Case Law Details

In re Mahaveer Impex (CAAR Mumbai)

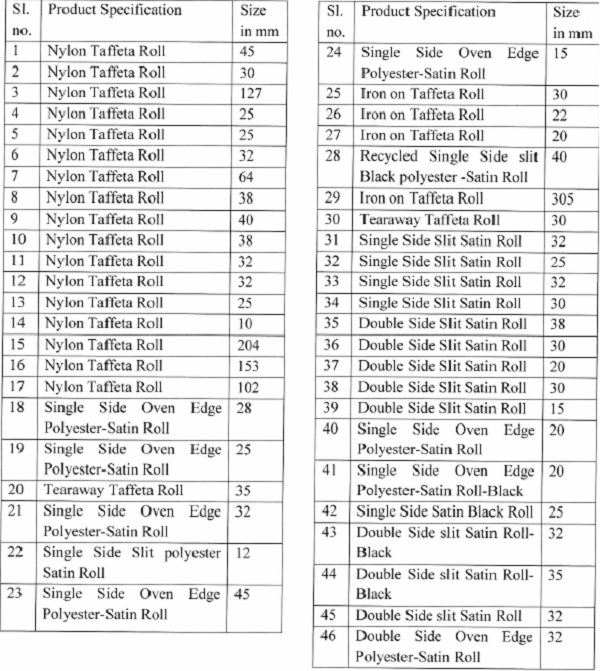

M/s Mahaveer Impex (hereinafter referred to as ‘the applicant’, in short) having address at 2nd Floor, 203, Mahaveer Apartments, 3rd Road, Khar West, Mumbai, Maharashtra, 400052 filed an application for advance ruling before the Customs Authority for Advance Rulings, Mumbai (CAAR, in short). The said application dated nil was received in the secretariat of the CAAR, Mumbai on 13.10.2022 along with its enclosures in terms of Section 28H (1) of the Customs Act, 1962 (hereinafter referred to as the ‘Act’). The applicant is seeking advance ruling on the classification for the proposed import of Rolls made of Polyester, Taffeta, Satin etc. which are available with width ranging from 10 millimetre to 810 millimetre, as described in Table – A.

Table-A

2. The applicant is engaged in the business of purchase and sale of products in India. They have proposed to import Rolls made of Polyester, Taffeta, Satin etc. which are available with width ranging from 10 millimetres to 810 millimetres (hereinafter referred to as the ‘products’), more specifically described in Table – A. The applicant submits that the ultimate customer of the products are the companies engaged in manufacturing of readymade garments. The products will be ultimately used for the purpose to capture trademark, wash care instructions and other details like country of manufacturing, size, make etc. on the products for the reference of retail customers. In this respect it is submitted that the products have following characteristics:

- The products are made of manmade fibres textile fabrics

- The products are not embroidered

- The products are in the pieces, in strips or cut to shape or size

- The products are known as labels in common parlance and trade

- There is no alternate use of the products except as labels

2.1 In the present case, the applicant has proposed to import products and will classify it under HSN code 5807 and pay Customs duty under entry no. 147 of Notification No. 82/2017-Cus., dated 27.10.2017 and IGST under entry no. 153 of Schedule II of Notification 1/2017 -IGST (Rate) 28 June 2017. The said activity of import will be a continuous activity in future. as well. Accordingly, the applicant seeks advance ruling on the classification and applicability of tariff entry & Customs/ IGST notification respectively on the products proposed to be imported by the applicant.

2.2 The applicant in the CAAR-I form has sought the advance ruling as to:

a) Whether the products proposed to be imported can be classified under Chapter HSN code 580710?

b) If answer to (a) above is negative, what is the classification of the products?

c) Whether the products are covered by entry no. 147 of Notification No. 82/2017-Cus., dated 27.10.2017 and entry no. 153 of Schedule II of Notification 1/2017 — IGST (Rate) dated 28 June 2017?

d) If answer to (c) above is negative, what is the basic Customs duty under First schedule of the Customs Tariff Act, 1975 and IGST rate under sub-section (7) of Section 3 of the said Customs Tariff Act read with Notifications issued on import of the products?

Since the applicant intends to import the said goods through Nhava Sheva Port, comments from the jurisdictional Principal Commissioner / Commissioner of Customs were invited.

3. The personal hearing in the matter was scheduled for 01.11.2022. S/Shri. S. S. Gupta, CA and Vaibhav Shah, CA, represented the applicant as authorised representatives and submitted multiple documents- explanatory notes, case laws etc., in support of their claim to classification under CTH 580710. Based on the documentary evidence on record including judgement of Hon’ble HC of Kolkata they requested to issue a ruling in favour of CTH 580710.

4. In this matter, the comments from the jurisdictional Commissionerate were received on 14-11-2022 from Office of the Commissioner of Customs, NS-III, Jawaharlal Nehru Custom House, Nhava Sheva, which are as below: –

4.1 It has been informed that issue covered under advance ruling sought is not pending in the applicant’s case in this office. Further, it has been submitted that importer intends to import Rolls made of Polyester, Taffeta, Satin etc., which are available with width ranging from 10 mm to 810 mm. The characteristics of the product mentioned by the applicant in its submission are: –

i. The products are made of manmade fibers textile fabrics

ii. The products are not embroidered

iii. The products are in the pieces, in strips or cut to shape or size

iv. The products are known as labels in common parlance and trade

v. There is no alternate use of the products except as labels

Further, website of foreign supplier, as mentioned by the applicant in its application at para no. 06 is visited and printouts of the items from website https://www.king-grp.com/ and https://www.fivestar-label.com/product/ are enclosed herewith for perusal and reference wherein it is noticed that fabric intended to be imported do not have essential character of a label i.e., no inscriptions or motifs are found inscribed on the item. Further, they are in running length which do not have regular cut markings or bear any typical design of a label.

4.2 HSN Explanatory notes to Chapter heading 58.07 read as under: –

| 5807 LABELS, BADGES AND SIMILAR ARTICLES OF TEXTILE MATERIALS IN THE PIECE, IN STRIPS OR CUT TO SHAPE OR SIZE, NOT EMBROIDERED | |||

| 5807 | 10 | – Woven: | |

| 5807 | 10 | 10 | — Of cotton |

| 5807 | 10 | 20 | — Of man-made fibre |

| 5807 | 10 | 90 | — Other |

| 5807 | 90 | – Other | |

| 5807 | 90 | 10 | — Felt or non-woven |

| 58079090 | — Other | ||

Subject to the conditions specified below this heading covers:

(A) Labels of any textile material (including knitted). These include labels of a kind used for marking wearing apparel, household linen, mattresses, tents, soft toys, or other goods. They are utilitarian labels bearing individual inscriptions or motifs. Such labels include, inter alia, commercial labels bearing the trade name or trade mark of the manufacturer or the nature of the constituent textile (“silk”, “viscose rayon” etc.) and labels used by private individuals (boarding school pupils, soldiers, etc.) to identify their personal property; the latter variety sometimes bear initials or figures or comprise sometimes a framed space to take a hand-written inscription.

(B) ……

The above articles are classified in this heading only if they fulfil the following conditions:

(1) They must not be embroidery. The inscriptions or motifs on the articles classified here are generally produced by weaving (usually broche work) or by printing.

(2) They must be in the piece, in strips (as is usually the case) or in separate units obtained by cutting to size or shape but must not be otherwise made up.

This heading does not include labels, badges and similar articles, which have been embroidered (heading 58.10) or made up otherwise than by cuttin to shape or size (heading 61.17, 62.17 or 63.07)

4.3 In light of above, point-wise reply to the applicant’s queries’ w.r.t. CAAR-I is as under: –

a) Products proposed to be imported does not fall under CTH 5807.10 The labels are classified in heading 5807 only if they fulfil the following conditions:

(1) They must not be embroidery. The inscriptions or motifs on the articles classified here are generally produced by weaving (usually broche work) or by printing.

(2) They must be in the piece, in strips (as is usually the case) or in separate units obtained by cutting to size or shape but must not be otherwise made up. In the instant case, product intended to be imported does not appear to be labels as they are not bearing individual inscriptions or motifs.

b) Products proposed to be imported is rightly classifiable under CTH 58063200 for products made of man-made fibres and narrow woven fabrics of a width not exceeding 30 cm. For width greater than 30cm which does not come under the purview of narrow woven fabrics will get classified as per the composition and characteristics of the fabrics i.e., whether woven, knitted or crocheted, whether impregnated, coated or laminated, whether made of filament yarn or staple fibres etc. To ascertain the composition for correct classification, valid previous test report in terms of DGFT Notification No.19/2015-2020 dated 04.09.2015, DGFT Public Notice No.32/2015-2020 dated 04.09.2015 and JNCH Public Notice No.81/2015 dated 15.10.2015, as amended from time to time is required.

c) Notification No. 82/2017-Cus., dated 27.10.2017 was rescinded w.e.f. 01.05.2022 (Serial No. 15 of Notification No. 05/2022-Customs dated 01.02.2022) (Ref: Finance Bill, 2022 read with CBIC letter No. 334/01/2022-TRU dated 01.02.2022). As the goods are not covered under CTH 5807.10, thus, entry no. 153 of Schedule II of Notification 1/2017 – IGST (Rate) 28 June 2017 is not applicable for goods.

d) For narrow woven fabrics made of man-made fibers, the total duty rate is 28.10 % (BCD: 20% + SWS: 10% + IGST: 05%). For woven fabrics other than narrow woven fabrics, Basic Customs Duty under First schedule of the Customs Tariff Act, 1975 and IGST rate under sub-section (7) of Section 3 of the said Customs Tariff Act will vary as per the composition and characteristics of the items imported and respective duties as per the classification mentioned in the Customs Tariff Act, 1975.

It is important to note that the jurisdictional Commissionerate has not commented upon or responded to the case laws quoted by the applicant.

5. The comments of the jurisdictional Commissioner were shared with the applicant for their rebuttal/ rejoinder, if any. The applicant, vide email dtd 05.12.2022 has submitted their rejoinder, whereby they have stated that the Commissioner of the customs, NS — III, vide letter dated 14.11.2022 has made an observation that the fabric proposed to be imported do not have the essential character of the label i.e., no inscriptions or motifs are found inscribed on the item and the Rolls are in a running length which do not have regular cut marking or bear any typical design of a labour. In view of the above observations, it is opined that the Rolls made of manmade fibres and narrow woven fabrics of a width not exceeding 30 cm are classifiable under chapter Tariff heading 58063200 and has recommended that for narrow woven fabrics made of man-made fibres, the total custom duty is 28.1% (BCD 20%, SWS 10% and IGST 5%).

5.1 It has been counter argued by the applicant that the Commissionerate has not provided any decision on the classification of the Rolls made of polyester, taffeta, satin etc. having width of more than 30 cms. They have submitted their counter reply against the above observations of the jurisdictional Commissioner and the same is reproduced as under:

5.2 Textiles labels printed or otherwise are classifiable under HSN 580710. It is submitted that the CTH 580710 does not require a label to be printed for classification under the heading. Further, there is no such requirement in the chapter and section notes. It is also submitted that the Hon’ble Calcutta High Court in the case of M/s Bijay Kumar Poddar vs Union of India 2000 (126) ELT 393 (Calcutta) has held the plain label strips as ‘labels’ considering that it is meant for printing and there is no alternate use of the same. The related sub-heading 5807 provides and covers labels and similar articles.

“25. The facts are not in dispute that the petitioner has imported plain label strips described as cloth for printing. The sample of that material also produced in the court and learned counsel submits that there cannot be any other use of this material, except for printing the labels and in the trade market under the catalogues, these plain strips are called labels. Learned Counsel for the respondent could not point out any use of the material produced in the court other than the use of the plain strips for purpose of printing labels. The material is known in the trade market as labels. We do not find any justification to put that material under the sub-heading 59.07. Sub-heading provides for woven fabrics of chapter 54 and not of plain weave woven strips of widths 1.5 cm to 3.5 cm. Its correct heading should be 58.07 as that entry does not cover only the labels, but also the similar materials. “

5.3 Additionally, CTH 580710 provides and covers labels and similar articles. Notwithstanding the submission above, if it is not label in strict sense in that case also the material imported can be said similar to label. Similar view is taken by the Hon’ble High Court in the case of Bijay Kumar Poddar (supra). The relevant extract of the decision is reproduced below:

21. In Collector of Central Excise, Shillong v. Wood Craft Products Ltd. 1995 (77) E.L.T. 23 (S.C.) considered words and phrases similar and same. In para 15 their Lordships observed as under: –

“15. The meaning of the expression “similar laminated wood” in the heading “Plywood, veneered panels and similar laminated wood, given in the explanatory note to the HSN for Heading No.44.12 therein, identical to Heading No. 44.08 in the Indian Tariff is also in accord with the general meaning of the relevant words used in that expression.

The headings means that it covers “Plywood” and “veneered panels” together with all kinds of “similar laminated wood”. In other words, treating “plywood” or “veneered panels” as “laminated wood”, it covers all kinds of laminated wood bearing any resemblance with ‘plywood” or “veneered panels”. The word “similar” is extensive and not restrictive like “same”. Thus, some resemblance with “plywood” or “veneered panels” is enough provided the article can be treated as “laminated wood”. The sweep of the heading is, therefore, wide and resort to the residuary Heading No. 44.10 is to be had only when a liberal construction of the wide Heading No. 44.08 cannot accommodate “block board” within it.”

22. Further in para 17 their Lordships has quoted their observations in case of Nat steel Equipment private Ltd. v. Collector of Central Ex., 1988 (34) E.L.T. 8 (S.C.): –

… The expression “similar” is a significant expression. It does not mean identical but it means corresponding to or resembling to in many respects, somewhat like or having a general likeness. The statute does not contemplate that goods classed under the words of ‘similar description’ shall be in all respects the same. If it did these words would be unnecessary. These were intended to embrace goods but not identical with those goods

23. Unprinted labels if not accepted (as labels then it amounts to) giving narrow meaning to it. It should be accepted as similar articles as that of label. Specially, when in the trade world it is known as label.

5.4 The applicant has submitted that the they also intend to import Rolls made of polyester, taffeta, satin etc., which are similar to reels in question in the decision given by the Calcutta High Court. Thus, on the basis of principles laid down by the Hon’ble High Court, the Rolls made of polyester, taffeta, satin etc. though not printed shall be classified as ‘labels’ under CSH 580710.

5.5 It is submitted that the rolls proposed to be imported by the applicant do not have an alternate use other than labels. The Commissioner, in his letter, has also not highlighted any alternate use of the rolls proposed to be imported by the applicant. It is submitted that one side or both sides of the rolls proposed to be imported by the applicant shall be coated/processed specially to enable printing; that it is a common practice of the retailers to stitch labels to the products to provide wash care information or details about the supplier/ make etc.; that the printing of such information is not legible & durable on the plain fabric as in the normal fabric printing is not clear and printing gets smudged. Further it is important that the information printed should stay for longer period and even after washing. The fabric undergoes a process like fabric washing by aqua hydrogen dioxide liquid caustic, dyeing, fluorescent bleacher, high pressure calendaring or by coating which enable printing on the same. The said processes/ coating on the fabric facilitates printing on the fabric, which is later stitched to the products. It is submitted that the coated/ processed side of the Rolls shines compared to the other side.

5.6 In view of the above, it is submitted that the Rolls with coating/processing either on one side or both sides are meant only for the purpose of use as labels to capture product/supplier/wash care information. Therefore, the Rolls proposed to be imported shall be classified as ‘labels’ or ‘similar articles’ as the Chapter Tariff Heading 580710 specifically covers all the products used as labels or similar articles.

5.7 It is submitted that the products are known as ‘labels’ in trade parlance. It can be observed from the name of the trade name of the supplier i.e., KING – Label fabric solution and Five Star label. It is submitted that it is well established that the products proposed to be imported are understood as ‘labels’ by the persons in the trade dealing with the subject goods. Therefore, applying to the ratio of the said judgments cited above, subject the products proposed to be imported shall mean ‘labels’ and are classifiable under the chapter heading 580710.

5.8 The applicant further submits that the rolls would be imported in standard sizes and can be cut as per the requirement of the customer. The Rolls come in a specified size as maintained by the suppliers and commonly accepted in the trade practices. The rolls shall be imported as per the standard size maintained by the supplier and subsequently sell the same to the Indian customers who will cut to size as per their requirements. Further, the Rolls have multiple industry applications like garments, toys, automobile and the same are required to be cut in the size as per the product’s requirement and hence, it does not come with marking. It is argued that if the rolls are given a specific marking for cutting then the same will have a limited application and can be used only by a particular customer/ industry. However, the applicant will import the Rolls and then identify the customer, and hence, the Rolls cannot come with a specific cut marking. Thus, the rolls without marking shall also be meant for use for labels and hence, it is classifiable under CTH 580710.

5.9 In view of above, the applicant submits that the rolls are classifiable under CTH 580710 and subject to basic customs duty of 10% under the First schedule of the customs Tariff Act, 1975 and IGST of 12% under entry 153 of Schedule II of Notification 1/2017-IGST (Rate) dated 28 June 2017.

6. I have gone through the contents of the application, above mentioned submissions and all the documents placed before me. I have also gone through the comments from the jurisdictional Commissionerate and have taken on record the rejoinder and additional submissions filed by the applicant. I proceed to deliberate upon the issue on the basis of documents and submissions placed on record. The applicant is seeking advance ruling on the classification for the proposed import of Rolls made of Polyester, Taffeta, Satin etc. with width ranges from 10 millimetre to 810 millimetre. I find that the jurisdictional Commissionerate in their comment has opined that the said products merit classification under CTH 5806 32 00 for products made of man-made fibres and narrow woven fabrics of a width not exceeding 30 ems, whereas, the applicant is seeking the classification of the said products under CTH 5807 10. I also find that there is only one item in their list of products which has width exceeding 30 cms. Therefore, in this context, it is necessary to examine the contending tariff headings for the said products.

6.1 Chapter heading 58.06 covers Narrow woven fabrics, other than goods of heading 58.07; narrow fabrics consisting of warp without weft assembled by means of an adhesive (bolducs).

| 5806 | 10 | 00 | – Woven pile fabrics (including terry towelling and similar terry fabrics) and chenille fabrics |

| 5806 | 20 | 00 | – Other woven fabrics, containing by weight 5% or more of elastomeric yarn or rubber thread |

| – Other woven fabrics : | |||

| 5806 | 31 | — Of cotton : | |

| 5806 | 32 | 00 | — Of man-made fibres |

| 5806 | 39 | — Of other textile materials : | |

| 5806 | 39 | 90 | — Other |

| 5806 | 40 | 00 | – Fabrics consisting of warp without weft assembled by means of an adhesive (bolducs) |

In order to understand the scope of this tariff heading it is essential to refer to the HSN Explanatory notes to CTH 58.06 which provide as under: –

(A) Narrow Woven Fabrics

In accordance with Note 5 to this Chapter, this heading includes as narrow woven fabrics:

(1) Warp and weft fabrics in strips of a width not exceeding 30 cm, provided with selvedges (flat or tubular) on both edges. These articles are produced on special ribbon looms several ribbons often being produced simultaneously; in some cases, the ribbons may be woven with wavy edges on one or both sides.

(2) Strips of a width not exceeding 30 cm, cut (or slit) from wider pieces of warp and weft fabric (whether cut (or slit) longitudinally or on the cross) and provided with false selvedges on both edges, or a normal woven selvedge on one edge and a false selvedge on the other. They may also be created when a fabric is treated before it is cut into strips in a manner that prevents the edges of those strips from unravelling. No demarcation between the narrow fabric and its false selvedges need be evident in that case. Strips cut (or slit) from fabric but not provided with a selvedge, either real or false, on each edge, are excluded from this heading and classified with ordinary woven fabrics.

(3) Seamless tubular warp and weft fabrics, of a width when flattened, not exceeding 30 cm. Fabrics consisting of strips with the edges joined to form a tube (by sewing, gumming or otherwise) are, however, excluded from this heading.

(4) Bias binding consisting of strips, with folded edges, of a width, when unfolded, not exceeding 30 cm, cut on the cross from warp and weft fabrics. These products are cut from wide fabrics and not provided, therefore, with a selvedge, either real or false.

These products remain classified here when watered (“moire”), embossed, printed, etc.

(B) Bolducs

This heading also covers narrow fabrics (bolducs) of a width usually ranging from a few mm to 1 cm, consisting of warp (parallelised yarns, monofilaments or textile fibres) without weft but assembled by means of an adhesive.

This heading excludes:

(a) Bandages, medicated or put up in forms or packings for retail sale (heading 30.05).

(b) Narrow woven fabrics with woven fringes, braided galloons and braids (heading 58.08).

(c) Narrow woven fabrics more specifically covered by other headings, e.g., those having the character of:

(1) Woven labels, badges and similar articles, in strips (heading 58.07 or 58.10)

6.2 Chapter heading 58.07 covers labels, badges and similar articles of textile materials, in the piece, in strips or cut to shape or size, not embroidered.

| 5807 | 10 | – Woven | |

| 5807 | 10 | 10 | — Of cotton |

| 5807 | 10 | 20 | — Of man-made fibre |

| 5807 | 10 | 90 | — Other |

| 5807 | 90 | – Other |

As per HSN Explanatory notes to CTH 58.07, subject to the conditions specified below, this heading covers:

(A) Labels of any textile material (including knitted). These include labels of a kind used for marking wearing apparel, household linen, mattresses, tents, soft toys, or other goods. They are utilitarian labels bearing individual inscriptions or motifs. Such labels include, inter alia, commercial labels bearing the trade name or trade mark of the manufacturer or the nature of the constituent textile (“silk”, “viscose rayon”, etc.) and labels used by private individuals (boarding school pupils, soldiers, etc.) to identify their personal property; the latter variety sometimes bear initials or figures or comprise sometimes a framed space to take a hand written inscription.

(B) Badges and similar articles of any textile material (including knitted). This category includes badges, emblems, “flashes”, etc., of a kind normally sewn to the outer part of wearing apparel (Sporting, military, local or national badges, etc., badges bearing the names of youth associations, sailors’ cap badges with the name of a ship, etc.). The above articles are classified in this heading only if they fulfil the following conditions:

(1) They must not be embroidery. The inscriptions or motifs on the articles classified here are generally produced by weaving (usually broche work) or by printing.

(2) They must be in the piece, in strips (as is usually the case) or in separate units obtained by cutting to size or shape but must not be otherwise made up.

This heading does not include labels, badges and similar articles, which have been embroidered (heading 58.10) or made up otherwise than by cutting to shape or size (heading 61.17, 62.17 or 63.07).

6.3 From the descriptions of the products as seen in Table-A above, I find that the same are of various type having sizes ranging from 10 mm to 305 mm, whereas in the CAAR-I application the applicant had mentioned sizes ranging from 10 mm to 810 mm. However, there is only one item in the list of products having width exceeding 300 mm, namely ‘Iron on Taffeta Roll – 305 mm’. I also find a plethora of case laws/judgements cited by the applicant in furtherance of their case. The jurisdictional Commissionerate has opined that the product under reference is covered under the heading 58.06 as narrow woven fab the applicant is seeking classification under Chapter heading 58.07 which covers labels, badges and similar articles of textile materials, in the piece, in strips or cut to shape or size, not embroidered.

6.4 The products under reference have sizes ranging from 10mm to 305mm and can be considered as narrow woven fabric but for the exclusion clause whereby it is mandated that this heading excludes:

(c) Narrow woven fabrics more specifically covered by other headings, e.g., those having the character of (1) Woven labels, badges and similar articles, in strips (heading 58.07 or 58.10).

The HSN Explanatory notes to CTH 58.07, subject to the conditions specified, cover the labels of any textile material. These include labels of a kind used for marking wearing apparel, household linen, mattresses, tents, soft toys, or other goods. They are utilitarian labels bearing individual inscriptions or motifs. Such labels include, inter alia, commercial labels bearing the trade name or trade mark of the manufacturer or the nature of the constituent textile (“silk”, “viscose rayon”, etc.) and labels used by private individuals (boarding school pupils, soldiers, etc.) to identify their personal property; the latter variety sometimes bear initials or figures or comprise sometimes a framed space to take a hand written inscription. Condition that these products must not be embroidery. Goods will not have embroidery on them. Due to this explanation in the HSN explanatory notes the proposed imports will get covered under exclusion clause of CTH 5806. In the instant case the goods will be imported without printing of labels on them. Applicant has argued that the textiles labels printed or otherwise are classifiable under HSN 5807 10. It is submitted by applicant that the CTH 5807 10 does not require a label to be printed for classification under the heading. Further, there is no such requirement in the chapter and section notes. In support of this argument the applicant has further submitted that the Hon’ble Calcutta High Court in the case of M/s Bijay Kumar Poddar vs Union of India 2000 (126) ELT 393 (Calcutta) has held the plain label strips as ‘labels’ considering that it is meant for printing and there is no alternate use of the same. The related sub-heading 5807 provides and covers labels and similar articles. Crux of the judgment is narrated in para 25 of the Court order and the same is reproduced below.

“25. The facts are not in dispute that the petitioner has imported plain label strips described as cloth for printing. The sample of that material also produced in the court and learned counsel submits that there cannot be any other use of this material, except for printing the labels and in the trade market under the catalogues, these plain strips are called labels. Learned Counsel for the respondent could not point out any use of the material produced in the court other than the use of the plain strips for purpose of printing labels. The material is known in the trade market as labels. We do not find any justification to put that material under the sub-heading 59.07. Sub-heading provides for woven fabrics of chapter 54 and not of plain weave woven strips of widths 1.5 cm to 3.5 cm. Its correct heading should be 58.07 as that entry does not cover only the labels, but also the similar materials.”

Honorable High Court has further opined that the CTH 5807 10 provides and covers labels and similar articles. Notwithstanding whether the imported goods came with printing on it or not then also, the Court held that, if it is not label in strict sense then also the material imported can be said similar to label. While delivering the judgment on classification honorable High Court discussed few apex court decisions as follows:

The apex court decision in the case of Atul Glass Industries Ltd. and Others v. Collector of Central Excise and Others – 1986 (25) E.L.T. 473 (S.C.) wherein para 8 their Lordships observed as under: –

“8. The test commonly applied to such cases is: How is the product identified by the class or section of people dealing with or using the product? That is a test which is attracted whenever the statute does not contain any definition. … ……. It is generally by its functional character that a product is so identified … …… When a consumer buys an article, he buys it because it performs a specific function for him. There is a mental association in the mind of the consumer between the article and the need it supplies in his life. It is the functional character of the article which identifies it in his mind. In the case of a glass, mirror, the consumer recalls primarily the reflective function of the article more than anything else. It is a mirror, an article which reflects images. It is referred to as a glass mirror only because the word glass is descriptive of the mirror in that glass has been used as a medium for manufacturing the mirror. The basic or fundamental character of the article lies in its being a mirror.”

It has been observed by their Lordship in Commissioner of Customs & C. Ex., Amritsar v. D.L. Steels – 2022 (381) E.L.T. 289 (S.C.) that “…… well-settled principle that words in a taxing statute must be construed in consonance with their commonly accepted meaning in the trade and their popular meaning. When a word is not explicitly defined, or there is ambiguity as to its meaning, it must be interpreted for the purpose of classification in the popular sense, which is the sense attributed to it by those people who are conversant with the subject matter that the statute is dealing with. This principle should commend to the authorities as it is a good fiscal policy not to put people in doubt or quandary about their tax liability. The common parlance test is an extension of the general principle of interpretation of statutes for deciphering the mind of the law-maker.”

Applying the same ratio, the product commonly identified by the section of people dealing in or using the same would be known as Label due to its functional character. Further, due to the exclusion clause the said label or similar articles in strip would not be covered under heading 58.06.

6.5 Further, labels, badges and similar articles of textile materials, in the piece, in strips or cut to shape or size, not embroidered are covered under Heading 58.07. The Apex Court in the case of CCE, Shillong vs. Wood Craft products ltd., 1995 (77) E.L.T. 23 (S.C.) has observed that ‘Words & Phrases – “similar” and “same” – The word “similar” is expansive and not restrictive like “same’. It would be not out of place to mention that in similar context in Nat Steel Equipment Private Ltd. v. Collector of Central Ex., 1988 (34) E.L.T. 8 (S.C.), while considering the meaning of the word “similar” in a tariff item, it was stated as follows:

“………. The expression “similar” is a significant expression. It does not mean identical but it means corresponding to or resembling to in many respects; somewhat like; or having a general likeness. The statute does not contemplate those goods classed under the words of ‘similar description’ shall be in all respects the same, If it did these words would be unnecessary. These were intended to embrace goods but not identical with those goods…… “

I also find that various courts in a plethora of cases have held that HSN explanatory notes have a persuasive effect in deciding the matters of classification. Keeping in view the observation of Apex Court in various decisions referred in forgoing paras as well as the decision of High Court decision in case of M/s Bijay Kumar Poddar vs Union of India, I find that the said products have to be considered as articles similar to labels of textile materials in strips and accordingly are classifiable under heading CTH 58.07. I do not find any grounds to disagree with the High Court decision in case of M/s Bijay Kumar Poddar vs Union of India 2000 (126) ELT 393 (Calcutta) on the issue of classification in the instant case.

6.6 The issue as per the CAAR-I application as to whether the products are covered by entry no. 147 of Notification No. 82/2017-Cus., dated 27.10.2017 gets settled with the introduction of Notification no. 05/2022-Customs dated 01st February, 2022, whereby the said notification has been rescinded w.e.f. 01.05.2022. However, the entry no. 153 of Schedule II of Notification 1/2017 — IGST (Rate) 28 June 2017 shall remain in operation since there has not been any change in the contents of the said notification. Therefore, for the aforesaid products the effective rate of duty would be 16.5 % (BCD: 10% + SWS: 10% + IGST: 5%). For the products under consideration the Basic Customs Duty under First schedule of the Customs Tariff Act, 1975 and IGST rate under sub-section (7) of Section 3 of the said Customs Tariff Act may vary as per the composition and characteristics of the items imported and respective duties as per the classification mentioned in the Customs Tariff Act, 1975.

7. In view of my aforesaid discussions, I rule that the products as detailed in Table-A merit classification as articles similar to label of textile material in strips under heading 58.07 and specifically under sub-heading 5807 10 20 of the first schedule to the Customs Tariff Act, 1975. Further, the issues of operation of notifications and rate of duty will be applicable as discussed in para 6.6 supra.