GOVERNMENT OF RAJASTHAN

FINANCE DEPARTMENT

(Tax Division)

Jaipur

No.F.12(13)FD/Tax/2022 | Dated: March 21, 2022

ORDER

In order to provide incentive to employees of Commercial Taxes Department for recovery of demands outstanding as on 01.03.2022, the State Government hereby issues the following Scheme which shall be known as “Incentive Scheme for Recovery of Outstanding Demands-2022”.

1. Short Title.- The Scheme shall be called “Incentive Scheme for Recovery of Outstanding Demands-2022”.

2. Operative Period.- The Scheme shall come into effect from 01.03.2022 and shall remain in force upto 31.03.2023.

3. Definitions.– (1) In the Scheme, unless the context otherwise requires:-

(a) “Act” means any of the following Acts:-

(i) The Rajasthan Sales Tax Act, 1954 (Act No. 29 of 1954);

(ii) The Rajasthan Sales Tax Act, 1994 (Act No. 22 of 1995);

(iii) The Central Sales Tax Act, 1956 (Central Act No. 74 of 1956);

(iv) The Rajasthan Value Added Tax Act, 2003 (Act No. 4 of 2003);

(v) The Rajasthan Tax on Entry of Goods into Local Areas Act, 1999 (Act No. 13 of 1999);

(vi) The Rajasthan Tax on Entry of Motor Vehicles into Local Areas Act, 1988 (Act No. 14 of 1988);

(vi) The Rajasthan Entertainments and Advertisements Tax Act, 1957 (Act No. 24 of 1957);

(vii) The Rajasthan Tax on Luxuries (in Hotels and Lodging Houses) Act, 1990 (Act No. 9 of 1996); and

(viii) The Rajasthan Tax on Luxuries (Tobacco and its Products) Act, 1994 (Act No. 11 of 1994);

(b) “Assessing Authority” means any officer or authority appointed under the Act;

(c) “Cash Recovery” means amount recovered in cash and/or through e-GRAS against any demand outstanding under the Act;

(d) “Competent Authority” means the authority competent to sanction the award of incentive to employees;

(e) “Department” means the Commercial Taxes Department, Rajasthan;

(f) “Incentive” means amount to be awarded in cash and calculated as per clause 6 of this scheme;

(g) “Outstanding Demand” means any demand pertaining to the Act, which is pending in the Demand and Collection Register;

(h) “Team of Assessing Authority” shall mean Assessing Authority, JCTO, TA, other ministerial, driver, Class-IV employees posted in his office and person(s) working on contractual basis in his ward;

(i) “Team of Deputy Commissioner (Adm.)” shall mean Deputy Commissioner(Adm.), JCTO, TA, other ministerial, driver, Class-IV employees posted in his office and person(s) working on contractual basis in his office; and

(j) “Total Outstanding Demand” shall mean the sum total of all demands outstanding under the Acts on the date of issuance of this order, but excluding the demands pertaining to dealers under liquidation.

(2) The words and expression used in this scheme but not defined here shall have the same meaning as assigned to them in the Act to which the outstanding demand pertains.

4. Scope of the Scheme.- The Scheme shall apply for award of incentive to:

(i) Deputy Commissioner (Adm.);

(ii) Assistant Commissioner;

(iii) Commercial Taxes Officer;

(iv) Assistant Commercial Taxes Officer;

(v) Junior Commercial Taxes Officer;

(vi) Tax Assistant;

(vii) Ministerial Staff;

(viii) Driver;

(ix) Class-IV Staff; or

(x) Any other person(s) working on contractual basis.

5. Eligibility criteria for Scheme.- Employee(s) shall be eligible for incentive when 50% of reduction has been made in total outstanding demand pertaining to the corresponding jurisdiction as on 01.03.2022.

6. Quantum and ceiling of Incentive.- Following incentives shall be provided on recovery of outstanding demands:-

| S. No. |

Reduction in Outstanding Demand |

% of Cash Recovery as incentive to Assessing Authority and his team |

% of Cash Recovery as incentive to concerned Deputy Commissioner(Adm.) |

| 1 | 2 | 3 | 4 |

| 1. | From 50% to 60% | 5% in such a manner that the amount of reward to a team shall not exceed Rs. 5,00,000/- | 0.5% of all wards in the concerned Zone eligible for incentive under this scheme in such a manner that the amount of reward to an individual shall not exceed Rs. 50,000/- |

| 2 | More than and upto 70% 60% | 7.5% in such a manner that the amount of reward to a team shall not exceed Rs. 6,00,000/- |

0.6% of all wards in the concerned Zone eligible for incentive under this scheme in such a manner that the amount of reward to an individual shall not exceed Rs. 75,000/- |

| 3. | More than 70% and upto 80% | 10% in such a manner that the amount of reward to a team shall not exceed Rs. 7,00,000/- | 0.7% of all wards in the concerned Zone eligible for incentive under this scheme in such a manner that the amount of reward to an individual shall not exceed Rs. 1,00,000/- |

| 4. | More than 80% and upto 90% | 12.5% in such a manner that the amount of reward to a team shall not exceed Rs. 8,00,000/- | 0.8% of all wards in the concerned Zone eligible for incentive under this scheme in such a manner that the amount of reward to an individual shall not exceed Rs. 1,25,000/- |

| 5. | More than 90% and upto 100% | 15% in such a manner that the amount of reward to a team shall not exceed Rs. 10,00,000/- | 1% of all wards in the concerned Zone eligible for incentive under this scheme in such a manner that the amount of reward to an individual shall not exceed Rs. 1,50,000/- |

Explanation: In case of any officer being eligible for incentive as per clause 5 of this scheme, the quantum of incentive shall be calculated on the basis of total cash recovery made during the operative period of this scheme, whether before or after fulfilling the criteria for eligibility.

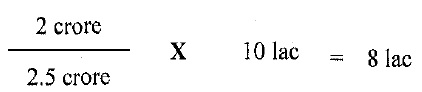

7. Maximum amount of incentive under the scheme — The total amount of incentive to be awarded under this scheme to all the teams shall not exceed rupees two crore. In case, the total amount of incentive to be awarded to all teams as per clause 6 of this scheme exceeds rupees two crore, the amount of incentive to be awarded to each team shall be calculated as under:-

Illustration:- If the amount of incentive accruing to team ‘A’ as per clause 6 is rupees 10 lac and the sum total of incentive accruing to all teams is rupees 2.5 crore, then the amount of incentive awarded to team ‘A’ shall be calculated as under:-

The amount so determined shall be divided among the members of the team as per clause 10 of this scheme.

8. Authority Competent to award Incentive.- The Authority competent to award Incentive shall be as mentioned in Column number 3 for the employees as mentioned against each of them in column number 2 of the table below:-

| S.No. | Level of Employees | Competent Authority |

| 1 | 2 | 3 |

| 1. | Team of Assessing Authority | Concerned Deputy Commissioner (Adm.) |

| 2. | Team of Deputy Commissioner (Adm.) | Commissioner |

9. Payment of Incentive.- The payment of incentive shall be made after 31st March, 2023.

10. Procedure- Procedure for award of incentive under this Scheme shall be as under:-

(i) Application shall be made in form as prescribed in clause 13 of this scheme by the head of the Team to the competent authority prescribed in Clause 8 of this Scheme upto 30.04.2023. Separate details shall be provided in case of more than one employee being posted at a particular level in a particular team during the operative period of the scheme.

(ii) The competent authority shall examine the facts and in case the correctness of the facts is verified, he shall proceed to sanction and disburse the amount within 30 days of receipt of application.

(iii) Ratio of Incentive among the team members shall be as per following Table:-

| S.No. | Name of Team | Ratio of Incentive | |

| l. | Team of Assessing Authority | Assessing Authority | 50% |

| JCTOs | 20% | ||

| TAs | 15% | ||

| Ministerial Staff | 10% | ||

| Driver, Class-IV Staff and any other person(s) working on contractual basis in his ward | 5% | ||

| 2. | Team of Deputy Commissioner (Adm.) | Deputy Commissioner (Adm.) | 50% |

| JCTOs | 20% | ||

| TAs | 15% | ||

| Ministerial Staff | 10% | ||

| Driver, Class-IV Staff and any other person(s) working on contractual basis in his office | 5% | ||

(iv) In case, more than one member any class of employee is posted in any team, the ratio mentioned against each of them above shall be distributed equally among all of them.

(v) In case, member of any class of employee is not posted in any team or any post is/has been vacant, then the ratio mentioned against each of them above shall be distributed proportionately among all other classes of employees as per percentage mentioned above.

(vi) Notwithstanding anything contained in this scheme, the amount of incentive shall be divided in proportion of amount of cash recovery made during the period of posting of any employee/person posted in the particular office during the operative period of this scheme.

(vii) If it is found that on account of mistake in the computation of incentive, the amount of incentive paid to any employee was in excess of the actual amount of incentive payable to him, then in such situation the excess amount paid to him shall be recovered along with interest at the rate of six percent per annum.

11. Incentive provided under the Scheme shall be out of purview of any statutory audit.- Any incentive sanctioned under the Scheme by the competent authority shall not be subject to any statutory audit; this includes eligibility, procedure, and quantum of incentive granted under the Scheme.

12. Power to review.-

(i) In case of any dispute arising in the implementation of the Scheme, the decision of Commissioner, Commercial Taxes shall be final.

(ii) If the competent authority is of the opinion that a specific case merits sanction of incentive to an employee because of revenue receipt to the Government, but incentive cannot be awarded due to any provision of the Scheme, in such cases, the matter may be referred to Secretary, Finance (Revenue) Department who may allow reward to such employee by relaxing provision(s) of the Scheme, so that employees may be motivated.

(iii) The incentive sanctioned by the competent authority shall not be reviewed or reopened. However, in exceptional cases, if Commissioner, Commercial Taxes is of the opinion that the review of the incentive sanctioned by the competent authority is necessary to redress any injustice meted out to employee, he may review the incentive sanctioned.

(iv) The Government in Finance Department reserves the right to amend or withdraw the Scheme without assigning any reason thereof.

13. Application:- The application for award of incentive under this scheme shall be submitted in the following format, namely:-

FORM

Application for award of Incentive

[As aer Clause 10 (i)]

| S.No. | Particulars | |

| 1. | Name | |

| 2. | Designation | |

| 3. | Place of posting during the operative period | |

| 4. | Amount of Outstanding Demand as on 01.03.2022 | |

| 5. | Amount reduced till 31.03.2023 | |

| 6. | % of Demand Recovered | |

| 7. | Amount of Cash recovery out of amount mentioned at S. No. 5 | |

| 8. | Eligibility as per applicable S.No.of table mentioned in Clause 6 of this Scheme | |

| 9, | Details of team members eligible for incentive along with their designation | |

| 10. | Remarks |

Signature of the applicant

Name———

Designation

Date:

[F.12 (13)FD/Tax/2022-129]

By order of the Governor,

(Tina Dabi)

Joint Secretary to the Government