CS Nidhi Singh

1. Introduction :

√ Tax on supply of goods or services.

√ Tax on Transaction value of supply i.e. the price actually paid or payable.

√ GST applies to all gods & Services except ALCOHOL, ELECTERCITY, PETROL, NATURAL GAS and DIESEL for human consumption.

2. Registration : (PAN based)

√ Threshold

- For Existing → Migration from old laws(Vat/ Excise/Service tax/Custom/Entry Tax)

- For New → If Turnover exceeds Rs.20 Lacs / Rs.10 Lacs (Incase of Special Category State).

- Aggregate Turnover → Include Exempt Supplies but exclude taxes & value of Reverse charge supplies.

√ For each State from where taxable supplies are being made.

√ Multiple business verticals in a State- registration for each business vertical, each business verticalà Separate Entity.

3. Types of GST :

√ IGST → On Inter State supplies of goods and/ or services → Levy of the Central Government.

√ CGST & SGST → On Intra State supplies of goods and/or services → Levy of the Central and State Government respectively (50%each).

4. Input Tax Credit :

√ ITC Avail

- IGST → against IGST CGST → SGST But in this sequence

- CGST → Only against CGST, Surplus if any, than against IGST

- SGST → Only against SGST Surplus if any, than against IGST.

√ Prerequisite for ITC

- Possession of invoice.

- Receipt of goods or services.

- Tax actually paid by supplier to government,

- Furnishing of return.

- furtherance of business

√ Full ITC on capital goods in same year.

√ Transition Provision

- Credit Claimed in last return filed from appointment date, can be claimed either as input or refund as the case may, except assesse opt for composition scheme.

5. Return Procedure :

- GSTR-1 Outward Supply Details (Till 10th of Succeeding Month).

- GSTR-2 Inward Supply Details (Till 15th of Succeeding Month).

- GSTR-2A Reconciliation of diff if any in inward supply (Till 15th of Succeeding Month (Hence Period allowed is11th to 15th)).

- GSTR-1A Reconciliation of diff if any in outward supply (Till 17th of Succeeding Month (Hence Period allowed is 16th & 17th)).

- GSTR-3 Monthly Final Return (Till 20th of Succeeding Month).

- GSTR-4 Quarterly Final Return (Till 18th of Succeeding Month of end of the Quarter, In case of Composition).

- GSTR-9 Annual Return (Till 30st of Succeeding Month of end of the Year).

6. Composition (Sec-10):

√ Eligibility → Small Taxable Person supplying goods up to Rs 75Lacs.

√ Rate of composition

- Trader – 1% (IGST)

- Manufacture -2% (IGST)

- Restaurant – 5 % (IGST)

(In case of CGST & SGST it is 50, 50 (%) respectively.)

√ Not Eligible

- Service Provider (Except Restaurant).

- Supplier of exempt goods.

- Interstate supplier of goods.

- Supply through E-commerce medium (TCS)

7. Reverse Charge (Sec-9(4)):

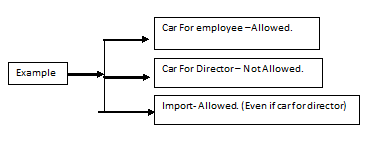

√ Governed by rule, the case till now is –

- Purchase from unregistered dealer.

8. Misc Provision :

√ System of matching of supplier’s and recipient’s invoice details month return will prevent “KACHA BILL” culture and back dated adjustment entries for window dressing and profit manipulation of accounts.

√ Negative list (not yet declared).

√ Payment of GST → Monthly → 20th of succeeding month.

9. Refund :

In Case of Export

→ Export sale at Zero Rate (bond) and claim refund of eligible input, or

→ Export at normal rate claim input credit and for balance if any remaining claim the refund.

10. Comments:

GST has treated as a rocket science since last year, half of country is afraid of its implication on their daily livelihood.

First and for most expected effect is price reduction as there will be single levy and input credit will also be there but my dear friend this single levy will itself include effect of all old taxes namely service tax, excise and state sales tax i.e. vat so ultimate cost to consumer will remain same.

Now if we talk about compliance part earlier there were many laws applicable which results in compliance of each respective law but now only one law is there so compliance of only one law is required but there are monthly three returns and one annual return which comes out to be 37 returns a year. More return means more costing to any businessman but this can prove to be a stepping stone for GST practitioners and all other professionals.

Bright side of this revolutionary change is its monthly return system which facilitate matching of your sales with purchase of other register dealer (buyer), Hope fully this will eliminate culture of back dated entries for window dressing of accounts, As one can take credit of purchase filled in return and this cross checked by sales of other dealer and vice versa.

These days on online shopping portals are coming up with GST clearance sale and the only question asked by general public is, I want to buy Car should I buy it now GST or after GST? Or I want to buy LED TV should I buy now or after GST? But believe me my friends even GST follower professionals can’t answer it. Those who are giving opinion are giving on the basic of general intact as luxury / Sin item will fall under 28% GST rate so if the product fall currently below this than buy and if current rate is more than this, then wait for GST implementation.

After Service tax this is second hit & trial by Indian Government and still there is lack of clarity at so many places at draft things need be more clear at both the ends that is drafting team and implementing professional. Mere conferences seminar or articles organized by government and other bodies can’t work till the date final roadmap is not ready.

Hope to come up with some more articles with more clarity in vision about GST.

HAPPY READING!!!

CS NIDHI SINGH

Life is One Time offer ……… use it well!!!

excellent:can you repeat once again

the following

1)transaction between registered and unregistered person

2)transaction between two unregistered persons

This is assuming 20 l limit is not crossed