 simple and easy steps to download the GST registration certificate from the common portal. The required 4 steps are being provided below, along with the required screen shot for the better understanding –

1. Visit the common GST portal i.e. https://www.gst.gov.in/;

2. Click on the icon ‘Login’ and provide appropriate Username and Password and also Type the characters you see in the image provided below;

3. Once you Login, navigate the following path –

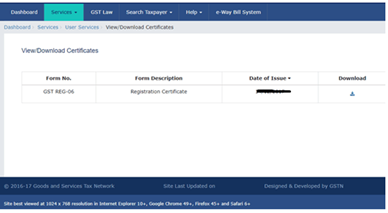

Services < User Services < View / Download Certificates;

4. Click on ‘Download’ button;

Just by following the above 4 simple and easy steps the registration certificate, in PDF format, would be downloaded.

UNDERSTANDING THE REGISTRATION CERTIFICATE –

The GST registration certificate is issued in Form GST REG- 06 and the same is divided into 3 parts.

Part 1 contains details of registration number and basic details of the business like Legal and trade name, Constitution of business, Address of Principal Place of business, Date of liability, Period of Validity, Type of Registration, Particulars of approving authority and Date of issue of the certificate.

Part 2 is defined as ‘Annexure A’ and it contains details of Additional Place of Business.

Part 3 is defined as ‘Annexure B’ and it contains details of all the Managing / Authorized Partners.

CERTAIN IMPORTANT RULES AND ITS DETAILING –

RULE 10 OF THE CENTRAL GOODS AND SERVICE TAX RULES, 2017 –

GST registration certificate is issued based on the provisions of rule 10 of the Central Goods and Service Tax Rules, 2017. Important features of the said rule are narrated hereunder –

- The registration certificate shall be made available only on the common portal. Meaning thereby that in order to get the physical copy of the registration certificate one needs to follow the 4 steps provided above and no physical copy would be provided by the department.

- 15 digits Goods and Service Tax Identification Number (GSTIN) / registration number shall be comprised of the following –

- First two digits represent the State Code;

- Next 10 digits represent Permanent Account Number (PAN) or Tax Deduction and Collection Account Number (TAN);

- Next 2 digits represent the entity code; and

- Final 1 digit represents a checksum character.

- The effective date of the registration would be as follows –

| APPLICATION TIME | EFFECTIVE DATE OF REGISTRATION |

| Application for registration has been submitted within a period of 30 days from the date on which the person becomes liable for registration | Date on which person becomes liable for registration |

| Application for registration has been submitted after the expiry of 30 days from the date on which the person becomes liable for registration | Date of grant of registration under rule 9 |

RULE 18 OF THE CENTRAL GOODS AND SERVICE TAX RULES, 2017 –

Rule 18 deals with the provisions relating to the display of the registration certificate. As per the said rule, it is mandatory for every registered person to display his Goods and Service Tax registration certificate in a noticeable location at his principal place of business and also at every additional place of his business.