I had Published articles in Taxguru with titles GST on Export of Services to Nepal and Bhutan & Procedure for Export via Land Customs Stations to Nepal, Bangladesh & Bhutan. I had received many Queries, Questions & Comments from many readers, thus I thought it’s my Responsibility to clarify those Doubts.

Let’s first understand basics and then move to clarifications.

Definition of Exports :

Definitions of Export of Goods & Export of Services are shown below:

In case of Export of Goods the Goods must be Physically moved from India to a Place outside India. Where as in case Export of Services below mentioned all the Five Conditions should be fulfilled.

Note : as per IGST (Amendment) Act, 2018, Following added to Sub-Clause (iv) of Sec 2(6)………………. “or in Indian rupees wherever Permitted by the Reserve Bank of India”

Now the Clause reads as

“The Payment for such service has been received by the supplier of service in Convertible Foreign Exchange or in Indian rupees wherever Permitted by the Reserve Bank of India”

This provides great relief to the Service Exporters relaxing Stringent Condition of Receiving only in Convertible Foreign Exchange. Now Service Exporters are allowed to Receive Payment in Indian rupees wherever Permitted by the Reserve Bank of India.

Now Let’s Answer the Queries :

Goods Exported to Nepal & Bhutan Payment Received in Indian Currency Whether Treated as Exports?

As per Section 2 (5) of IGST Act, 2017, Export of Goods means

“Taking out of India to a place outside India”.

No Condition attached for Receiving Payment either in Indian Currency or in any other Currency.

Therefore once the Goods are Taken Out of India from India, it is Treated as Exports.

Export Order Received from Nepal / Bhutan Goods Sourced from China & Delivered Directly to Nepal / Bhutan Order Fulfilled & Payment Received Whether Treated as Export?

As per Section 2 (5) of IGST Act, 2017, Export of Goods means

“Taking Goods out of India to a place outside India”.

Since Goods are Not taken Out of India Physically, but Moved from China, it is not Fulfilling Condition in the definition, therefore it is Not Treated as Exports.

Whether Export to Nepal / Bhutan Can be Made Through LUT?

The acceptance of LUT for supplies of Goods or Services to Nepal or Bhutan will be permissible irrespective of whether the payments are made in Indian currency or convertible foreign exchange as long as they are in accordance with the applicable RBI guidelines.

Refer following Notifications

Notification No. 37/2017 – Central Tax, 4th October, 2017

Circular No. 8/8/2017-GST; Dated the 4th October, 2017 amended vide

Circular No. 88/07/2019-GST; Dated the 1 st February, 2019

Condition of Receipt of Export Proceeds in case of Service Exports in Foreign Exchange had been Removed vide Notification No. 42/2017- Integrated Tax(Rate) dated 27th October, 2017

Whether Exemption on Supply of Services Associated with Transit Cargo to Nepal and Bhutan?

Notification No. 30/2017, Central Tax (Rate), 29th September, 2017 was released to amend the Notification No. 12/2017- Central Tax (Rate), dated the 28th June, 2017 by exempting tax on Supply of services associated with transit cargo to Nepal and Bhutan

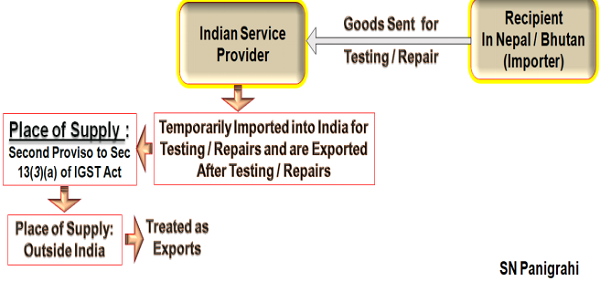

A client based out of Nepal / Bhutan, send his products to a Registered Person in India for Testing / Repair. Testing / Repair is done in India. Kindly clarify if GST is payable / applicable on the same?

Goods Temporarily Imported into India for Testing / Repairs and are Exported After Testing / Repairs, the Place of Supply shall be Outside India. Subject to other Conditions of Definition as per Section 2 (6) of IGST Act, 2017 is Satisfied, it is Treated as Export of Service (Even though Consideration is Received in India Currency).

By Plain reading of Sec 13(3)(a) of IGST Act, may Confuse by treating the Place of Supply in India, but read with Second Provo to the Section clear the Confusion, there by treating the Place of Supply Outside India.

Sec 13(3)(a) of IGST Act, services supplied in respect of goods which are required to be made physically available by the recipient of services to the supplier of services, or to a person acting on behalf of the supplier of services in order to provide the services:

Provided …………….

Provided further that nothing contained in this clause shall apply in the case of services supplied in respect of goods which are temporarily imported into India for repairs and are exported after repairs without being put to any other use in India, than that which is required for such repairs;

Commentary – Place of supply in case of any treatment or process (which may not come within the four corners of the definition of job work) done on goods temporarily imported into India and then exported without putting them to any other use in India, to be outside India.

Shipperfrom Nepal / Bhutan, Export to outside India. In that case some operation process done in Kolkata, India. Whether the Services Provided by Service Provider (C&F Agent / Forwarder) in India to Shipper in Nepal / Bhutan is Treated as Export of Service?

As per Sec 13(2) of IGST Act, the Place of Supply of Services shall be the Location of the Recipient of Services

Since the Services are Provided from India to the Recipient in Nepal / Bhutan, the Place of Supply is Location of the Recipient of Services, ie Outside India. Subject to other Conditions of Definition as per Section 2 (6) of IGST Act, 2017 is Satisfied, it is Treated as Export of Service (Even though Consideration is Received in India Currency).

We are Providing Services of Transportation of Goods from India to Nepal / Bhutan. Whether these Services are Treated as Export of Services?

As per Sec 13(9) of IGST Act, the Place of Supply of Services of Transportation of Goods, other than by way of mail or courier, shall be the Place of Destination of Such Goods.

Since the Services of Transportation of Good provided from India to the Recipient in Nepal / Bhutan, the Place of Supply is Outside India. Subject to other Conditions of Definition as per Section 2 (6) of IGST Act, 2017 is Satisfied, it is Treated as Export of Service (Even though Consideration is Received in India Currency).

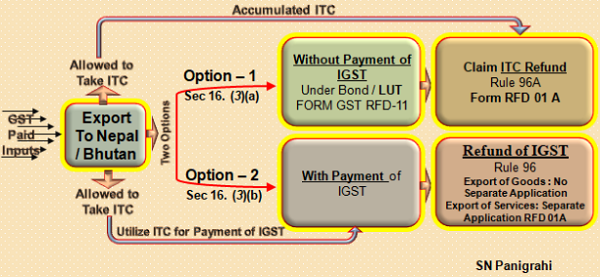

For Export to Nepal / Bhutan how to make the Invoice? Do we need to charge IGST or we need to make under L.U.T without Paying GST? Whether we can get Export Refunds?

As per Sec 16. (3) of IGST Act : A registered person making zero rated supply shall be eligible to claim refund under either of the following options, namely:––

a) he may supply goods or services or both under bond or Letter of Undertaking, subject to such conditions, safeguards and procedure as may be prescribed, without payment of integrated tax and claim refund of unutilised input tax credit; or

b) he may supply goods or services or both, subject to such conditions, safeguards and procedure as may be prescribed, on payment of integrated tax and claim refund of such tax paid on goods or services or both supplied,

in accordance with the provisions of section 54 of the Central Goods and Services Tax Act or the rules made thereunder.

That means the Exporter has Two Option

1. Export Under LUT / Bond without Payment of GST & Claim Refund of Accumulated ITC

2. Export on Payment of IGST and Claim Refund of IGST

Electronic Cargo Tracking System (ECTS)

Customs Procedure for Export of Cargo in Containers and Closed bodied Trucks from ICDs/CFSs through Land Customs Stations (LCSs) for Export to Nepal, Bangladesh, Bhutan Adoption of ECTS Seal.

Disclaimer : The views and opinions; thoughts and assumptions; analysis and conclusions expressed in this article are those of the authors and do not necessarily reflect any legal standing.

Author : SN Panigrahi, GST & Foreign Trade Consultant, Practitioner, Corporate Trainer & Author Can be reached @ snpanigrahi1963@gmail.com

Hi,

we are supplying material in NEPAL against LUT and getting the payments in Bank through NEFT/RTGS.

But this time one of the Nepal customer has came directly to our shop and purchased the Material approx. 2K and paid in CASH. It this invoice is eligible for Export without pay or we have to pay the IGST on this invoice.

Please suggest so that we can file this invoice in our GSTR1 accordingly whether we have to pay GST on this invoice or not.

thanks and regards

Rohit Talwar

We have supplied materials to Nepal under LUT. As part of the business process, we have to issue a credit note which is possible to give in the sales invoice without call-back materials to India since the freight cost is too high because as per RBI 100% payment is needed against the invoice

Should Exemption Certificate to be provided by Bhutan Govt.?

If I provide Technical Consultancy Services on Establishing Testing Lab to a Company situated in Nepal, and received the cost of services in INR, do I have to pay GST in India on receipts.

WHETHER EXPORT OF FABRICS IS BAINED TO NEPAL OR NOT IF BAINED THAT WHAT NOTIFICATION WHERE THE GOVT HAS BAINED EXPORT TO NEPAL.

For goods delivered directly from china to nepal and payment received in India for export order. Its an Merchant trading as per RBI norms. Shipment done through switch bill of lading. Its treated as non-gst supply in gst act

A is a Indian Co appoint a Transporter X to carry his goods upto Nepal border for export.

The service provide by X is not an export activity as he is appointed by A who is a Indian Co. and paid freight to X for providing such service for export.

The same situation would happen even if X delivered such goods in Nepal teritioy as per Mutual agreement between A & the Nepalese Co.

-seeking clarification!

2. Any service for processing / repair service provide by any Indian Co. during transit to a foreign National is an export activity and IGST would charge .But the same will change if the said National has any offfice in India within the jurisdiction of service provider or the regional consulate general office who act as an agent of such foreign National Here CGST/ IGST would apply.

-seeking Clarification!

We export goods to nepal and receives payment in INR. Did we required to submit BRC to the bank?

Is it mandatory for us to do that?

Sir,

We needs to sales of goods to nepal and we dont have LUT OR Bond in this case igst applicable or not and if then we may claim refund the same.

Good Morning

We are receiving amount in Indian Currency but have to goods deliver in Nepal should we treat this as Export and if treat this as export how did we satisfy Bank “As banks need some shipping bill and amount should be in currency other then Indian currency”

Yesterday my question was how we can recover money with any importer of Nepal .credit sales on exim code to Nepal and they are not making payment of our dues amount .all are imported throu Nepal bhansar against his exim code.

Please solve my problem.

Bharat ka koe wholesaler Nepal ke vyapari ko export karta hay.india ke vyapari ke pas i.e.c aur Nepal ke pas exim hay.sara kam official hay.

Agar uska payment vyapari nahi bhejta hay to payment ke liye koe legal prakriya ho to batlaye.

Bharat ka koe wholesaler Nepal ke vyapari ko export karta hay.india ke vyapari ke pas i.e.c aur Nepal ke pas exim hay.sara kam official hay.

Agar uska payment vyapari nahi bhejta hay to payment ke liye koe legal prakriya ho to batlaye.

Sir g,Mera Jaynagar bihar,me.whole sale

cloth business hay.mere pas export import ka licence hay.

Agar koe vyapari exim code se credit purchase karta hay aur custom(Nepal)ka payment karke mal le jata hay.maal sabhi credit m hi jata hay.

Agar es tarah ka payment customer nahi bhej raha hay to uske payment ki recovery Kaise hogi.

Legal action le sakte hai ,send your full details so that I can try to get best advice to recover payment

I am Supplying a Service to Company in Nepal. Do I need to Add GST in my Tax Invoice ?

Also is there any requirement of special nomenclature to be used in Bill ?

Please give information on above 2 quotation on urgent basis

Sir,i want to know that whether export license is required to supply a material to bhutan?

& while making invoice i have to pay IGST only or some another tax also?

Can we get gst refund if we supply material from india to nepal if we get LUT

While we raising invoice to NEPAL, for sending spares, will IGST is applicable, or not

Sir my question is if seller belongs from Bhutan and purchaser belongs from Nepal, but goods stocked at Indian place and send through Indian railways Rakes by paying freight with GST amount. Then what is the procedure for take GST refund.

We are carrying out Construction works for an Indian company in Nepal. The project is funded by Exim bank. Can we receive payments from our principle Indian company from their India bank account in Indian Rupees in our India bank account, without any implication of GST.

Regds.