1. There are mainly four types of GST:

IGST: Integrated Goods and Service Tax is collected by central government for the transactions between states or a state and union territory ie., interstate. The benefits are shared by the central and state.

CGST: Central Goods and Service Tax is collected by the central government for the transactions within a state ie., intrastate. The benefits will be taken by the central government.

SGST: State Goods and Service Tax is collected by the state government for the transactions within a state ie., intrastate. The benefits of this tax are received by the state.

UTGST: Union Territory Goods and Service Tax is for the transactions within a union territory by the Union Territory government and benefits are received by them.

Sri. Raju of Chennai sells 40,00 units to sri. Roshan of Chennai @Rs.100 per unit. GST rate is 12%.How is GST calculated?

| Taxable value of supply | 400,000 |

| Add:–GST | |

| CGST @6% on 400,000 | 24,000 |

| SGST @6% on 400,000 | 24,000 |

| 448,000. |

III. Credit Utilization

CGST credit can be used for the payment of CGST liability.

CGST-CGST.

SGST/UTGST credit can be used for payment of SGST/UTGST liability

SGST/UTGST——SGST/UTGST.

No cross-utilization permitted between CGST and SGST/UTGST.

Mr. Akbar of Ernakulam supplied 100,000 units @20 per unit. The GST rate is 18%.The customer is sri. Asok of Bangalore. Show how GST is calculated.

| Taxable value of supply | 20,00,000 |

| Add:–GST | |

| IGST @18% on 20,00,000 | 360,000 |

| 23,60,000. |

Revenue from IGST will be apportioned among the central Government and state

Governments.

Example of GST Payment

A’ Manufacturer (Thrissur) to Output Manufacturer(Thrissur)’B’

A sells goods worth Rs.100. Tax to be paid in cash

| Particulars | Amount. | |

| Value for A 100 | 100 | |

| CGST@9% 9 | 9 | Central Govt: 9 |

| SGST@9% 9 | 9 | Kerala Government : 9 |

| 118 |

B‘ (Thrissur) sells with 15% value addition to ‘ C’ (Thrissur ) (VAT Dealer)

| Particulars | Amount. |

| Cost for B | 100 |

| Value Add.@15% | 15 |

| Base value for GST | 115 |

| CGST@9% | 10.35 |

| SGST@9% | 10.35 |

| Total Value | 135.70 |

| Tax to be paid in cash | |

–

| Central Govt: | ||

| CGST | :10.35 | Balance—1.35 |

| CGST Credit:9 | ||

| 1.35 | ||

| Kerala Govt: | ||

| SGST | 10.35 | |

| SGST Credit:9 | Balance-1.35 | |

C’ Sells with 15% value addition to Consumer (Thrissur)

Particulars Amount

Cost for C 115

Value add. 17.25

Base value for GST 132.25

CGST@9% 11.90

SGST@9% 11.90

Total value 156.05

Tax to be paid cash:

| Particulars | Amount. |

| Cost for C | 115 |

| Value add. | 17.25 |

| Base value for GST | 132.25 |

| CGST@9% | 11.90 |

| SGST@9% | 11.90 |

| Total Value | 156.05 |

| Tax to be paid in cash | |

–

| Kerala Govt: | |||

| Central Govt. | SGST | 11.90 | |

| CGST | 11.90 | SGST Credit | 10.35 |

| CGST Credit | 10.35 | 1.55 | |

| 1.55 | |||

Utilization of Input Tax credit of IGST

IGST (output)

Discharged by using credit of

(Preference is given )

1. IGST

2. CGST

3. SGST

CGST Credit will be first utilized for payment of CGST liability and then IGST liability in the following manner:

I. CGST

II. IGST

SGST Credit will be first utilized for payment of SGST Liability and then IGST liability in following manner

SGST—-

I. SGST

II. IGST

..A’ Manufacturer (Thrissur ) to Output Manufacturer(Thrissur )’B’

| II. | A sells goods worth Rs.200 | Tax to be paid in cash | |

| III. | Particulars | Amount | |

| IV. | Value for A | 200 | |

| V. | CGST@9% | 18 | Central Govt:18 |

| VI. | SGST@9% | 18 | Kerala Government :18 |

| VII. | |||

| VIII. | 236 |

B ‘(Thrissur) sells with 15% value addition

to ‘C’(Delhi)(VAT Dealer).

| Particulars | Amount. |

| Cost for B | 200 |

| Value Add.@15% | 30 |

| Base value for GST | 230 |

| IGST@18% | 41.40 |

| Total Value | 271.40 |

| Tax to be paid in cash | |

–

| Central Govt | |

| IGST | 41.40 |

| CGST CREDIT | 18 |

| SGST CREDIT | 18 |

| 5.40 | |

Kerala govt. will transfer Rs.18 to CG for payment of IGST

VII. Three Ledgers in GST.(Ledgers maintained by the GST department)

A. Electronic Cash Ledger

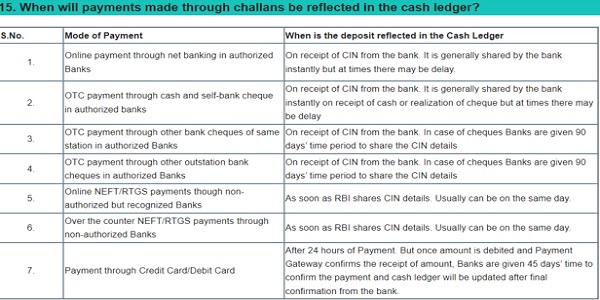

It is an account of the taxpayer maintained by GST system reflecting the cash deposits in recognized Banks and payments of taxes and other dues made by the taxpayer. The Tax Deducted at Source (TDS) and Tax Collected at Source (TCS) are also accounted for in the Electronic Cash Ledger as cash deposits of the taxpayer.

A registered taxpayer can make cash deposits in the recognized Banks through the prescribed modes to the Electronic Cash Ledger using any of the Online or Offline modes permitted by the GST Portal. The Cash deposits can be used for making payment(s) like tax liability, interest, penalties, fee, and others.

The Electronic Cash Ledger has four Major Heads IGST, CGST, SGST/UTGST, and CESS. Each of these Major Heads have the five following Minor Heads:

1. Tax

2. Interest

3. Penalty

4. Fee

5. Others

Electronic Cash Ledger is maintained on the GST Portal available at https://www.gst.gov.in/

Electronic Cash Ledger can only be viewed by the taxpayers themselves, or their authorized signatories and GST Practitioner. It can also be viewed by their Jurisdictional Officials (JO).

The amount available in the Electronic Cash Ledger can be utilised for payment of any liability for the respective major and minor heads. For example, liability for the tax under SGST/UTGST can be settled only from the available amount of cash under SGST/UTGST Major head.

For example, an amount of INR 1000 is available under minor head ‘tax’ of major head ‘SGST/UTGST’ and the taxpayer has a liability of INR 200 for minor head ‘interest’ under the same major head ‘SGST/UTGST’. Since, there is no amount available under minor head ‘interest’ under major head “SGST/UTGST”, therefore, interest payment cannot be made from the amount available under ‘tax’ of the same major head.

(Source: https://www.gst.gov.in/help/helpmodules/)

B. Electronic Credit Ledger,

In the Electronic Credit Ledger, all credits accrued on account of inward supplies made by a taxpayer within a tax period are accumulated. The ledger is maintained Major Head-wise, i.e., IGST, CGST, SGST, and CESS.

Taxpayers can view their Electronic Credit Ledger in the post login mode by logging on to the GST Portal. Path: Services > Ledgers > Electronic Credit Ledger

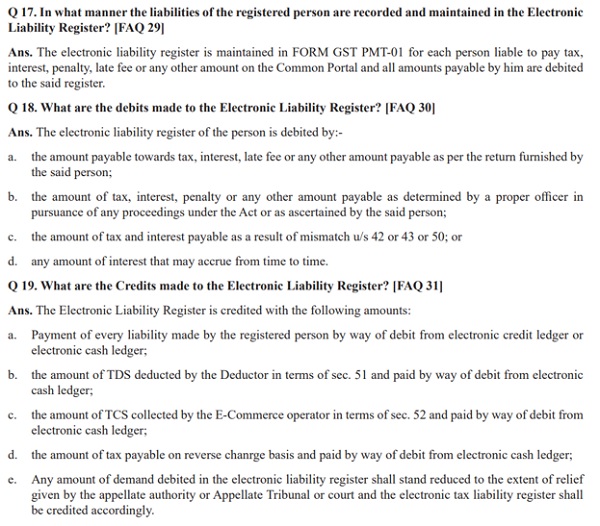

C. Electronic Liability Register

All return related liabilities accrued are displayed in the Electronic Liability Register: Part I: Return related liabilities. Payments made from the Electronic Cash Ledger and/or credit utilized to discharge the liabilities are also shown in the register. Liabilities pertaining to GST CMP-03, GST ITC-03 and GST REG-16 are also posted in Part-I. It can be accessed in the post-login mode using the path Services > Ledgers > Electronic Liability Register > Part-I: Return related liabilities.

All liabilities other than return related are displayed in the Electronic Liability Register: Part II: other than return related liabilities. Payments made from the Electronic Cash Ledger and/or credit utilized to discharge the liabilities are also shown in the register. Liabilities not covered in Part-I are accounted for in Part-II. It can be accessed in the post-login mode using the path Services > Ledgers > Electronic Liability Register > Part – II: Other than return related liabilities.

(Source:https://icmai.in/upload/Students/Syllabus2022/Inter_Stdy_Mtrl/P7_B.pdf)

VIII.Mr Sivan 530,00 on account of ITC of CGST in the electronic credit Ledger .He has to pay the following Tax liability.

Tax payable under

IGST -200,00

SGST-180,00

CGST-140,00

Determine the order of utilization of the ITC available in electronic credit ledger ,

- CGST CREDIT -530,00

- CGST Liability -140,00

- IGST Liability-200,00

- Balance-190,00.

1X.TDS

Details are as follows

| Person responsible for deducting TDS | department or establishment of the Central Government or State Government; or

(b) local authority; or (c) Governmental agencies; or (d)PSU |

| TDS percentage | 2% |

| Amount on which TDS applicable | Base amount of the bill |

| When TDS | a.Total value of supply under contract is exceeding Rs 250,000 or

b.Location and place of supply of supplier is different from the place of registration of recipient . |

| Due date of payment of TDS | 10 th of the succeeding month |

| GST registration | Compulsory |

| Section | 51of the CGST Act |

X.TCS

Details are as follows

| Person responsible for deducting TCS | every electronic commerce operator not being an agent, shall collect an amount calculated at such rate not exceeding one per cent., as may be notified by the Government on the recommendations of the Council, of the net value of taxable supplies made through it by other suppliers where the consideration with respect to such supplies is to be collected by the operator. |

| TCS percentage | 1% |

| Amount on which TCS applicable | Net value of taxable supply |

| Net value of taxable supply | Net value of taxable supplies” shall mean the aggregate value of taxable supplies of goods or services or both, other than services notified under sub-section (5) of section 9, made during any month by all registered persons through the operator reduced by the aggregate value of taxable supplies returned to the suppliers during the said month. |

| Due date of payment of TCS | 10 th of the succeeding month |

| GST registration | Compulsory |

| Section | 52of the CGST Act |