Page Contents

- What is Goods and Services tax ?

- Benefits of GST

- Who can Register ?

- GST : Categories / Components

- Input Credit Adjustment

- Returns Process Flow and Tax payment

- How GST Operates?

- (Case 1)

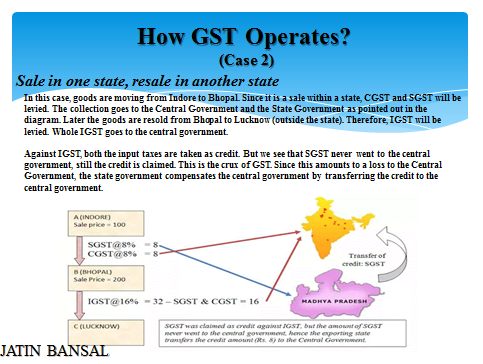

- How GST Operates?

- (Case 2)

- Consequences of Non-compliance

- Late Fee & Interest

- Failure to furnish returns

- Quarterly (for composite dealer)/ Monthly (for regular dealer): Rs.100/- per day for

- every day subject to a maximum of Rs. 5000/-

- Annual Return :Rs.100/- per day for every day subject to a maximum of Rs. 0.25 % of  aggregate turnover

- Interest on total tax due ‚Äď Rate yet to be notified

- Cancellation of Registration

- Fines

- Compliance Rating will be visible to all suppliers and customers

- Late Fee & Interest

What is Goods and Services tax ?

GST is a Value added Tax (VAT) and is proposed to be a comprehensive indirect tax levy on manufacture, sale and consumption of goods as well as services at the national level.

It will replace all indirect taxes levied on goods and services by the Indian Central and State governments.

It is an indirect tax for the whole nation , which will make India one unified common market.

Understanding GST Р5 Easy Steps

1. GST (Goods & Services Tax), a single unified indirect tax system aims at uniting India‚Äôs complex¬†taxation structure to a ‚ÄėOne Nation- One Tax‚Äô regime.

2. It will be levied on all supplies with seamless flow of credit (for both goods &  services) till it reaches the end consumer

3. Only value addition will be taxed and burden of tax is to be borne by the final consumer.

4. GST would replace indirect taxes

5. Central Excise Duty

- CVD & SAD

- CST & VAT

- Entry Tax & Octroi

- Surcharges & Cess

- Service Tax

Benefits of GST

- GST will be beneficial to all segments alike- business and industry, central and state governments, the ultimate consumer and the bank as whole.

- Under GST, there would be only one tax from the manufacturer to the consumer, leading to transparency of taxes paid to the final consumer.

- Proper credit mechanism would be incorporated in the accounting itself which will avoid any kind of conflicts

- What makes GST an important tax reform is it simplifies the tax structure, increases tax compliance,  increases govt revenue and integrates states.

- With the implementation of GST, the indirect tax system (excise, state-level VAT, service tax) is  expected to evolve. This will bring with it plenty of opportunities. A single tax would replace multiple taxes.

- Because of prevention of leakages, the overall tax burden on most commodities will come down, which will benefit consumers

Who can Register ?

WHO WILL BE REQUIRED TO TAKE REGISTRATION UNDER GST

- A business entity with an annual turnover of upto  20 lakhs would not be required to register for GST unless he voluntarily chooses.     (Section 22)

The annual turnover threshold in the Special Category States (as per Sec 279A of Constitution of India)

- Jammu & Kashmir

- Uttarakhand

- Himachal Pradesh

- Sikkim

- Arunachal Pradesh

- Assam

- Manipur

- Meghalaya

- Mizoram

- Nagaland

- Tripura ( North-East States)

for not taking  registration  is  10 lakhs.

Liability to be registered irrespective of threshold  : (Section 24)

- Persons making inter-State taxable supply

- Persons required to pay tax under reverse charge

- Casual and non-resident taxable persons

- E-Commerce operator

- Persons who supply goods through e-commerce operator

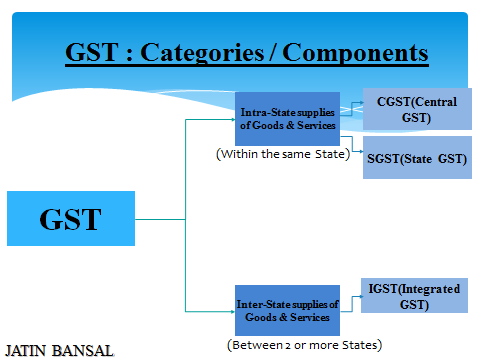

GST : Categories / Components

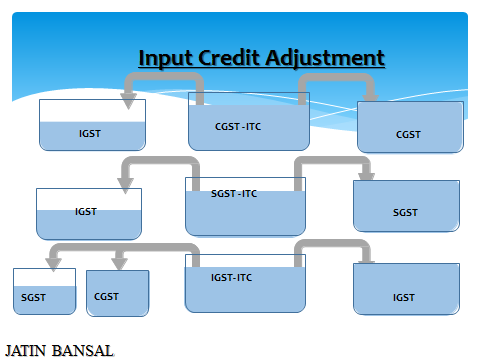

Input Credit Adjustment

Returns Process Flow and Tax payment

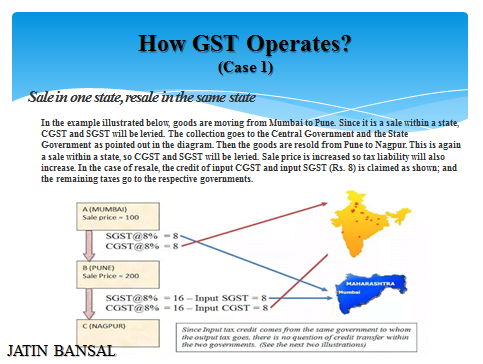

How GST Operates?

(Case 1)

How GST Operates?

(Case 2)

Consequences of Non-compliance

Late Fee & Interest

Failure to furnish returns

Quarterly (for composite dealer)/ Monthly (for regular dealer): Rs.100/- per day for

every day subject to a maximum of Rs. 5000/-

Annual Return :Rs.100/- per day for every day subject to a maximum of Rs. 0.25 % of  aggregate turnover

Interest on total tax due ‚Äď Rate yet to be notified

Cancellation of Registration

Regular dealer: If returns are not furnished for 6 consecutive tax period

Composite dealer: If returns are not furnished for 3 consecutive tax period

Fines

Tax evasion

Rs.10,000/- or an equal amount to the extent of tax evaded

Fine with imprisonment upto 5 years depending on amount of tax evasion with slab  ranging from 25 Lakhs to 500 Lakhs

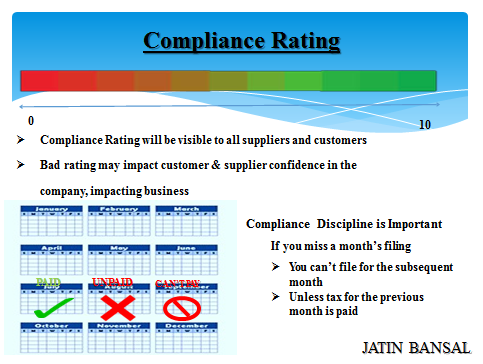

Compliance Rating will be visible to all suppliers and customers

It  is helpful for the Dealers who want to Business with UNKNOWN Dealers and there is risk as the Another Person(SELLER DEALER) complies with regulations or furnish his Returns properly or not. Because of ITC (Input Tax Credit)

FOR QUERIES CONTACT ME :-NAME- JATIN BANSAL

CONTACT NO- 9988866349,9988666349

EMAIL ID– CAJATINBANSAL9@GMAIL.COM

We are Facility Mgt company and 18% will be charged to all client, our sub vendors who does mainly supply & installation (for eg Electrical works)works so how does they should raise bill on us ?

Sir

I am sole proprietor in service Industry

Personal Fixed Deposit does the Interest earned gets calculated in the aggregate turnover of my business