This Covid-19 pandemic has caused havoc not only nationally but internationally as well. Initially it was not in deep thoughts that India will be having any likely effect from the pandemic which was then impacting only the foreign directives. In other words the world economies will also have an impact upon Indian economy.

To begin with let me discuss these impacts first at national level and then at international level.

National level-Impact on Indian Economy

1. The economic impact of the 2020-21 corona virus pandemic in India has been hugely disruptive. World Bank and credit rating agencies have downgraded India’s growth for fiscal year 2021 with the lowest figures India has seen in three decades since India’s economic liberalization in the 1990s.

Moody’s 5.3% from 6.6%

OECD 5.1% from 6.2%

UBS 5.1% from 5.6%

Barclays 5.6% from 6.5%

Fitch 5.4% from 5.9%

Source: Deloitte

2. Stock markets in India posted their worst loses in history on 23 March 2020 will leads to reduced wealth effect.

3. Within a month, unemployment rose from 6.7% on 15 March to 26% on 19 April. During the lockdown, an estimated 140 million (140 million) people lost employment. Further this year will be difficult for campus selection for Professionals and others lead to unemployment and reduce consumer spending

4. As per Media reports, Both State and Central Govt. are also planning to defer the new recruitment till this pandemic period since priority has been changed,

5. Consumer spending will take a hit due to movement restrictions and fear of falling sick.

6. Due to lack of demand from China, USA & Europe, more than of 40% Indian Export will be badly affected, leads to reduction in foreign reserves. Sharp depreciation of Rupee against the dollar is from 71.7 per US$ on 3rd January to 75.6 per US$. This will worsen trade deficit as export contribution to GDP is low.

7. More Exposure to stressed industries and MSMEs leads to stress on banks and impact the credit rating.

8. Rising Bond yields make borrowing more expensive, thereby reducing bank margin.

9. Tourism Travel &Hospitality: Various businesses such as hotels and airlines are cutting salaries and laying off employees. India is big on cultural and historical tourism, attracting domestic and foreign nationals throughout the year. But with visa’s being suspended and tourist attractions being shut indefinitely, the whole tourism value chain, which includes hotels, restaurants, attractions, agents, and operators is expected to face losses worth thousands of crores.

10. Raw materials and spare parts: Nearly 55% of electronics imported by India originate from China. These imports have already slid down to 40% in light of the corona virus outbreak and subsequent lock down. Higher Input Prices and Reduced Profitability leads to decline in Capacity Building, Business sentiments and investment.

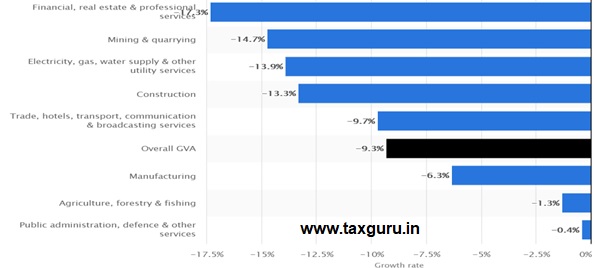

11. Estimated impact from the corona virus (COVID-19) on India between April and June 2020, by sector GVA ( Gross value Added)

Source: Statista.com

12. CII has made a survey of CEO of 300 companies

- 65% of TOP CEO has confirmed that there will be 40% reduction in their revenue.

- 45% CEO also confirm that at least one year / Full fiscal year is needed for protracted economy recovery after things go back to normal.

- Due to this lock down there will be 53.1% lack of demand.

- Disruption of supply and distribution chains, lack of credit, manpower and raw material.

- Export demand will take time and will be resuming only after a year.

- Indian Production will also affected adversely because major raw material/ components depends on China, and china industrial Production is badly affected

- Migration of labour will badly effect the production / manufacturer and supply chain. It will be very difficult to call then back early in the situation of fear and life threat.

13. Now Let us discuss Working capital Management issues during COVID Situation

1. As per GST law if Taxable person has not make payment to their supplier within 180 days than ITC already availed has to be reversed and to make the payment along with Interest this is cause the blockage of Working capital leads to less availability of funds for Salary payments and other fixed over heads which create the gap between demand & supply.

2. Govt. payments are stuck-up due to this huge impact on

Similarly even non receipt of payment from Buyer, the Supplier has to make the payment of GST to the exchequer, this tantamount to blockage of working capital requirement again create GAP between Demand and supply.

3. Impact on Recovery due to Cheque Bounce– as per negotiable Instrument act intimation is to be given within 30 days through Post/ Speed post/ Courier but due to this lock down condition will impact on recovery

4. Cheque validity period is 3 month and due to this pandemic situation and logistic problem cheque may not be presented within 3 month will impact the receipt.

Hon’ble SC Extends limitation under Arbitration Act of Sec 138 of Negotiable instrument Act wef. 15th march 2020 on 6th May by CJI SA Bobde, Justic Deepak Gupta and Justic Hrishikesh Roy Bench invoking special power under Article 142 of Constitution of India.

5. During this pandemic situation everybody is working from Home through Video conferencing and cyber crime issues has increased many fold even confidentially of data is on stake. i.e. has warned not to use ZOOM app.

6. Collateral value of securities has been reduced drastically against the loan taken by our Businessman and Lenders may take action at any point of time and lenders may ask from their debtors to increase security, at this havoc situation it’s a unwarranted situation. Future retail Group is the best example of this.

7. Statutory Auditors will face issue on closing of 31st March books of accounts

Due to Statutory Auditors conservative approach, they may insist Co. to create more provisions that lead to reduction in Bottom line

a. Inventory Valuation as on 31st March 2020 and they have to rely on management PV report which is not sufficient audit evidence and violation of SA( standard on auditing) 501 and SA 705 and auditors have to modify/ qualify their report.

b. Net Realizable Value (NRV) – Big Hit in near future in case company is not able to recover cost of material and labour

c. Going Concern: First management has to certify the going concern and then Auditors has to check this aspect. Further management has to check the financial Position of the company and look at difference between Liquidity and solvency.

d. Impairment Testing – Cash estimate and forecast – Auditors can raise issue on the accuracy of the forecast and may impress for creation of Provision, leads to downside the bottom line.

e. Expected Credit Loss (ECL): Probability of default

f. Authenticity of documents received on mail.

g. Internal control over financial reporting

h. Whether the cost incurred during lockdown be classified as exceptional costs in P&L A/c

i. Impact on Internal Audit

Taxability of person having Dual residential status

1. Status of Residence: – if anybody stay in India more than 182 days he became Indian resident and taxability of Income issue will arise.

2. Indian Company or Foreign co is being decided on the basis of POEM (place of effective management), during this pandemic situation free movement is restricted hence any forced BoD meeting will leads to became Indian company being POEM

Since global economy are also impacted by COVID-19 pandemic this could have some positive as well as negative impact on Indian economy to discuss with I will discuss some

Positive side:-

1. China exit is under discussion since long and hence due to recent indication, given by Union Minister Mr Nitin Gadkari and Piyush Goyal at the webcast of ICAI- the Indian economy is open to welcome companies which are moving out of china. Here Govt. should open Single window clearance

2. Globally the oil prices have substantially come down from US$ 68.5 per barrel on 3rd January to US$ 28.2 per barrel on 20th March and times to come, further lower oil price could be a boom for India’s Fiscal and current account deficit.

3. Because of Video Conferencing huge number of man hrs which were earlier wasted in international travel, have became avoidable now.

In future only need base travel will be allowed for within India/ outside India.

4. Positive impact on Pharmaceuticals Company: As COVID-19 is rapidly making its way through India, medication is going to be the number one consumer demand, and because there aren’t nearly enough APIs to manufacture drugs, the subsequent traders and the market are witnessing skyrocketing prices. The prices of vitamins and penicillin alone already see a 50% surge.

5. Govt. is planning their more spending in In-fracture (being labour oriented) to generate more Jobs. As per an estimate 2.27 jobs is created on the spending of Rs. 1000 or say more than 227 crore men days will be created on the spending of 1 lakh Crore.

NITI Aayog earlier Known as Planning Commission

Negative Side:-

1. The global economy could shrink by up to one per cent in 2020 due to the corona virus pandemic, a reversal from the previous forecast of 2.5 per cent growth

2. disrupting global supply chains and international trade

3. Moody has declined Global rating of every country

4. Economy of every country will be badly affected like India.

5. Unemployment will leads in every country.

6. A sharp decline in consumer spending.

7. Foreign Exchange Market is badly impacted due to which there will be currency fluctuation.

8. Due to Forex-fluctuation and lock down situation forward contracts will also be impacted. Many countries has made OIL @ 68-70$.

9. The prices of Commodity and precious metals like gold, silver are impacted internationally which could have positive as well as negative impact on sellers, Investors and consumers since Delivery based transaction is effected due to lock down.

10. most international indices are nearing bear market territory (declining at least 20 percent from the 52-week high)

11. Tourism, Hospitality, Aviation sector will badly affected.

12. A Fear factor of getting effected by the pandemic is preventing global Businessman to take immediate decision on Foreign Investments i.e. many Pvt. Equity firm outside India are not having any encouragement to invest in Trembling Economy. I.e black Stone ( is waiting for Right time)

13. China may take equity control on some of the Stressed industries which is strategic for Indian point of view, similarly he can make investment in other country as well. India has already banned such transactions.

14. The Global leader have also lost some quantity of faith in Economy Corporation and movement i.e. recent policy issue between US and India about export of medicines for COVID treatment however this issue got resolved amicably.

15. Similarly there are chances of Global Economic War between various nations and some of the countries Australia, UK are in talks in media to have filled Compensation suits against China.

Conclusion

Besides all above positives and negative we have to move forward with all new enthusiasm and strength as is said

1. JAB Jagho Tab savera &

2. 2020 is for alive and not to make Profits

Author- CA Vijay Kumar Choudhary | B.Com, FCA, MBA (HRM), FxTM | CGM (Finance) – NBCC India Limited

COMMENT FOR GSTR 1 FOR THE PERIOD OF MARCH 2020 TO MAY 2020:- DUE DATE FOR THIS PERIOD IS 30.06.2020

PLEASE REFER

Circular No. 136/06/2020-GST dated 3rd April 2020 AND DUE DATE FOR GSTR 3B IS VALUE BASE AND IS 24.06.2020 AND 29.06.2020. AND CONDITION TO AVAIL ITC IS AS PER NOTIFICATION NO 75/2019- CENTRAL TAX DATED 26.12.2019 IS RESTRICTED TO 10% ON THOSE INVOICES WHICH ARE NOT UPLOADED ON GST PORTAL. SO REQUESTING TO ISSUE AUTHORITY TO CHANGE DUE DATES FOR GSTR 1 OR GSTR 3B MAY CHANGES AS PER ITC CLAIM AS PER NOTIFICANT 75/2019 CENTRAL TAX DATED 26.12.2019

FININACE MINISRTY HAS TO ISSUE AUTORITY TO EXTEND TIME LIMIT OF TAXABLE PERSON PAYMENT PERIOD OF 180 DAYS OR SUPPOSE TO GIVE EXEMPTION FOR LOCKDOWN PERIOD