In the earlier article, we saw the basics of the new tax rates applicable to the real estate service and some terms like RREP/REP etc. Now let’s move onto the taxability of TDR/FSI. The following article covers taxability / value / rate / time etc. on supply of TDR by landlord. This is made applicable to all the new projects after 1st April, 2019 and also to the ongoing projects that have opted to pay tax at the new rate.

1. Who is a Developer-promoter?

A promoter is the one who constructs or converts a building into apartments or develops a plot for sale.

2. Who is a landowner- promoter?

A promoter who transfers the land or development rights or FSI to a developer-promoter for construction of apartments and receives constructed apartments against such transferred rights and sells such apartments to his buyers independently.

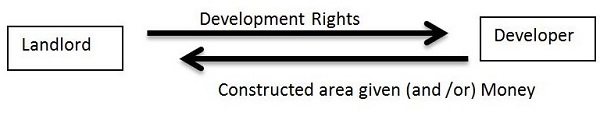

3. Next Question arises what is TDR?

As seen from above, landlord provides right to develop a land to a developer, for which he receives consideration which can be Constructed units or Money or both, these rights are called as TDR (Transferrable Development Right)

4. Are TDR taxable?

4. Are TDR taxable?

The service of supplying TDR is exempt from GST to the extent it leads into construction of residential apartments. But there is a condition that these residential apartments (units) should be sold before the date of completion certificate/first occupation. That is to say-

| Constructed Residential Units sold | |

| Before issue of completion certificate/ 1st Occupancy | After issue of completion certificate/ 1st Occupancy |

| TDR EXEMPT i.e. no tax to pay. | TDR TAXABLE i.e. tax is required to be paid. |

5. What if TDR is provided, for construction of Commercial Apartment?

The exemption to pay tax on supply of TDR is only to the extent where the output is residential unit. Where TDR service is used for construction of commercial units, the same will be taxable.

6. What needs to be taxed?

GST is payable for providing service of TDR, only to the extent of –

- Unsold residential units laying with the developer as inventory on the date of completion certificate.

- Commercial units (irrespective of whether completion certificate there or not).

- For example there is a project of 100 units (flat/shop etc.)

- 80 out of which are residential units (50 units sold before completion certificate, rest 30 units are in stock) and

- 20 units are commercial shops.

- Then proportionate TDR in relation to 20 commercial units and 30 residential units which are lying in stock shall be taxable.

7. What Value should be considered for taxability?

The Value of supply of service against consideration shall be deemed to be equal to the value charged from independent buyer, closest to the date of transfer of development rights.

8. At what rate tax will be paid?

GST will be payable at the rates applicable depending upon which type of unit is being sold –

a) RREP/REP, b) Affordable/Other residential or commercial (which we have already seen in the previous article)

9. Who will pay the taxes?

- The Service of – Supply of TDR is now covered under RCM. That is, the developer who receives the TDR would be liable to pay tax.

- Taxable portion of TDR would include service towards construction of both residential as well as commercial units.

10. When the tax needs to be paid?

- Tax needs to be paid at the end of the project i.e. the date of Completion certificate or its 1st occupancy (whichever is earlier)

11. What if both commercial as well as residential units are built?

As we have discussed, service of providing TDR is exempt where residential unit is provided before date of completion. In case where both commercial as well as residential units are being built then ,the amount of exemption can be worked out as-

12. What if landlord receives only monetary amount as consideration?

No GST would be payable, as the developer would not be providing any construction service to the landlord; rather he would be only making payment to landlord against rights received.

13. What about FSI and long term lease premium?

The above points in relation to rate/time/value etc. all shall apply to FSI and long term lease premium (for details refer to the notifications issued in this relation).

This article is for guidance only, not intended to be substituted for detailed research or the exercise of professional judgment.

In notification no. 3/2019, it been defined the landowner promoter to be a registered person. So is that so that all the landowner should be registered?