1.Background :

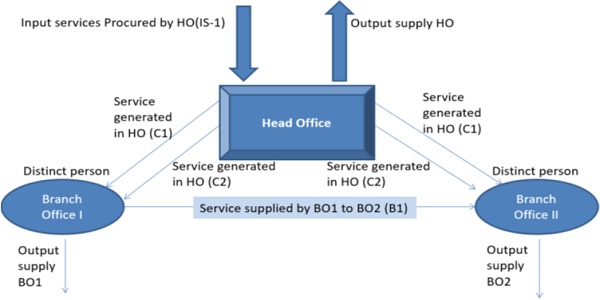

In the Current multi locational Business environments, most of the Companies are setting up their Principle Place of business in one State (Head Office/ Corporate Office) and Operating their business in different states all over India (Brach Offices). The HO, BOs are having different GST registrations in different states. The common expenditure incurred at HO should be Shared to all braches of Company.

2.What is Cross Charge?

“Cross-charge” is a concept where the GST registration of Corporate Office/HO/any other office raises invoice on the other offices (having separate GST registration), towards the services provided to such offices. The expression “Cross-charge” is not defined under the GST laws. It is a phrase colloquially referred in the industry to identify the supplies made between GST registrations of a single person. Wherever the expression “Cross-charge” is being referred in this article , it would mean as reference to the supplies made between distinct persons.

As per Section 25(4) and 25(5) of Central Goods and Services Tax Act, 2017 (“CGST”), where a person has obtained or is required to obtain registration in a state or union territory in respect of an establishment, has an establishment in another state or union territory, then such establishments shall be treated as establishments of distinct persons for the purpose of this Act. Accordingly, cross charging refers to invoicing supply of goods or services amongst distinct persons.

As per Entry 2 of Schedule 1 read with Section 7 of CGST, supply of goods or services without consideration amongst ‘distinct person’ is liable to be taxed. GST being a destination based tax, a supply of goods or services amongst the branches of a same entity located across two different states, comes under the ambit of tax. In line with the said provisions, every supply between distinct persons results in cross charge between such entities and will be undertaken by issue of appropriate documents entitling the receiver of the supply for GST credit.

3. Cross Charge & ISD:-

ISD (Input Service Distributor) and cross charge are different concepts. These two concepts are not alternatives to each although both of these concepts relate to distribution of ITC to distinct persons. In ISD there is transfer to credit attributable to beneficiary distinct person and cross charge there is charging of the goods or services to distinct persons who are beneficiary of services directly or indirectly and may not have any input service GST to be distributed. In ISD there is no services provided by any distinct person under same PAN but provided by third party.

Whereas the ISD is for services, invoices in nature of cross charge can be issued both for goods and services for distribution of credit without ISD registration. If taxable person is not registered as ISD, in that case distribution of credit must be made by cross charge invoice or debit note. Cross charge is mandatory to be followed and GST discharged lest department determines and foists liability of GST u/s 74, with no opportunity to avail credit by the recipient in view of section 17(5)(i).

There are no specific provisions in GST Act or Rules about levy of GST as cross charge. It is the term used when a taxable person provides goods or services to its own constituents having separate registration numbers. In the course of furtherance of business, if taxable person, supplies any goods or services to any other person who is distinct person having registration under one PAN or to a related person as defined in Explanation to section 15, without consideration , as an exception to Section 7(c), it shall be supply liable to GST, if the limit of turnover exceeds threshold limit in respective States.

The combined reading of Entry 2 of Schedule 1 and the concept of distinct persons in section 25(4) and (5) and related persons in Explanation to section 15, when supply is without consideration , gives rise to the taxability of supply even without consideration. The cross charge is used even when cross charge is with consideration .It means charge levied on distinct person by a distinct person. Thus, based on the provisions as stated above, any supplies between different GST registrations of the same entity, even without consideration shall be termed as a supply and shall attract GST. In line with the said provisions, every supply between distinct persons or related persons, even without consideration, whether charged or not will be liable to GST. Although, the receiver of the supply shall be entitled to GST credit subject to conditions. An important point is that in the case of the inter related persons or distinct persons, any supply or deemed supply (supply without raising invoice for cross charge) even without consideration will be treated as supply and will be taxed on the basis of valuation as per Rule 28.

The Rule 28 does not speak of supply without consideration but speaks only supplies between distinct person or related persons. In all cases that is to say supply with or without consideration it is advisable that the taxable persons raises invoices on the basis of principles of valuation u/r 28 and 30, lest Departmental Assessors are given opportunity of valuation and levy tax on the value based on Rule 28 and 30 and recover tax from the taxable person At the time of levy, it is too late for the recipient to claim of ITC since the claim of ITC is governed by time limitation and also claim of ITC is ineligible u/s 17(5)(i). The prudent practice has to first determine whether benefit of supply of goods and /or services are to other distinct person under same PAN directly or indirectly and secondly to value the same as per principles as per Rule 28, raise invoice on the value and collect GST, and issue tax invoice on the recipient, so that though tax is paid, the recipient is enabled to avail ITC. A taxable person raising invoice on its distinct person may any value if recipient is entitled to full ITC, as provided in 2nd Proviso to Rule 28.

4.Valuation of supply- The Key Issues.

As per Section 15 of CGST, value of supply, in case of distinct person is determined as per Rule 28 to 31 of CGST Rules which prescribes the method to determine the value of supply. As per Rule 28 of CGST Rules, the value of supply of goods or services or both between distinct persons as specified in Section 25(4) of CGST, other than where the supply is made through an agent, shall be,

a. The open market value of such supply; or

b. Where the open market value of supply is not available, be the value of supply of goods or services of like kind and quality; or

c. 110% of cost of acquisition of such goods or cost of provision of such other services; or

d. Any other reasonable means.

However, if the BOs are eligible to avail full ITC on the invoices raised by the HO, any value can be adopted by the company as OMV as per second proviso to Rule 28.

Concerns of valuation where recipient is not eligible for full credit

The same is not the case where the recipient is not eligible for full credit.

The recipient GST registration may not be eligible for full credit in diverse situations.

The first situation is where the recipient is engaged in an exempt supply. For instance, where the goods being supplied by the recipient GST registration is exempt (example: supply of Maize).

Non-eligibility due to restriction in credit

While the above is a clear case of the recipient registration not being entitled to input tax credit, there are other situations. In a case where the recipient registration is engaged in provision of canteen service to its employees which is taxable at 5% with the condition of not taking the input tax charged on goods and services used in supplying the service, the recipient is not eligible for full input tax credit.

Provision of exempt supply to employees

Additionally, there are also instances of recovery from employees towards supplies which are exempt, for instance, service of residential accommodation.

The distribution of ITC can be under either way of ISD or cross charge , as may be advantage and preferable on the basis of facts and circumstances of each case.

5. What are the Common Services to be shared by HO to Branch offices:-

The Top management like CEO / CFO / CS sits at HO and taking decisions / functions in respect of entire business of the company. Hence all the services should be distributed to the Brach offices. Some of the expenditure is listed below.

Accounting Services, IT and Systems Management Services, Procurement Services, Supply Chain Management Services, Sharing of brand name, logo, marketing material etc. Common bank account for business operations, operated from corporate office Centralisation of various internal functions such as tax compliances, legal, HR, IT Consultancy support etc. Infrastructure sharing by different business segments in corporate office and management time invested in decision making for different business segments Contract/price negotiations/discussions with external stakeholders, including customers, vendor, banks.

6.Method of Apportionment of ITC under Cross Charge :

There are no specific provisions under GST Law to distribute ITC on common Services. The Tax Payer has to follow the consistent and reasonable approach to apportion the Common ITC. One of the consistent approach is “ Apportion of ITC on Turnover basis”. Procurement, management and distribution of common input services are separate services provided by HO to Branch Offices (BO) and apportioned amongst the different locations in proportion to their turnover. HO will issue invoice for such common functions to BO and transfer equal input tax credit to BO enabling them to utilize such tax credit resulting into no blockage of credits.

It is noteworthy that Entry 1 of Schedule III to the CGST excludes services by an employee to the employer in the course of or in relation to his employment, from the ambit of GST laws.

7. Cross Charge in Case of SEZ :-

In Case of Cross Charge is required to a unit located in SEZ. Since supply to a SEZ is considered as a zero rated supply, cross charge may be required to be considered as export under both the options i.e. on payment of IGST or under LUT without payment of IGST.

Further, an ISD may distribute credit attributable to SEZ under an invoice and SEZ shall be eligible to avail the credit on the same.

8.Advance Rulings / Judicial Pronouncements :

| In M/s. Columbia Asia Hospitals Pvt. Ltd (GST AAAR Karnataka) Appeal Number: Order No. KAR/AAAR/Appeal-05/2018 Date of Judgment/Order: 12/12/2018 | Activities such as accounting, administrative work, etc. carried out by employees sitting at the corporate office for other offices shall be treated as taxable supply of service in terms of Entry 2 of Schedule I read with Section 7 of the CGST Act and GST is payable on the said supply of services.

The company is not discharging GST on the activities carried out by the HO for its BOs/SOs |

| Held that expenses on employment employees employed by head office whose expenses are charged to branches are liable to GST. In their case the costs incurred by head office /units for procurement of common input services, are allocated and recovered proportionately from each recipient units to determine office./plant wise profitability.

It is further held that if the head office acting only as an agent as per Rule 33 in procurement of services for its branches or units and no GST is not to be collected. The issue of valuation is decided by the AAAR. It held that allocation and recovery of the cost of the employees of Head Office will attract GST. It held that entry I of Sch. III will not be applicable since the service of employees are not to employer by supply of services from Head Office to Branches/Units. However, it held that the invoice value will be value for valuation purpose as per provisions of clause(c) of Rule 28. |

|

|

Tata Sia Airlines Limited (2021) 124 Taxmann.com 93 (AAR –Haryana) Dated 29.01.2020 |

Held that charges towards maintenance of aircrafts from Head Office to branch shall qualify as supply of service and GST is payable on the said charges recovered from Branch office and the input tax credit pertaining to services only on the procurement made by HO towards maintenance of aircraft (including lease thereof) shall be distributed by way of input service distributor mechanism and the credit pertaining to goods (including capital goods) shall be distributed by way of normal registration mechanism |

| CBIC Chairman Press Note on 22nd August 2022 | The Central Board of Indirect Taxes & Custom (CBIC) has said it is examining the issue related with taxability of activities performed by the office of an organisation in one State to the office of that organisation in another State. |

The CBIC itself has issued FAQ on Banking, Insurance and Stock, brokers section wherein it clarified that HO has an option to either cross charge (allocation of expenses) the services or raise an ISD invoice. Thus, HO was not obligated to get itself registered as an ISD where it is doing cross charge.

9.Time limit for allocation of expense or distribution of ITC

Under ISD, ITC received in a month is to be distributed in the same month. On the other hand, cross-charge invoices can be raised based on supply of services i.e. monthly, quarterly, or annually as per the arrangement between the distinct persons. Hence, time limit for availing of credit for recipient unit, in case of ISD, will start from the date invoice was issued by original supplier. However, such time limit, in case of cross charge, will start from the date of cross charge invoice.

10.Conclusion :-

The whole essence of Term “ Cross Charge” is Share the Common Services to Brach offices treated as distinctive persons.

It is pertaining to note that Supreme Court in case of State of West Bengal Vs Culcutta club (2019)110 Taxmann.com 47/76 GST 614 (SC) held that since the member of club and the club itself are one and as such, there can be no sale between them. The same analogy can be imported in to matter of cross charge and to a limited extent it can be logically inferred that since different branches / offices of an entity work hand in hand to achieve a common goal albeit having different registrations due to statutory compulsions, they inevitably continue to be inseparable and constitute one entity undertaking myriad of end number of transactions in its day to day business.

Furthermore, measuring such transactions is an arbitrary and unjust notwithstanding the rules provided for the pecuniary measurement of such transactions under GST Law.

However, to avoid the Tax litigation with the Department, where there is an element of supply of services or goods rendered among distinct taxable persons, the cost of common input functions incurred is cross charged, even though it relates to the same legal entity, to enable distribution of accumulated input tax credit among distinct taxable persons so as to utilize the same against their output tax liabilities.

11. Way Forward :

> Common services procured by HO (with GST), be distributed to all units through ISD.

> Common services procured by HO (without GST) by be cross charged to all units with GST.

> Other common expenses incurred in HO (employee cost, common goods consumed, etc.) to be cross charged with GST.

> If recipient eligible for full credit, even a nominal value can be adopted for all such common expenses.

> If recipient not eligible for full credit, valuation based on Rule 28.