Recommendations made by the GST Council in the 23rd meeting at Guwahati on 10th November, 2017

The GST Council, in its 23rd meeting held at Guwahati on 10th November 2017, has recommended the following facilitative measures for taxpayers:

Return Filing

a) The return filing process is to be further simplified in the following manner:

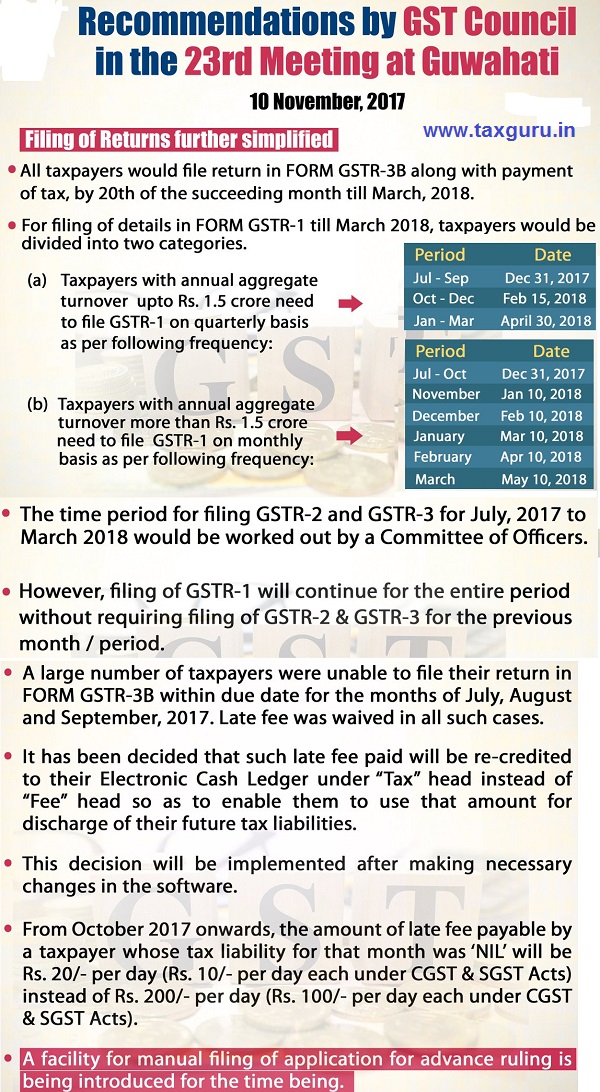

i. All taxpayers would file return in FORM GSTR-3B along with payment of tax by 20th of the succeeding month till March, 2018.

ii. For filing of details in FORM GSTR-1 till March 2018, taxpayers would be divided into two categories. Details of these two categories along with the last date of filing GSTR 1 are as follows:

(a) Taxpayers with annual aggregate turnover upto Rs. 1.5 crore need to file GSTR-1 on quarterly basis as per following frequency:

| Period | Dates |

| Jul- Sep | 31st Dec 2017 |

| Oct- Dec | 15th Feb 2018 |

| Jan- Mar | 30th April 2018 |

(b) Taxpayers with annual aggregate turnover more than Rs. 1.5 crore need to file GSTR-1 on monthly basis as per following frequency:

| Period | Dates |

| Jul- Oct | 31st Dec 2017 |

| Nov | 10th Jan 2018 |

| Dec | 10th Feb 2018 |

| Jan | 10th Mar 2018 |

| Feb | 10th Apr 2018 |

| Mar | 10th May 2018 |

iii. The time period for filing GSTR-2 and GSTR-3 for the months of July, 2017 to March 2018 would be worked out by a Committee of Officers. However, filing of GSTR-1 will continue for the entire period without requiring filing of GSTR-2 & GSTR-3 for the previous month / period.

b) A large number of taxpayers were unable to file their return in FORM GSTR-3B within due date for the months of July, August and September, 2017. Late fee was waived in all such cases. It has been decided that where such late fee was paid, it will be re-credited to their Electronic Cash Ledger under “Tax” head instead of “Fee” head so as to enable them to use that amount for discharge of their future tax liabilities. The software changes for this would be made and thereafter this decision will be implemented.

c) For subsequent months, i.e. October 2017 on wards, the amount of late fee payable by a taxpayer whose tax liability for that month was ‘NIL’ will be Rs. 20/- per day (Rs. 10/- per day each under CGST & SGST Acts) instead of Rs. 200/- per day (Rs. 100/- per day each under CGST & SGST Acts).

Manual Filing

d) A facility for manual filing of application for advance ruling is being introduced for the time being.

Further benefits for service providers

e) Exports of services to Nepal and Bhutan have already been exempted from GST. It has now been decided that such exporters will also be eligible for claiming Input Tax Credit in respect of goods or services used for effecting such exempt supply of servicesto Nepal and Bhutan.

f) In an earlier meeting of the GST Council, it was decided to exempt those service providers whose annual aggregate turnover is less than Rs. 20 lakhs (Rs. 10 lakhs in special category states except J & K) from obtaining registration even if they are making inter-State taxable supplies of services. As a further measure towards taxpayer facilitation, it has been decided to exempt such suppliers providing services through an e-commerce platform from obtaining compulsory registration provided their aggregate turnover does not exceed twenty lakh rupees. As a result, all service providers, whether supplying intra- State, inter-State or through e-commerce operator, will be exempt from obtaining GST registration, provided their aggregate turnover does not exceed Rs. 20 lakhs (Rs. 10 lakhs in special category States except J & K).

Extension of dates

g) Taking cognizance of the late availability or unavailability of some forms on the common portal, it has been decided that the due dates for furnishing the following forms shall be extended as under:

| S. No. | FORM and Details | Original due date | Revised due date |

| 1 | GST ITC-04 for the quarter July-September, 2017 | 25.10.2017 | 31.12.2017 |

| 2 | GSTR-4 for the quarter July-September, 2017 | 18.10.2017 | 24.12.2017 |

| 3 | GSTR-5 for July, 2017 | 20.08.2017 or 7 days from the last date of registration whichever is earlier | 11.12.2017 |

| 4 | GSTR-5A for July, 2017 | 20.08.2017 | 15.12.2017 |

| 5 | GSTR-6 for July, 2017 | 13.08.2017 | 31.12.2017 |

| 6 | TRAN-1 | 30.09.2017 | 31.12.2017 (One-time option of revision also to be given till this date) |

Revised due dates for subsequent tax periods will be announced in due course.

Benefits for Diplomatic Missions/UN organizations

h) In order to lessen the compliance burden on Foreign Diplomatic Missions / UN Organizations, a centralized UIN will be issued to every Foreign Diplomatic Mission / UN Organization by the Central Government and all compliance for such agencies will be done by the Central Government in coordination with the Ministry of External Affairs.

2. Relevant notifications for all of the above decisions will be issued shorty, so as to be effective from 15.11.2017.

Source- Press Information Bureau, Government of India, Ministry of Finance, 10-November-2017

our agency was suppling Security Guards to Gstin registred companices. they paying GST but our annual turnover is below 20 Lakhs. what is % of gst we want to pay (there is no any seperate HSN NO is forund . pl help

My exporter says make an Deemed for export invoice @ 0.1% GST, i pay 5% GST for procuring the goods, how do i claim the balance 4.9%? Will i get a refund, if yes, how will be credited in my bank account and when? If no, the time taken to fulfill the balance amount will be cumbersome and not viable to do business, please advice

LATE FEES REDUCED TORS 20FOR NIL RET ONLY-ANNUAL AGGREGATE TURNOVER BE DEFINED/EXPLAINED IN DETAIL–BEST/LEGAL WOULD BE JULY TURNOVER2017 IN GST LAW

MULTIPLY BY 12–

What does the term aggregate annual turnover mean? Current FY or Previous PY

Dear Sir,

I have registered my self under GST as I was providing services which were interstate. I collected the GST and paid it to Govt on monthly basis. but now due to amendment I am not liable for GST as my total receipts is less than 20 lakhs during the year and no registration is required under GST in case the total turnover is less than Rs 20 Lakhs. Please guide me Cam I surrender my GST and if so how I can surrender the GST being my turnover less than Rs 20 lakhs a year.

I shall fell obliged.