In India any dispute to get resolved finally, in our judicial systems takes inordinate time and in taxation even more due to the following reasons:

– Adjudication is by issuer of Notice- Fully Conflicted/ biased – therefore almost certain to confirm w/o application of mind in 98% of the cases. It is a farce at

– Appeal is to another senior officer of revenue- Partly Conflicted – favourable cases may be investigated for graft, CAG remarks etc. Courts have observed that it is from Ceaser to Ceaser ( same authority) therefore here also the confirmation of demand mechanically exists in a big way. May be only some of the frivolous cases of smaller amounts get dropped at this point in 95% of the cases.

– There is considerable improvement in favorable orders by the officers in last 5 years however, the review mechanism of the department lead to the disputes being kept alive.

– Non-filing of vacancies of Judges at various appellate courts – Tribunals, HC’s & SC leading to filing of the cases pendency. In GST it is multiplied as every State would need one Tribunal.

– Many others including meeting targets, no money in coffers, PMO direction.

It is known that, we had a forum called settlement commission in the erstwhile central excise and service tax laws. Settlement commission would resolve disputes with quick and easy settlements of tax disputes on high revenue stake matters. Provisions were made and bifurcated based on the types of cases which can be eligible for settlement commission. The proceedings under this forum was deemed to be judicial proceedings and provided immunity to the applicants as the orders passed under this could not be re-opened and were conclusive.

Under the GST Act, there is neither the concept of settlement commission nor any such similar forums to settle disputes. However, to great extent, the facility for early settlement of the cases are provided under GST law by way of various concessions in penalty whoever comes forward for payment of tax, interest in the initial days of dispute. The possible options under GST for early settlement of disputes are explained below:

1. Payment of dues in installment – section 80:

Section 80 of CGST Act, 2017 provides the facility of payments in monthly installments (maximum of 24). For this, an application shall be made to the jurisdictional Commissioner. However, the self-assesssed tax dues (declared in returns) would not be eligible for this facility. Financially, it is a viable as it allows time for arranging the funds for those in temporary financial difficulty. The early availment of this option can avoid the entire penalty.

2. Bonafide errors – Options

Section 73 and 74 provides the power to the proper officer under the Act to issue Show Cause Notice (SCN) for recovery of any tax dues and prescribes the time limit and manner of adjudication.

| Sl No | Particulars |

| 1 | Situations and circumstances covered under section 73 |

| 2 | Section 73 is invoked for

a. Tax not paid b. Tax short paid c. Tax erroneously refunded or d. Input tax credit wrongly availed or utilized All the above situations must arise out of cases not involving in fraud, willful misstatement or suppression of facts. |

| 3 | Scenario 1: A SCN may be issued citing the above reasons, where the assesee has the option of settling the issues before issue of SCN by virtue of provision 73(5) |

| 4 | The assesee may re-verify their compliance with the law and if any discrepancy found which may lead the situations mentioned in Sl.No 2 above ( tax not paid, short paid, erroneously refunded or input tax credit wrongly availed or utilized) can opt for voluntarily disclosing such discrepancy and pay the amount along with interest. |

| 5 | If the assessee is not able to ascertain the tax amount, they may approach the proper officer to assist is ascertaining such amount. |

| 6 | Once the amount payable is ascertained and paid along with the interest the same has to be intimated to the proper officer. |

| 7 | Scenario 1A :In case the ascertainment of tax is done by the proper officer and the tax has been discharged along with interest, the assessee is safe from further issue of SCN for that period. Therefore, the matter gets settled and cannot be re-opened. |

| 8 | Scenario 1B: In case the assessee himself has ascertained the liability and has aid tax along with interest, assessee is safe to the extent of the such tax paid. |

| 9 | Scenario 2: Situation after issue of SCN. The assessee has to verify whether all the elements in the SCN is correct. If found correct the assessee may pay the taxes as demanded in the SCN along with interest within 30 days of the issue of SCN. Once the payment is made the matter would be treated as concluded. |

Note:

1. No penalty in imposable under the above circumstances.

2. Time limit to issue and conclude a show cause notice is 3 years from the due date for furnishing of annual returns for the financial year.

3. Longer Period Options

| Sl No | Particulars |

| 1 | Situations and circumstances covered under section 74 |

| 2 | Section 74 is invoked for

a. Tax not paid b. Tax short paid c. Tax erroneously refunded or d. Input tax credit wrongly availed or utilized All the above situations must arise out of cases involving in fraud, willful misstatement or suppression of facts. |

| 3 | Assessee must be careful before opting to settlement of the case against notice issued under section 74. By opting the provisions under this section, it would be deemed that the assessee has accepted that the case is arisen out of fraud, willful misstatement or suppression of facts. If the assessee has not involved in any of the above-mentioned activities such as fraud, willful misstatement or suppression of facts, they must disprove the allegation made and see that the matter assessed under section 73. This would ensure that he can pass on the additional tax to his customers and they would be eligible for credit. |

| 4 | The assessee, to counter the grounds of alleged activities of fraud, willful misstatement or suppression of facts , various case laws can be sought as ground wherein the meaning and phrase of “fraud, willful misstatement or suppression of facts” has been discussed and explained. |

| 5 | Due care should be taken before opting to settle the matters in the SCN issued under this section, as it would amount to accepting that the assessee has committed such offence which would be brought on records of the department. In the GST law the penalties are rigorous for habitual offences. Therefore, one should opt under this section only if they have committed such offence. |

| 6 | Scenario 1: The assessee may opt to settle the matter arising out of the said situations mentioned in Sl no 2. |

| 7 | Scenario 1A: The assessee may approach the proper officer to ascertain the sum of tax payable and pay the determined amount. |

| 8 | The amount ascertained above has to be paid before the issue of SCN along with interest and penalty equivalent to 15% of such tax amount determined. If the amount determined by the proper officer is paid, then the matter stands concluded. |

| 9 | Scenario 1B: Assessee himself can compute the tax payable and pay the tax along with applicable interest and penalty equivalent to 15% of such tax determined. |

| 10 | The amount paid has to be intimated to the proper officer. |

| 11 | In this case the assessee is safe to the extent of tax paid in respect of the computation made by the assessee. |

| 12 | Scenario 2: SCN is issued by the reasons specified in Sl no 2, (fraud, willful misstatement, suppression of facts) |

| 13 | In the above instance the assessee has to pay the tax, applicable interest and penalty equivalent to 25% of such tax amount Within 30 days of the issue of SCN. Once paid within time specified, the matter stands to be concluded. |

| 14 | It is important to note that the assessee has to pay the tax amount as quantified in the SCN, hence it is advised to verify the tax quantified in the SCN is correct or not. |

| 15 | In this scenario the quantification cannot be disputed. |

Note: Time limit to issue and conclude a show cause notice in cases where extended period applicable is 5 years from the due date for furnishing of annual returns for the financial year.

Summary in flow chart

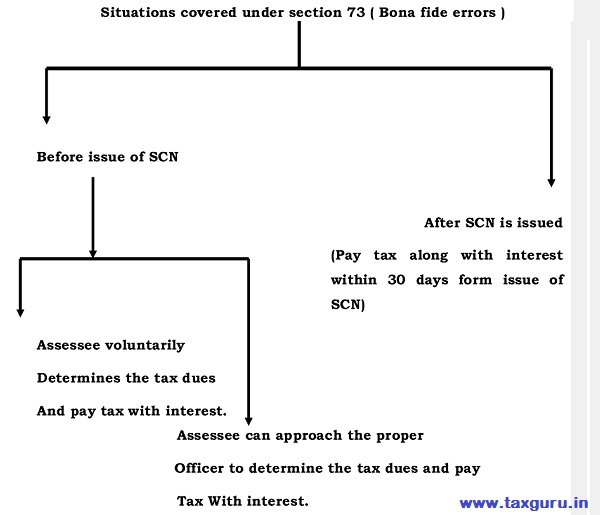

Situations covered under section 73 (Bona fide errors )

Situations covered under section 74 (Longer period options)

Conclusion:

GST is in the initial years of implementation and many grey areas needs to be clarified by the Government. The frequent amendments in the GST law coupled with the IT glitches/troubles lead to lot of mistakes which many times are unknown to the taxpayers. The latest COVID-19 crisis also adds the fuel to it. Hence, it is suggested to introduce amnesty scheme that helps the trade to settle their disputes at the early stages and focus on their business.

Acknowledgements to CA Venkataprasad P. Any inputs/suggestions, please write to rajendra@hiregange.com

CA Rajendra Prabhu S P