HISTORY

In the year of 2000 NDA Government set up a committee to design a model for GST, headed by ASIM DASGUPTA, (finance minister of West Bengal).

Arun Jaitly (Finance Minister) introduced the Constitution (One Hundred and Twenty second Amendment) Bill, 2014, in Lok Sabha on 19 December, 2014 that was passed by House in 6 May, 2015. After passing the Bill by Lok Sabha, Government attempted to move the Bill for consideration in the Rajya Sabha on 11 May, 2015, but member of opposition repeatedly stalled the Proceeding of the House so, still Bill hasn’t passed by the Rajya Sabha.

MEANING

“GST” stand for “Goods and Service Tax” is a comprehensive indirect tax levy on Manufacturer, Sale and consumption of goods as well as services at the National Level by the Central Government.

WHY WE NEED FOR GST

Important concept for GST is to eliminate “cascading effect of taxes” (tax on taxes).

We can understand this by a simple Example;

1. (Local Sales Tax)

X sells its goods to Y of Rs 110 after charging of tax @10% (Rs.100 cost + Rs 10 tax). Y further Sells its goods to Z after charging of Tax of Rs 121 (110 +110@10%). When B calculates his tax liability he also includes the sales tax paid on previous purchases which is how becomes tax on tax.

2. (Value Added Tax)

It is based on the value of the goods, added by the transferor. It is the tax in relation to the difference of the value added by the transferor and not just a profit. In this system every next dealer take credit of the tax paid at earlier stage against his tax liability.

But, in VAT system the credit of input is available against output. However the credit of VAT is not available against excise and credit of excise is not available against VAT, whereas VAT is computed on total value that also includes excise duty. So we can say, in VAT systems tax imposes upon taxes.

Systems of Indirect Taxation in India

As per above, some tax goes to Central Government and some goes to State Government that’s reason why cross utilization of credit was not allowed. So it’s not a valid reason to justify the cascading effect of taxes. So, GST is introduced for combat of this Problem.

Former Finance Minister, Dr. Pranav Mukharjee comes with an Idea of Dual GST Model, means administered by both Central Government and State Government.

ADVANTAGES AND DISADVANTAGES OF GST

| ADVANTAGE |

DISADVANTAGE |

| Its Remove Multiple Taxation means tax upon tax | Increase the Rate of Taxes Suddenly |

| Minimized the Tax Evasion |

Tax on retail will be Double |

| Create a Single Market |

Imported Goods would be Tax at higher Rate |

| Increase in Government Revenue |

|

| Reduction in Price |

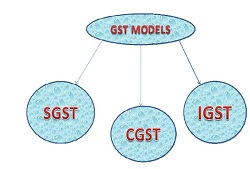

GST MODELS

SGST- State GST collected by the State Government

SGST- State GST collected by the State Government

CGST- Central GST collected by the central..Government

IGST- Integrated GST collected by central Government.

HOW GST WORKS IN INDIA

If any transaction (sale) has been made within the state,

Earlier- Value Added Tax, Central Excise or Service Tax Imposed

New Systems – SGST and CGST will be imposed

If any transaction (sale) has been made outside the state

Earlier- Central Sales Tax, Central Excise or Service Tax Imposed

New Systems- IGST will be imposed

IF TRANSACTION (SALE) MADE WITH IN SAME STATE

If goods are moving from Patna to Gaya, its called sale within the state CGST and SGST will be imposed, we can understand with below chart…..

In above Chart Ram (Patna) sells his goods to Shyam (Gaya), it is Intra State Sales so CGST and SGST will be imposed so, tax on Input i.e Rs 10 will be go to both CG and SG.

Further Shyam (Gaya) sells goods to Mohan (Ara) it again intra state Sale then CGST and SGST will be imposed.

Since input tax credit comes from the same Government to whom the output tax Goes.

IF TRANSACTION (SALE) MADE WITHIN STATE AND RESALE IN OTHER STATE

Here goods moving from Patna to Gaya so, its intra State Sales then CGST and SGST will be Imposed further goods moving from Gaya to Delhi, its Inter State Sales then IGST will be imposed

As per above chart dealer claimed both input credit of Rs 20 from Central Government whereas amount of SGST never went to the central Government so, in this situation state Government transfer the credit amount of Rs 10 to Central Government…….

IF TRANSACTION BETWEEN TWO STATE AND AGAIN RESALE IN SAME STATE

In this situation goods are moving from Delhi to Bihar so, its Inter State sale IGST will be Imposed, further goods moving from Patna to Ara, its Intra State Sale so, CGST and SGST will be imposed.

As per above chart, goods are moving one state to another state (Inter state sale) IGST has been imposed and amount is going to Central Government but , Input Tax credit has been taken from the state Government and Central government will Compensates to State Government of Rs. 10.

(Prepared by Sanoj Kumar (CS Trainee)- E-maid id-cssanoj.icsi@gmail.com)

Good , Keep it up .

Its a long journey of GST ?