CBIC enables Central Excise and Service Tax Duties payment collection from ICEGATE via NEFT/RTGS

The Central Board Indirect Taxes and Customs ( CBIC ) has enabled Central Excise and Service Tax Duties payment collection from ICEGATE via NEFT/RTGS. The CBIC has issued advisory and explained Steps for making and enabling payments through icegate portal.

The payment module can be accessed from www.cbicpay.icegate.gov.in

Central Excise / Service Tax NEFT – RTGS Payments Process

Step 1 : Access CBIC-GST Portal https://cbic-gst.gov.in/ and click on ACES(CE&ST)Login

Step 2 : Login with Existing User ID and password and enters Captcha – Central Excise

Step 3 : Click on the Menu

Step 4 : Click “E-Payments” → Generate Challan

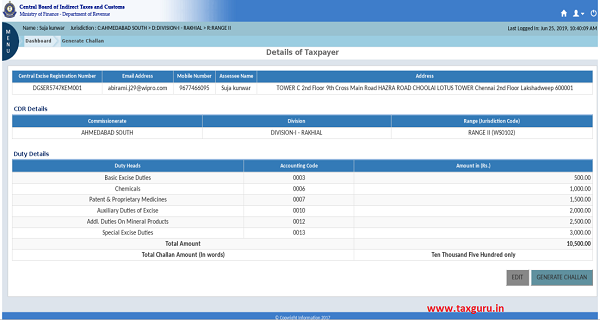

Step 5 : Details of Taxpayer is displayed. Check the details and then Click to Select Accounting Codes

Step 6 : List of Accounting Codes is displayed. User can select a Maximum of Six Select Accounting Codes

Step 7 : Duty Heads and Accounting Codes are displayed

Step 8 : Enter the amount and click NEXT

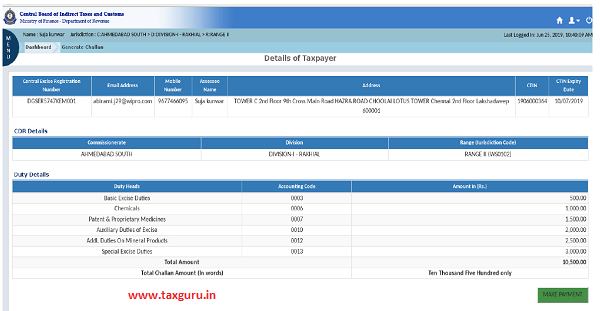

Step 9 : Total amount and Total Challan amount is displayed in words. User has to verify and click GENERATE CHALLAN

A dialog box will be displayed – ‘Challan Status – Please wait for Challan Generation will complete in 30 seconds’

‘Challan Generated Successfully with CTIN No.’ is displayed (Common Temporary Identification No.) Click CLOSE

Step 10 : Click MAKE PAYMENT

Step 11: Once the User clicks on MAKE PAYMENT at ACES GST portal, the taxpayer is redirected to the ICEGATE e Payment web page, where four inputs are required to be entered as shown below.

Step 12: Select “Central Excise/ Service Tax” for Duty Type, “CE” or “ST” for Document Type, Location Code for Location, enter the Registration Number for Identification Number and Click on Submit

Step 13: On clicking Submit, the user is directed to a page displaying the list of unpaid challans as shown below

Step 14: On the List of unpaid challans page, the user can select up to a maximum of 10 Challans and confirm the challans for payment by clicking Confirm Challan.

Step 15: On clicking Confirm Challan, the user is directed to List of selected challans page showing the details of selected challans. To make the payment the of the total amount, click Pay Now or Back to select another group of challans.

Step 16: On clicking Pay now, the user is directed to Payment Options page showing the modes of payment. To make the payment the user can select NEFT or RTGS and click Generate Mandate Form.

Step 17: On clicking Generate Mandate Form, the user is directed to Mandate Form Details page showing the details required to make the NEFT/RTGS payment. The User can use the details to make an online payment or save a copy to pay at any bank branch by clicking Print/Save. Another payment can be started by clicking Home

Step 18: The User can use the below details to make an online payment through his personal/ corporate Internet Banking Portal and following the procedure to make an NEFT/ RTGS payment. For further assistance at banks User may get in touch with banks customer service.

Step 19: On clicking Print Save, an action box is opened allowing the user to save a PDF copy of the Mandate form

Step 19A: A sample PDF copy of the Mandate form is as above, which can be taken to branch of any scheduled commercial bank and made payment through any offline mode. There is no restriction for the user to make payment from a particular set of bank. For further assistance at banks User may get in touch with banks customer service.

Step 1 : Login with Existing User ID and Password and enters Captcha – Service Tax

For Service Tax.

Post Login – All the steps should be followed as shown above.

(Service Tax Accounting Codes to be selected from drop down . Ex. As below)

Rest all the steps are the same.

Track Challan Status – Post Login

Under Menu → E-Payment → Track Challan

The User will be displayed with status all the challans viz., Paid / NOT PAID / In Progress.

To make payments for the NOT PAID Challans, user can click on the MAKE PAYMENT button.

On Clicking the MAKE PAYMENT button, the user will be directed to ICEGATE Portal. User has to follow the Step 11 – 19 as shown above for making payments.

Don’t forget to check icegate tracking shipping bill.

I paid the challan thru neft but on the portal its showing not paid. My bank says the payment has gone thru. What do I do?

On making payment of arrears of Service tax along with Mandate form through the bank, need to know procedure, how to download the paid challan from CBIC web portal.

not download paid challan??

Pleas Help For Not Paymen RTGS & NEFT Pleas Require to Right RBI IFSC CODE..Contact No.9326953131

Thank you for this information. But, mandate form does not have an account type. What account type should I enter while making the NEFT payment?