Ministry of Finance

Posting a growth rate of 12% Y-o-Y, 14.97 lakh crore gross GST collection during April-December 2023 period

Gross GST collection averages 1.66 lakh crore in first 9 months of FY24

1,64,882 crore gross GST revenue collection for December, 2023

Posted On: 01 JAN 2024

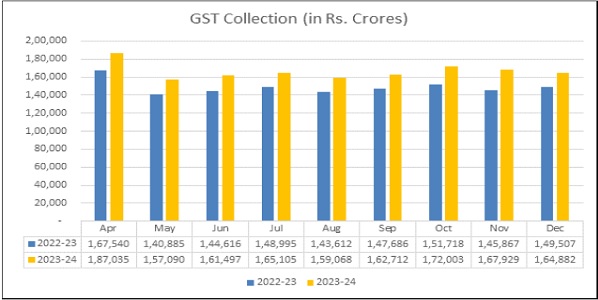

During the April-December 2023 period, gross GST collection witnessed a robust 12% y-o-y growth, reaching ₹14.97 lakh crore, as against ₹13.40 lakh crore collected in the same period of the previous year (April-December 2022).

The average monthly gross GST collection of ₹1.66 lakh crore in the first 9-month period this year represents a 12% increase compared to the ₹1.49 lakh crore average recorded in the corresponding period of FY23.

The gross GST revenue collected in the month of December, 2023 is ₹1,64,882 crore out of which CGST is ₹30,443 crore, SGST is ₹37,935 crore, IGST is ₹84,255 crore (including ₹41,534 crore collected on import of goods) and cess is ₹12,249 crore (including ₹1,079 crore collected on import of goods). Notably, this marks the seventh month so far this year with collections exceeding ₹1.60 lakh crore.

The government has settled ₹40,057 crore to CGST and ₹33,652 crore to SGST from IGST. The total revenue of Centre and the States in the month of December, 2023 after regular settlement is ₹70,501 crore for CGST and ₹71,587 crore for the SGST.

The revenues for the month of December, 2023 are 10.3% higher than the GST revenues in the same month last year. During the month, the revenues from domestic transactions (including import of services) are 13% higher than the revenues from these sources during the same month last year.

The chart below shows trends in monthly gross GST revenues during the current year. Table-1 shows the state-wise figures of GST collected in each State during the month of December 2023 as compared to December 2022. Table-2 shows the state-wise figures of post settlement GST revenue of each State till the month of December 2023.

Chart: Trends in GST Collection

Table -1: State-wise growth of GST Revenues during December, 2023

| State/UT | Dec-22 | Dec-23 | Growth (%) |

| Jammu and Kashmir | 410 | 492 | 20% |

| Himachal Pradesh | 708 | 745 | 5% |

| Punjab | 1,734 | 1,875 | 8% |

| Chandigarh | 218 | 281 | 29% |

| Uttarakhand | 1,253 | 1,470 | 17% |

| Haryana | 6,678 | 8,130 | 22% |

| Delhi | 4,401 | 5,121 | 16% |

| Rajasthan | 3,789 | 3,828 | 1% |

| Uttar Pradesh | 7,178 | 8,011 | 12% |

| Bihar | 1,309 | 1,487 | 14% |

| Sikkim | 290 | 254 | -13% |

| Arunachal Pradesh | 67 | 97 | 44% |

| Nagaland | 44 | 46 | 4% |

| Manipur | 46 | 50 | 9% |

| Mizoram | 23 | 27 | 18% |

| Tripura | 78 | 79 | 2% |

| Meghalaya | 171 | 171 | 0% |

| Assam | 1,150 | 1,303 | 13% |

| West Bengal | 4,583 | 5,019 | 10% |

| Jharkhand | 2,536 | 2,632 | 4% |

| Odisha | 3,854 | 4,351 | 13% |

| Chhattisgarh | 2,585 | 2,613 | 1% |

| Madhya Pradesh | 3,079 | 3,423 | 11% |

| Gujarat | 9,238 | 9,874 | 7% |

| Dadra and Nagar Haveli and Daman & Diu | 318 | 333 | 5% |

| Maharashtra | 23,598 | 26,814 | 14% |

| Karnataka | 10,061 | 11,759 | 17% |

| Goa | 460 | 553 | 20% |

| Lakshadweep | 1 | 4 | 310% |

| Kerala | 2,185 | 2,458 | 12% |

| Tamil Nadu | 8,324 | 9,888 | 19% |

| Puducherry | 192 | 232 | 21% |

| Andaman and Nicobar Islands | 21 | 28 | 35% |

| Telangana | 4,178 | 4,753 | 14% |

| Andhra Pradesh | 3,182 | 3,545 | 11% |

| Ladakh | 26 | 58 | 127% |

| Other Territory | 249 | 227 | -9% |

| Center Jurisdiction | 179 | 243 | 36% |

| Grand Total | 1,08,394 | 1,22,270 | 13% |

Table-2: SGST & SGST portion of IGST settled to States/UTs April-December (Rs. in crore)

| Pre-Settlement SGST | Post-Settlement SGST [2] | |||||

| State/UT | 2022-23 | 2023-24 | Growth | 2022-23 | 2023-24 | Growth |

| Jammu and Kashmir | 1,699 | 2,188 | 29% | 5,442 | 6,02 | 11% |

| Himachal Pradesh | 1,731 | 1,929 | 11% | 4,205 | 4,16 | -1% |

| Punjab | 5,719 | 6,280 | 10% | 14,371 | 16,382 | 14% |

| Chandigarh | 451 | 495 | 10% | 1,582 | 1,708 | 8% |

| Uttarakhand | 3,568 | 4,046 | 13% | 5,758 | 6,288 | 9% |

| Haryana | 13,424 | 14,992 | 12% | 23,134 | 25,733 | 11% |

| Delhi | 10,167 | 11,544 | 14% | 21,426 | 23,611 | 10% |

| Rajasthan | 11,483 | 12,732 | 11% | 25,903 | 28,794 | 11% |

| Uttar Pradesh | 20,098 | 24,164 | 20% | 49,384 | 55,656 | 13% |

| Bihar | 5,307 | 6,067 | 14% | 17,360 | 19,157 | 10% |

| Sikkim | 221 | 341 | 54% | 623 | 73 | 18% |

| Arunachal Pradesh | 344 | 464 | 35% | 1,176 | 1,41 | 21% |

| Nagaland | 158 | 226 | 43% | 716 | 78 | 9% |

| Manipur | 216 | 254 | 18% | 1,046 | 81 | -22% |

| Mizoram | 130 | 197 | 51% | 623 | 70 | 14% |

| Tripura | 311 | 375 | 21% | 1,074 | 1,16 | 9% |

| Meghalaya | 339 | 438 | 29% | 1,087 | 1,24 | 14% |

| Assam | 3,785 | 4,346 | 15% | 9,280 | 10,727 | 16% |

| West Bengal | 15,959 | 17,428 | 9% | 29,170 | 31,300 | 7% |

| Jharkhand | 5,562 | 6,545 | 18% | 8,237 | 9,14 | 11% |

| Odisha | 10,313 | 11,903 | 15% | 14,046 | 18,093 | 29% |

| Chhattisgarh | 5,426 | 6,004 | 11% | 8,370 | 9,93 | 19% |

| Madhya Pradesh | 7,890 | 9,606 | 22% | 20,834 | 24,026 | 15% |

| Gujarat | 27,820 | 31,028 | 12% | 42,354 | 46,624 | 10% |

| Dadra and Nagar Haveli and Daman and Diu | 479 | 481 | 0% | 889 | 804 | -10% |

| Maharashtra | 63,169 | 74,589 | 18% | 95,981 | 1,08,887 | 13% |

| Karnataka | 25,976 | 30,070 | 16% | 48,642 | 54,881 | 13% |

| Goa | 1,435 | 1,685 | 17% | 2,606 | 2,95 | 13% |

| Lakshadweep | 7 | 17 | 153% | 22 | 7 | 222% |

| Kerala | 9,011 | 10,293 | 14% | 21,953 | 23,045 | 5% |

| Tamil Nadu | 26,657 | 30,329 | 14% | 43,332 | 47,960 | 11% |

| Puducherry | 344 | 371 | 8% | 876 | 1,03 | 18% |

| Andaman and Nicobar Islands | 133 | 155 | 16% | 365 | 38 | 7% |

| Telangana | 12,287 | 14,579 | 19% | 27,964 | 29,889 | 7% |

| Andhra Pradesh | 9,298 | 10,407 | 12% | 21,137 | 23,481 | 11% |

| Ladakh | 123 | 186 | 51% | 420 | 52 | 25% |

| Other Territory | 135 | 182 | 35% | 420 | 90 | 115% |

| Grand Total | 3,01,175 | 3,46,938 | 15% | 5,71,807 | 6,39,052 | 12% |

****