Introduction: This article discusses in detail about GST on Travel Agents & Tour Operators & its related aspects.

Air Travel Agent

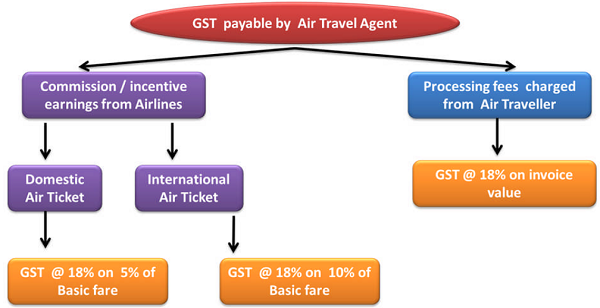

An Air Travel Agent earns two types of income:

- commission from the Airlines for booking of air tickets;

- income in the form of processing fees etc. from the client for whom he books the tickets.

So the Air Travel Agent shall be raising below 2 types of invoices containing the details of name, address, GST Registration Numbers of the parties to whom the invoice is being issued and details about Place of Supply.:

- On the Airlines for commission for selling its Air tickets;

- On the Air traveler for its processing fees/ service charges / facilitation charges.

As per rule 32(3) of CGST Rules, the value of supply of services in relation to booking of tickets for travel by air provided by an air travel agent, shall be deemed to be an amount calculated at the rate of:

- 5%of the basic fare in the case of domestic bookings, and

- 10%of the basic fare in the case of international bookings

Explanation – For the purposes of this sub-rule, the expression “basic fare” means that part of the air fare on which commission is normally paid to the air travel agent by the airline.

So, GST is payable is as par below chart:

Place of supply for an Air Travel Agent(ATA) for booking tickets to Pax

When an Air Travel Agent provides services to a person who is:

1. Located in India and the person is registered under the GST law then, the place of Supply shall be the location of service receiver;

2. Located in India but not registered under the GST Law but his address is available on records then the place of Supply shall be the location of the service receiver;

3. Located in India but not registered under the GST Law and his address is not available on records then the place of Supply shall be the location of the service provider;

4. If in case of the Air Travel Agent who is located in India but the Origin and Location of Airlines is not from India and the destination as well as location of passenger is not in India.

Then in the given case neither the Airlines nor the passenger will be registered under GST and nor will their address be available from the records, hence in the given case the place of supply shall be the location of service provider i.e. the location of the Air Travel Agent which is in India and hence this transaction would be liable to Tax.

Examples for place of supply in case of an Air travel Agent where ATA receives processing fees / Service charges from the Passenger (Pax):

| Location of Air travel Agent | Location of the recipient (Pax) | Place of supply for the Air Travel Agent | Tax to be charged by the Air Travel Agent |

| Delhi | Delhi | Delhi | CGST/SGST |

| Gurgaon (Haryana) | Delhi | Delhi | IGST |

Examples for place of supply in case of an Air travel Agent where ATA receives Commission from the Airlines:

| Location of Air travel Agent | Location Of the Airlines | Place of supply for the Air Travel Agent | Tax to be charged by the Air Travel Agent |

| Delhi | Delhi | Delhi | CGST/SGST |

| Delhi | Gurgaon ( Haryana) | Gurgaon ( Haryana) | IGST |

| Delhi | London (UK) | Delhi | CGST/SGST |

Segment Payouts / commission/ incentives from CRS/GDS

Air Travel Agent also earns Segment Payouts / commission/ incentives from CRS/GDS like Ameadus, Worldspan, Galileo, Abacus for using their software for making booking in Airlines reservations systems.

Place of supply of services.

- In case the services are provided by the Air Travel Agents to Indian software companies, then the place of supply of services shall be the location of services receiver i.e. place of registration of Indian software company.

- In case the services are provided by the Air Travel Agents to foreign software companies, then the agent would fall within the definition of “intermediary” AND the place of supply of services shall be the location of services provider i.e. place of Air Travel Agent.

VISA AND PASSPORT ASSISTANCE

The visa processing charges charged by visa statutory authorities i.e. the consulates/embassies will be exempt from the payment of GST.

Visa/passport processing charges charged only by the statutory authorities is exempt from tax.

Visa/passports are done through Visa Facilitation Centers (VFCs) authorized by embassies / Visa Handling Agents then the same shall be liable to tax.

However, when the ATA provides these services to their client after adding further fees by whatever name called he shall be liable to pay tax on them as well and he can take Input Tax Credit of the tax paid to the VFC. GST will be applicable @18% for this service.

DOMESTIC AND INTERNATIONAL MEDICLAIM POLICIES AND TRAVEL INSURANCE BY TRAVEL AGENTS

Travel Agents issues mediclaim policies and travel insurance for clients through various insurance service providers and gets commission on cut and pay basis or at the end of the month (for overseas policies)

The Travel Agents must be registered Insurance agent to issue mediclaim policies and travel insurance in India.

The agents are required to register with IRDA as per Insurance Act, 1938.

Place of supply for an Air Travel Agent(ATA) for issuing travel/ mediclaim insurance policies to Pax shall be as listed below.

When an Air Travel Agent provides services to a person who is:

1. Located in India and is registered under the GST law then, the place of Supply shall be the location of service receiver;

2. Located in India but not registered under the GST Law but his address is available on records then the place of Supply shall be the location of the service receiver;

3. Located in India but not registered under the GST Law and his address is not available on records then the place of Supply shall be the location of the service provider;

4. If in case of the Air Travel Agent who is located in India but the mediclaim and travel insurance services are provided to a person who is not located in India, then the place of supply shall be the location of service provider i.e. the location of the Air Travel Agent which is in India and hence this transaction would be liable to Tax.

GST will be applicable @18% for this service

DOMESTIC / INTERNATIONAL HOTEL BOOKINGS

- In case of hotel bookings the tour operator is acting as an intermediary for the purpose of booking tours for his

- Hence in case it is domestic hotel booking then the place of supply shall be as per the general rule i.e. location of Hotel.

- In case it is international hotel booking then the place of supply shall be location of agent.

Examples for place of supply in case of an Agent where the agent receives Commission from the hotel/Cruise:

| Location of Travel Agent

|

Location of the Hotel / Cruise | Place of supply for the Travel Agent | Tax to be charged by the Travel Agent |

| Delhi | Delhi | Delhi | CGST/SGST |

| Delhi | Gurgaon ( Haryana) | Gurgaon ( Haryana) | IGST |

| Delhi | London (UK) | Delhi | CGST/SGST |

Place of Supply for an agent who books hotel/Cruise for the client and receives Service charges/ Markup from the client and hotel/Cruise directly raise invoice to the client, when service recipient is:

1. Located in India and is registered under the GST law then, the place of Supply shall be the location of service receiver;

2. Located in India but not registered under the GST Law but his address is available on records then the place of Supply shall be the location of the service receiver;

3. Located in India but not registered under the GST Law and his address is not available on records then the place of Supply shall be the location of the service provider;

4. where the location of Tour operator is in India and the location of the recipient is out of India, the place of supply in this case shall be the:

- Location where the services are actually performed

Examples for place of supply in case of an Agent where the agent receives Service charges/Markup from the Pax :

| Location of Agent | Location of the Pax (address for Billing to pax) | Location of the Hotel/ Cruise | Place of supply for the Agent | Tax to by charged by the Agent | ||||

| Maharashtra | Maharashtra | Gujarat | Maharashtra | CGST/SGST | ||||

| Maharashtra | Delhi | Gujarat | Delhi | IGST | ||||

| Maharashtra | USA | Gujarat | Gujarat (location where service is actually performed) | IGST | ||||

| Maharashtra | Delhi | USA | Delhi | IGST | ||||

GST will be applicable @5% with no ITC

Inbound /outbound package tours provided by the tour operator

Inbound tour operators

Tours organized by the Tour Operator, within India for the tourist coming from abroad is generally known as inbound tours.

There may be two types of contracts entered into by the tour operator:

- the tour operator receives commission i.e. it has booked the tour on commission basis or

- on principal basis i.e. on its own account has done the various bookings and then raises bill on the client.

If the tour is on principal basis then the place of supply of service shall be the location of performance of service i.e. in India and Taxable @ 5% without ITC.

However if the tour is on commission basis then the tour operator will be acting as an intermediary and the place of supply shall be the location of service provider i.e. in India and hence the services will now become taxable and Taxable @18%.

Outbound tour operators

Tours organized by the Tour Operator, outside India, for the tourist going abroad is generally known as outbound tour.

There may be two types of contracts entered into by the tour operator:

- the tour operator receives commission i.e. it has booked the tour on commission basis or

- on principal basis i.e. on its own account has done the various bookings and then raises bill on the client.

The Place of supply in case where the tour operator receives commission from another tour operator situated outside India, shall be the place of the tour operator i.e. India.

The place of supply in case of Principal to Principal outbound tour operator services is, when service recipient is:

1. Located in India and is registered under the GST law then, the place of Supply shall be the location of service receiver;

2. Located in India but not registered under the GST Law but his address is available on records then the place of Supply shall be the location of the service receiver;

3. Located in India but not registered under the GST Law and his address is not available on records then the place of Supply shall be the location of the service provider;

Car rental

The place of supply where an agent is booking a car on hire (with or without driver) to be further provided to any Pax or any Agent for Service charges/Markup, shall be determined as below.

When an Travel Agent provides services to a person who is:

1. Located in India and is registered under the GST law then, the place of Supply shall be the location of service receiver;

2. Located in India but not registered under the GST Law but his address is available on records then the place of Supply shall be the location of the service receiver;

3. Located in India but not registered under the GST Law and his address is not available on records then the place of Supply shall be the location of the service provider;

4. If in case of the Air Travel Agent who is located in India but the mediclaim and travel insurance services are provided to a person who is not located in India, then the place of supply shall be the location of service provider i.e. the location of the Air Travel Agent which is in India and hence this transaction would be liable to Tax.

Examples for place of supply in case of an Agent where the agent books a car for a pax or for an agent on Service charge basis :

| Location of Agent | Location of the Pax/ Agent | Location of the place where car is to be used | Place of supply for the Agent | Tax to be charged by the Agent |

| Maharashtra | Maharashtra | Gujarat | Maharashtra | CGST/SGST |

| Maharashtra | Delhi | Gujarat | Delhi | IGST |

| Maharashtra | USA (Foreign person) | Gujarat | Maharashtra | CGST/SGST |

GST applicable for renting of motor vehicle shall be @ 5% with no ITC or 12% with ITC.

Foreign Railway booking:

If an agent is receiving commission from a foreign railway company which has its registered office out of India, the place of supply shall be determined in accordance with Section 13(8)(c), i.e. Location of supplier of Service (INTERMEDIARY) i.e. the agent.

If an agent is receiving commission from a foreign railway company which has its registered office in India, the place of supply shall be determined in accordance with Section 12(2), i.e. when an Travel Agent provides services to a person who is:

- Located in India and is registered under the GST law then, the place of Supply shall be the location of service receiver;

- Located in India but not registered under the GST Law but his address is available on records then the place of Supply shall be the location of the service receiver;

- Located in India but not registered under the GST Law and his address is not available on records then the place of Supply shall be the location of the service provider.

Examples for place of supply in case of an Agent where the agent receives commission from the foreign railway company:

| Location of Agent | Location of the Foreign Railway Company | Place of supply for the Agent | x to be charged by the Agent |

| Maharashtra | Maharashtra | Maharashtra | CGST/SGST |

| Maharashtra | Delhi | Delhi | IGST |

| Maharashtra | USA | Maharashtra | CGST/SGST |

If the agent is receiving Service charges from the Pax, the place of supply shall be determined in accordance with Section 12(2), i.e. when an Travel Agent provides services to a person who is:

- Located in India and is registered under the GST law then, the place of Supply shall be the location of service receiver;

- Located in India but not registered under the GST Law but his address is available on records then the place of Supply shall be the location of the service receiver;

- Located in India but not registered under the GST Law and his address is not available on records then the place of Supply shall be the location of the service provider.

Examples for place of supply in case of an Agent where the agent receives Service charges from the Pax:

| Location of Agent | Location of the Pax | Place of supply for the Agent | Tax to be charged by the Agent |

| Maharashtra | Maharashtra | Maharashtra | CGST/SGST |

| Maharashtra | Delhi | Delhi | IGST |

GST for booking for foreign railway is @18%

Foreign Exchange:

The following options for determining value of supply for a person providing service in relation to purchase or sale of foreign currency and money changing:

Option A

| When any currency is exchanged from or to Indian Rupees (INR) | Value shall be difference between the Buying or selling rate and RBI reference rate, multiplied by total units of currency | |

| If in relation to the above case, RBI reference rate is not available | Value shall be 1% of gross amount of INR provided or received by the person changing the money | |

| If neither of the currencies exchanged in INR | Value shall be 1% of lesser of two amounts by converting any of the two currencies into INR | |

Option B

| Gross Amount of Currency Exchanged | Value to be considered for Supply of Service |

| Upto Rs. 1,00,000 | 1% of Gross amount of currency Exchanged, Subject to Minimum amount of Rs. 250. |

| Exceeding Rs. 1,00,000 to Rs.

10,00,000 |

Rs. 1,000 + 0.5% of Gross amount of currency Exchanged |

| Exceeding Rs. 10,00,000 | Rs. 5,000 + 0.1% of Gross amount of currency Exchanged, Subject to Maximum amount of Rs. 60,000. |

List of Travel related services along with HSN code & rates of taxes

| HSN CODE | Particulars of Services | Rate of Tax |

| 9964 | Transport of passengers, with or without accompanied belongings, by – (a) air, embarking from or terminating in an airport located in the state of Arunachal Pradesh, Assam, Manipur, Meghalaya, Mizoram, Nagaland, Sikkim, or Tripura or at Bagdogra located in West Bengal; (b) non-airconditioned contract carriage other than radio taxi, for transportation of passengers, excluding tourism, conducted tour, charter or hire; or (c) stage carriage other than air-conditioned stage carriage. | Nil |

| 9964 | Services provided to the Central Government, by way of transport of passengers with or without accompanied belongings, by air, embarking from or terminating at a regional connectivity scheme airport, against consideration in the form of viability gap funding: Provided that nothing contained in this entry shall apply on or after the expiry of a period of one year from the date of commencement of operations of the regional connectivity scheme airport as notified by the Ministry of Civil Aviation. | Nil |

| 9964 | Service of transportation of passengers, with or without accompanied belongings, by— (a) railways in a class other than— (i) first class; or (ii) an air-conditioned coach; (b) metro, monorail or tramway; (c) inland waterways; (d) public transport, other than predominantly for tourism purpose, in a vessel between places located in India; and (e) metered cabs or auto rickshaws (including e-rickshaws). | Nil |

| 9964 | Transport of passengers by rail in first class or air conditioned coaches | 5 – with ITC of input services |

| 9964 | Transport of passengers, by- (a) air conditioned contract carriage other than motorcab; (b) air conditioned stage carriage; (c) radio taxi | 5 – No ITC & 12 with ITC |

| 9964 | Transport of passengers by air in economy class | 5 – with ITC of input services |

| 9964 | Transport of passengers, by air, embarking from or terminating in a Regional Connectivity Scheme Airport | 5 – with ITC of input services |

| 9964 | Transport of passengers by air in other than economy class. | 12 |

| 996411 | Local land transport services of passengers by railways, metro, monorail, bus, tramway, autos, three wheelers, scooters and other motor vehicles | 18 |

| 996412 | Taxi services including radio taxi & other similar services; | 18 |

| 996413 | Non-scheduled local bus and coach charter services | 18 |

| 996414 | Other land transportation services of passengers. | 18 |

| 996415 | Local water transport services of passengers by ferries, cruises etc | 18 |

| 996416 | Sightseeing transportation services by rail, land, water & air | 18 |

| 996419 | Other local transportation services of passengers n.e.c. | 18 |

| 996421 | Long-distance transport services of passengers through Rail network by Railways, Metro etc | 18 |

| 996422 | Long-distance transport services of passengers through Road by Bus, Car, non-scheduled long distance bus and coach services, stage carriage etc | 18 |

| 996423 | Taxi services including radio taxi & other similar services | 18 |

| 996424 | Coastal and transoceanic (overseas) water transport services of passengers by Ferries, Cruise Ships etc | 18 |

| 996425 | Domestic/International Scheduled Air transport services of passengers | 18 |

| 996426 | Domestic/international non-scheduled air transport services of Passengers | 18 |

| 996427 | Space transport services of passengers | 18 |

| 996429 | Other long-distance transportation services of passengers n.e.c. | 18 |

The author is a practising CA and is registered Insolvency Professional. He can be reached at cavinodchaurasia@gmail.com , Mob. +91 9953587496.

Please provide me ITC part as tour operator. If I get hotel bill from vendor in Slkim for a package tour conducted by me (WB) , will I get ITC in my place WB (tour operator)

मेरा क्लाइंट टूर ऑपरेटर है क्या वोह किसी महीने में १८% का बिल काट कर इनपुट लेता है और फिर वह 5% पर काट कर टैक्स जमा करता है तो कोई प्रॉब्लम तो नहीं होगा

i have passenger Travel service n my gst registration in Maharashtra i gave service to passenger in Maharashtra to Maharashtra but his gst registration in delhi which gst applicable (sgst cgst or igst)

Sir

I have started a travel agency. Proprietary concern. Please advice is GST registration is mandatory in case foreigners book a tour package online and make payment.

Thanks in advance

Anu

Kindly provide entries for Foreign currency sold or purchase from clients with GST

CAN TRAVEL AGENT CAN CLAIM GST INPUT ON HOTEL BOOKING. FOR EXAMPLE IF I AM IN DELHI AND BOOK HOTEL FOR MY CLIENTS KEEPING MARKUP OR GETTING COMMISSION OR GETTING BOOKING FEES WHETHER HOTEL IS IN DELHI AND CLIENT LOCATION CAN BE DELHI OR MUMBAI

i have working with travel agent i want to know we i book ticket which gst no i will put in airline agent [my co.]or end corporate user ? please advice me

If a travel agent books all hotels, car/bus/train/flight and activities on Principal basis but still earns certain percentage of TAC (travel agent commission). In such cases what shall be the GST implications? Kindly guide

Sir

My client is working as a tour and travel agent and booking ticket/hotel through Agent-Make my trip etc for passanger. Make up trip issued invoice showing breakup of all expenses incurred by him for booking to tickets etc after that charged service charges with gst .kindly guide me how we raise the bill to the passanger and which amount I show in gst return.

I have travel business. my sale and purchase were the same 22 lakhs in last financial year. i am not Gst registered. is there any problem for me?

I have GST no. for my Travel Agency and I have not started working yet

Do i still need to pay any GST or any monthly charges

Suppose I do not charge Service Charge from Customer while booking package. Service Charge is that amount on which GST will be charged. Will that Invoice be required to be uploaded in GSTR-1? Otherwise Turnover will not match.

What is the procedure of Commission received from airlines in GST

How much is the limit for tour operator

is there any compulsion to take GST no if turn over less 20 L

I, earned commission from Cleartrip Private Limited for booking of Air ticket. Is GST charged on commission? Plz. help.

My client has purchased a tour package from dubai supplier and invoice received from him does not contain any gst, obviously. This package will be further sold by my client afer adding his profit. Is he liable to pay any GST on the Package received from dubai

Sir we booked luxury coach bus traveled from Chandrapur (Maharashtra) to Mumbai (Maharashtra)

what will be Gst ? 4 day tour without accommodation. is any circular plz send me.

Dear Sir,

We are operating our own cruises in the river Ganges in West Bengal and are registered under GST in WB only. We are into the inbound tour for the foreign client companies. We have standard tour itineraries & have written agreements with our foreign clients’ companies for their booked departures. We bill to them directly for their guests for the scheduled cruising, shore excursions etc. We are getting foreign remittance directly into our bank account in India from our foreign client. Being tour operator 5% GST is applicable. My question is, Should we charge IGST or CGST+SGST on our billing to our foreign clients.

Moreover, onboard foreigner guest also spends money on the ship for the paid services like the spa (18% GST), laundry (18% GST), paid alcohol (No GST), shopping at the ship boutique (applicable GST rates) etc. My question is, Should we charge IGST or CGST+SGST on our billing to our onboard foreign guests.

Sir

If an agent is merely acting as an intermediary i.e he is paying 8 k to a tour operator and he is collecting 10 k from customer for the purpose of booking of accomodation then what will be the implication

Sir most of the people say that place of Services by Air Travel Agent is the place where the passenger embarks the airplane.

Which view is correct or there is some amendment in the law in this respect as I sent the problem to CBEC.

Sir,Does the agent have to compulsorily register irrespective of turnover under section 24 ? .(agent who performs services on behalf of another )