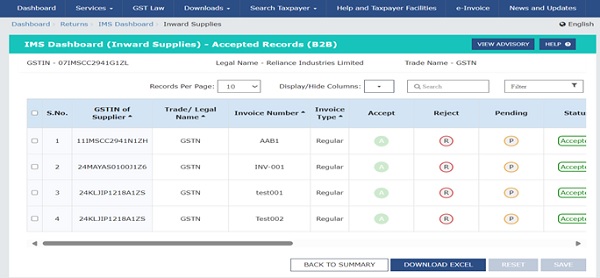

Recently the GSTN portal has issued a new advisory on Invoice Management System (IMS). IMS will provide the preview of GSTR-2B based on the invoices (including credit/debit notes) saved by supplier in GSTR 1, IFF, or 1A and enable taxpayers to review and take action before they are reflected in GSTR 2B. This IMS system is going to be implemented from 1st Oct 2024. A sample screenshot of the same is provided below:

1. Option to Accept, reject, or keep them pending:

IMS will allow the recipient to either accept or reject an invoice or to keep it pending. The actions can be taken from the time of saving of the invoices by the supplier/auto-population through e-invoicing in GSTR 1/IFF/1A till the recipient taxpayer files GSTR-3B. These actions will also be visible to the supplier. At the time of generation of GSTR-2B, only the records filed by the supplier will be considered. In case any changes are made in actions after generation of GSTR-2B, recipient taxpayer will be required to regenerate GSTR-2B.

The records/invoices saved or filed through IFF by a QRMP taxpayer will flow to IMS for the recipient, and will become part of GSTR-2B, as per action taken by the recipient in IMS on the same. The GSTR- 2B of the recipient will be generated monthly, unless the recipient is a QRMP taxpayer.

2. Option not to take actions:

A. Deemed acceptance: Records where NO ACTION has been taken will be deemed to be accepted by the recipients.

B. ACCEPT or REJECT the records: Accepted records (along with deemed accepted records) will form part of GSTR-2B and populated in GSTR-3B as eligible ITC. Rejected records will become part of ‘ITC rejected’ section of GSTR-2B and will not auto-populate in GSTR 3B.

C. Keep PENDING: You can select the invoice as pending and deal with it later. It will be carried forward to subsequent months in IMS dashboard till the time they are accepted or rejected. The actions will get reset if any changes are made by the supplier before filing the return.

3. ‘Pending’ action shall not be allowed in following scenarios:

a. Original Credit note

b. Upward amendment of the credit note irrespective of the action taken by recipient on the original credit note

c. Downward amendment of the credit-note if original credit note was rejected by recipient

d. Downward amendment of Invoice/ Debit note where original Invoice/ Debit note was accepted by recipient and respective GSTR 3B has also been filed.

In effect, acceptance of such records will reduce the ITC of the recipient taxpayer, and rejection will result in increase in liability of supplier in GSTR 3B for the subsequent tax period.

Highlighted Action taken by recipient which increase the liability of supplier:

| Document | Original Value | Action by recipient | Amended Value | Action by Recipient |

| Credit Note | 100 | Reject | – | – |

| Credit Note | 100 | Any | 110 | Reject |

| Credit Note | 100 | Reject | 90 | Reject |

| Invoice/ Debit note | 100 | Accept & 3B filed | 90 | Reject |

4. Following supplies will not appear in IMS but will directly be populated in the GSTR-3B:

a. Inward supplies from registered persons liable to reverse charge,

b. supplies where ITC is barred under section 16(4) or on account of POS rule.

Other key highlights of IMS:

- It is mandatory to recompute GSTR 2B from IMS dashboard in case of any change in action already taken on concerned records or any action is taken after 14th of the month i.e. date of generation of Draft GSTR-2B.

- Records will flow to IMS dashboard at the time of saving of record by supplier in respective form and recipient can take action on such record in IMS. However, such records will be populated in the GSTR 2B after filling of return in GSTR-1/IFF/1A by the supplier.

- All the accepted/ deemed accepted/ rejected records will move out of IMS dashboard after filing of respective GSTR 3B.

- Pending records will remain on IMS dashboard and these records can be accepted or rejected in future months.

- Any change made in a record/invoice before filing GSTR-1/1A/IFF by the supplier will reset the record’s status on recipient’s IMS dashboard.

- GSTR 2B will be sequential now. i.e. system will generate GSTR 2B of a return period only if GSTR 3B of previous return period is filed.

Some issues which I feel are unanswered / not considered while issuing advisory:

a. Legal validity and functionality: The effectiveness of the IMS relies on the legal framework. In the absence of sufficient legal authorization, GSTN-driven functionalities’ attempt to revive the defunct GSTR-2 and GSTR-3 systems might lack legal validity.

b. Deemed action & responsibility: An element of ambiguity towards transaction responsibilities is introduced by the ‘no action equals deemed action’ option in the IMS architecture. If the system’s operations are presumed to be user-generated, the transaction ownership basis may need to be re-evaluated.

c. Recipient Compliance: On the other hand, recipients’ reliance on supplier GSTR 1 filing has also raised issues. If a supplier modifies a saved invoice during GSTR-1 filing, the recipient’s action on the saved invoice could be nullified. There is a question of recipients’ compliance with IMS within a specified timeframe, considering that there may be existing systems in place for GSTR 2B compliance during the GSTR-3B filing.

d. Tracking pending invoices & ITC claims: The IMS will necessitate extra compliance measures to monitor invoices categorized as pending in IMS compared to those marked as pending in SAP. This introduces an added level of reconciliation within the compliance process.

e. Mistakenly rejected invoices: Invoices labeled as rejected in the IMS will not be included in GSTR-2B and will be eliminated from the IMS dashboard after GSTR-3B is filed. However, concerns arise if an invoice was supposed to be accepted. The process for correcting such discrepancies remains unclear.

f. Supplier Liability Activated by Recipient Action: The advisory indicates that a recipient’s actions may inadvertently increase the liability of a supplier. The specifics of how this process would function remain ambiguous and could lead to disagreements.

Numerous inquiries remain regarding the implementation of IMS and its impact on the existing return filing procedure. A more thorough understanding of the system’s functionality will be obtained upon its launch next month. It is imperative for the industry to meticulously monitor the activities carried out or disregarded within IMS and evaluate the consequent implications for GST compliance.