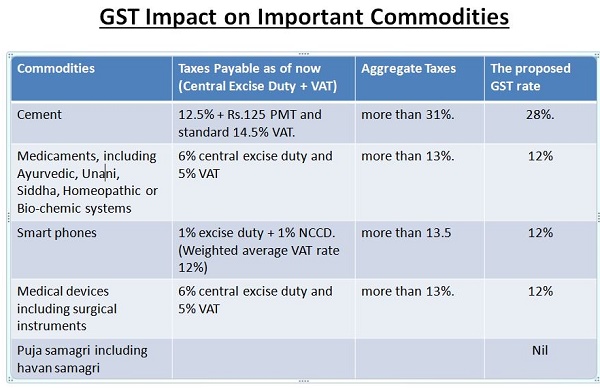

Goods and Services Tax (GST) will lead to lower tax burden in several commodities including packaged cement, Medicaments, Smart phones, and medical devices, including surgical instruments

The roll out of Goods and Services (GST) Tax will bring benefits to the consumers due to reduced tax rates on various commodities such as packaged cement, medicaments, smart phones, and medical devices, etc.

1. Cement: Packaged cement attracts central excise duty of 12.5% + Rs.125 PMT and standard VAT rate of 14.5%. At these rates, the present total tax incidence works out to more than 29%. If we include tax incidence on account of CST, octroi, entry tax, etc., the present total tax incidence would work out to more than 31%. As against this, the proposed GST rate for cement is 28%.

2. Medicaments, including Ayurvedic, Unani, Siddha, Homeopathic or Bio-chemic systems: Medicaments, in general, attract 6% central excise duty and 5% VAT. Further, CST, octroi, entry tax, etc. are also applicable in general. At these rates, the present total tax incidence works out to more than 13%. As against this, the proposed GST rate on medicines, including ayurvedic medicines, is 12%.

3. Smart phones: Smart phone attracts 2% central excise duty [1% excise duty + 1% NCCD]. VAT rates vary from State to State from 5% to 15%. Weighted average VAT rate on smart phones works out to about 12%. Thus. the present total tax incidence on smart phones works out to more than 13.5%. As against this, the proposed GST rate for smart phones is 12%.

4. Medical devices including surgical instruments: Medical devices, including surgical instruments, in general attract 6% central excise duty and 5% VAT. Along with CST, octroi, entry tax, etc., the present total tax incidence on them works out to more than 13%. As against this, the proposed rate under GST is 12%.

5. Puja samagri including havan samagri: These goods will be under Nil category.

However, exact formulation for the same is yet to be finalized.

Source- CBEC