The GST Council, in its 39th meeting held on 14th March 2020, had recommended to adopt and implement linking of GSTR-1 & GSTR-2A with GSTR-3B. As we know GSTR-2A is a dynamic return, so to solve this issue, GSTR-2B has been introduced.

All About GSTR-2B

The GST Council, in its 39th meeting held on 14th March 2020, had recommended to adopt and implement linking of GSTR-1 & GSTR-2A with GSTR-3B. As we know GSTR-2A is a dynamic return, so to solve this issue, GSTR-2B has been introduced.

1) What is GSTR-2B?

Ans: – It is a static form of GSTR-2A, which is auto-drafted Input Tax Credit (ITC) statement generated for every recipient, on the basis of the information furnished by their suppliers, in their respective Form GSTR-1 & 5 and Form GSTR-6 filed by ISD. It will help in reduction in time taken for preparing return, minimising errors, assist reconciliation & simplify compliance relating to filing of return.

2) Which documents/details will GSTR-2B contain?

Ans: – i) It will contain all documents filed by suppliers/ISD in their Form GSTR-1, 5 & 6 between 12th day of preceding month to 11th day of current month. Thus, statement generated on 12th of August will contain data from 12th July 2020 to 11th August 2020.

Thus, it is very important to note that, data should not be directly picked from GSTR-2B and filed in GSTR-3B, date of invoice should be carefully checked so that credit is not taken twice or has been missed. Cut of dates advisory is given in GSTR-2B

E.g.: – Following invoices are filed by supplier in GSTR-1/5 for the July 2020.

| Date of Invoice | GSTR-1/5 filed on | Will reflect in GSTR-2B of Month | To be taken in GSTR-3B of Month |

| 14/07/2020 | 11/08/2020 | July 2020 (generated on 12th Aug ’20) | July 2020 |

| 14/07/2020 | 13/08/2020 | Aug 2020 (generated on 12th Sept ’20) | Can be taken in July 2020, subject to 10% criteria. |

| 15/03/2020 | 11/08/2020 | July 2020 (generated on 12th Aug ’20) | Verify if credit has been taken in GSTR-3B of March’20 |

ii) It also contains information on imports of goods from the ICEGATE system including data on imports from Special Economic Zones Units / Developers. (This will be made available in GSTR-2B from 12th September 2020 onwards)

Reverse charge credit on import of services is not part of this statement and need to be entered by taxpayers in Table 4(A) (2) of FORM GSTR-3B.

Email / SMS to taxpayer will be sent informing them about generation of GSTR-2B.

3) What are the steps to view/ download GSTR-2B?

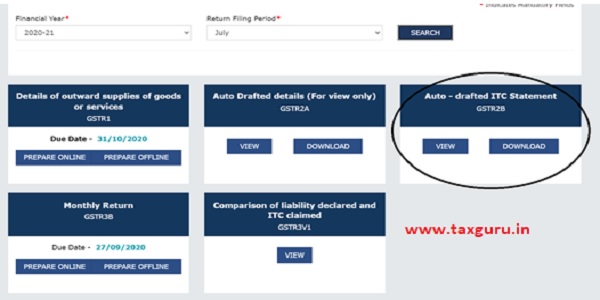

Ans: – Taxpayers can access their GSTR-2B through: Login to GST Portal > Returns Dashboard > Select Return period (July 2020) > GSTR-2B.

It can also be downloaded- Just click on the download option. If data has more than 1000 records then its cannot be viewed, it has to be downloaded

Excel file can be immediately downloaded, unlike GSTR-2A where in file is generated and excel is available after 20 minutes.

4) What are the contents of GSTR-2B?

Ans: – i) Once you click on the view option, you will be able to view Summary of ITC available/ Not Available

This summary can be expanded to view additional details like B2B invoices, debit notes, amendment, ISD Invoices, amendments, credit notes etc.

Summary can be downloaded in PDF as well as in excel.

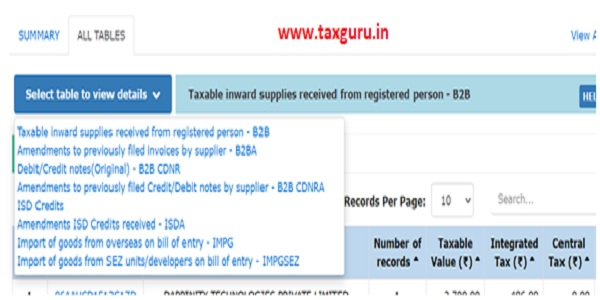

ii) If we click on all tables, we can view details on the basis of which summary is made- Invoice wise as well as supplier wise.

Invoice wise details-

Supplier wise details-

Supplier wise details-

Other functionalities are: –

1) Option to view table wise details under all tables option

2) Filter option in document details tab

3) Next to the filter, in the search option we can also enter a particular invoice number to search.

Thanks Divya for providing such crucial information to users like s , I got clarity from your article .

thank you

whether input to be taken as per 2a or 2b

Well explained

on what basis can i claim Input Tax Credit as per GST2A or GSTRB