Ankit Gupta

Hello readers, finally the day came we all are waiting for, GST become reality; I know that everyone in Industry, Business world & Professionals are confused about GST Provisions & its implications.

I bring you the live procedures to get yourself registered under GST and get GSTIN easily.

Before starting the steps, keep following documents & information with yourself in e form to complete the registration process.

DOCUMENTS REQUIRED

FOR PROPRIETORSHIP FIRM REGISTRATION

1. Name of Firm

2. Copy of PAN card of Proprietor

3. Identity Proof (Aadhar Card / Passport / Election ID)

4. Address Proof of Place of business (Rent Agreement / NOC / Electricity bill is preferable in views of Author)

5. Photograph of Proprietor

6. Bank Statement or First Page of Bank Passbook

7. Mobile Number & Email Address of Proprietor

8. Digital Signatures (if Aadhar Authentication is not possible)

FOR PARTNERSHIP FIRM REGISTRATION

1. Copy of PAN card of all Partners & Firm

2. Identity Proof of all Partners(Aadhar Card / Passport / Election ID)

3. Address Proof of Place of business (Rent Agreement / NOC / Electricity bill is preferable in views of Author)

4. Photograph of all Partners

5. Bank Statement

6. Mobile Number & Email Address of all Partners & Firm (if there)

7. Digital Signatures of Authorized Partner(if Aadhaar Authentication is not possible)

8. Partnership Deed

9. Letter of Authorization

FOR PRIVATE LIMITED COMPANY REGISTRATION

1. Copy of PAN card of all Directors & Company

2. Identity Proof of all Directors (Aadhar Card / Passport / Election ID)

3. Address Proof of Place of business (Rent Agreement / NOC / Electricity bill is preferable in views of Author)

4. Photograph of all Directors

5. Bank Statement

6. Mobile Number & Email Address of all Directors & Company (if there)

7. Digital Signatures of Authorized Director

8. Certificate of Incorporation

9. Letter of Authorization

STEP BY STEP REGISTRATION PROCESS

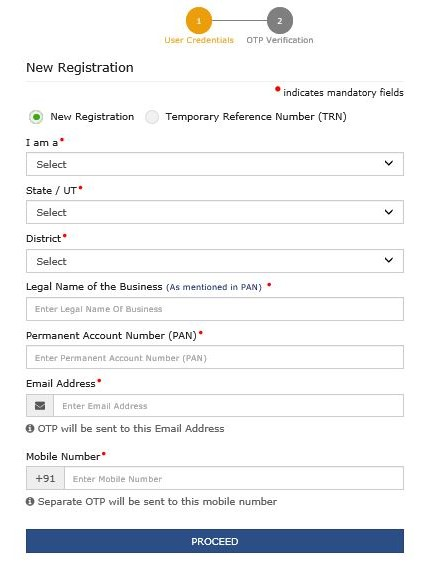

STEP1

Visit www.gst.gov.in

Go to services and under registration — Click on New Registration

Select Category Taxpayer, Specify State along with Legal Name of business as per PAN card along with PAN, Email & Mobile Number in this form.

STEP2

After completing Step1, you will be in receipt of OTP (One Time Password) on both email address as well as Mobile number specified in above Form

Enter OTP and click on proceed.

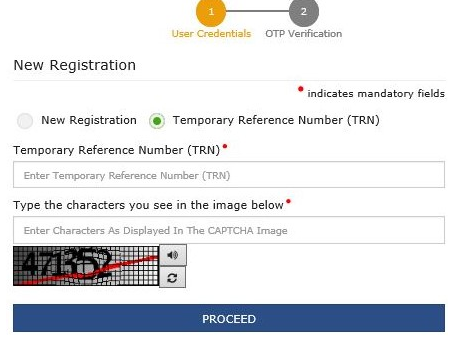

STEP3

After submission of above form, a Temporary Reference Number will generated and will be communicated to the applicant on email as well.

To commence filing application form, user is required to quote TRN number to proceed.

Illustrative image provided below:

STEP4

Login using TRN to commence filing GST Registration application form

Verify your login using your Mobile / Email OTP then click on action to proceed.

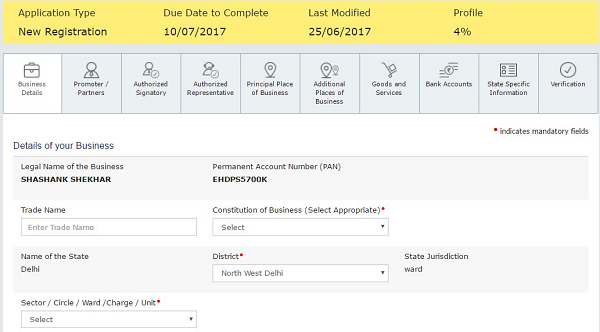

STEP5 : ENTER BUSINESS DETAILS

On this page, applicant is required to submit information like:

- Trade Name

- Constitution of business

- Jurisdiction

- Composition scheme availed or not

- Reason of obtaining registration

- Date of commencement of business

- Date of liability

STEP 6 : SPECIFY PROMOTOR / PARTNER DETAILS

Applicant needs to specify information such as:

- Name of applicant

- Father’s Name

- Date of birth

- Gender

- Designation

- Residential address

- Mobile Number

- Email Address

- PAN

- DIN (if case of Director / Partner of LLP)

- Citizenship

- Passport number (Mandatory for non citizens)

- Photograph (Required as attachment)

Note : In case of Proprietorship business Proprietor is the authorized Signatory.

In case of Partnership Firm / LLP / Company, an Authorization letter is required to be attached which must be signed by the person authorized by the entity and key Managerial persons of entity.

If the promoter details entered above is the Authorized Signatory then Tick on Primary Authorized Signatory under Authorized Signatory Page.

STEP7 : SPECIFY DETAILS OF AUTHORISED REPRESENTATIVE

(Like GST Practitioner)

On this page, the applicant is required to specify the details of its Authorised Signatory such as GST Practitioner for whom Enrolment Number of GST Practitioner are required to be specified.

STEP 8: SPECIFY DETAIL OF PRINCIPAL PLACE OF BUSINESS AND ADDITIONAL PLACE OF BUSINESS(ES)

On this page, applicant is required to specify following information:

- Address of Place of business

- Specify Nature of business entity (Exporter / Importer / Trader / Leasing / Service Provider / Warehouse / Works contract / EOU etc.)

- Proof of place of business (Required in attachment) ( Attach – NOC, Rent Agreement, Electricity Bill, Ownership Proof)

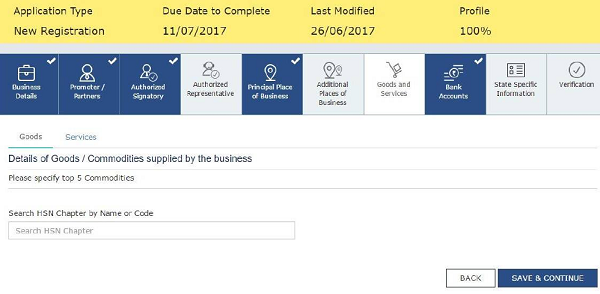

STEP 9 :SPECIFY THE DETAIL OF GOODS & SERVICES PROVIDED

On this page, the applicant is required to give details of Goods & Services they are dealing with.

Applicant can search it using HSN code.

Note that: Upto 5 items can be added.

STEP 10: ENTER BANK ACCOUNT DETAILS

On this Page, applicant is required to specify information like Bank Account Number, Account type and Bank’s IFSC code

Applicant is required to attach Bank Statement or Bank passbook or Cancelled Cheque.

STEP 11: VERIFICATION OF REGISTRATION FORM

GST Application form can be verified using Digital Signatures or E Signature or EVC

On successful submission of form, a message will be displayed on screen like below:

G.S.T. RULES RELATED TO REGISTRATION

A. Registration Procedure under GST rules

a. Every person seeking registration shall declare his PAN,Email & Mobile Number, State in PART A of FORM GST REG 01.

b. On successful verification of PAN, Mobile Number & Email.address, a temporary reference number shall be generated, using such reference number in PART B of FORM GST REG 01 application can be filed.

c. After filing such application, an acknowledgement shall be generated in FORM GST REG 02.

d. Then, application will be examined by Proper Officer and if the same is found in order then Proper Officer shall grant registration to the applicant within 3 working days from the date of submission of application.

e. Where the application is found to be deficient then Proper Officer may issue issue notice to the applicant electronically in FORM GST REG 03 within 3 working days from the date of submission of application.

f. Applicant on receipt of Notice shall furnish clarification, document etc in FORM GST REG 04 within 7 days from the date of receipt of Notice.

g. Where the proper Officer is satisfied that with the Clarification, document provided then he may approve the grant of registration within 7 working days from the date of receipt of clarification.

h. Where no reply is furnished or proper officer is not satisfied with the clarification received from the applicant then proper officer shall after recording reasons in writing, reject registration application and inform applicant electronically in FORM GST REG 05.

i. If the proper officer fails to take any action within the designated time as per GST Act and its rules then the application for grant of registration shall be deemed to have been approved & Registration certificate shall be made available within 3 days.

j. Where the registration application have been approved then a Certificate of Registration will be issued to the applicant in FORM GST REG 06 showing principal place of business & Additional Place of business(es).

NOTE THAT: Where the Proper officer is satisfied that the Physical verification of the place of business is required after grant of registration then such proper officer may get such verification done and upload report in FORM GST REG 30 within 15 working days of verification.

B. Four Things to do after obtaining GST Registration

a) Every Registered person shall display his Certificate of Registration at his place of business and at every additional place of business.

b) Every Registered person shall display GSTIN on the notice board exhibited at the entry of his place of place of business and at every additional place of business.

c) Make & Preserve books of accounts required as per GST Act & Rules made

d) File GST Returns on timely basis to avoid payment of penalty of Rs.100 per day or/& cancellation of Registration.

The Author of this blog is CA. Ankit Gupta who is a practicing Chartered Accountant and can be reached at 91-9811985576 or caankitgupta27@gmail.com for suggestions and queries.

Regarding GST REG-04 , what if form is not submitted within 7 days. please provide process for submitting clarification form if not filled within 7days

SUBMIT WITH E-SIGNATURE OPTION IS DIMMED OUT? HOW TO RESOLVE?

Hi,

Is the registration for Input Service Distributor also open. If yes, how to apply as I can not see any option for it. thanks.

in case of proprietor firm, what will be the Trade Name?

Legal Name is proprietor name

Is Trade Name = Firm name.

Very nicely present , appreciable

Very Nice & Informative Article. Keep it up Ankit.

Documents required for GSt registration, process for Govt Department,

Sir,

your article is very educative. also please let us know how to make corrections after the registration is done.