Supply is wider term used in GST law as the GST is based on Supply only. Now the question arises what is supply. Supply is transfer of goods and services on which GST will be imposed. Supply has been elaborated in IGST law whether the supply is interstate supply or Intra- State supply. This is important aspect of GST because if the supply is Intra- State, then CGST and SGST will be attracted otherwise if the supply is Inter State then IGST will be levied. To understand whether the transaction is Inter State or Intra- State or Import or Export, it is important to understand the provision of Place of Supply which has been provided in Section- 10 to 14 of the IGST Law.

Place of Supply has been defined in Section 2[86] of CGST Law as follows;

“Place of supply ” means the Place of supply as referred to in chapter-V of the IGST Act.

Place of Supply of Goods other than supply of goods imported in to or exported from India [ Section -10 ]

| Situation | Place of Supply |

| 1. Movement of goods by supplier or recipient. | Where the movement of goods terminate for delivery to recipient. |

| 2. where the goods are delivered to recipient or any person on the direction of third person by way of transfer of title or otherwise, it shall be deemed that third person has received the goods | shall be principal place of business of third person not recipient.

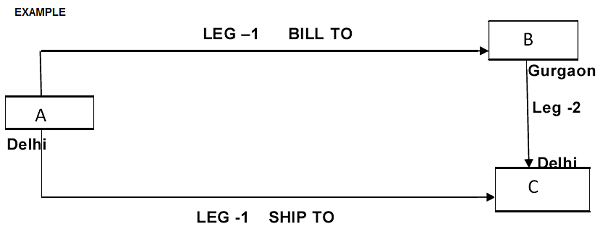

Look at the Annexure ‘1’ below |

| 3. where there is no movement of goods either by supplier or recipient | Location of such goods at the time of delivery to recipient |

| 4. where goods are assembled or installed at site | Shall be where the goods are assembled or installed |

| 5. where the goods are supplied on board a conveyance, like vessel, aircraft, train or motor vehicle | Shall be goods where taken on board |

GST is understood as “destination based consumption tax” but there is no provision which declare this fact. We find that the destination principal of GST is full captured. The law maker has declared, in each case of supply , its destination of supply.

(a) where a consideration is payable for the supply of goods or services or both, the person who is liable to pay that consideration;

(b) where no consideration is payable for the supply of goods, the person to whom the goods are delivered or made available, or to whom possession or use of the goods is given or made available; and

(c) where no consideration is payable for the supply of a service, the person to whom the service is rendered, and any reference to a person to whom a supply is made shall be construed as a reference to the recipient of the supply and shall include an agent acting as such on behalf of the recipient in relation to the goods or services or both supplied;

Annexure ‘ 1 ’

Supply Involved movement of goods and delivered to person on the instruction of third person

First Leg ;

| Case | Location of supplier | Location of recipient | Principal place of business of Third Party | Type of tax |

| 1 | Ahmedabad | Ahmedabad | Chandigarh | IGST at Ahemdabad |

| 2 | Ahmedabad | Mumbai | Ahmedabad | CGST at Ahemdabad |

| 3 | Ahmedabad | Banglore | Banglore | IGST Ahemadabad |

| 4 | Ahmedabad | Haridwar | Haridwar | IGST at Ahemadabad |

Second Leg ;

| Case | Location of supplier | Location of recipient | Principal place of business of Third Party | Type of tax |

| 1 | Ahmedabad | Ahmedabad | Chandigarh | IGST at Chandigarh |

| 2 | Ahmedabad | Mumbai | Ahmedabad | IGST at Ahemadabad |

| 3 | Ahmedabad | Banglore | Banglore | CGST at Banglore |

| 4 | Ahmedabad | Haridwar | Haridwar | CGST at Haridwar |

In the above diagram – A is sending goods to C on the instruction of B . For the leg-1 bill will be raised from Delhi to Gurgaon on IGST. On the second leg B will bill to B from Gurgaon to Delhi on IGST .

Where Supply does not involve movement of goods

| Case | Location of supplier | Location of recipient | Location of Goods | Place of Supply | Type of tax |

| 1 | Delhi | Gurgaon | Gurgaon | Gurgaon | IGST at Delhi |

| 2 | Gujrat | Gurgaon | Faridabad | Faridabad | IGST at Gujrat |

| 3 | Tamil Nadu | Kerala | Tamil Nadu | Tamil Nadu | CGST at Tamil Nadu |

Place of supply of Goods import into and export from India [ Section -11 ]

√ Place of supply of goods imported in to India shall be the location of importer.

√ Place of supply of goods exported from India shall be the location outside India.

Place of supply of Goods import into and export from India [ Section -11 ]

√ Place of supply of goods imported in to India shall be the location of importer.

√ Place of supply of goods exported from India shall be the location outside India.

Section 2[5] Export of Goods means

“ with its grammatical variation and cognate expression, means taking goods out of India”

Section 2[10] Import of goods means

“ with its grammatical variation and cognate expression, means bringing goods to India from place outside India”

Place of supply of Services where the location of supplier of services and location of recipient of services is in India. [ Section -12 ]

| Situation | Place of Supply |

| 1. Except the specific services mentioned below , the place of supply of services to registered person | Shall be the location of such person |

| 2. Except the specific services mentioned below , the place of supply of services to unregistered person | Location of recipient of services where the address exist

Location of supplier otherwise |

| 3.a] services in relation to immovable property including services by Architect, interior decorator, surveyor, engineers, estate agent, grant of right to use immovable property for carrying out or co-ordination of construction work

b] lodging accommodation by hotel, inn, guest house, home stay, club or campsite, house boat or other vessel c] accommodation in immovable property for marriage or reception or matter related therewith, official, social , cultural , religious or business function including service for such functions. d] ancillary to above services in a, b and c |

Location of Immovable property, boat or vessel

If immovable property, boat or vessel is located outside India then location of the recipient. If the services are provided in more than one State, proportion of service provided in each State. |

| 4. restaurant and catering service, personal grooming , fitness, beauty treatment, health services including cosmetic and plastic surgery | Where the services are actually performed |

| 5. training and performance appraisal | Location of registered person.

Location where the service are performed in case of unregistered person. |

| 6. Admission to cultural, artistic, sporting ,scientific, educational or entertainment event or amusement park or any other place | Where the event is actually held |

| 7. organizing of a cultural, artistic, sporting ,scientific, educational or entertainment including supply of services to exhibition, conference, fair, celebration or similar events | If to registered person, location of such person

Other than registered person, place of such event actually held If event is held outside India then location of the recipient If the services are provided in more than one State, proportion of service provided in each State |

| 8. transportation of goods including by mail or courier | In case to registered person, location of such person.

Otherwise , location where the goods are handed over. |

| 9. Transportation of passenger | In case to registered person, location of such person

Otherwise , place where person embark on conveyance for continuous journey Return journey shall be treated as separate journey |

| 10. services on board a conveyance such as vessel, aircraft, train or motor vehicle | First schedule departure point of the conveyance |

| 11.telecommunication including data transfer, broadcasting, cable and DTH television services

a] fixed line, leased circuit , internet lease circuit, cable or dish antenna- b] Mobile connection for telecommunication, internet on post paid basis- c] Mobile connection for telecommunication, internet and DTH on prepaid basis- i] through selling agent or reseller or distributor of SIM or recharge voucher ii] by any person to the final subscriber d] any other case other than b and c above |

Where it is installed Billing Address Address of seller , re seller or distributor as per the record of supplier Where prepayment is received or voucher is sold Address of recipient as per the record of supplier Where the address of the recipient is not known , location of supplier. If prepaid service or recharge is made on internet banking, address of recipient. |

| 12. banking and other financial services including stock brooking | Location of recipient of services, if recipient location not known then location of supplier |

| 13. Insurance services | In case to registered person, location of such person.

Otherwise , location of the recipient of services. |

| 14. advertisement service to State Govt. or Central Government, statutory body or local authority for identifiable States and the value of such supply identifiable to each State | Proportion to amount attributable to service provided by way of dissemination in the respective State as per the contract. |

Place of Supply of services where the location of the supplier or location of recipient is out of India. [ Section -13]

| Situation | Place of Supply |

| 1. Except the specific services mentioned below | Location of recipient of services where the address exist

Location of supplier otherwise |

| 2.a] Goods required to be made available for providing services to the supplier of services

Where services are provided from remote location by way of electronic means b] service supplied to individual , represented either as recipient of service or person acting on behalf of recipient which required the physical presence of receiver. |

Location where the services are performed.

Location where the Goods are situated.

This clause shall not apply in services supplied in respect of goods temporarily imported in to India and are exported after repair. Location where the service are performed |

| 3. services in relation to immovable property including services in this regard by expert and estate agent, supply of hotel accommodation by hotel, inn, guest house, home stay, club or campsite, grant of right to use immovable property, services for carrying out or coordination of construction work, including Architect or interior decorator. | Location of Immovable property.

|

| 4. admission to or organizing of a cultural, artistic, sporting ,scientific, educational or entertainment, exhibition, conference, fair, celebration or similar events | Where the event is actually held |

| 5. where the services referred to in 2,3 and 4 is supplied at more than one location, including in taxable territory | Location shall be taxable territory where the greatest proportion of service is provided. |

| 6. where the services referred to in 2,3,4 and 5 is supplied at more than one State | Proportion to amount attributable to service provided by way of dissemination in the respective State as per the contract |

| 7.a] Service by banking company or financial institution or non banking finance company

b] Intermediary services c] hiring of means of transport including yacht other than aircraft and vessel up to one month. |

Location of Supplier |

| 8. transportation of goods including by mail or courier | Place of Destination |

| 9. Transportation of passenger | Where the passenger embark on conveyance for continuous journey. |

| 10. services on board a conveyance such as vessel, aircraft, train or motor vehicle | First schedule departure point of the conveyance |

| 11.a] service of “ online information and Database access or retrieval “

b] for the purpose of this sub section, person receiving such services shall be deemed to be located in taxable territory, if following two condition are being satisfy i] location of address presented by the recipient via internet ii] payment settle by recipient by any card has been issued in taxable territory iii] billing address of recipient of service is in taxable territory iv] internet address protocol of the device used by recipient is in taxable territory v] the bank of recipient of service is in taxable territory vi] country code of SIM used by recipient of service is in taxable territory vii]location of the fixed land line use by recipient is in taxable territory |

Location of recipient of services |

√ Import of goods and services in to India shall be treated as interstate trade or commerce.

√ Supply of Goods or Services from India to place outside India shall be treated as Inter State trade or commerce.

√ Supply of goods or services to SEZ developer or SEZ unit shall be treated as Inter State trade or commerce.

√Any supply of goods or services which is not an Intra State supply shall be treated as Inter State Trade or Commerce.

As per Section 2[6] Export of services means ;

i. Supplier is located in India

ii. Recipient of service is located outside India

iii. Place of supply is out of India

iv. Payment of such services is received in convertible foreign exchange

v. Supplier of service and recipient of service is not merely distinct person in accordance with explanation 1 of Section- 8

As per Section 2[11] the import of service shall means ;

i. Supplier of service is located out of India

ii. Recipient of service is located in India

iii. Place of supply of service is in India

Special provision for payment of tax by supplier of online information data base access retrieval [OIDAR] – Section -14

Supply of OIDAR service by person located in Non taxable territory to person non taxable online , the supplier of services shall be liable for payment of IGST on such supply of services.

Supplier of such service shall for the payment of IGST , take single registration under the Simplified Registration Scheme. Any person representing such person may also get registration on his behalf and pay taxes. If the supplier does not have any presence or representative , may appoint such person and pay taxes.

Disclaimer :

The contents of this article are solely for information and knowledge and does not constitute any professional advice or recommendation. Author does not accept any liability for any loss or damage of any kind arising out of this information set out in the article and any action taken based thereon.

About the Author:

The contents of this article are solely for information and knowledge and does not constitute any professional advice or recommendation. Author does not accept any liability for any loss or damage of any kind arising out of this information set out in the article and any action taken based thereon.

nice article sir