Article explains Meaning of job work under GST Law, Classification of job-work transaction as supply of goods or service for GST, Treatment of job work transactions in GST in diffrect Scenarios i.e. (a. Supply of goods from Principal to Job worker & returned by job worker within specified time b. Supply of goods from Principal to Job worker and returned by job worker after specified time c. Supply of goods from Principal to Job worker & then job worker sends to another job worker d. Supply of goods from Principal’s vendor directly to Job worker & e. Supply of goods from Principal to Job worker and delivered to customer/ exported from job worker’s place) and other important points related to Concept of job work under GST.

Page Contents

- > Meaning of job work:

- > Classification of job-work transaction as supply of goods or service:

- > Treatment of job work transactions in GST:

- ◊ Scenario 1:- Supply of goods from Principal to Job worker & returned by job worker within specified time

- ◊ Scenario 2:- Supply of goods from Principal to Job worker and returned by job worker after specified time

- ◊ Scenario 3:- Supply of goods from Principal to Job worker & then job worker sends to another job worker

- ◊ Scenario 4:- Supply of goods from Principal’s vendor directly to Job worker

- ◊ Scenario 5:- Supply of goods from Principal to Job worker and delivered to customer/ exported from job worker’s place

- > Other important points

> Meaning of job work:

Section 2(68) of the Act, defines “job work” as any treatment or process undertaken by a person on goods belonging to another registered person and the expression “job worker” shall be construed accordingly. The definition of job work contains three important phrases, namely:

- Treatment or process: there is no indication here that the result of the treatment or process must be manufacture; that is, the emergence of a distinct new product. Works such as fabrication, repair, Packing,

Re-packing, Testing & Inspection, Labelling etc. which are not related to manufacture also gets included under the term “job work”. Similarly, though the treatment or processing applied to the inputs provided by Principal results in emergence of a new product with different name, character and use, the transaction will qualify as job work only for the purpose of GST.

- Goods belonging to another person: A reasonable approach demands that at least one, if not more, of the primary material must be provided by the principal.

It is not required that 100% of the goods required for the treatment or process must necessarily be provided by the principal and on the other hand it is not specified that only non-essential or ancillary goods alone are provided by the principal and yet the goods attempt to operate under the job work model.

- Such person being a registered person: Interesting fact that unless the principal is himself already registered, the entire transaction will fail to be job work.

> Classification of job-work transaction as supply of goods or service:

Once a particular transaction is determined as job work transaction, the next question which arises is whether the said job-transaction is to be treated as “supply of goods” or “supply of services”. In some facts of the case, it may so happen that the job worker is supplying only labour but in many cases the job worker is supplying both material and labour. In case where the job worker is supplying both material and labour, it will be composite contract. Thus, it is important to mention, that Schedule – II of the CGST Act, 2017 which deems that certain activities to be treated as supply of goods or supply of services has a specific. Entry 3 which specifies that any treatment or process undertaken by a person on goods belonging to other person is deemed to be a supply of service. Hence, all the provisions of supply of service for determining the place of supply, time of supply, etc. will be applicable to a job work transaction.

> Treatment of job work transactions in GST:

Section 143 of the CGST Act provides that a registered person acting as Principal may send any inputs or capital goods without payment of tax to a job worker for job work and from there subsequently to another job worker and likewise. The exemption from payment of tax shall be available only if the Principal brings back to any of his place of business, the inputs/ capital goods/others as the case maybe, within the prescribed time as mentioned below:-

| Inputs | Capital Goods | Moulds and dies, jigs and fixtures, or tools |

| Within 1 year | Within 3 years | No time limit |

◊ Scenario 1:- Supply of goods from Principal to Job worker & returned by job worker within specified time

| Particulars | Supply from principal to job worker | Supply from job worker to principal |

| DELIVERY

CHALLAN |

As per Rule 45 of the CGST Rules, the Principal shall send the inputs, semi-finished goods or capital goods to a job worker under the cover of a Delivery Challan issued in triplicate.

Value of DC will be value of goods sent to job worker. |

While returning goods, the job worker shall endorse and send back the challan issued by the principal.

Also, in case where goods are delivered in parts (in piecemeal) by the job worker, the challan issued originally by the principal cannot be endorsed and a fresh challan is required to be issued by the job worker. |

| TAX INVOICE | Principal does not need to issue any Invoice to job worker. | After completion of the job work, the job worker shall return the said goods to the principal’s premises under delivery challan and prepare his tax invoice for job work charges. |

| EWAY BILL | As per third proviso to Rule 138 of the CGST Rules, 2017 where principal and job worker are situated inter-state, E-way bill must be generated without any limit. For Intra-state movement, Eway bill has to be issued by the principal based on the threshold limits specified by the respective States. | The E-way bill will be generated by the Principal on the basis of Delivery Challan. Registered job worker can also generated E-way bill |

| INPUT TAX CREDIT | As per Section 19(1) of CGST Act, 2017, the principal is allowed to take credit on inputs / capital goods sent to the job worker. Also, ITC can be availed by the principal even if such inputs / capital goods are not being first received by the principal and are directly sent to job worker. | Since principal does not issue any tax invoice to the job worker, there is no question of Input Tax Credit to be claimed by the job worker. |

| RECORDS TO BE MAINTAINED | The Principal is required to maintain proper books of accounts for inputs and capital goods sent on job work basis. The details of challans in respect of goods dispatched to or received from a job worker or sent from one job worker to another shall be reported in Form GST ITC-04 | No such requirement on job worker’s part. |

| RETURN TO BE FILED | The details of delivery challans in respect of goods dispatched to a job worker or received from a job worker or sent from one job worker to another during a quarter shall be reported in FORM GST ITC-04 furnished for that period on or before the twenty fifth day of the month succeeding the said quarter. | In case of registered job worker, one shall report its supply in GSTR 1 and GSTR 3B |

◊ Scenario 2:- Supply of goods from Principal to Job worker and returned by job worker after specified time

| Particulars | Supply from principal to job worker |

Supply to Job Worker to Principal |

| DELIVERY CHALLAN | Same as scenario 1 | Same as scenario 1 |

| TAX INVOICE | In case where inputs, semi- finished goods and capital goods are not returned to principal as per prescribed time limit then the same will be treated as Supply of the Principal & the principal has to issue tax invoice for the goods delivered for Job Work. Value of the goods shall be considered as per the provisions of Section 15 of CGST Act, 2017 & as per Rule 30 & Rule 31 of CGST Rules, 2017 | Same as scenario 1

Tax Invoice will also include value of goods along with job work charges. |

| E-WAY BILL | Same as scenario 1 | Same as scenario 1 |

| INPUT TAX CREDIT | Same as scenario 1 | Where goods are not returned in prescribed period, principal has to issue invoice and declare such supplies in his return for that particular month in which the time period of one year/ three years has expired.

Since date of invoice will be of current period, job worker is eligible to avail the input tax credit of the same |

| RECORDS | Same as scenario 1 | Same as scenario 1 |

| RETURN TO BE FILED | Same as scenario 1

Since it will be treated as supply, it shall be declared in FORM GSTR 1 and FORM GSTR 3B and the principal shall be liable to pay the tax along with applicable interest. Value of such deemed supply will be the value as declared in the challan by principal (without including transportation cost and job work charges) |

Same as scenario 1 |

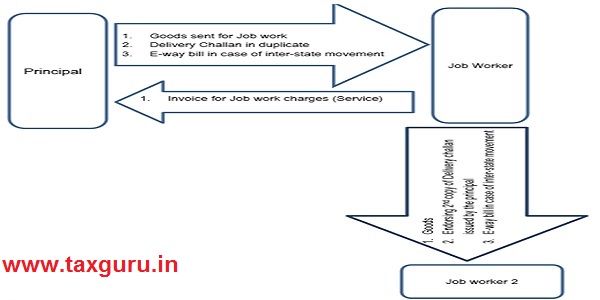

◊ Scenario 3:- Supply of goods from Principal to Job worker & then job worker sends to another job worker

| Particulars | Supply from principal to job worker | Supply from job worker to principal |

| DELIVERY CHALLAN | Same as scenario 1 | In case goods are sent from one job-worker to another, either the job-worker or the principal may issue a separate challan or alternatively, the original challan issued by the principal can be endorsed. |

| TAX INVOICE | Same as scenario 1 | Same as scenario 1 |

| E-WAY BILL | Same as scenario 1 | Same as scenario 1 |

| INPUT TAX CREDIT | Same as scenario 1 | Same as scenario 1 |

| RECORDS TO BE MAINTAINED | Same as scenario 1 | Same as scenario 1 |

| RETURN TO BE FILED | Same as scenario 1 | Same as scenario 1 |

◊ Scenario 4:- Supply of goods from Principal’s vendor directly to Job worker

| Particulars | Supply from principal to job worker | Supply from job worker to principal |

| DELIVERY CHALLAN | The challan needs to be issued by Principal even in case where the goods are sent to the job worker directly from the place of a supplier. | Same as scenario 1 |

| TAX INVOICE | Same as scenario 1 | Same as scenario 1 |

| E-WAY BILL | Same as scenario 1

E-way Bill has to be issued by Principal irrespective of the fact whether the movement of goods has taken place from the place of business of Principal (Buyer) or the Supplier or job worker |

Same as scenario 1 |

| INPUT TAX CREDIT | Same as scenario 1 | Same as scenario 1 |

| RECORDS TO BE MAINTAINED | Same as scenario 1 | Same as scenario 1 |

| RETURN TO BE FILED | Same as scenario 1 | Same as scenario 1 |

| OTHER POINTS | Invoice to be issued by the supplier in the name of the principal wherein the job worker’s name and address shall also be mentioned as the consignee, in terms of rule 46(o) of the CGST Rules.

In case of import of goods by the principal which are then supplied directly from the customs station of import, the goods may move from the customs station of import to the place of business of the job worker with a copy of Bill of Entry. In both the above cases, the principal shall issue the DC & send the same to the job worker directly. |

◊ Scenario 5:- Supply of goods from Principal to Job worker and delivered to customer/ exported from job worker’s place

| Particulars | Supply from principal to job worker |

Supply from job worker to customer/ exports |

| DELIVERY CHALLAN | Same as scenario 1 | While sending goods, the job worker send the challan to the Customer directly along with the Tax Invoice generated by Principal |

| TAX INVOICE | Same as scenario 1 | Job Worker shall raise invoice to Principal for job work charges & principal shall issue invoice to customer.

It is also clarified that in case of exports directly from the job worker’s place of business/premises, the LUT or bond, as the case may be, shall be executed by the principal |

| E-WAY BILL | Same as scenario 1 | Same as scenario 1 |

| INPUT TAX CREDIT | Same as scenario 1 | Same as scenario 1 |

| RECORDS TO BE MAINTAINED | Same as scenario 1 | Same as scenario 1 |

| RETURN TO BE FILED | Same as scenario 1

Additionally, the supply made by the principal through the job worker place of business/ premises shall be reported in Form GSTR 1 & Form GSTR-3B |

No such requirement on job worker’s part |

Other Points:

a. Section 143 of the CGST Act provides that the principal may supply goods from the place of business/ premises of an unregistered job worker only if he declares such job worker’s place of business /premises as his additional place of business. Incase of registered job worker there is no such requirement.

b. Also if the job worker is situated in a different state as that of the principal, then the principal can directly supply the goods from the place of business of the Job worker only if the job worker is registered.

c. Since the supply is being made by the principal, it is clarified that the time, value and place of supply would have to be determined in the hands of the principal irrespective of the location of the job worker’s place of business/premises.

◊ Scenario 6:- Supply from Unregistered Principal to Job worker and returned back.

If Principal is unregistered then, job work will merely be work and the provisions of job work covered by section 143 of the Act will not be applicable.

The same may be deemed supply of job-worked goods and the valuation will have to be done as per Rule 27 to Rule 31 of the CGST Rules.

> Other important points

◊ Rate of Job Work:– It is covered under Entry 26 of Notification No. 11/2017- Central Tax (Rate) dated 28.06.2017. Rates prescribed are 3%, 5%, 12% 18% based on nature of Job Work.

◊ Registration By Job Worker:- A Job worker is required to obtain registration incase his aggregate turnover, to be computed on all India basis, in a financial year exceeds the threshold limit regardless of whether the principal and the job worker are located in the same state or in different states.

◊ Treatment of Waste & Scrap:- Waste & Scrap generated during job work can be supplied as under:-

i. If the job worker is registered, then it can be supplied by the job worker directly from his place of business, on payment of appropriate tax applicable on the said waste / scrap.

ii. If he is not registered, then the waste / scrap generated should be returned to the principal along with the goods and such waste / scrap would be supplied by the principal on payment of tax. Alternatively, the principal may supply waste / scrap directly from premises of job worker under his invoice on payment of tax.

iii. The principal should also maintain proper records of clearance of waste / scrap from the premises of the job worker.

◊ Loss/ Destruction of Goods:-

i. Where goods are sent by the principal to the job worker and same are lost/ destroyed due to some unavoidable circumstances, goods will not be returned by the job worker to the principal.

ii. Since goods are lost or destroyed section 17(5) (h) will be applicable and principal is required to reverse the credit on inputs or capital goods and it will not be treated as deemed supply as per section 19(3).

Authors-

CA Shreyans Dedhia, Partner of MASD , Email ID : shreyans.dedhia@masd.co.in

Harshil Mehta, Consultant , Email ID : harshil.mehta@masd.co.in

It is a wonderful article. I have benefited a lot by reading this brief which has given me best understanding of concept of job work under Indian GST Act. I am legal practitioner doing practice in the field of GST laws of Pakistan and Canada. In Pakistan Job work is referred to as Toll manufacturing or contract manufacturing. Here sales tax on goods is levied by Federal Government whereas sales tax on services is administered by 4 provincial governments. Federal law treats toll manufacturing as “Manufacture” and required the job worker to pay sales tax to government whereas provincial sales tax laws treat “Toll manufacturing” as service and require the job workers to pay sales tax to provincial governments. Indian GST law is in line with Canadian HST law to some extent

Nicely explained all scenarios … need your views similar on repair work coming under AMC/ Warranty. where here is no change in functionality of material or equipment.