There is no ambiguity that for every taxpayer provision related to refunds are always most favourite under any Act and GST Act is no different. In fact, every organization designs their business process in such a manner so as to make optimum utilization of the refund provisions

With the help of this article, we shall provide the readers the ready reckoner and the important points that should be kept in mind while filing refund applications incorporating all the relevant Sections, Rules and Circulars upto 31 March 2020

For the sake of easy understanding, we shall be discussing the refund provisions in the following manner:

1. Points to be considered while filing refund applications

2. Procedure of filing refund application

3. Types of refund

POINTS TO BE CONSIDERED WHILE FILING GST REFUND APPLICATIONS

> Refund can only be filed electronically. Manual Application can be allowed to be filed by the authorities only in exceptional circumstances

> The refund may be filed for a tax period or by clubbing successive tax period, which may spread across different financial years also

> Many times the ITC on inward supplies is spread in multiple months whereas the Zero Rated supplies or inverted duty supplies are done in few months, in these cases the period of refund should be selected the maximum to ensure higher amount of refunds

> Refund can be obtained for tax and interest, if any, before the expiry of two years from the relevant date. Relevant date is specified against every refund case given below

> Refund shall not be paid to the applicant if the amount is less than Rs. 1,000. This amount shall be applied for each tax head separately and not cumulatively

> The refund allowed may be adjusted with any tax or other outstanding from the applicant

> If the date of credit of refund in the bank account of the applicant exceeds 60 days from the date of generation of ARN, then the applicant shall be eligible for interest @6% for the number of days beyond such 60 days till the actual date of credit of refund in the bank

> In the cases where refund of Input Tax Credit is involved, i.e. type (a), (c) and (e) given below

-

- Refunds can be filed chronologically, i.e. once a refund is submitted for any tax period, subsequent refund application for previous period shall not be allowed

- Refund of only that ITC shall be allowed which is appearing in Form GSTR-2A of the applicant. This guideline given in Circular is against the eligibility of ITC as given in Act and Rules and is subject to litigation

- Transitional Credit cannot be treated as part of Net ITC and hence no refund allowed

> In the refund of tax falling under type (i) to (l) given below, the refund shall be allowed to the applicant in the same proportion in which original payment was made, i.e. where the tax to be refunded has been paid by Credit as well as Cash ledger, the refund to be paid in credit ledger and cash (i.e. Bank Account) shall be in the same proportion in which they were debited during the relevant period

> The complete refund is processed for all heads of tax, i.e. IGST, CGST, SGST and cess by the same jurisdictional officer to whom the refund application is forwarded by the portal

> In the case of refund on account of export of goods with payment of tax, the shipping bill filed by an exporter is deemed to be an application for refund along with details filled in GSTR-1 and GSTR-3B, hence the same is not discussed below

PROCEDURE OF FILING GST REFUND APPLICATION

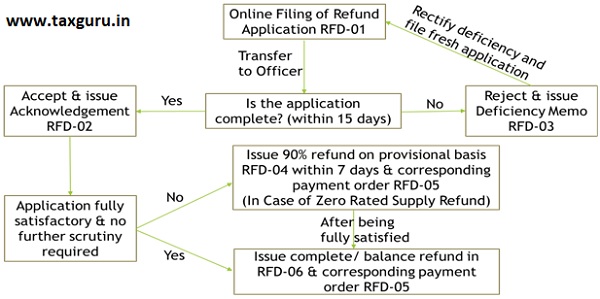

a) Online Application Form GST RFD-01

The application for refund shall be supported by various documents depending upon the category of refund. The online portal provides facility to upload 10 files of 5MB each. The application is transferred to the jurisdiction officer for the purpose of further processing

b) Deficiency Memo Form GST RFD-03

if any deficiency is noticed in the application submitted by the taxpayer, the jurisdictional officer shall issue deficiency memo in Form RFD-03 within 15 days of submission of application, requiring the taxpayer to file fresh refund application after rectification of deficiencies. Any amount of Input Tax Credit / Cash debited from Ledgers shall be re-credited automatically in the ledgers of the taxpayer. Important point to be noted is that the application filed after Deficiency memo is treated as a fresh application and the limitation period of 2 years shall also apply to the new application

c) Acknowledgement Form GST RFD-02

If the refund application is complete in all aspects, acknowledgement in Form RFD-02 shall be issued within 15 days of submission of application. Once an acknowledgement has been issued no deficiency memo on whatsoever grounds can be issued by the officer.

d) Provisional Order (RFD-04) / Payment Order (RFD-05) / Refund Order (RFD-06)

-

- The officer upon being satisfied that prima facie the refund is due towards the applicant may sanction 90% of the refund amount on a provisional basis within seven days of the refund application in Form RFD-04 in the case of any claim for refund on account of zero-rated supplies

- However, the officer may upon being fully satisfied about the eligibility of the refund and is of opinion that no further scrutiny is required, directly issue refund order Form RFD-06, which is practically happening in mostly all the cases

- Along with issue of the above forms, payment order Form RFD-05 shall be issued for the amount sanctioned and the same shall be electronically credited to the applicants bank account.

e) Other Forms (RFD-07 / RFD-08 / RFD-09)

-

- Form RFD-07 is prescribed in Rules for adjustment of refund with any outstanding demand from the applicant, but this is also now incorporated in Form RFD-06

- If officer is of the view that certain refund amount is non-admissible, then notice is Form RFD-08 shall be issued asking reasons why the refund should not be rejected, against which the applicant shall submit reply in Form RFD-09

TYPES OF GST REFUND

a) Refund of unutilized input tax credit (ITC) on account of exports without payment of tax

-

- The amount of refund shall be the least of:

- (Zero Rated Turnover/Adjusted Total Turnover) * Net ITC

- Balance in Electronic Credit Ledger at the time of filing of refund

- Balance in Electronic Credit Ledger at the end of period for which refund is filed

- The relevant date in the case of goods shall be:

- If exported by sea or air, the date when ship or aircraft leaves India

- If exported by land, the date when such goods passes frontier

- If exported through Post, the date of despatch of goods by Post Office

- The relevant date in the case of services shall be the date of:

- Receipt of convertible foreign exchange or Indian rupees wherever permitted by the RBI, where services have been completed prior to receipt of payment

- Issue of invoice, where payment had been received prior to issue of invoice

- In case of export of goods, the shipping bill details as uploaded in the refund application in statement 3 shall be checked by the officer with ICEGATE. In the case of services BRC/ FIRC details shall be uploaded as a proof of receipt of payment

- ITC paid on Capital Goods shall not be included in Net ITC for the purpose of computing refund

- Receipt of convertible foreign exchange, or Indian rupees wherever permitted by RBI is a precondition in case …..of refund against export of services only and not in the case of goods

- The refund cannot be denied even if LUT has not been furnished by the applicant on a timely basis and such delay can be condoned by the officer. Also if the applicant fails to export the goods within a period of 3 months from the date of invoice, the jurisdictional commissioner may consider granting extension of time limit for export

- If there is difference in the value of invoice and shipping bill, then lower of the two should be considered for the purpose of refund

- A taxpayer who has received goods at GST 0.05% and 0.10% under Notification 40/2017 and 41/2017 – Central Tax Rate and Integrated Tax Rate respectively can export the goods only against LUT and then file refund under this category

- The amount of refund shall be the least of:

b) Refund of tax paid on export of services with payment of tax

-

- Unlike the case of export of goods with tax (refer last paragraph of points to be considered for goods), refund in the case of export of services with payment of tax needs to be filed separately

- The details of the invoices and corresponding BRC/ FIRC shall be uploaded in statement 2

- The relevant date remains the same as mentioned in above point

c) Refund of unutilized ITC on account of supplies made to SEZ Unit/SEZ Developer without payment of tax

-

- The amount of refund shall be the least of:

- (Zero Rated Turnover/Adjusted Total Turnover) * Net ITC

- Balance in Electronic Credit Ledger at the time of filing of refund

- Balance in Electronic Credit Ledger at the end of period for which refund is filed

- The refund shall be filed once the supply is admitted in full in SEZ for authorised operations as endorsed by the specified officer of the zone

- The details of supply to SEZ shall be uploaded in statement 5

- The amount of refund shall be the least of:

d) Refund of tax paid on supplies made to SEZ Unit/SEZ Developer with payment of tax

-

- The refund shall be filed once the supply is admitted in full in SEZ for authorised operations as endorsed by the specified officer of the zone

- The details of supply to SEZ shall be uploaded in statement 4

e) Refund of unutilized ITC on account of accumulation due to inverted tax structure

-

- The amount of refund shall be the least of:

- {(Turnover of inverted rated supply) x Net ITC ÷ Adjusted Total Turnover} – tax payable on such inverted rated supply

- Balance in Electronic Credit Ledger at the time of filing of refund

- Balance in Electronic Credit Ledger at the end of period for which refund is filed

- The supplier supplying goods to exporter at GST 0.05% and 0.10% as detailed above shall also be eligible to file refund in this category

- ITC paid on Capital Goods and Input Services shall not be included in Net ITC for the purpose of computing refund

- If rate of tax has been reduced from upper rate to lower rate on any goods, the same shall not be eligible for refund in this case

- The relevant date is the due date of furnishing of the return under Section 39 for the period in which such claim for refund arises

- The details of inward and outward supplies along with corresponding tax values shall be uploaded in statement 1A

- The amount of refund shall be the least of:

f) Refund to supplier of tax paid on deemed export supplies

-

- For the purpose of filing refund, duly signed copy of invoice by the recipient EOU or acknowledgement by jurisdictional tax officer about receipt of said deemed export supplies by the authorisation holder shall be needed

- An undertaking that the recipient shall not claim ITC nor refund of tax charged in respect of such supplies

- The details of outward supplies shall be uploaded in statement 5B

- The relevant date is the date on which the return relating to such deemed exports is furnished

g) Refund to recipient of tax paid on deemed export supplies

-

- The amount of refund shall be the least of:

- Net Input ITC of Deemed Exports

- Balance in Electronic Credit Ledger at the time of filing of refund

- Balance in Electronic Credit Ledger at the end of period for which refund is filed

- A declaration that supplier has not availed refund with respect to said supplies

- The details of inward supplies shall be uploaded in statement 5B

- The amount of refund shall be the least of:

h) Refund of excess balance in Electronic Cash Ledger

-

- Balance lying in Electronic Cash ledger, which can be on account of excess challan payment or due to excess TDS deduction can be claimed as refund under this category

i) Refund of excess payment of tax

-

- Supporting documents to establish excessive payment of tax shall be uploaded with the refund application

j) Refund of tax paid on intra-State supply which is subsequently held to be inter-State supply and vice versa

-

- The details of supplies wherein the Place of Supply has changed shall be uploaded in the refund application in statement 6 stating the initial Place of Supply considered along with tax paid and the re-assessed Place of Supply with taxes

k) Refund on account of assessment/provisional assessment/appeal/any other order

-

- Reference number and copy of the assessment / appeal / any order along with proof of payment of pre-deposit for which refund is being claimed shall be uploaded

l) Refund on account of “any other” ground or reason

-

- Any other refund case which is not included in any of the cases can be claimed in this category mentioning the specification and amount of refund at the portal

Procedure to claim GST refund for Goods Export by Post Office “PBE-II”?

we have claimed refund for rs.5 lac,

due to come service bills of rs 1.5 lac , our total refund we get from gst department is 3.5 lac,rs 1.5 lac is rejected due to service bills

balance of rs 1.5 lac rupees how can we apply to transfer in our gst electronic credit ledger

Sir,

If there is huge balance in Electronic Credit Ledger can we claim the refund under ‘Any other category’. Kindly guide.

Drea Sir,

We received FY 2020-21 business event advance during FY 2019-20 from our customer as and when we received an advance we have been discharged the GST liability issuing the receipt voucher to our customer and been filled our GSTR-1 and GSTR-3B but due to this Covid-19 we announced that FY 2020-21 event been cancelled, so our customers are asking their 100% advance refund, so we have been refunding them their advance paid money and issuing the refund voucher and the same time we are filing FORM GST RFD-01 under the category “Refund of excess payment of tax” do advice me do we need to declare this refund amount any of the monthly return like GSTR-1 / GSTR-3B if yes kindly let us know under which return and which head do we need to mention this and the same time if your answer is “NO” not required to disclose in monthly return than how come already disclosed advance amount in GSTR-1 & GSTR3B will be nullified, since we are not giving any Tax invoice reason being work/Service not provided thanks.

Sir, I have filed for refund application under section 19 of IGST Act (Tax wrongfully paid under IGST but later paid under CGST & SGST. However my refund application was rejected. What is the next step? Do I have to file an appeal? If so under what head? Demand Order or Registration Order?

SIR

I HAVE APPLIED FOR REFUND FOR THE YEAR 17-18 ON BEFORE 30.6.20 FOR DIFFERENCE OF RATE OF TAX , BUT THE OFFICER HAS REJECTED THE SAME AS TIME WORD . IT IS WRONG OR RIGHT

Hello Sir,

I have a doubt regarding GST Refund of ITC in the case of Exports without payment of tax :

We have input for two years ie 18-19 and 19-20, but export invoices were issued in the year 19-20.

While filing Refund applicatio for 18-19, the eligible amount of refund came to zero as there was no export of goods.

can i claim total input of 18-19 and 19-20 in the 19-20 itself as we have exports in the year 19-20

Hi Sir,

We are doing export of services. We have 3 GSTN in states Tamil Nadu, Delhi and Maharashtra. There is accumulation of ITC in the Electronic Leger in all the GSTN. But, all the Export sales (Zero Rated Suply) are reported against Maharashtra GSTN. Could you clarify whether we can claim refund agaist Tamilnadu GSTN where accumulation ITC is more than other States?

Could you revert on the procedure to apply for refund in this case

Dear sir, we have refund of un-utilised credit on account of export without payment of Tax. I have applied refund application in “Any other(specify)” category under circular 110/29/2019 dtd 3 rd Oct19. Tax officer said Tax period selected is only Jan’20 (as my export is in January 20 minth) which should be Dec’19-Jan’20 as we have ITC in both months. But portal is not giving option to select two months. only one month can be selected which is not giving correct refund to me. What is solution in this case.

Hello sir

I have read all your articles at taxguru.

I have a doubts if the exporter imported inputs under Advance Authorization and finished goods exported India on payment of IGST.

N.N.18/2015-Customs, dated 01.04.2015 as amended vide N.N.79/2017-Customs, dated 13.10.2017 ineralia grants exemption from payment of Basic Custom duty and Integrated tax to inputs imported under advance authorization scheme.

so i have below doubts:

1. if he imports partially inputs availing the above mentioned notification(i.e. without IGST payment import), then under which Rule he claimed refund (Whether Rule 89(4) or Rule 89(4B) ? then shall he file two refund application for same tax period.

2. if he import all inputs availing the above mentioned notification(i.e. without IGST payment import), then under which Rule he claimed refund. (Whether Rule 89(4) or Rule 89(4B) ? and If the exporter have claimed refund under Rule 89(4B), how he quantified the refund amount as there is no refund formula ?

Thanking You

Sunil JB