K S Basavaraj

Joint Commissioner of Commercial Taxes, Taxes (E Audit)

CORE FIELD AMENDMENT OPTION IS ENABLED FROM 27/09/2017

♦ What all can be amended?

1. Business Details

2. Promoter/Partner Details

3. Principal Place of Business

4. Additional Place of Business

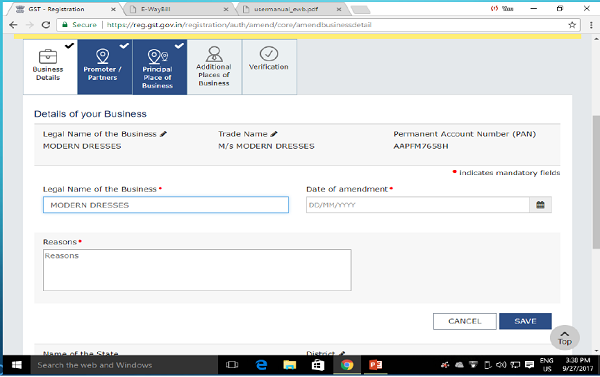

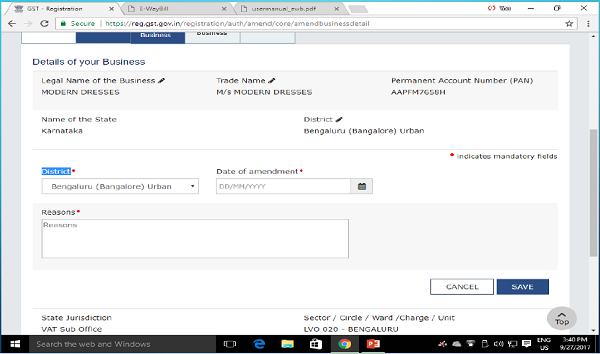

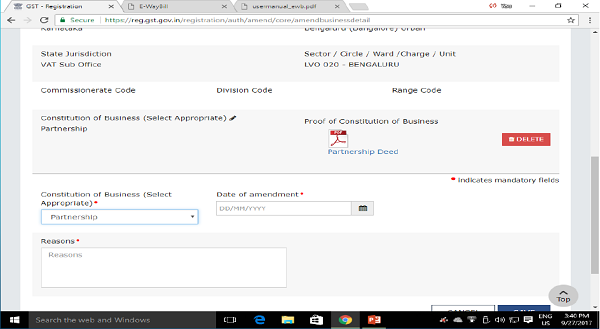

BUSINESS DETAILS

➢ Legal Name of the Business

➢ Trade Name

➢ District

➢ Constitution of Business

• Mandatory fields to be filled- Amendment (New name/district/constitution)

Date of Amendment

Reason for Amendment

DOCUMENT UPLOADED AS A PROOF OF CONSTITUTION OF BUSINESS SHOULD BE DELETED WHILE AMENDING IT

LEGAL NAME OF THE BUSINESS

TRADE NAME

DISTRICT

CONSTITUTION OF BUSINESS

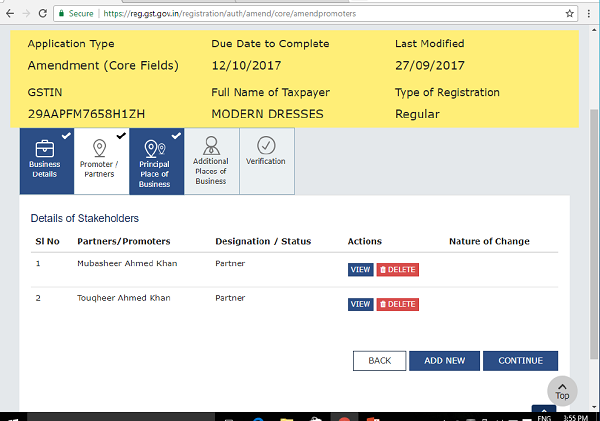

PROMOTER/PARTNER DETAILS

- New Partners/ Promoters/ Members/Directors of the board wrt to the constitution of business can be ADDED and earlier ones can be DELETED

- Any changes with respect to existing partner/promoter have to be done under Non core amendment

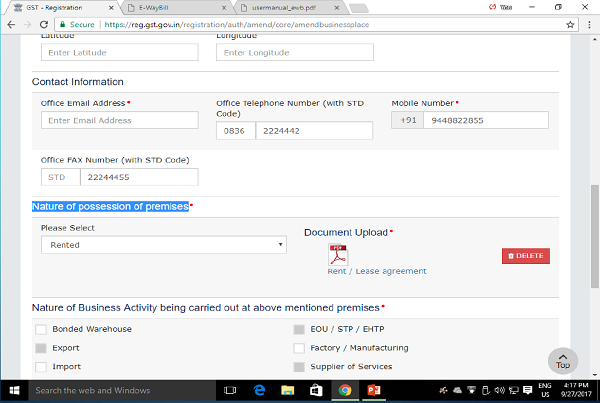

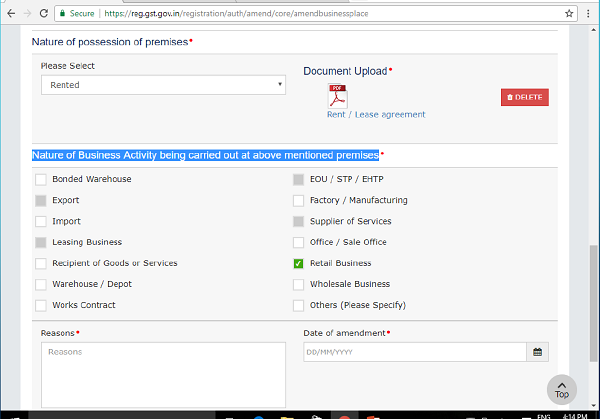

PRINCIPAL PLACE OF BUSINESS

What all can be amended?

(to be accompanied by Date of Amendment and Reasons)

- Address

- Contact Information

- Nature of possession of premises (Document uploaded earlier to be deleted to amend)

- Nature of Business Activity being carried out at above mentioned premises (For Composition taxable persons, EXPORT, LEASING BUSINESS AND SERVICES OPTION are disabled)

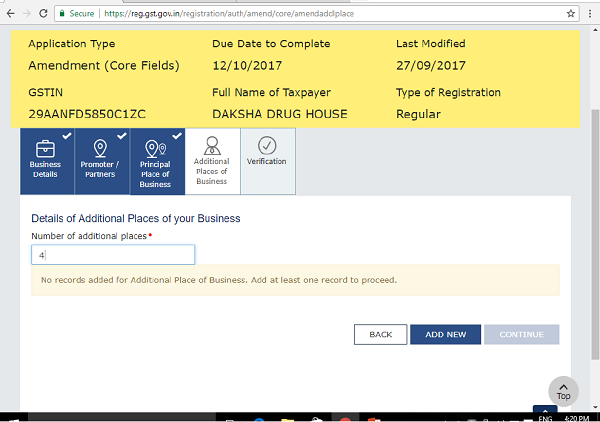

ADDITIONAL PLACE OF BUSINESS

- Amendment in additional place of business is similar to that for Principal place of business

- Addition and Deletion of Additional places can be done

- All the details of Address, Contact info, Nature of possession and of business activity can be made

VERIFY AND SIGN USING EVC/DSC

- Once the Amendments made are SAVED and VERIFIED, an ARN is generated

- The said application is processed through Official login

- The duration to save the changes made is fifteen days prior to signing of Amendment application

- Applicants who could not opt for Composition levy can now edit their nature of business activity( deselect option of services et al) and avail the benefit

Hello Sir,

I want to add a additional place of business and amended the core field and all other details but while i want to verify it an error massage is reflecting that ” Error-Minimum 2 Promoters & Partners Required

Minimum 2 promoters & Partners needs to be added. Please add the details to proceed further” please suggest me sir what to do

Hello

There are spelling mistakes in my Trade Name and Principal Place address since registration (July 2017) that i want to ammend but which “date of ammendment” to choose July 2017 or current date.

Please provide your suggestion

sir i want to change my taxpayer type from ISD to Regular. how to make amendment. somebody says that we can amend by changing nature of business activity. but it is not in the edit option in my portal. how to rectify it

Hello

Sir i want to change my constituion of business from proprietor to (HUF) i’m HUF of firm but bimistakely it got updated to Proprietor,so to update it i went with core fields but unfortunately i’m not able to because its asking to delete attached document so please can you help how to go with it