GST Portal update- Disclosures of supplies through E-commerce Operators and amendment of the details in GSTR-1

Introduction: Recent amendments to GST returns, effective from January 2024, aim to enhance transparency in online supply disclosures. The changes, recommended by the GST Council and implemented by the Government of India, primarily target businesses supplying goods or services through E-commerce platforms. These amendments introduce new tables and provisions in Form GSTR-1, impacting both suppliers and E-commerce operators (ECOs). Key changes include mandatory disclosures of supplies made through ECOs, amendments to reported details, and the introduction of specific tables for different supply scenarios. The Government’s objective is to streamline disclosures, prevent tax evasion, and promote transparency in E-commerce transactions.

Disclosures in GST Returns for the businesses supplying their goods or services through the E-commerce platforms and for the E-commerce platforms themselves have undergone several changes w.e.f. 01st January 2024. The Government doing so intends to bring in more transparency for the online supplies of goods and services by streamlining the disclosures in the GST returns filed by the taxpayers and putting checks and balances to identify the tax evasions.

The Government of India on the recommendations of the GST Council, vide Notification No 26/2022- Central Tax dated 26th December 2022, proposed the following amendments in Form GSTR-1 amongst others;

| Table No | Instruction |

| 14(a) | Details of the supplies reported in any table from 4 to 10, made through e-commerce operator on which ECO is liable to collect tax at source (TCS) under section 52, shall be reported by the supplier |

| 14(b) | Details of supplies made through ECO, on which ECO is liable to pay tax u/s 9(5), shall be reported by the supplier. Tax on such supplies shall be paid by the ECO and not by the supplier |

| 14A(a) | Amendment to supplies reported in table 14(a) in earlier tax period shall be reported |

| 14A(b) | Amendment to supplies reported in table 14(b) in earlier tax period shall be reported |

| 15 | i) ECO shall report details of the supplies made through him/her on which he/she is liable to pay tax u/s 9(5).

ii) GSTIN of supplier and recipient, if registered, shall be reported. iii) Details of the documents issued by ECO shall be reported, if recipient is registered |

| 15A(I) | Amendment to the details reported in table 15 in earlier tax periods in respect of registered recipients shall be reported |

| 15A(II) | Amendment to the details reported in table 15 in earlier tax periods in respect of unregistered recipients shall be reported.” |

However, the aforesaid proposed changes in the GST Returns came into the limelight only from the tax period January 2024.

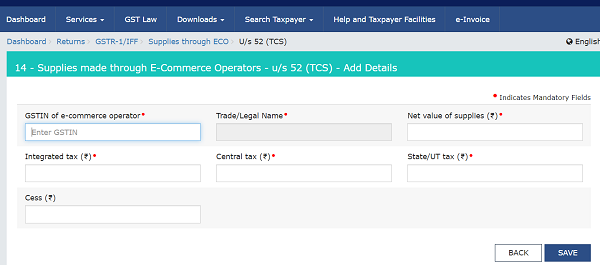

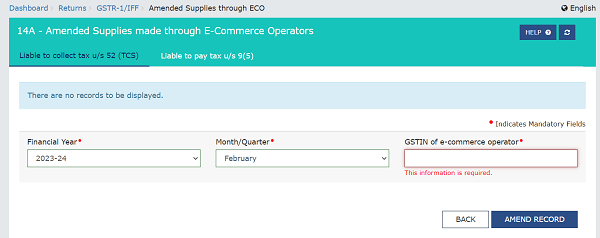

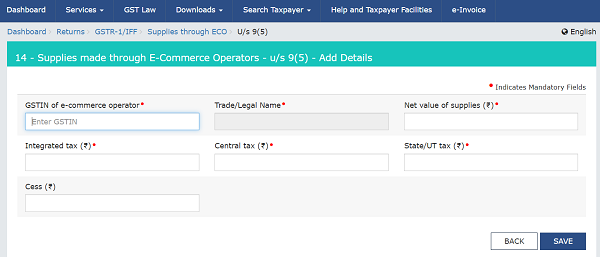

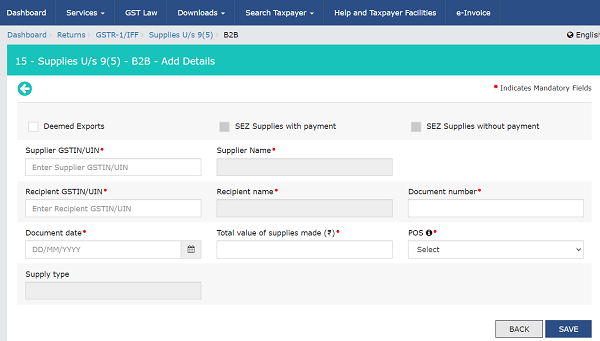

Snippets from the GST portal of the new tables are as follows;

|

Table 14(a) Disclosure: Details of the supplies reported in any table from 4 to 10, made through e-commerce operator on which ECO is liable to collect tax at source (TCS) under section 52, shall be reported by the supplier

Table 14A(a) Amendment: In case of any errors committed in the above table 14(a) the amendment shall be carried out in the following Amendment Table 14A(a) of GSTR-1.

|

| Table 14(b) Disclosure: Details of supplies made through ECO, on which ECO is liable to pay tax u/s 9(5), shall be reported by the supplier. Tax on such supplies shall be paid by the ECO and not by the supplier.

Table 14A(b) Amendment: In case of any errors committed in the above tables 14(b) the correction shall be carried out in the following Amendment Table 14A(b) of GSTR-1.

|

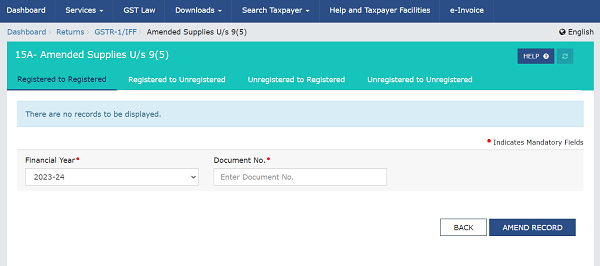

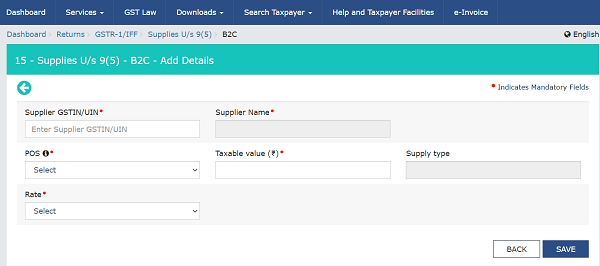

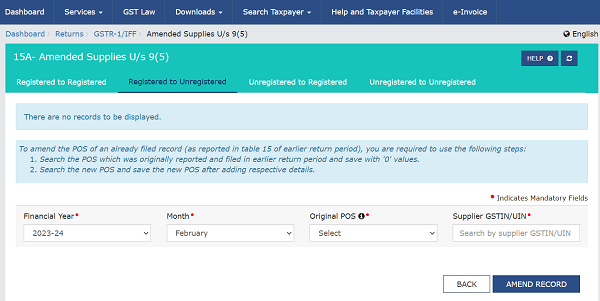

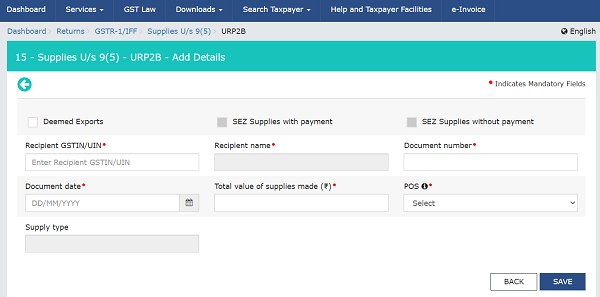

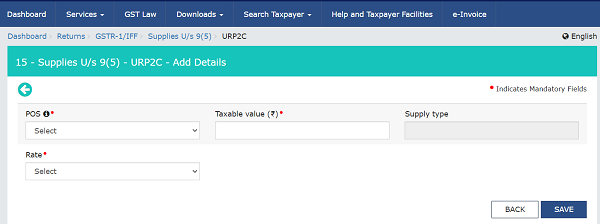

| Table 15- To be filled by E-commerce Operator (ECO) |

| Table 15 Disclosure [Supplies u/s 9(5)] Registered to Registered:

Table 15 Amendment (Registered to Registered): In case of any errors committed in the above table an amendment shall be carried out in the following Amendment Table of GSTR-1.

|

| Table 15 Disclosure [Supplies u/s 9(5)] Registered to Unregistered

Table 15 Amendment (Registered to Unregistered): In case of any errors committed in the above table an amendment shall be carried out in the following Amendment Table of GSTR-1.

|

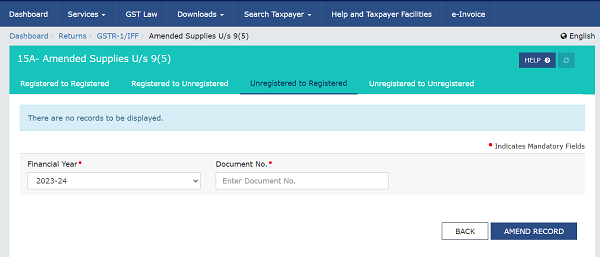

| Table 15 Disclosure [Supplies u/s 9(5)] Unregistered to Registered

Table 15 Amendment (Unregistered to Registered): In case of any errors committed in the above table an amendment shall be carried out in the following Amendment Table of GSTR-1.

|

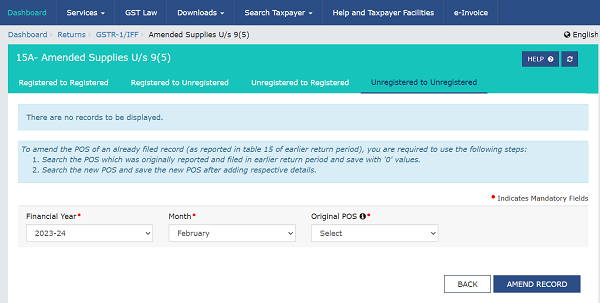

| Table 15 Disclosure [Supplies u/s 9(5)] Unregistered to Unregistered

Table 15 Amendment (Unregistered to Unregistered): In case of any errors committed in the above table an amendment shall be carried out in the following Amendment Table of GSTR-1.

|

Further, GSTN has issued the following Advisory on the aforesaid changes made in the GST Returns;

| Date of issuance | Description of the Advisory |

| 15th January 2024 | Introduction of the new Table 14 and 15 in GSTR-1 |

| 12th March 2024 | Introduction of New 14A and 15A Tables |

The advisories issued by the GSTN can be accessed from the following links;

1. GSTN Advisory on introduction of new Tables 14 & 15 in GSTR-1

2. Advisory on GSTR-1/IFF: Introduction of New 14A and 15A tables

Conclusion: The amendments to GST returns, particularly the introduction of new tables in Form GSTR-1, signify the Government’s commitment to ensuring tax compliance and transparency in E-commerce transactions. By requiring detailed disclosures and providing avenues for amendments, these changes aim to address loopholes, prevent tax evasion, and promote fair practices in the digital economy. Taxpayers, especially those involved in E-commerce, should familiarize themselves with these amendments to ensure compliance and avoid penalties. Additionally, the provision for feedback and suggestions underscores the Government’s willingness to engage with stakeholders and refine the GST framework for optimal effectiveness.

Suggestions or feedback can be sent to thulasiram@hnaindia.com