GST Circular No. 122 dated 05.11.2019

♠ Generation and quoting of Document Identification Number (DIN) on any communication issued by the officers of the CBIC to tax payers and other concerned persons

♠ To begin with, w.e.f 8th November, 2019, DIN would be used for any search authorisation, summons, arrest memo, inspection notices, and letters issued in the course of any enquiry

♠ This would create digital directory for maintaining a proper audit trail of such communication

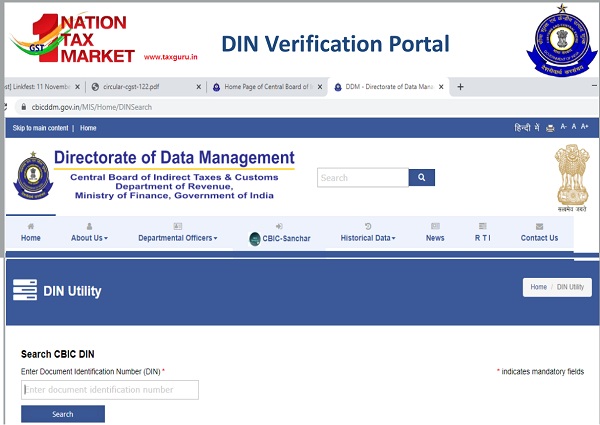

♠ Recipients would get digital facility https://www.cbicddm.gov.in/MIS/Home/DINSearch) to verify the genuineness of such communication

♠ The digital platform for generation of DIN is hosted on the Directorate of data management (DDM)’s online portal www.cbicddm.gov.in

♠ Any specified communication which does not bear DIN and is not covered by the exceptions mentioned in the circular no. 122/2019-GST shall be treated as invalid and shall be deemed to have never been issued.

Exceptions:

- DIN is mandatory, however, in following circumstances, communications may be issued without auto generated DIN

- Reasons to be recorded in concerned file and the communication shall state that it has been issued without DIN

- Following exigencies-

-

- Technical difficulties in generating DIN

- When communication is required to urgently issued and the authorised officer is outside office

- Such communications issued without DIN shall be regularised with in 15 days ( By post facto approval of superior officer, generating DIN after such approval

DIN Verification Portal

DIN Verification

- On entering the DIN, a taxpayer will be able to see following

- This is a valid DIN with DIN number

- Date of generation of DIN

- Name of the office issuing the communication