Article explains Persons required to generate E-way Bill, Primary responsibility of generating e-way bills, E-way bill in case of Supply of goods by unregistered person to unregistered recipient, Goods exempted from e-way bill requirement, Threshold limit for generating e-way bill, Validity period of e-way bill, E-way bill in case of Movement of goods for shorter distance, Consolidated e-way bill, Modification of e-way bill, E-way bill in case of Import or Export and Penalty for non compliance of E-way bill provisions.

Page Contents

- Persons required to generate E-way Bill

- Primary responsibility of generating e-way bills

- Supply of goods by unregistered person to unregistered recipient

- Goods exempted from e-way bill requirement

- Threshold limit for generating e-way bill

- Validity period of e-way bill

- Movement of goods for shorter distance

- Consolidated e-way bill

- Modification of e-way bill

- E-way bill in case of Import or Export

- Penalty

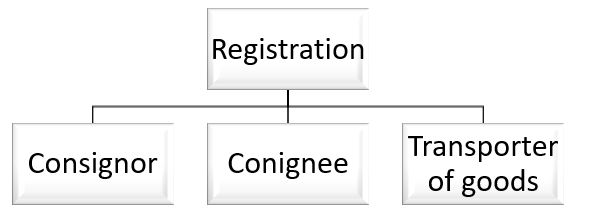

Persons required to generate E-way Bill

Following persons are required to generate E-way Bill:

- The registered Consignor

- The registered consignee

- A transporter of the goods

Note: The unregistered transporter can enrol on the common portal and generate the e-way bill for movement of goods for his clients.

The person who is generating e-way bill must have the following documents:

- Tax Invoice; or

- Bill of sale; or

- Delivery Challan

- Transporter’s ID, who is transporting the goods with the transporter document number

- The vehicle number in which the goods are transported

Primary responsibility of generating e-way bills

The primary responsibility is of the registered person (the consignor or the consignee) who causes the movement of goods. If the consignor or the consignee does not generate e-way bill then it should be generated by the transporter.

In case of supply by an unregistered person to registered person then the liability to generate e-way bill is on the recipient being the registered person.

Supply of goods by unregistered person to unregistered recipient

As per rule 138(1), the primarily requirement to fill Part A of the Form EWB-01 is on registered person who causes the movement of goods. If the consignor or the consignee both are unregistered then it is not necessary to generate EWB-01. If such unregistered person wants to generate EWB then one can go to online portal and select the option “enrolment for citizen” (Not activated).

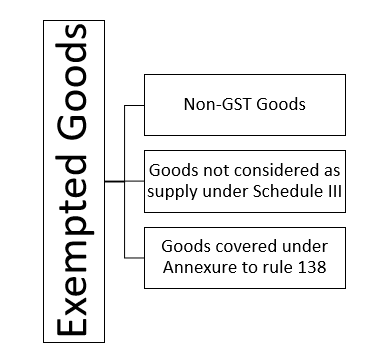

Goods exempted from e-way bill requirement

As per Notification no. 12/2018 e-way bill is not required for the goods mentioned in Notification No. 2/2017- Central Tax (Rate). In addition to these goods, such goods are also exempted from the requirement of e-way bill:

1. Non GST goods

- Alcoholic Liquor for human consumption

- Petroleum crude

- High speed diesel oil

- Motor Spirit

- Natural Gas

- Aviation turbine fuel

2. Goods not considered as supply under Schedule III

3. Goods covered under Annexure to rule 138

- Postal Baggage

- LPG, Kerosene

- Jewellery, Precious metals, stones

- Currency

- Used and personal household effects

Threshold limit for generating e-way bill

E-way bill is required to be generated if the consignment value exceeds Rs. 50,000 but there are certain exceptions to this. E-way bill is required

- If there is interstate movement of goods sent for job-work irrespective of the value of consignment.

- In case of interstate movement of handicraft goods.

- Where the goods are supplied in same truck and value of each invoice individually crosses the threshold limit of ₹ 50000

- Where transportation of goods commence prior to date of implementation of e-way bill but delivery completed to buyer after 01.04.2018.

Please note a transporters need not generate the Eway bill where value of each invoice individually is less than or equal to Rs 50,000 BUT In Aggregate (all invoices put together) exceeds Rs 50,000.

Validity period of e-way bill

| Type of vehicle | Distance | Validity |

| Regular transport cargo (other than over dimensional cargo) | Upto 100 km | One day |

| For every 100 km or part therof | One additional day | |

| Over dimensional cargo | Upto 20 km | One day |

| For every 20 km or part therof | One additional day |

Note:

- However, such period can be extended by updating the details in Part-B of FORM GST EWB-01.

- E-way bill can be generated for the maximum distance of 3000 km.

Movement of goods for shorter distance

E-way bill is required to generated irrespective of the distance. However, e-way bill rules provide for relaxation of not generating e-way bill for shorter distance:

1. Movement to weighbridge [Rule 138(14)(d)]

- Where goods are transported

- From place of business of consignor to a weighment bridge or back

- Distance is upto 20 kms

- Movement is accompanied by delivery challan

2. Movement to transporters place [Rule138(3)]

- Where goods are transported

- From place of business of consignor to the business of transporter for further movement of such goods

- It is Intra state movement

- Distance is upto 50 kms.

Consolidated e-way bill

- Generated by the transporter.

- Contains the multiple e-way bills for multiple consignments being carried by a transporter in one single conveyance.

- Vehicle number can be updated by regenerating the consolidated e-way bill.

Modification of e-way bill

Once the e-way bill is generated it cannot be modified. Only Part B can be modified. The e-way bill can be cancelled by the generator within 24 hours of generation of EWB. Whereas the recipient can cancel/reject the e-way bill within 72 hours of its generation or actual receipt of goods, whichever is earlier.

E-way bill in case of Import or Export

- In case of export to Nepal e-way bill has to be generated only till the port/ customs clearance where customs examination is done.

- In case of High sea sales, as the supply is said to be made before the goods cross the customs frontiers of India itself, e-way bill is not required to be generated.

- E-way bill is required to be generated if goods are to be transported from the port to the warehouse.

- E-way bill is not required for movement of goods between CFS/ICD to port or vice versa in the course of importation and exportation of goods.

Penalty

A person who is required to make the movement of goods under e-way bill, does not make the movement of goods in accordance with the e-way bill rules shall be liable to a penalty of Rs. 10,000 or tax to be avoided, whichever is greater.

| Condition | Taxable Goods | Exempted Goods |

| Owner come forward for payment of penalty | Payment of applicable tax and penalty equal to 100% of tax payable on such goods | Payment of 2% of the value of goods or Rs. 25,000, whichever is less |

| Owner of goods does not come forward for payment of penalty | Payment of applicable tax and penalty equal to 50% of value of goods reduced by tax amount paid thereon | Payment of 5% of the value of goods or Rs. 25,000, whichever is less. |

If my Taxable amount of sales invoice is 49,000/- and GST is Rs.8,820/-, Total Value-57,820/-. For this consignment GST is required ?

in one case consignment moved from delhi to haldwani . Part B of the e way bill could not be filled . It was 28.4.2018 . E way bill system in the country just started . I need some court judgement on the issue . Actually goods were detailed at Haldwani . IGST of Rs. 76000.00 and penalty of Rs. 76000.00 was imposed then good were released . I need some important judgement on the issue .

One query

Word “Warehouse” mentioned under point 3 of head Import or export means Custom warehouse or recipient warehouse which is not located under customs.

I think u should have correction under the Heading

Threshold limit for generating e-way bill

point number 4….Rules are changed for overall value exceeds 50000…..only any invoice exceeds 50000 required eway bill, subject to state to state