Life is always undefined and under this uncertainty it is highly imperative to secure your family’s financial needs in your absence. There are several insurance companies offering different types of term plans in the market. Selecting the best amongst them can certainly be difficult.

Here you can learn the features of an ideal term plan and comprehend how the Max Life Smart Term Plan turns out to be the best term plan.

How an Ideal Term plan should be –

Term plans have gained popularity over the years. Currently, there are several term insurance plan options in the market to choose from. This confusion along with it lots and lots of confusion in terms of selection of the insurance company and then the specific term plan policy.

Clearing the basics, first of all, lets us understand the features of an ideal term plan, which are listed here under –

- Claim Settlement Ratio –

In simple terms, Claim Settlement Ratio means the number of claims passed by the insurance company in a fixed period of time. Before going for any specific term plan, it is important to study the Claim Settlement Ratio of the insurance company. The IRDA publishes the Claim Settlement Ratio for all the insurance companies.

It can be concluded that the insurance company with higher Claim Settlement Ratio are more reliable.

- Premium amount –

The second most important feature is the premium amount payable. Different insurance companies are charging different premiums for different types of features. The premium amount charged should be compared with the types of features offered.

It is pointless to say here that the insurance company which provides more features with less premium amount should obviously be preferred.

- Reputation of the insurance company –

Before opting for a specific insurance company, it is vital important to check the reputation of the insurance company in the market.

- Rider / Add-on Coverage –

The riders / Add-on covers provided by the insurance company. In general, a policy that provides the basic coverage and further offers additional benefits / riders are the good one to opt for.

- Keep in mind the inflation factor while deciding the term plan.

Features of Max Life Smart Term Plan –

After understanding the features of an ideal term plan, one would obviously ponder about the insurance company which provides the term plan covering all the features. The Max Life Smart Term Plan is the answer to all such question.

The features of Max Life Smart Term Plan are highlighted here under –

- It is a flexible term plan which triggers people from different walks of life and age group.

- It offers the maximum life insurance term of up to 50 years and coverage ceasing age of 85 years.

- It offers to pay back the entire premium amount i.e. if the insurer survives the entire policy term, he will receive back the complete amount of annualized premiums paid under the base policy.

- Choice of multiple premium payment option –

- Single pay;

- Regular pay;

- Pay till 60; and

- Limited pay (5, 10, 12 and 15 years).

- Covers complete protection against around 40 critical illness which includes kidney failure, heart attack and cancer. Max Life even offers immediate financial help in the form of accelerated payouts under its Accelerated Critical illness (ACI) benefit.

- It offers an option to increase insurance coverage on achieving milestones in life.

- Tax benefits available under section 10 (10D) and section 80C and section 80D of the Income Tax Act, 1961.

- The term plan provides seven different alternatives for death benefit payout which includes increasing monthly income and lump sum payouts.

- Max Life tops the ranking of Average Claim Settlement Ratio of last three year. This specifically highlights its easy claim clearing policy.

- It provides flexible premium payment options as per the budget of the insurer.

- Over and above all it’s 1-day claim settlement feature is like cherry on the top.

Let’s do some comparative analysis

Obviously, no one would be convinced just by saying that Max Life Smart Term Plan is the best. Let’s do some comparative analysis to prove the point –

1) Term Return of Premium –

Term Return of Premium provides dual benefit firstly the financial security to the family in case of death of the insurer and secondly the plan offers an assured return of premium meaning thereby that the total premium paid during the tenure of the policy would be paid back to the policy holder.

Now a days, many companies provide Term Insurance with Return of Premium, however, with the limited option. Max Life Insurance provides Term Insurance with Return of Premium with multiple options as featured here under –

1. Cheapest Term Insurance with Return of Premium in regular pay

2. Term Insurance with Return of Premium plan with longest coverage term (till 85 years)

3. Term Insurance with Return of Premium with widest range of death benefit options.

Following table reflects the Term Insurance with Return of Premium – Premium comparison between Max and leading insurance company. The table clearly voices that Max provides Term Insurance with Return of Premium with lowest premium amount –

As can be seen, the premium amount chargeable by Max Life is only INR 2,106 for Term Insurance with Return of Premium (Regular pay, Sum assured – 1 Cr, coverage up to 75 years) which is 26% less than the premium amount charged by HDFC Life and around 10% less than the premium amount charged by TATA AIA Life.

Further, the premium amount chargeable by Max Life is only INR 3,807 for Term Insurance with Return of Premium (Regular pay, Sum assured – 2 Cr) which is 22% less than the premium amount charged by HDFC Life and around 18% less than the premium amount charged by TATA AIA Life.

2) Death Benefit Variants –

Seven death benefit variants available under Max Life Smart Term Plan which are listed hereunder –

- Life Cover;

- Income Protector;

- Income + Inflation Protector;

- Life Cover + Income;

- Life Cover + Increasing Income;

- Increasing Cover;

- Reducing Cover.

Following table helps to figure out that the Max Life offers the best death variants with 7 different options as against the other leading insurance companies –

3) Limited pay –

Limited pay option featured under ‘Max Life Smart Term Plan’ permits the individual to pay the premiums for a limited period of time, however, it offers the full insurance cover for the entire policy term.

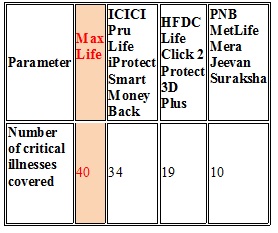

4) Critical illness coverage –

Currently, many insurance companies provide critical illness insurance. However, the number of illnesses covered differ from provider to provider. Max Life covers 40 critical illnesses, the maximum among all insurance companies with a comparable premium.

- * Age: 35 yrs. | Male | Non-Smoker

- Regular pay | coverage up to 77 years | 1 crore with return of premium

Max Life provides instant financial help in the form of accelerated payouts under its Accelerated Critical Illness Benefit. Further, it also offers the freedom to increase the plan coverage during the policy term.

5) Claims Settlement Ratio –

The term insurance ensures that in case of any unfortunate event, the financial needs of the family is fulfilled. The good claims settlement ratio/claim paid ratio of any life insurance company indicates it trustworthiness at the time of claim settlement.

Understanding the Claim Settlement Ratio, in simple term, it means total number of claims approved / paid as divided by the total number of claims received. Concluding thereby that the insurance company with higher Claim Settlement Ratio should be the most preferred one.

Amongst all the top leading insurance company, the one leading the point table of Claim Settlement Ratio is Max Life. The Max Life tops the table of Claim Settlement Ratio derived by average of 3 years Claim Settlement Ratio –

It is important to understand why Max Life is leading the ‘Claim Settlement Ratio’ table. Max Life Insurance works with the principle of ‘Fairest, Fastest and Friendliest’ in Claims processing. Max Life offers instant claim proposition within 48 hours from the claim intimation. Max Life appoints a Claim Relationship Officer for each and every death claim to ensure full guidance to the claimant / beneficiaries and each stage of claim process.

With low premium amount, 7 death benefit variants, limited pay option, 40 critical illness coverage and highest claim settlement ratio we may conclude that ‘Max Life Smart Term Plan’ is one of the best term plan.

Karan, the above are all false claims made and max is worst company for term insurance. They are good in conventional plan. Icici and hdfc are truely best insurance company for term insurance