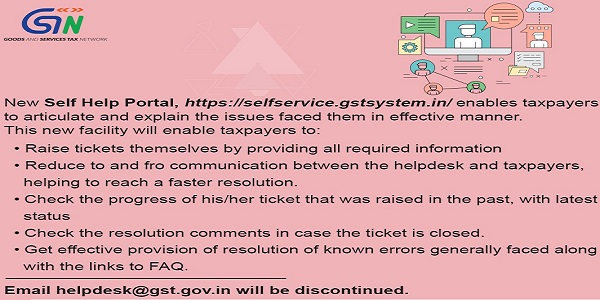

To enable taxpayers to express their issues and problems related to GST System and its services, GSTN today launches a Self Help Portal (https://selfservice.gstsystem.in/) as a single platform where tax payer can log tickets for any issues or concerns and for quick resolution. New Self Help Portal enables taxpayers to articulate and explain the issues faced them in effective manner.

Portal is live from today i.e 22 Jan 2018.

The new system is user friendly and the tax payer can articulate and explain the issues faced them in effective manner. This new facility will have the following advantages:

- Enable the raising of tickets by tax payers themselves, providing all required information and reducing to and fro communication between helpdesk and tax payers, helping to reach a faster resolution.

- Enable the tax payer to check the progress of his ticket that raised in the past, with latest status.

- Check the progress of his/her ticket that was raised in the past, with latest status

- Check the resolution comments in case the ticket is closed.

- Effective functionality of providing resolution of known errors generally faced along with the links to FAQ (based on the issue that being faced).

- Better analysis of data on issues faced by taxpayers and other stakeholders using GST System

FAQs are embedded in self services portal itself for further assistance.

Please note: GST helpdesk mailbox: helpdesk@gst.gov.in will be discontinued. Please reach to helpdesk @ (0120-4888999) in case of any queries.

(republished with Amendments)

I have already filed my GSTR 3b and GSTR 1 for the month of Feb & March’2018 previous financial year. But When I was filed my GSTR 3b for the month of Feb’18 tax liability not adjusted with my electronic cash ledger due to technical problem mistakenly Nil returned filed. But sir I field my GSTR1 correctly and paid my tax liability on due date. That time I think my paid tax adjust automatically but till date it was not adjust and balance shown cash ledger. so Sir what i do

sir I AM SHIPPING GOOD FROM HOWRAH TO HUBLI MY OFFICE IS IN BANGALORE WHAT WE HAVE TO MENTION IN E WAY BILL, AS I DO NOT WANT TO SHARE MY BUYER DETAILS TO MY SELLER.

GST TAX PAID CHALLAN NOT SHOWN IN CASH LEDGER BALANCE AND NOT UTILIZE CASH.

DEC QUARTER 2017

CPIN:18011900176498

GSTIN-19AANPZ4214C1ZI

Email Id : smsalescor@rediffmail.com

GST No: 33AATPM2400R1ZC

From July 1st to 30th September We Were in composition scheme. Then automatically it was changed to GST3B regular system. We contacted to sales tax office they informed to be pay the tax amount as per GST. So, we have paid Rs. 27,798 as GST tax. September 2017. Recepit No: 17113300077254, Dt: 14/11/2017.

Now from Oct 1st to till date we are changed in regular GST scheme. So why we have to pay composition tax. But as per GST web site. Instruction we have to pay composition tax. So, we have paid composition tax of Rs. 10,892. So, we request kindly refund the GST amount Rs. 27,798 when wad paid by us earlier.

Sir, Mistakenly invoice for the month of September 2017 booked in the month of August 2017 GSTR-1 Return

& invoice for the month of October 2017 booked in the month of September 2017 GSTR-1 Return.

Return for the both month filed with wrong invoice due to this we fails to submit October 2017 GSTR-1 return.

Invoice amended for the month of August 2017 and September 2017 in the month of Oct 2017 Amended Sheet No. 9.

GSTR-1 filed for the month of July, August, September, November & December 2017. Please suggest how to rectify the error.

I HAVE SUBMITTED THE TRANS -1 BUT NOT FILED .SO I COULD NOT TO BE FILE THE GSTR-3B FOR THE MONTH OF DEC’2017 DUE TO MESSAGE SHOWN PLEASE FILE THE TRANS -1 WHEN I GO TO FILE TRANS-1 THE MESSAGE SHOWN THE DATE IS OVER OF TRANS-1, PL HELP TO RESOLVE THE SAME

I HAVE SUBMITTED THE TRANS -1 BUT NOT FILED .SO I COULD NOT TO BE FILE THE GSTR-3B FOR THE MONTH OF DEC’2017 DUE TO MESSAGE SHOWN PLEASE FILE THE TRANS -1 WHEN I GO TO FILE TRANS-1 THE MESSAGE SHOWN THE DATE IS OVER OF TRANS-1

Sir I have submitted return with less refund

if i want show rmaining refund what can i do

Sir my gst for cancle

ONLY FOR GST NOTIFICATIONS

FOR MY MAIL ID PAR >