New enhancement allows downloading E-Way bills for one month period in one go

– The facility was earlier available for the period of 5-days interval.

– User can download E-way bill using the Reports tab in E-way bill portal

– The facility is aimed to provide relief to taxpayers and transporters

E-way bill, a document, which is generated for the movement of goods, can now be downloaded for the last one month period with a single click. This facility has been made available on the Eway bill portal run by National Informatics Centre (NIC).Till recently, the taxpayers or transporters could download e-waybills generated by them for a limited period of 5-days interval. This was causing hardship as the taxpayers had to download the e-waybills multiple times in amonth. Suggestions were received from taxpayers to increase the number of days for which E-way bills could be downloaded.

Keeping in view the demand of taxpayers, the system has been enhanced to enable the download of e-waybills for a longer period, that is, for one month. Taxpayers can now make use of this facility to download the e-waybills in excel format and use in their systems. This facility is presently available daily between 8 AM to 12 noon so as to ensure that performance of the e-way system is not impacted for regular activities of the e-way bill system.

Transporters can continue using the same path as they were doing before for downloading of E-way bills, i.e.

Visit E-way bill portal (https://ewaybillgst.gov.in/) >> Fill login credentials >> Go the Reports tab >> Download E-way bills from My E-way bill Report.

E-way bill is required to be generated by a registered GST taxpayer for the movement of goods if the value of the consignment is more than Rs. 50,000 for inter-state movement. For intra-state movement, limits vary from state to state.

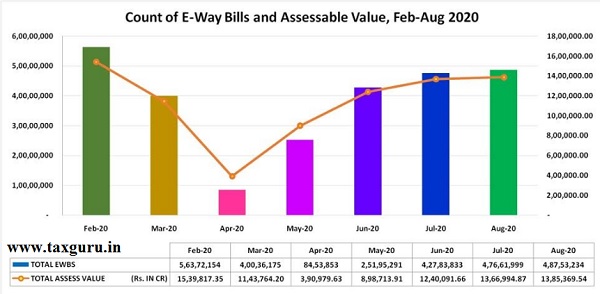

E-Way bill generations over the months in 2020 (up to 13th Sep 2020)

It is notable that the e-waybill system has been running smoothly from April 2018 and generating 5+ Crores of e-waybills on monthly average. The lockdown period between April-May 2020 saw a major slump in the e-waybills generation indicating non-movement of goods. However, from the month of June-2020 the number of e-waybills is gradually picking up and it has reached the normal number of e-way bill generation during this month.

Not working – E-Way bills for one month period in one go

not working constantly prompts This report is available from 8 AM to 12 PM and i tried the whole day

Very useful website for Finance professionals.