Under Reporting and Misreporting of incomes. A Pragmatic Move for Transfer Pricing Adjustments

1. Back Ground:

The Finance Bill 2016, the penalty regime in income-tax law is creates insomnia among the Tax Payers. Earlier mechanism in Income Tax Act 1961 provided for a levy of penalty, for concealment of income or furnishing inaccurate particulars of income u/s 271(1) (c), of an amount between 100% to 300% of the tax sought to be evaded. The new system U/s 270A of IT Act classifies all variations made in the income into two categories – ‘under-reporting’ and ‘misreporting’. The penalties are now Triggered to 50% and 200% of the prescribed tax base computed on under-reported or misreported income respectively. The effective date of the above section from Assessment Year 2017-18.

2. Under Reporting of Income:

The Faceless Assessing Officer, Jurisdictional Assessing officer or the Commissioner (Appeals) or the Principal Commissioner or the Commissioner may during the course of any proceedings under the Act, direct that any person who has under-reported his income shall be liable to pay penalty in addition to tax, if any, on the under-reported income. By using the word ‘may’ in the new section the legislature seeks to retain the existing fundamental feature of penalty that it should not be levied unless the conduct of assessee has been contumacious.

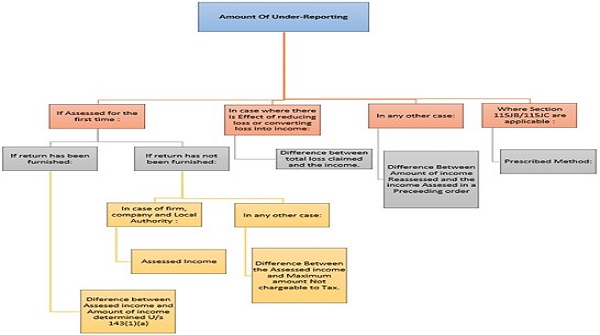

3. Instances of Under Reporting of Income:

4. Exclusions from under-reporting

Sub-section (6) of the Section 270A provides following situations where despite addition to the income during assessment / reassessment the assessee would not be treated as having under-reported his income. (This does not apply in case of misreporting)

a) Bona-fide explanation: If an assessee offers a bona-fide explanation in respect of the relevant income (alleged to be under-reported) and substantiates such explanation by disclosing all material facts. For example if assessee adopted a legal interpretation which is not accepted by department;

b) Cases of estimation of income: Where the AO determines the income on the basis of estimate provided the account are correct and complete however method (of accounting?) is such that income cannot be properly deduced therefrom;

c) Estimated self disallowances: Where the Assessee had himself made a disallowance in return of income (e.g. under section 14A) while the AO enhances the disallowance;

d) Transfer Pricing addition: TP addition would per se not be treated as under-reporting. This is subject to the condition that assessee had (a) maintained all documentation (b) declared the transaction and (c) disclosed material facts pertaining to the transaction; and

e) Undisclosed income admitted during search as per section 271AAB

5. Misreporting of income:

Section 270A(1) says that the income-tax authority may direct any person who has under-reported income shall be liable to pay penalty in addition to tax. The under-reported income can be a simpliciter under-reported income given above or it could be an under-reported income due to misreporting of income. The misreported income falls within the domain of under-reported income. The term ‘under-reported income’ encompasses ‘misreported income’.

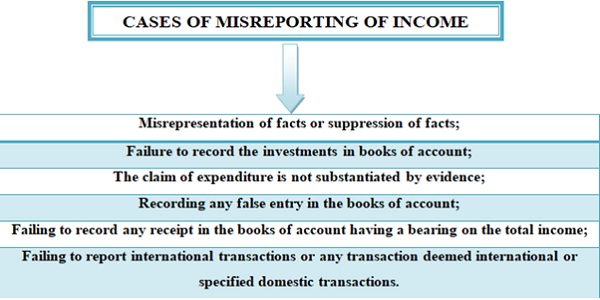

6. Instances of Misreporting of Income

7. Difference between Underreporting and Misreporting

Underreporting of income entails ignoring or just partially declaring the real income obtained, and misreporting of income refers to knowingly submitting inaccurate or misleading information regarding income.

| Particulars | Under reporting of Income | Misreporting of Income |

| Nature | While underreporting of income entails ignoring or just partially declaring the real income obtained | Misreporting of income refers to knowingly submitting inaccurate or misleading information regarding income |

| Intent | While underreporting may result from ignorance, negligence, or a failure to understand the reporting requirements, | Misreporting suggests an intentional act of submitting inaccurate data to deceive or manipulate. |

| Scope of Inaccuracy | underreporting entails an inadequate or partial income statement with/without any manipulation. | Misreporting sometimes entails falsifying income projections or inflating deductions to reduce tax payments significantly. |

| Penalties | While underreporting can result in penalties that are usually 50% of the tax due | Penalties for misreporting are typically more severe., income reporting errors can result in larger fines of up to 200% of the tax due. |

| Legal Treatment | Tax authorities usually handle underreporting as a civil tax concern and levy penalties and fines. | Misreporting is often considered a more severe offense and may occasionally be subject to criminal prosecution. |

| Detection | underreporting can make it difficult for tax officials to spot differences between reported and real income. | Misreporting might be harder to spot since it includes deliberate manipulation and the fabrication of misleading records. |

8. Immunity from Penalty u/s 270A

Section 270AA allows an Tax Payer to make an application u/s 270AA to the Assessing Officer within one month to grant immunity from imposition of penalty u/s 270A and initiation of proceedings of prosecution u/s 276C of the Act, subject to condition that:

a. Tax and interest payable is paid within the time allowed in the notice of demand;

b. No appeal is preferred against such order.

It may be noted that Immunity u/s 270AA is granted in cases of under-reporting of income and not on account of misreporting of income. Where such application is accepted by Assessing officer u/s 270AA, no appeal u/s 246A or application of revision u/s 264 can be preferred against such assessment order passed.

9. Misreporting and under reporting for Transfer Pricing adjustments

The extensive litigation surrounding Indian Transfer Pricing Provisions, the potential exposure to penalty becomes an important consideration for taxpayers. Finance Act 2016 inserted Sec. 270A w.e.f 01.04.2017 which provides for levy of penalty for ‘under reporting and misreporting of income.’ Under the new provision, specific instances of under-reporting and mis-reporting of income are provided, and the revenue authorities no longer have discretion to levy penalty.

If case Tax payers had maintained all documentation, declared the transaction and disclosed material facts pertaining to the transaction with regards to international transaction or specified domestic transaction penalty can’t be levied under section 270A of the Act. In our article we discuss, if all Transfer pricing documents are well maintained by the Tax payer and still invoke the section 270A by the AO / Appellate authorities and how to handle the matters.

While affirming or deleting the levy of penalty, Courts have taken into consideration the conduct of the assesse (whether bona fide) in disclosing all the relevant information, as also the difference of approach in selecting comparable, benchmarking methods, computation of adjustments, etc. given the complexity of TP assessments.

Tax Payers has acted under a bona fide belief (after considering all the relevant provisions) and has not acted deliberately in defiance of law or was guilty of conduct contumacious or dishonest, or acted in conscious disregard of its obligation. Thus, the taxpayer has neither under-reported nor misreported its income.

- Tax Payer maintained all Transfer Pricing Documentation required under the Provisions of Section 92D of the Act read with Rule 10D of the Income Tax Rules 1961 (“Rules”) for determinations of the arm’s length price of its international transaction based on the detailed analysis and prepared the Transfer Pricing Report. Accordingly, the price determined by the Assessee is in accordance with the provisions contained in section 92C and in the manner prescribed under that section, in good faith and with due diligence.

- The Tax Payer has disclosed/ declared all the international transactions undertaken during the year and has also provided the necessary/ appropriate documents and time to time explanations and at no point in time during the assessment proceedings did the Taxpayer display contumacious conduct. The fact that the Ld. TPO/ DRP/ITAT has adopted different interpretation of the information and explanations provided during the assessment proceedings / Appellate Proceedings would not automatically result in initiation of penalty by concluding that the Tax Payer has under-reported income.

- The determination of arm’s length price of the international transaction is a matter of interpretation and depends on the facts and opinions. Merely because transfer pricing adjustments are made by the Ld. TPO /DRP without appreciating the submissions made, it cannot automatically deem that the Taxpayer has under-reported any income in consequence of misreporting thereof.

- Further, no new evidence was unearthed during the course of the assessment proceedings/Appellate proceedings nor was any explanation provided during the course of assessment / Appeal was found false/inaccurate. This clearly proves that the Tax payer had at all point in time furnished all material facts to substantiate the explanations provided and has not acted under a malicious intent.

In view of all the above, we mentioned that the Taxpayer has carried out all the activities in bona fide belief and has disclosed all the material facts to substantiate the explanation provided. Thus, the exclusions provided in Section 270A(6)(a) squarely applies for the Transfer Pricing adjustments.

In addition to the above, we wish to draw your attention to Para 4.25 of the Organisation for Economic Co-operation and Development (“OECD”) TP guidelines which state that

“……However, owing to the nature of transfer pricing problems, care should be taken to ensure that the administration of a penalty system as applied in such cases is fair and not unduly onerous for taxpayers.”

Further, Para 4.28 of the OECD TP guidelines suggest that “…. Second, it would be unfair to impose sizable penalties on taxpayers that made a reasonable effort in good faith to set the terms of their transactions with associated enterprises in a manner consistent with the arm’s length principle.….”

Judicial Pronouncements can be placed on the following precedents wherein it was held that if the assessment is debatable, the penalty proceedings cannot survive.

Hon’ble High Court of Delhi, in case of GE Capital US Holdings INC Versus DY Commissioner of Income Tax (International Taxation) Circle 1(3) (1), New Delhi and Ors W.P (C ) 1646/2022 Dated 31.05.2024 discussed an issue wherein focus was on penalties under Sections 270A and 270AA of the Income Tax Act, 1961. Hon’ble Court scrutinized show cause notices (SCNs) issued by the Assessing Officer (AO), highlighting their ambiguity for failing to clearly specify whether penalties were attributed to under-reporting or misreporting of income. Hon’ble court quashed these show cause notices and overturned the rejection of immunity applications under Section 270AA, it opined that show cause notices in terms of which the action u/s 270A failed to specify whether the assessee was being tried on an allegation of under-reporting or misreporting.

- CIT v. M/s Harsh International Pvt Ltd (HC Delhi) ITA 622/2019 & CM APPL. 30813/2019

- CIT vs. Harshwardhan Chemical (HC Rajasthan)

Conclusion

Strict compliance with transfer pricing regulations is a must whether it is in respect of furnishing documents or information or it relates to reporting income. It is necessary for a business to understand the concept of transfer pricing and transfer pricing penalties in order to meet the compliance requirements and to eliminate the risk of non-compliance.