Jainam P. Shah

One of the many disputes that have continued to exist in the present regime of taxation of sale of goods to determination of the nature of transaction as inter-State sale subject to Central Sales Tax or local sale subject to VAT. Now, with the advent of GST which aims to simplify indirect taxation in India it would be interesting to investigate whether the legislature has been aware of this challenge or not and if so, how has it sought to address it.

For, inter-state transactions, IGST would be levied under GST regime, which would be sum of total of both CGST and SGST and will be administered and levied by the Central Government. Here, in this article we are going to understand how to determine nature of supply, whether it is an Intra-State Supply of Inter-State Supply.

Section 7, 8 and 9 of the IGST deals with the transactions to be treated as Inter-State Supply.

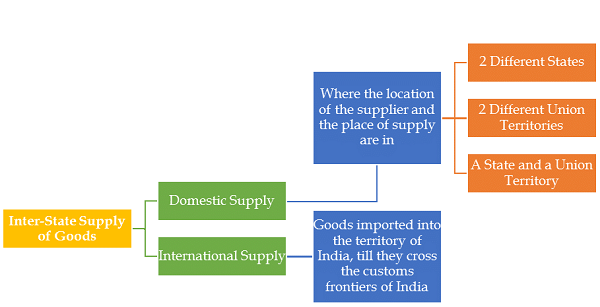

Inter-State supply of Goods [Section 7 (1) & (2)]

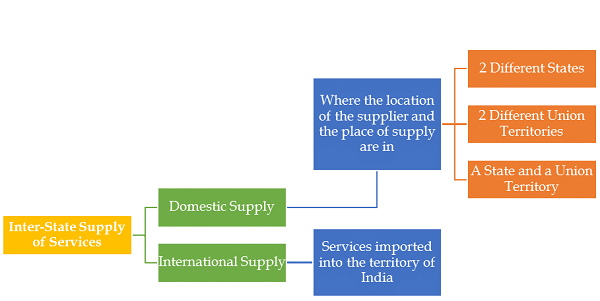

Inter-State supply of Services [Section 7 (3) & (4)]

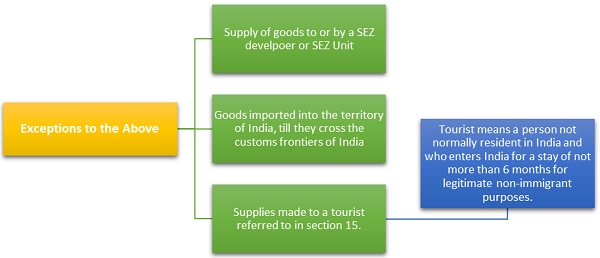

Inter-State supply of Goods and Services (Others) [Section 7 (5)]

Intra-State Supply of Goods [Section 8 (1)]

Supply of goods where the location of the supplier and the place of supply of goods are in the same State or same Union territory shall be treated as intra-State supply.

Intra-State Supply of Services [Section 8 (2)]

Supply of services where the location of the supplier and the place of supply of services are in the same State or same Union territory shall be treated as intra-State supply.

Establishment [Explanation to Section 8]

Note: A person carrying on a business through a branch or an agency or a representational office in any territory shall be treated as having an establishment in that territory.

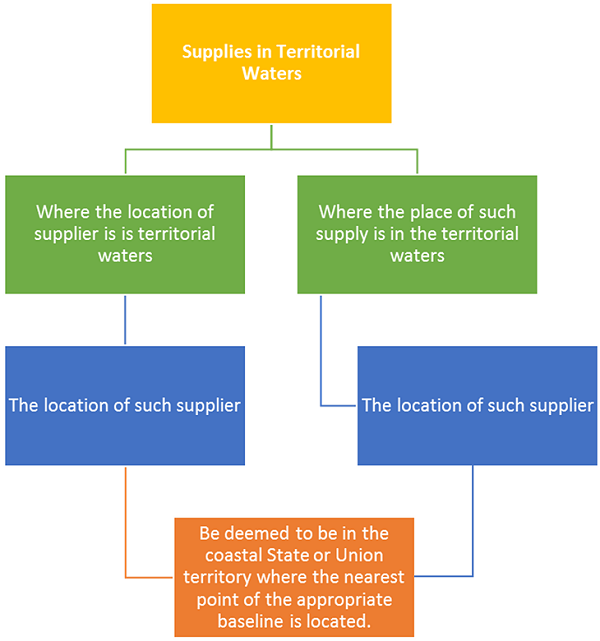

Supplies in territorial waters [Section 9]

The author is a practicing Chartered Accountant in the fields of Audit, Direct and Indirect Taxes, Company Law, Project Finance at Ahmedabad. He has authored book on Companies Act, 2013 which is published by Internationally renowned publisher. He can be reached at ca.jainam@gmail.com.