SOP for Demand creation, Set off & Temp ID creation (DRC-07)- Assessment and Adjudication

Introduction

DRC-07 is the summary of all orders. Every order which ultimately ends up in demand creation, liability is created through DRC-07. By submitting DRC-07 to GSTN, liability against the tax payer will be created in part B {other than return related liability} of the Liability Ledger. The same can be viewed from the GST back end by verifying the ‘’other than return liability’ of the tax payer in the liability ledger. Demand can be created through the demand creation link provided in the GSTR3A notice module and ‘belated filing of returns’ module. In all other cases demand can be created in the sub module ‘demand and Recovery’ of the adjudication module. The officer has to be followed the manual process flow which requires demand creation subsequent to the final order.

In the case of assessment of URPs, officer has to create a temporary ID/suo motu registration prior to demand creation since, demand can only be created against a registered person in GST. By creating a Temp ID, a cash ledger and liability ledger will be created in the common portal for demand creation and subsequent set off of liability by depositing cash in the cash ledger.

DRC-07 Form

A new DRC-07 can be created by clicking on the Create New button in the Demand and Recovery module.

| Main Details | ||

| Name | Description | Remarks |

| GSTIN/Temp ID | GSTN/Temporary ID | Mandatory for creation of DRC-07. The GSTIN must be registered under Kerala SGST Act. For all others, click on “Generate Temp Id” to generate a temporary Id using the Suo motu registration form. |

| Legal Name | Legal Name of business | Non-editable. For GSTIN registered under the Kerala SGST act, the same shall be auto populated. For temporary registration, it will be a combination of first, middle and last name from Suo motu Registration. |

| Trade Name | Trade Name | Non-editable. For GSTIN registered under the Kerala SGST act and having a trade name in registration, the same shall be auto populated. For temporary registration and GSTIN registrations without trade name, it will be shown as “NIL” |

| Order Details | ||

| Name | Description | Remarks |

| Order Type | Type of order | Mandatory. The order type must be selected as Others (default) |

| Order Date | Date of issue of order | Mandatory. The date must be less than or equal to current date |

| Financial Year | Financial Year on which the order was issued | Auto filled and disabled |

| Order Number | Order number of assessment order | Mandatory. The order number is a 20-character ID, which will be auto generated. |

| Due Date | Due date for payment of tax, interest, cess and penalty | Mandatory. Due date must be with 90 days from the order date |

| Notice Reference Number | Reference number of notice | Optional |

| Notice Issue Date | Date of issue of notice | Optional |

| Preamble | Preamble | Ignore |

| Introduction | Introduction | Ignore |

| Submission made by notice | Submission made by notice | Ignore |

| Offences made/alleged to have been made | Offences made/alleged to have been made | Ignore |

| Discussion and Finding | Conclusion | Ignore |

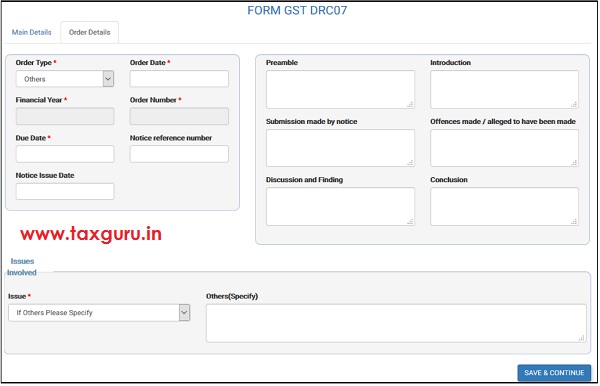

| Issue | Type Issues involved | Mandatory. Select “If Others Please Specify”. |

| Others(Specify) | Description of issues | Optional. Description of issues may be provided. |

| Address Details | ||

| Name | Description | Remarks |

| Door number | Door number | Mandatory. House number may be provided. |

| Floor Number | Floor Number | Optional |

| Building Number | Building Number | Optional |

| Building Name | Building Name | Optional |

| Street | Street Name | Mandatory |

| Area | Area Name | Optional |

| City | City Name | Mandatory |

| Pin Code | Pin Code | Mandatory |

| State | State name | Mandatory |

| District | District Name | Mandatory |

| Demand Details | ||

| Note: –

1) Multiple demand details may be added for different acts, tax rates and POS 2) For SGST/CGST act, the act and tax rate combination must be unique 3) For IGST act, the act, tax rate and POS combination must be unique |

||

| Name | Description | Remarks |

| Act | GST Act | Mandatory. Select SGST/CGST/IGST/CESS |

| Tax Rate | Tax rate according to the act selected | Mandatory. Select from the available tax rates for SGST/CGST/IGST. For CESS, the tax rate can be any number between 0 and 99.99 |

| Turnover | Turnover under the selected act and tax rate. | Mandatory. Whole number (13 digits allowed) |

| POS | Place of Supply | Mandatory. For SGST/CGST, the value shall be “Kerala”. For IGST, POS must be selected from the dropdown. |

| Tax | Tax component | Auto-calculated with formula (Tax Rate x Turnover) / 100 and round half up to the nearest whole number |

| Interest | Interest Component | Optional. Default is zero. |

| Penalty | Penalty Component | Optional. Default is zero. |

| Cess | Cess component | Optional. Default is zero |

| Others | Others Component | Optional. Default is zero. |

| Total | Total | Auto-calculated with formula Tax + Interest + Penalty +cess +Others |

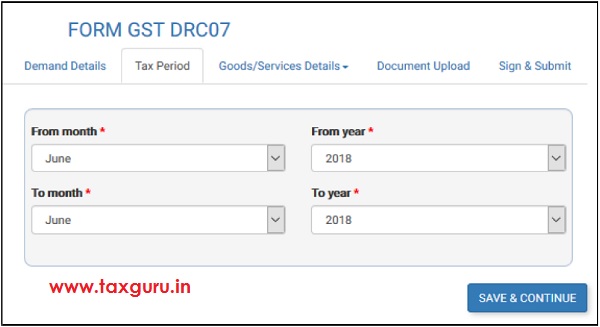

| Tax Period | ||

| Name | Description | Remarks |

| From month | Tax period from month | Mandatory. Auto selected to the month of order date |

| From year | Tax period from year | Mandatory. Auto selected to the year of order date |

| To month | Tax period to month | Mandatory. Auto selected to the month of order date |

| To year | Tax period to year | Mandatory. Auto selected to the year of order date |

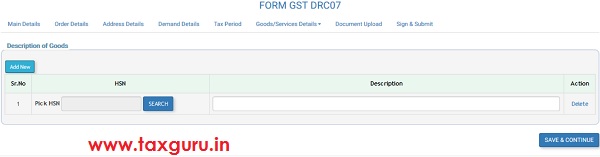

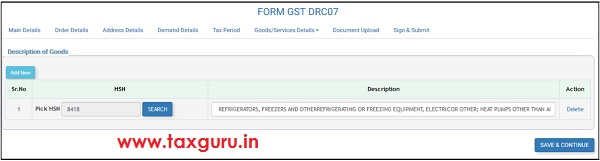

| Description of Goods | ||

| Name | Description | Remarks |

| HSN | HSN code of goods | Optional. |

| Description | Description of goods | Optional. |

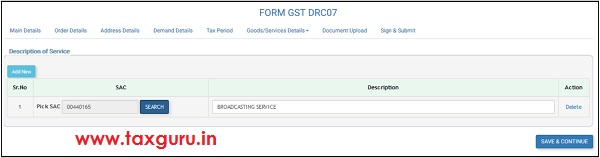

| Description of Services | ||

| SAC | SAC code of service | Optional |

| Description | Description of service | Optional |

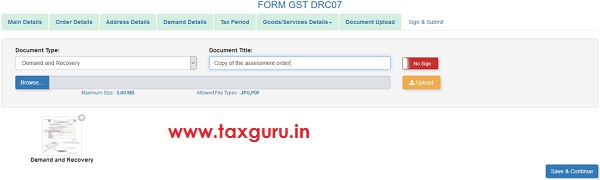

| Document Upload | ||

| Document Type | Type of document | Mandatory. “Demand and Recovery” must be selected. |

| Document Title | Description of the document uploaded | Mandatory. e.g. copy of assessment order. |

| Browse | To browse the file for uploading | The file must be in JPEG/PDF format with size less than 5 MB |

| Upload | Upload button | Click the upload the file to GSTN |

| Sign/No sign | For digital signing | For digital signing opt “sign” |

| Sign and Submit | ||

|

||

Suo motu Registration Form

The Suo motu registration form is displayed when the officer clicks on Generate Temporary Id link during creation of DRC-07.

Basic Details

| Name | Description | Remarks |

| Case No. | Auto generated | Mandatory |

| Date | Date of suo-motu registration/ Temp-ID creation | Mandatory |

| Brief description of the case | Brief description of the case | Mandatory |

Person Details

| Name | Description | Remarks |

| First Name | First Name | Mandatory |

| Middle Name | Middle Name | Optional |

| Last Name | Last Name | Optional |

| Father’s First Name | Father’s First Name | Mandatory |

| Father’s Middle Name | Father’s Middle Name | Optional |

| Father’s Last Name | Father’s Last Name | Optional |

| Gender | Gender | Mandatory |

| Date of Birth | Date of Birth | Mandatory |

Address Details

| Name | Description | Remarks |

| Building /Flat No | Building /Flat No | Mandatory |

| Floor No | Floor No | Optional |

| Building Name | Building Name | Optional |

| Road/Street/Lane | Road/Street/Lane | Mandatory |

| Locality | Locality | Mandatory |

| State | State | Mandatory |

| District | District | Mandatory |

| Pin code | Pin code | Mandatory |

| Contact Details | ||

| Name | Description | Remarks |

| Mobile Number | Mobile Number | Mandatory. The temporary Id and password for initial login shall be sent to this mobile number |

| Email Address | Email Address | Mandatory. The temporary Id and password for initial login shall be sent to this email Id |

| Identification Details | ||

| Name | Description | Remarks |

| Do you have a PAN number? | Yes or No based on PAN availability | Mandatory |

| PAN | PAN | If Yes is selected above, then Mandatory otherwise Optional |

| Other ID Type | Aadhaar No/Voter Id/Passport No/Driving Licence No/Other | Mandatory if PAN is not available |

| Other Id Card No | Card number of Aadhaar No/Voter Id/Passport No/Driving Licence No/Other | Mandatory if PAN is not available |

| Other ID Card Name | Name as shown in Aadhaar No/Voter Id/Passport No/Driving Licence No/Other | Mandatory if PAN is not available |

| Document Upload | ||

| Mandatory | ||

| Seized Document Upload | ||

| Optional | ||

| Sign and Submit | ||

|

||

User Interface Flow

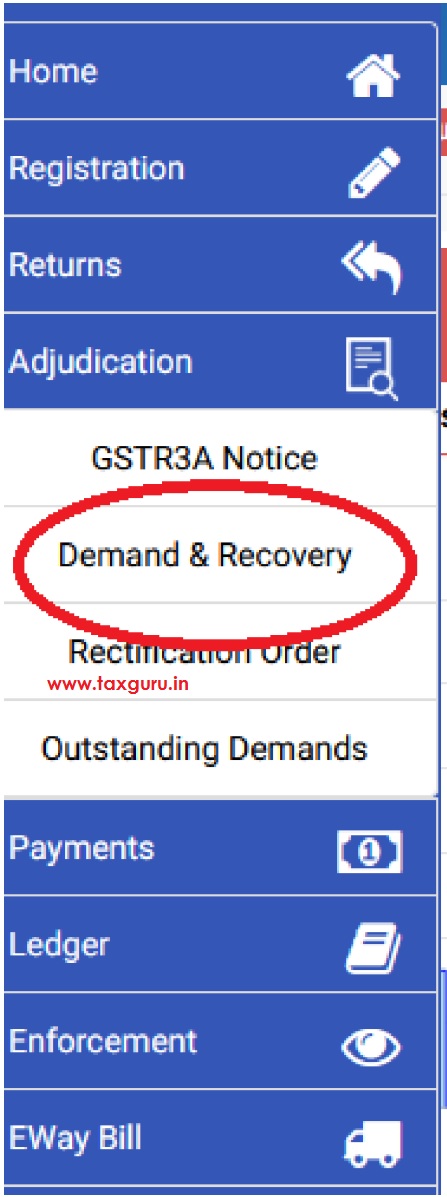

Demand and Recovery menu

Click on Demand and Recovery menu in the adjudication module.

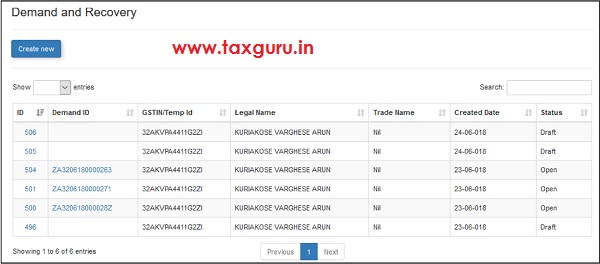

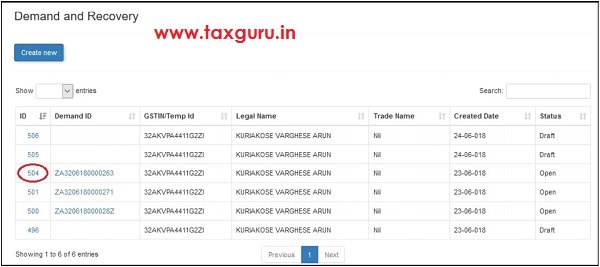

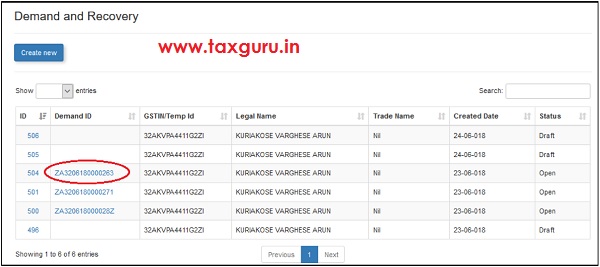

DRC-07 List View

The demand and Recovery module will be shows the list of DRC-07 drafted or submitted. The draft DRC-07 records shall have the status Draft. The DRC-07 submitted to GSTN will have a demand Id created and the status can be Open, Partial Setoff, Full Set off.

a. Open: Demand is created and no set off is attempted

b. Partial Setoff: Demand was partially set off using available cash and credit.

c. Full Set off: Demand was fully set off and no liability is pending against the demand

Create new DRC-07

Click on the Create New button to create a new DRC-07

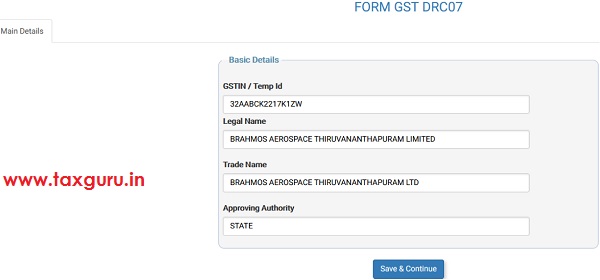

Provide a GSTN for which DRC-07 must be created. Click on Search button. If the person does not have a GSTIN registration, a temporary Id may be generated by clicking the Generate Temp Id link (See Suo motu registration).

The Legal name and trade name will be displayed. Click on Save and Continue.

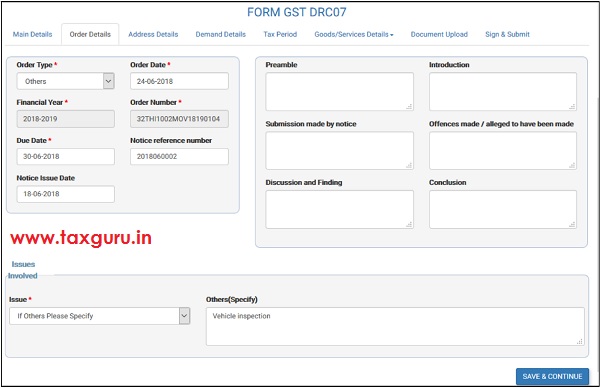

The Order Details form will be opened as shown.

Fill in the Order Details and click on Save and Continue button. In the ‘issue’ field you can select the issues from the drop down provided. If you select the option ‘others’, then you have to specify the issue briefly in the column provided for the same.

When you click the save & continue button, a confirmation box will appear to confirm whether you have manually issued the order. You continue the process of demand creation by clicking the ‘confirm’ button.

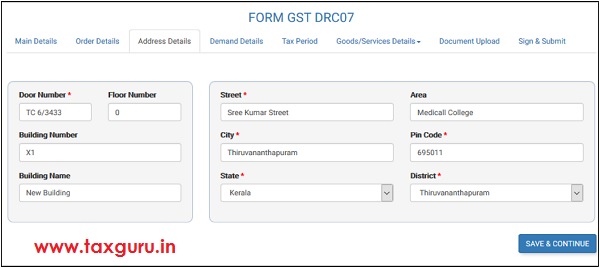

On confirmation the order details , the system will navigate to ‘address details ‘ page where you have to enter the address details of the tax payer. Red coloured asterisks glyphs shows the mandatory fields . Fill in the Address details and click on Save and Continue button.

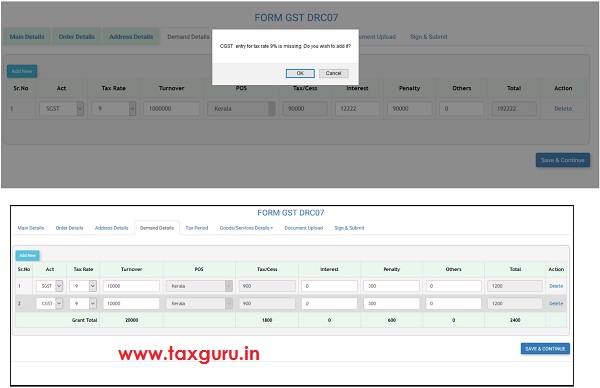

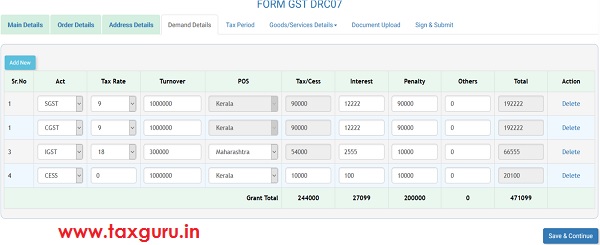

After entering the address details , it will navigate to ‘Demand Details’’ where you have to enter the demand details. Click on ‘Add New’ button to add a new demand row. Select Act, Tax Rate and enter the turnover, select POS (Only for IGST/Cess). The tax will be automatically calculated and displayed. Enter penalty amount and the total will be re-calculated. After entering the SGST demand details , Click on Add New to add the CGST demand details. Like wise you can enter the demand details for multiple rate by using ‘ADD NEW’ button. If you proceed to click ‘save & continue’ with out adding the corresponding SGST or CGST demand details a pop up will appear ‘do you wish to add’ by selecting the ‘ok’ you add the details.

In the case IGST demand only, you have to select the ‘place of Supply’ from the drop down provided. In all other cases the POS will kerela by default

–

In the case of cess, you have to enter the rate of cess if applicable and in all other cases you to provide the rate as zero and enter the cess amount in the field provided.

Finally , the grand total will be displayed at the bottom. Then Click on Save and Continue button.

In the Tax Period tab , the order month and year will be auto populated/ or enter the period details and then Click on Save and Continue.

In Goods Details form, click on Add New to add a new goods entry. You can enter any number of goods details by using the ’ add new’ button. Click on the Search button to search and select an HSN code matching the description.

Click on the Search button to search and select an HSN code matching the description.

From the HSN picker click the ‘select ‘ button to choose the most meaningful commodity.

The description can be modified to a meaningful commodity name if required. Click on Add New button to add more goods. Then click on Save and Continue button.

Add Services details like Goods details and click on Save and Continue.

In Document Upload form, the supporting order copy {Assessment order} may be uploaded in PDF format. Provide a document title, click on Browse button to select the file and the click on the Upload button to upload the file to GSTN. After successful upload, the thumbnail preview of the document is shown below. The document may be previewed by clicking on the thumbnail.

Multiple supporting documents may be uploaded. Click on Save and Continue button.

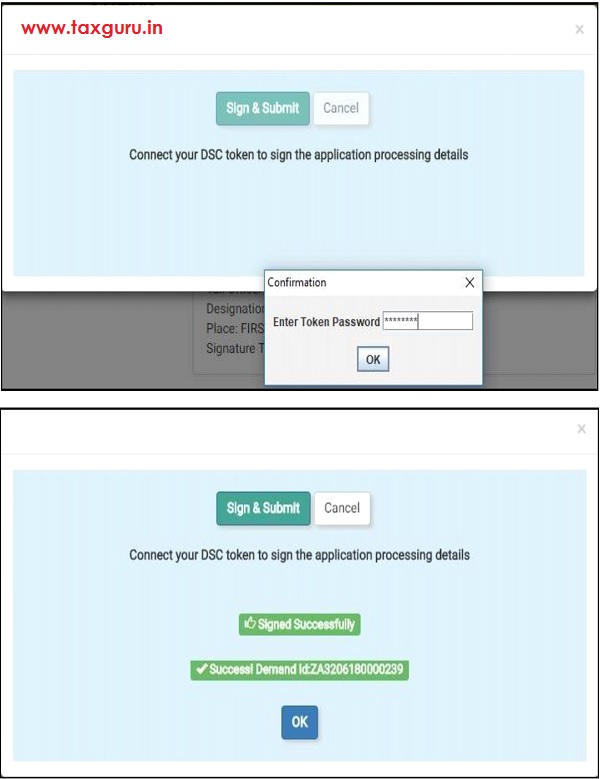

The Sign and Submit page shows the officer details as shown below. Click on Sign and Submit button to proceed with sign and submit.

Make sure DSC token is connected for digital signature and then click on Sign and Submit. A DSC pin dialog will be shown. Enter the PIN and click OK to sign and submit DRC07. A demand Id will be generated, and a tax liability shall be created in the tax liability ledger of the GSTIN/Temporary registration. Click OK to return to the DRC07 list.

View and export submitted DRC07

A DRC-07 in draft state can be opened by clicking on the ID link for finalization and submission. Once submitted, a summary of DRC-07 along with PDF report may be generated by clicking on the ID.

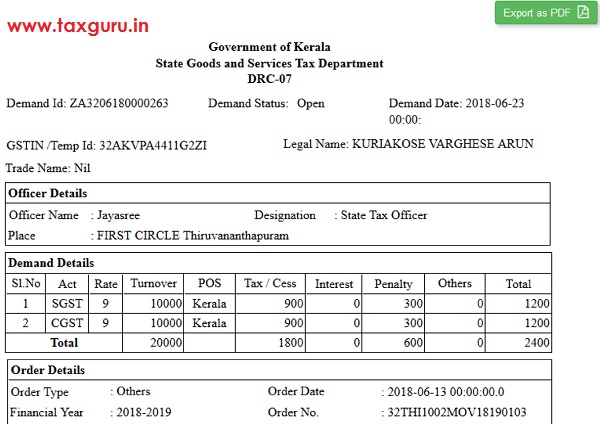

DRC-07 Submitted View

To export DRC-07 to PDF format click on Export to PDF button.

View Demand Summary

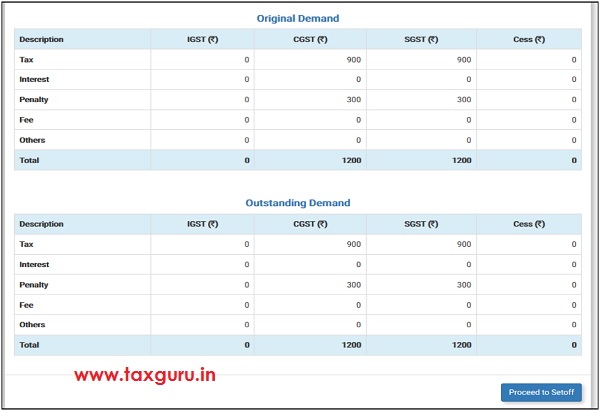

To view the demand summary, click on the Demand ID in the list of demands.

The Demand Summary page shows the original demand along with the current outstanding demand. If the demand outstanding is greater than zero, the officer can proceed to set off the outstanding demand by clicking on Proceed to Set off button.

Suo motu Registration

Suo motu registration can be used to generate a temporary Id to raise demand against unregistered persons. To create temporary Id, click on Generate Temporary Id link

The Suo moto registration form will be displayed. Fill the Basic Details, Person Details, Address Details, Contact Details and Identity Details.

Upload a memo document and click on the Submit button to sign and submit the suo motu registration request to GSTN.

After successful generation of temporary Id, the temporary Id is shown in the text box to continue DRC07 generation as shown below

![]()