Page Contents

A. FAQs on View Submitted Application

Q.1 Where can I access my submitted applications?

Ans: You can login to the GST Portal and navigate to Services > User Services > View My Submissions to access your submitted applications.

Q.2 What is the difference between a saved application and a submitted application?

Ans: A saved application is an incomplete application and it can be accessed, edited, or deleted until you submit it to the GST System or until its date of expiry, whichever is earlier.

A submitted application is an application that has been submitted on the GST Portal by the taxpayer by clicking the Submit button. This application can neither be edited nor deleted by the taxpayer.

You can, however, access the read only version of the submitted application in PDF. You can also track the status of the submitted application using the ARN received upon the application’s successful submission.

B. Manual on View Submitted Application

How can I view my submitted applications?

To view the submitted applications, perform the following steps:

1. Access the https://www.gst.gov.in/ URL. The GST Home page is displayed.

2. Click the REGISTER NOW link.

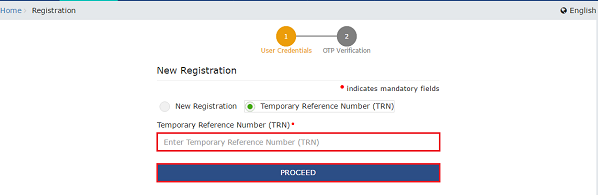

3. Select the Temporary Reference Number (TRN) option.

4. In the Temporary Reference Number (TRN) field, enter the TRN received.

5. Click the PROCEED button.

6. In the Mobile/Email OTP field, enter the OTP you received on your mobile number and email address. OTP is valid only for 10 minutes.

Note:

- OTP sent to mobile number and email address are same.

- In case OTP is invalid, try again by clicking the Click here to resend the OTP link. You will receive the OTP on your registered mobile number or email ID again. Enter the newly received OTP again.

7. Click the PROCEED button.

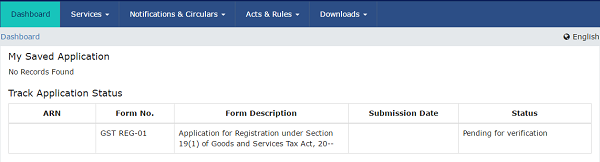

8. The Dashboard is displayed. You can check the current status of the submitted application under Status column.

Alternatively, you can click the Services > User Services > View My Submissions command to view your submissions.

(Republished with amendments)

****

Disclaimer: The contents of this article are for information purposes only and does not constitute an advice or a legal opinion and are personal views of the author. It is based upon relevant law and/or facts available at that point of time and prepared with due accuracy & reliability. Readers are requested to check and refer relevant provisions of statute, latest judicial pronouncements, circulars, clarifications etc before acting on the basis of the above write up. The possibility of other views on the subject matter cannot be ruled out. By the use of the said information, you agree that Author / TaxGuru is not responsible or liable in any manner for the authenticity, accuracy, completeness, errors or any kind of omissions in this piece of information for any action taken thereof. This is not any kind of advertisement or solicitation of work by a professional.