The Government is committed to ensure all consumers enjoy the benefit of lower prices of goods and services under GST.

Under GST, suppliers of goods and services must pass on any reduction in the rate of tax or the benefit of input tax credit to consumers by way of commensurate reduction in prices. If this is not done, the consumer’s interest is protected by the National Anti-profiteering Authority which may order:

(a) reduction in prices;

(b) return of the amount not passed on with interest @ 18% to the recipient;

(c) imposition of penalty; and

(d) cancellation of registration of the supplier.

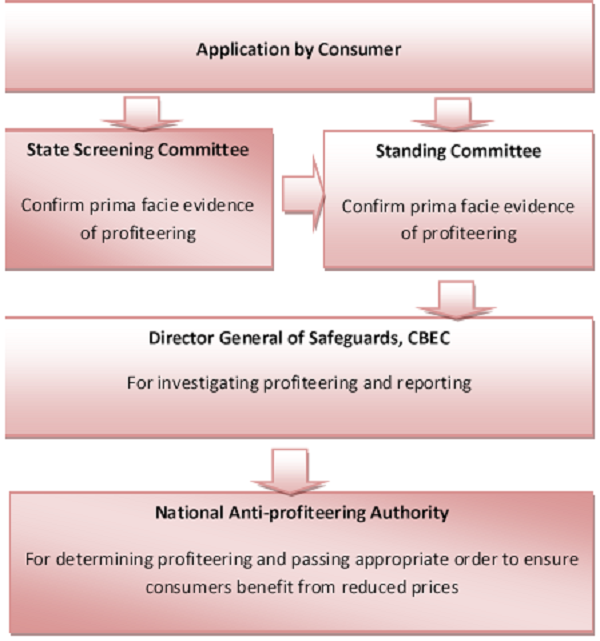

Affected consumers may file an application, in the prescribed format, before the Standing Committee on Anti-profiteering if the profiteering has all-India character OR before the State Screening Committees if the profiteering is of local nature.

Contact for further details:

Standing Committee on Anti-profiteering,

Second Floor, Bhai Vir Singh Sahitya Sadan,

Bhai Vir Singh Marg, Gole Market, New Delhi -110001.

Tel No.: 011-2371537, Fax No.: 011-23741542, Email: dgsafeguards@nic.in.

Please provide prescribed format or website link for filing Anti-profiteering complaint