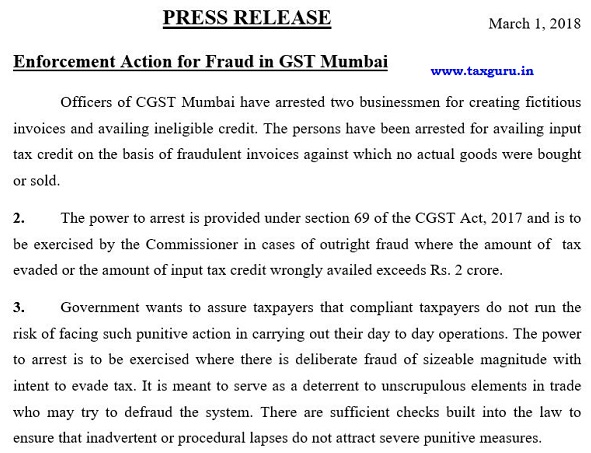

Enforcement Action for Fraud in GST Mumbai

Officers of CGST Mumbai have arrested two businessmen for creating fictitious invoices and availing ineligible credit. The persons have been arrested for availing input tax credit on the basis of fraudulent invoices against which no actual goods were bought or sold.

The power to arrest is provided under section 69 of the CGST Act, 2017 and is to be exercised by the Commissioner in cases of outright fraud where the amount of tax evaded or the amount of input tax credit wrongly availed exceeds 2 crore.

Government wants to assure taxpayers that compliant taxpayers do not run the risk of facing such punitive action in carrying out their day to day operations. The power to arrest is to be exercised where there is deliberate fraud of sizeable magnitude with intent to evade tax. It is meant to serve as a deterrent to unscrupulous elements in trade who may try to defraud the system. There are sufficient checks built into the law to ensure that inadvertent or procedural lapses do not attract severe punitive measures.

Source- CBEC

Fraud of even 1 Rs by way of fictitious bill, should be considered equal offence.

Why is the arrestee’s identity held back?

Not appreciated such ‘fictitious invoices and availing ineligible credit’ in any manner.

Similarly,

where is ‘One Nation-One Law’ rule, minister’s total income, Perquisites is tax free on the cost of tax payer’s hard earned money ?

I feel Law should be respected, equal to all.