#AD

Due to the increase in complexity in GST compliance and a lot of manual work related to reconciliation and reporting, GST Audit has become a very typical job for CA’s to match and reconcile every return. Practicing Chartered Accountants always need a tool that can minimize the clerical work and increase accuracy and effectiveness in the reporting and reconciliation.

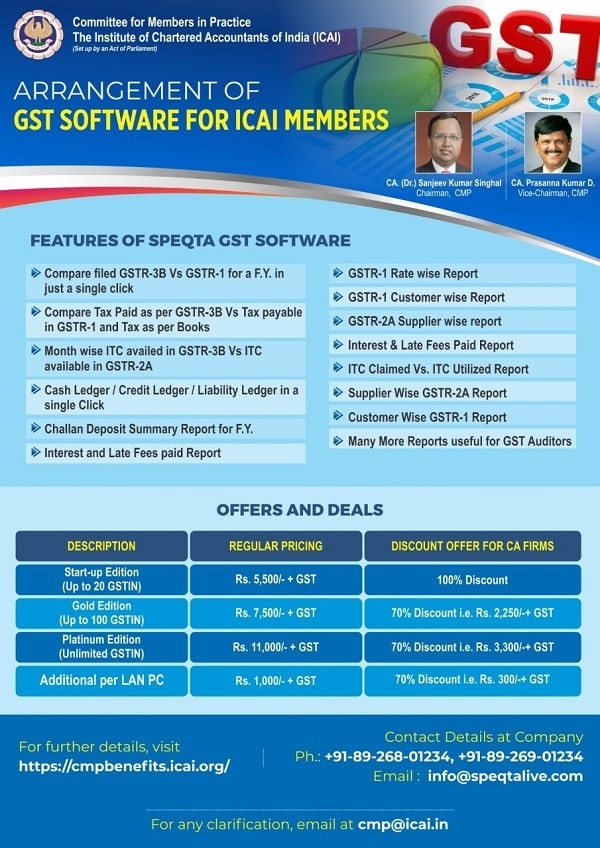

Considering the practical issues being faced by the practicing Chartered Accountants and with an objective to make IT savvy office management and audit tools for CA firms & SMPs ICAI has done a lot of arrangements in the past for the benefit of members. In a recent arrangement, Committee for Members in Practice, ICAI (CMP) entered into an arrangement with SPEQTA GST to provide the GST Return Filing, GST Reporting, and GST Reconciliation tool to its members free of cost for small firms having less than 20 clients (GSTIN) and for the firms having more than 20 clients (GSTIN) at a discount of 70%.

Features of SPEQTA GST Software are as under:

- Secured Desktop Solution: SPEQTA GST is Secured Desktop Software developed on Microsoft technologies. The most important aspect of desktop software is that the data of all your clients remain on your PC itself and the software company will not have any access to your client’s contact information so that there will not be any chance of misuse of your clients’ data and no any marketing be done by software company even if you stop using their software.

- GST Return Filing: Very easy filing of GSTR-1, GSTR-3B GSTR-4, CMP-08, GSTR-7, GSTR-9 & GSTR-9C available in software and before uploading the data on GST portal software can give you an error report with inbuilt validation tool to save your time.

- Strong Validation: One-Click GSTIN validation before uploading GSTR-1 on the portal and validation engine to reduce the chance of error in uploading JSON. Validate & compare data uploaded on the portal with software before final submission. While Filing GSTR-3B you can compare the GSTR-3B data as per software and as per System Computed Data so as to avoid any chance of error.

- Intelligent Reports: One-Click Automatic Report generation through software based on GSTR returns filed on the portal. More than 55 Reports are available in the software so as to facilitate the Chartered Accountants to prepare the working for Finalization of Statutory Audit and Income Tax Audit. These reports will help CA to take intelligent decisions and form opinions on Audits.

- Intelligent GST Reconciliation: Most efficient and intelligent tool to reconcile sale data with GSTR-1, Purchase data with Portal data (GSTR-2A, GSTR-3B, Table 8A of GSTR-9) available in Software. Also, the option to reconcile GSTR-2A with Table 8A of GSTR-9 and GSTR-2A with GSTR-2B is available in Software.

- Online Activities through Software: One-Click Login to GST Portal, Verify GSTIN before uploading data on GSTR-1, Single Click Nil Filing of GSTR-3B, View GST Notice, and Orders issued by the department, View DRC-03 filed on Portal, View Refund Filed Report, One-Click Challan Generation and many useful options to save time.

- Productivity tools: Check and Search GST Notification, Circulars, and Orders from a single dashboard with a search facility, Add Task Reminder and Whatsup and Email Notifications to clients for providing data for filing Returns.

Many More Other Features and List is continuously increasing…

ICAI GST Software Arrangement

Offer for ICAI Members: As per arrangement with ICAI GST Software is free for CA Firms for 3 years without any cost if the clients (GSTIN) of CA firms are less than 20. If more than 20 clients (GSTIN) in that case GST Software for CA is available at a discount of 70% as per the arrangement of ICAI.

To Activate Free GST Software for CA in Practice Please https://icai.speqtalive.com/

To Know more about ICAI Initiatives Please Visit CMP Benefits – CMP Benefits (icai.org)

to avail gst free software for CAs in practice

MS 210450

please send link. I M CA since 1984

Really SPEQTA is a good platform for GST and e-filing. Easy to reach for support,,,👍👍👍