WHAT HAPPENED IN RAJYA SABHA ON 3RD AUGUST 2016: IMPORTANT BULLET POINTS:-

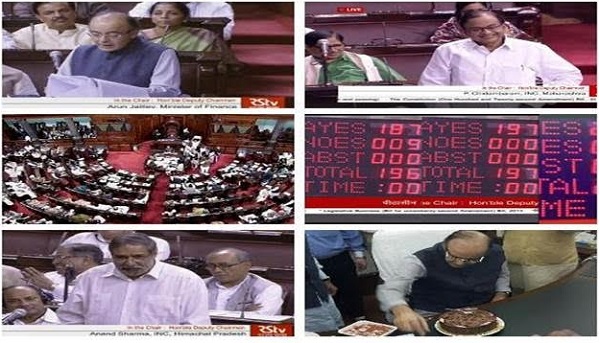

On Historic Day of 3rd August 2016, Rajya Sabha passed with 203 to 187 votes in favour of “GST – 122nd Constitutional Amendment Bill”, which has cleared the road mad of “Reality of GST to be Soon”. Below Bullet points of discussion had on 3rd August 2016 in Rajya Sabha :-

⇒ First time, in last 13 years, so much elaborate discussion happened on GST in Parliament.

⇒ Discussion on GST started in Rajya Sabha at 2.00 PM which continued till 9.40 PM on 3rd August 2016.

⇒ All the members of Rajya Sabha from all states and all political parties participated in GST discussion and one can definitely say, it was constructive discussion.

⇒ Members explained and raised points with respect to benefits of GST, Care needs to be taken, assurance from government, compensation of state for loss of revenue, what about revenue to Local Municipal Bodies as octroi will be removed etc

⇒ First time in last two years of functioning of parliament, Congress Party raised some really valid points on discussion of GST.

⇒ Important point raised is that once GST Act is introduced in parliament, it should be introduced as Finance Bill and not money Bill, which will help more constructive discussion on GST provisions. Chidambaram said, “In the interest of the country, please bring it as a financial bill.” However this may become hurdle as well. Therefore our smart honorable Finance Minister replied that “we will fully comply with the Constitution”

⇒ With this victory, Honorable Finance Minister Cut the cake

Below are important snaps of moments in Rajya Sabha on 3rd August 2016

WHY MODI GOVERNMENT GOT SUCCESS FOR PASSING GST BILL IN RAJYA SABHA:-

All the state was having insecurity with respect to loss of revenue due to GST since long. State were having fear that central government will not compensate there loss of revenue due to GST. In Past, Congress government assured compensation to state for loss of revenue due to CST rate reduction in 2009. However state were never given compensation by congress. This was point in mind of all statement. Honorable Finance Minister took positive discussion and assured to state that, this government will repay the CST compensation in 3 installment, of which one installment is already paid. This gave confidence to state that Modi government will do justice with state and this is how they start agreeing to GST Constitutional Amendment Bill.

NOW WHAT NEXT:

⇒ This bill will be sent to lower house for its approval, as there are amendment.

⇒ Then 50% of State assemblies need to approve it

⇒ Then President assent will be required.

⇒ And thereafter next journey of GST will start that is Actual GST Law, its structure, Rate, Rules etc. In this, there is high need of having elaborate discussion. It may take much time.

WHEN GST WILL COME:

⇒ If everything works smoothly, then GST will come in mid of 2017 that is October 2017

⇒ Else it may come on April 2018

I will conclude by saying that “3rd August 2016 will always be remembers in History of GST”

(Author can be reached at munotswapnil@gmail.com)