Key highlights of the Circulars issued by GST Policy Wing, CBIC on 18th February 2019 :

The GST Policy wing of CBIC has issued 3 circulars today clarifying 3 issues –

1. Requirement of disclosing details of Inter-State Supplies made to Unregistered Persons in return GSTR 3B and GSTR 1

2. Disclosing Place of Supply (POS) along with Name of the State on invoices issued for Inter-State Supplies

3. Nature of tax payment made for supply of warehoused goods deposited in a Customs Bonded warehouse for the period July 2017 to March 2018.

The Key highlights of the Circulars along with our comments on impact is summarized below for ease of understanding –

| Sl. No | Circular No and date | Highlights of the Circular | Impact of the Circular |

| 1 | Circular No. 89/08/2019-GST dated February 18, 2019 | Mentioning details of inter-State supplies made to unregistered persons in Table 3.2 of FORM GSTR-3B and Table 7B of FORM GSTR-1

A registered supplier is required to mention the details of inter -State supplies made to unregistered persons, composition taxable persons and UIN holders in Table 3.2 of FORM GSTR-3B. Further, the details of all inter-State supplies made to unregistered persons where the invoice value is up to Rs 2.5 lakhs (rate-wise) are required to be reported in Table 7B of FORM GSTR-1 The apportionment of IGST collected on inter–State supplies made to unregistered persons in the State where such supply takes place is based on the information reported in Table 3.2 of FORM GSTR-3B by the registered person. As such, non-mentioning of the said information results in- (i) non-apportionment of the due amount of IGST to the State where such supply takes place; and (ii) a mis-match in the quantum of goods or services actually supplied in a State and the amount of integrated tax apportioned between the Centre and that State Contravention of the above shall attract penal action under the provisions of section 125 of the CGST Act |

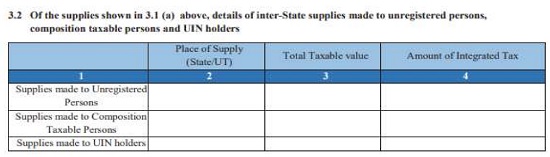

The business needs to correctly furnish details while filing GSTR 1 and GSTR 3B. Table 3.2 of GSTR 3B is for reporting inter -State supplies made to unregistered persons, composition taxable persons and UIN holders.

Also, Table 7B of GSTR 1 mandates reporting details of all inter-State supplies made to unregistered persons where the invoice value is up to Rs 2.5 lakhs (State-wise and rate-wise) Non Reporting of aforesaid details does not impact any tax liability since taxable value is reported in Table 3.1 of GSTR 3B and only break-up of the above is required in Table 3.2. The non-reporting of correct details has lead to – (i) Non-apportionment of IGST to the State where such supply takes place. (ii) Mismatch of quantitative details of Goods or Service or both with amount of IGST apportionment between Centre and State (Refer to Table 3.2 of GTSR 3B enumerated below) |

| Table 3.2 of GTSR 3B |  |

||

| 2 | Circular No. 90/09/2019-GST dated February 18, 2019 | Compliance of Rule 46(n) of the CGST Rules, 2017 while issuing invoices in case of inter- State supply

A Registered person supplying taxable goods or services or both should issue tax invoice which shall correspond to requirements enumerated in Sec 31 of CGST Act, 2017 and Rule 46 of CGST Rules, 2018. A number of Registered Persons (especially Banking, Insurance and Telecom Sectors, etc) do not mention Place of Supply and name of State (for Inter-State supply) for Inter-State Supply tax invoices. Since, GST is a destination-based consumption tax, the tax paid by a registered person accrues to the State in which the consumption of goods or services or both takes place. Contravention of the above shall attract penal action under the provisions of section 125 of the CGST Act |

All registered persons making supply of goods or services or both in the course of inter-State trade or commerce to specify the place of supply along with the name of the State in the tax invoice.

Sections 10 and 12 of the Integrated Goods and Services Tax Act, 2017 deals with the place of supply in case of supply of goods and services respectively. Such disclosure shall ensure that the tax shall accrue to the State in which the consumption of goods or services or both takes place |

| 3 | Circular No. 91/10/2019-GST dated February 18, 2019 | Clarification regarding tax payment made for supply of warehoused goods while being deposited in a customs bonded warehouse for the period July, 2017 to March, 2018

CBIC had issued a circular No. 3/1/2018-IGST on 25th May 2018 clarifying applicability of integrated tax on goods transferred/sold while being deposited in a warehouse. It was clarified that from 1st of April, 2018 the supply of warehoused goods before their clearance from the warehouse would not be subject to the levy of integrated tax For the period from 1st of July, 2017 to 31st of March, 2018 (hereinafter referred to as the “said period”), the GSTN portal did not have the facility to enable the taxpayer to report payment of integrated tax, in the details required to be submitted in FORM GSTR-1, for such supplies especially where the supplier and the recipient were located in the same State or Union territory. As such where the facility to report such transactions as IGST was not available on GSTN portal, tax payers had reported it as Intra-State Supplies and paid Central Tax and State Tax instead of Integrated Tax. An one-time exception has been made by CBIC, where taxpayers have discharged CGST & SGST, instead of IGST, during the period July, 2017 to March, 2018. It would be deemed compliance with the provisions of law as far as payment of tax on such supplies is concerned as long as the amount of tax paid as central tax and state tax is equal to the due amount of integrated tax on such supplies. |

CBIC had issued a circular No. 3/1/2018-IGST dated 25th May 2018 clarifying applicability of integrated tax on goods transferred/sold while being deposited in a warehouse.

It was clarified by CBIC that from 1st of April, 2018 the supply of warehoused goods before their clearance from the warehouse would not be subject to the levy of integrated tax. The circular deals with payment of tax for the period 1st of July, 2017 to 31st of March, 2018. Where the supplier and recipient were located in the same State, the GSTN Portal did not have facility to enable taxpayers to report Inter-State supplies (IGST) and hence, tax payers during the period July 2017 to March 2018 have reported the same as Intra-State supplies and discharged Central and State Tax instead of Integrated Tax. CBIC has decided to create an one-time exception by issuing this circular and has clarified that suppliers who have paid central tax and state tax on such supplies, during the said period, would be deemed to have complied, provided there is no short fall in payment of tax on such supplies. |

Note – This is for information only. For exact details of changes, the notification/Circular may please be referred to.

Copy of Circulars issued by the GST Policy Wing, CBIC can be viewed by clicking at the links provided below –

| Title | Notification No. | Date |

|---|---|---|

| GST on supply of warehoused goods while being deposited in a customs bonded- Reg. | Circular No. 91/10/2019-GST | 18/02/2018 |

| Mentioning of place of supply with State in GST invoice is must in case of inter- State supply | Circular No. 90/09/2019-GST | 18/02/2019 |

| Reporting of Inter-State supplies to unregistered persons in Form GSTR-3B and Form GSTR-1 | Circular No. 89/08/2019-GST | 18/02/2019 |

About TaxMarvel: TaxMarvel is a Consulting firm focused on providing GST services to small and medium enterprises. We offer host of GST Services be it registration or compliance or consulting or litigation support. We make GST easy for businesses by bringing in technology and subject matter expertise. We are present at following locations: Hyderabad, Kolkata, New Delhi and Bangalore.

You can contact us at: support@taxmarvel.com | +91-9903129064

Thanks a lot with infomation

I am obliged to you because of the stile of throwing light to a subject in time – great going

Thanks a lot for these valuable information