Deposit of Punjab Professional Tax

Introduction

Article 276, Clause 2 of the Indian Constitution covers the provision concerning professional tax in the country. Professional tax is imposed by state governments on the individuals who are employed in governmental, private and non-governmental organizations. The quantum of levy varies according to the strata of income, but wouldn’t exceed INR 2,500 in a year. Professional tax in the State of Punjab is administered by the “(Punjab Act No.11 of 2018).” This Development Tax is Payable by those person whose income exceeds the maximum amount which is not chargeable to Income Tax (i.e. Rs.250, 000/-) after allowing all deductions as per Income tax act and amount payable under this Act. Further salary for this purpose does not include Bonus and Gratuity. The provision isn’t applicable for Person who earns Wages on casual basis, Person Engaged exclusively in Agricultural Activity, and Senior Citizens Exempt as per Section No.4. In this article, we look at the various aspects Payment of Punjab State Development Tax in detail. For complete act and rules refer the link https://psdt.punjab.gov.in/

Current Burning Issue – How to deposit the tax deducted to Government treasury

The current burning issue is where to deposit the tax that has been deducted from the salary of Employee. Please follow the below steps to Generate the Challan and deposit the tax online/Offline-

Generation of Challan

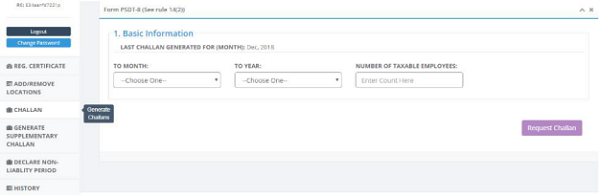

Once the Employer has created his Login ID, the employer will see the below

Click on Challan Option and the below screen will appear

Fill in the above details and generate the challan. After generation of challan visit the below web portal for creating a treasury receipt of directly making the payment to the Punjab treasury

https://www.ctp.punjabgovt.gov.in/portal.htm

Login as Guest user on the above portal and enter details as per the challan generated on Punjab State development tax portal

Select department – “Department of Finance” and then select Major Head “0028”. Once done you will see purpose “Receipt under Punjab State Development Tax”.

Then proceed with onscreen instructions for deposit of tax online or to create offline challan for deposit at SBI Bank Counter.

Trust this helps.

Author is a practicing chartered accountant based out of Amritsar and practices Income tax, Company Law, GST and other related laws. Please like this page so that i feel motivated and post more helpful posts like this.

Sir how I can find old challan for Punjab development tax if it is missing

When while making payment of challan, if there will be problem occurs in bank site, the if we again try to make payment , then message recd as “Refresh Payment Status, ” when we click the same , the message recd Oops

Please update

Dear Sir,

Please advise how to pay Professional Tax last two month we are try to pay professional tax through https://ctp.punjabgovt.gov.in/portal.htm but site not working

So please advise how to pay Professional Tax

so please suggestion how to pay Professional tax

I registered my firm today. Now when i am choosing FY 2018 to create a challan, i am getting Message “You cannot log in current session”. What is to be done now ? or i have to create the challan physically and submit the details.

Hello Sir,

After processing payment on ctp portal as guest user, an error screen came before the generation of challan. Amount has been successfully paid as per Bank Report.

I tried contacted CTP support but no one replied either on mobile or email address. Do you know how can I download the challan?

after generating challan

how and where amount to be deposited

Dear Sir,

Jai Hind!

Why to Select Department of Finance When Registration is with Dept of Excise and Taxation ?

Moreover the purpose, “Receipt under Punjab State Development Tax” is appearing under the option “Deptt of Excise and taxation” also.