While we are raised to abide by the principle that investment is good, we are not always pointed in the right direction in terms of tools of investments. This is why picking the right tool becomes particularly tricky for first-time investors considering the many financial options there are in the market. Hence, Tata Capital launched its very own Mutual Fund Investment App called Moneyfy in March 2020, which enables customers to plan their mutual fund investments and set their financial goals conveniently. Moneyfy aims to provide customers with an innovative suite of investment options digitally and help make investing smarter and simpler.

You can download Monefy APP here ->

Page Contents

- Why Tata Capital’s ‘Moneyfy’ is trustworthy?

- What are the Core Features of Moneyfy?

- What are the Services provided by Moneyfy?

- What is Moneyfy’s Goal-Based Fund and what are Its Features?

- Is Moneyfy Useful for New Investors?

- What are the Various Types of Funds Available with Moneyfy?

- What tools are provided by Moneyfy to assist the investor?

- Conclusion :

Why Tata Capital’s ‘Moneyfy’ is trustworthy?

Brand Tata depicts a fountain of knowledge or a tree of trust under which people can take shelter. Tata stands for excellence, reliability, and strength of the company’s products.

The essence of Moneyfy by Tata Capital is encapsulated in its promise – “Time to Get Your Money into Action”. This itself gives us the surety and assurance that if we opt for Moneyfy for our investments, we will surely use our money wisely and earn wonderful benefits out of it.

With the app, they seek to build strong relationships with their customers via a deep understanding of their needs, strong financial expertise, and the delivery of superior and consistent customer experience across all touch-points.

What are the Core Features of Moneyfy?

The core features of Moneyfy are as under:

1. Fully Digitized Process helps users complete KYC to be ‘Investment Ready’ on Moneyfy.

2. Investment in mutual funds can be started with an amount as low as Rs. 500.

3. Customers can easily start and track their monthly SIP investments.

4. Using the SIP calculator, users can see a future estimate amount which can be availed on SIPs.

5. Users can also create/identify personalised financial goals in terms of amount and years.

6. Customers on Moneyfy can compare different funds, invest and redeem money up to INR 50,000 instantly in Instant Redemption funds, and buy insurance from a varied set of providers.

7. Customers can also apply for their Loan and Insurance needs.

What are the Services provided by Moneyfy?

Moneyfy is mainly dealing into 3 most important financial services in today’s era, i.e.

a) Investments

b) Insurance

c) Loans

The detailed explanation is as under:

A) Investments:

Total 3 categories of investments are possible through Moneyfy.

i. Mutual Funds:

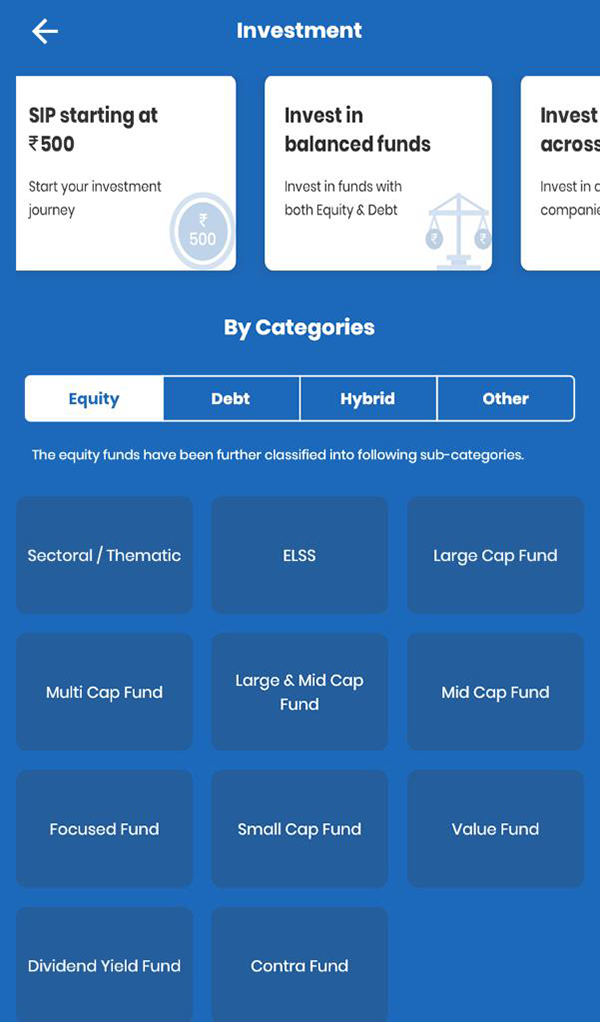

Moneyfy provides full-service capability on mutual funds across equity, debt, and hybrid categories.

They provide us a DIY feature with which you can build and optimise your Mutual Fund Portfolio all by yourself on the following basis –

-

- Category & Sub Category of the fund

- Rating – Morning Star & Value Research – Individually and Separately

- Risk Rating

- Tax Benefits

- Fund Size

- By AMC

- By Fund Manager

- Minimum SIP Amount

Also, Moneyfy provides various types of Mutual Funds such as Large Cap Fund, Small Cap, Mid Cap, Multi-Cap, Liquid funds, Credit Risk Fund, Low Duration Fund, and Banking & PSU Debt fund.

Moneyfy creates a Mutual Fund Platform in which the investor gets an opportunity to invest in various leading Mutual Fund houses such as AXIS Mutual Fund, Baroda MF, Birla Sunlife Mutual Fund, BNP Paribas Mutual Fund, BOI Axa Mutual Fund, Canara Robeco MF, DHFL – PGIM Mutual Fund, DSP Mutual Fund, Edelweiss Mutual Fund, Franklin Templeton Mutual Fund, etc.

ii. Instant Redemption Funds:

These are Liquid fund schemes which can be redeemed instantly. You can either withdraw Rs 50,000 or 90% of the invested amount. Your amount will be credited in minimum 2 minutes and maximum 30 minutes. The benefit of investing in Instant Redemption Fund is easy access to funds when required, and it is a very simple and quick process.

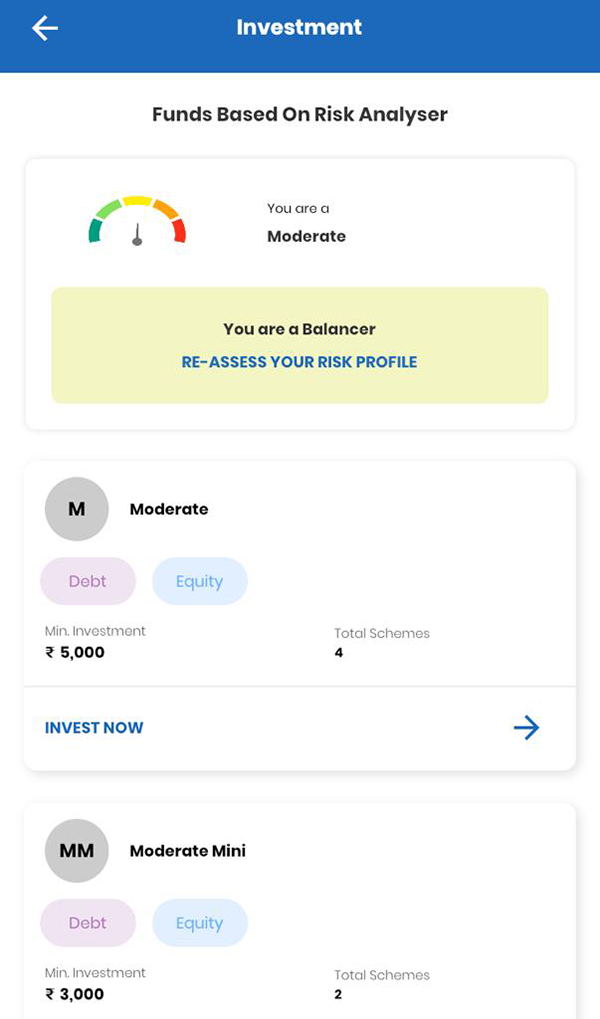

iii. Risk Profile:

A risk profile is the evaluation of an individual’s willingness, and ability to take risks. It can also refer to the threats to which an organization is exposed. A risk profile is important for determining a proper investment asset allocation for a portfolio. Organizations use a risk profile as a way to mitigate potential risks and threats.

B) Insurance:

Moneyfy can provide you various types of insurance to protect you such as Term Insurance, Travel Insurance, Health Insurance, Two-Wheeler Insurance, Private Car Insurance, and Critical Illness Insurance.

C) Loan:

Moneyfy also provides various loans such as Personal Loan, Home Loan, Business Loan, Used Car Loan, Two-Wheeler Loan, and Loan against Property.

The benefits of loan services provided by Moneyfy are Quick Approval & Hassle-Free Process, Flexible EMI Options, Secured System to Keep Your Data Safe and Paperless Procedure.

What is Moneyfy’s Goal-Based Fund and what are Its Features?

Moneyfy offers goal-based Investment options, where you can set up goals & achieve them by investing either through SIP or lump sum money.

You can set up any of the following goals and start investing right away –

– Purchase your dream home

– Invest to buy a car

– Checking off a dream vacation

– Funding for higher education

– Enjoying a carefree retirement

– Funding a big fat wedding

– Building wealth for financial freedom

– Bringing your custom goals to life

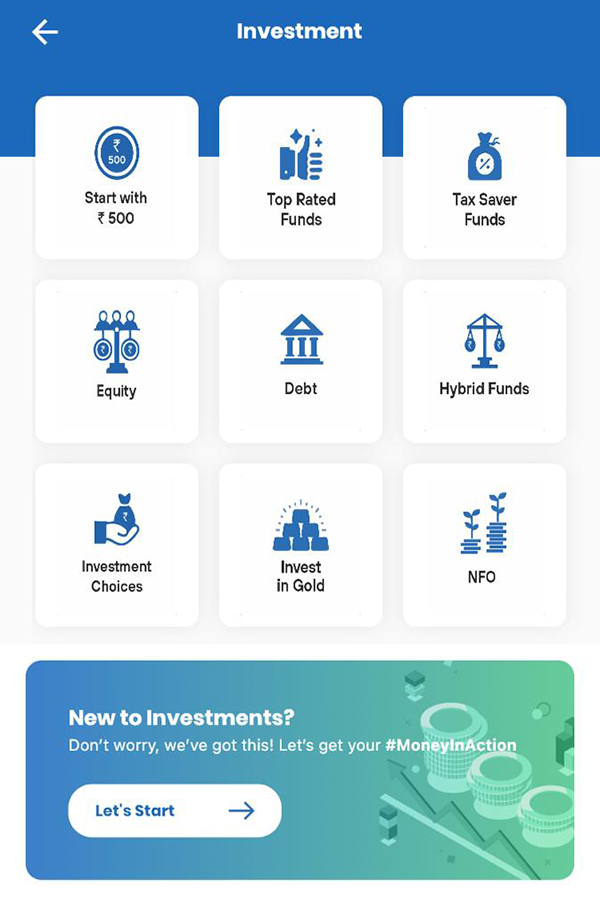

Is Moneyfy Useful for New Investors?

Moneyfy is an ideal choice for new investors. It’s a simple process in which you have to log in to the app, complete your KYC process, and become investment-ready within minutes. Moneyfy offers simple & easy investment options to new investors. It is also the right pick for people who have already invested in Mutual Fund as it makes your investment process faster, better, and easier.

What are the Various Types of Funds Available with Moneyfy?

- Top-Rated Funds:

Invest in top-rated mutual funds, rated by Value Research and Morningstar. The ratings are objective and based on the past performance of the mutual funds.

- Tax-Saver Funds (ELSS):

ELSS is an open-ended equity-linked saving scheme with a statutory lock-in of 3 years with tax benefit U/S 80C. It invests a minimum of 80% of total assets in equity and equity-related instruments in accordance with Equity-linked Saving Scheme, 2005 notified by the Ministry of Finance.

- Invest in Gold Funds:

Add some glitter to your portfolio by investing in gold funds. These are funds of funds that invest in gold ETFs that in turn invest in gold bullion.

- Starting SIP with as low as Rs.500:

Invest with discipline in mutual funds via SIP starting at just Rs. 500 per month.

- Invest in:

o Large and Mid-Cap Funds:

Large & Mid Cap Fund is an open-ended equity scheme investing a minimum of 35% each in large and mid-cap companies’ equity and equity-related instruments.

o Multi-Cap Funds:

Multi-Cap Fund is an open-ended equity scheme investing across large-cap, mid-cap, and small-cap stocks with at least 65% of total assets invested in equity and equity related instruments.

o Value Funds:

Value Fund is an open-ended equity scheme which follows a value investment strategy with a minimum of 65% of total assets invested in equity and equity related instruments.

o Dividend Yield Fund:

Dividend Yield Fund is an open-ended equity scheme investing predominantly in dividend-yielding stocks, with a minimum of 65% of total assets invested in equity and equity related instruments.

o Contra Funds:

Contra Fund is an open-ended equity scheme that follows a contrarian investment strategy with a minimum of 65% of total assets invested in equity and equity related instruments.

What tools are provided by Moneyfy to assist the investor?

Moneyfy has the 3 most important tools required to calculate one’s future. These tools are as under:

- SIP Calculator:

This SIP calculator is used to decide the amount of investment required to make in SIP to achieve a future goal

- EMI Calculator:

You can calculate EMI for Home or Other loans

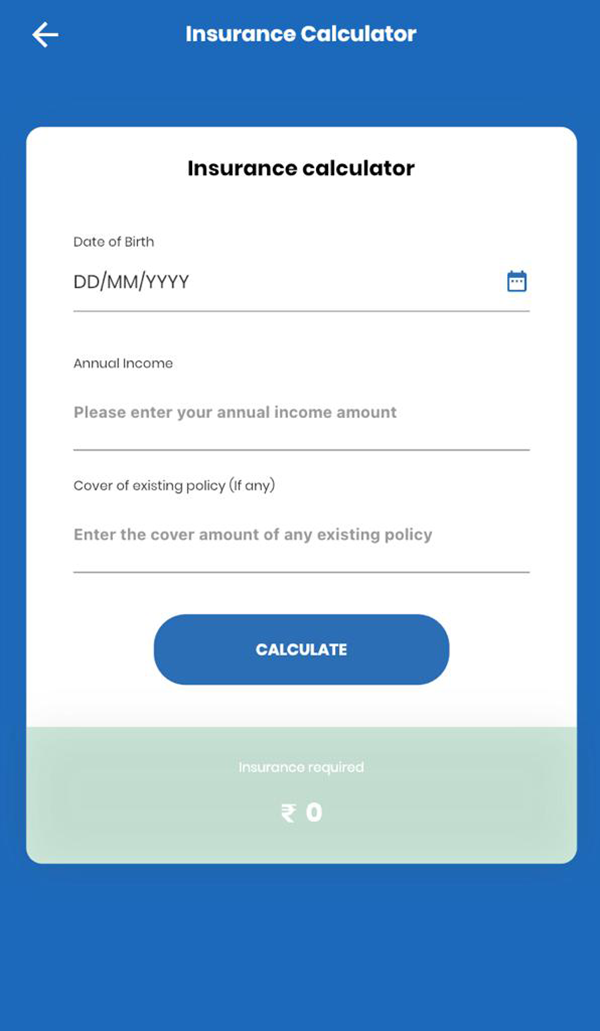

- Life Cover Calculator for Insurance:

You can calculate your life cover with our Insurance Cover calculator based on your age, annual income, and existing cover. Ideally, life cover should be 10 to 15 times your annual income.

Conclusion :

Moneyfy complies with all your financial needs under one roof, and to get a quick and easy solution for your financial needs, anytime and anywhere. Moneyfy is one of the best tools to get your #MoneyInAction.

Even basic stuf such as do they provide direct plans, mf in demat etc not provided and yet you say all needs under one roof!