Sponsored

MANUFACTURING IN CUSTOMS BONDED FACILITY

‘A Scheme for manufacturing and other operations in a Customs Bonded Facility to Promote India as a Global Manufacturing Hub’

OVERVIEW

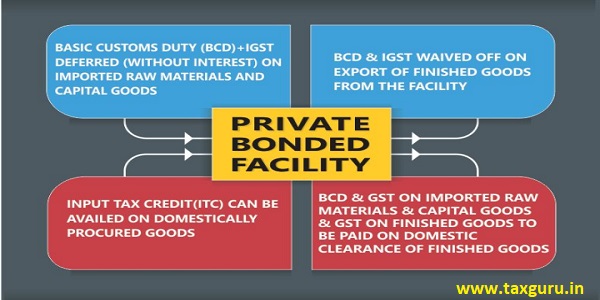

India allows duty-free import of raw materials and capital goods for manufacturing and other operations in a bonded manufacturing facility.

- Deferment of import duty on imported capital goods and raw materials .

- Exemption of the deferred duty If these imported inputs are utilized for exports purpose.

- Duty payable only when the finished / capital goods are cleared to the domestic market.

- When finished goods are exported, in addition to the waiver of BCD + IGST on the imported (and duty deferred) goods used, the GST on the finished goods can be zero-rated. Any input GST can be taken as a credit against output GST.

ADVANTAGES

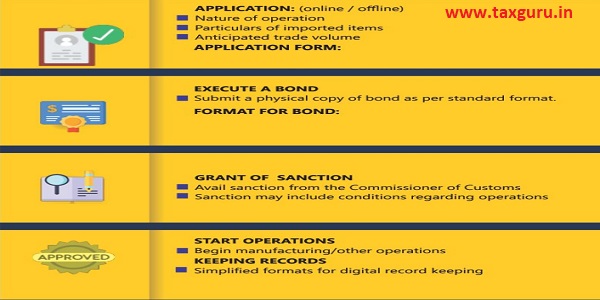

HOW TO APPLY

Download Brochure on Scheme for Manufacturing In Customs Bonded Facility

Sponsored

Kindly Refer to

Privacy Policy &

Complete Terms of Use and Disclaimer.